Crisis, resilience, and adaptation: farming and financial services in times of climate change

by TVS Ravi Kumar, Rajnish Kumar and Graham Wright

Aug 8, 2023

6 min

Climate change poses great challenges for small farmers. It disrupts their agricultural schedules and leads to lower crop yields and financial instability. The CIFAR Climate Resilient Agriculture (CRAg) working group recognizes these challenges and intends to address their needs through digital technology. It brings together different stakeholders to facilitate knowledge exchange and encourage the development of business models and start-ups that strengthen smallholder farmers’ climate resilience and adaptation.

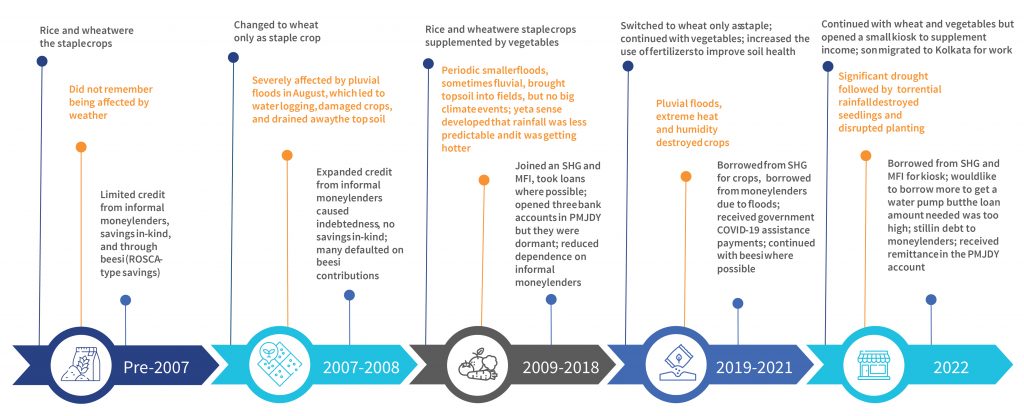

“I have lived through a lot. Sometimes too much,” says Krishna Lal wistfully.[1] He remembers his youth and early adulthood fondly as a time when life in the village was simple and his family usually had enough food on the table. In those days, the village was far away from bank branches, and anyway Krishna Lal and his family considered themselves “too poor for banks.” Instead, when they had emergencies, which usually arose when they needed doctors or medicines, they would borrow from local moneylenders.

This tranquil life changed in 2007 when the worst floods “in living memory” washed through the village, sweeping all they had before them. The rainfall in July was five times higher than the monthly average. By August, the entire village was underwater. These largely pluvial floods waterlogged the fields, destroyed the rice crops, and remained for many months.

Fortunately, Krishna Lal had good relations with the moneylenders, and so he could borrow several times to keep food on the family’s table. Yet, with the loss of the rice crops, Krishna Lal could not save any grain and had to keep borrowing. On some days, the family ate only one meal. Devi’s beesi saw many participants stop their monthly contributions. It took years and significant changes in membership to rebuild the trust.

In the period from 2009 until 2019, life in the village returned to normal and grew increasingly sophisticated. With improved roads to the market, farmers, including Krishna Lal began to grow a range of vegetables alongside these staples. Krishna Lal found okra particularly lucrative. Some small-scale floods occurred in this decade—most notably in 2019, but nothing of the scale seen in 2007-2008. However, all the villagers noted that the monsoon was less and less predictable, and that the summers were hotter than they remembered from earlier times.

It was in this period that Krishna Lal encouraged Devi to join a self-help group formed by a local NGO to save and sometimes even borrow to help manage the household finances. This helped reduce their dependence on local moneylenders. She found the meetings and the bookkeeping a chore, but when the group got access to bank-linkage loans, Devi could borrow to buy fertilizer and a TV. Krishna also increased the dosage of fertilizer as he was not getting the yield as before. These fertilizers he usually bought at a premium of almost 30-40% over the MRP due to short supply from local retailers.

In 2017, after many attempts, Krishna Lal managed to open a bank account under the government’s Pradhan Mantri Jan-Dhan Yojana (PMJDY) financial inclusion program. But the accounts were largely dormant as all the transactions happened in cash. The government’s zealous drive to ensure every adult in India had an account meant that bank staff and banking correspondents (agents) were heavily incentivized to open accounts, whether people needed them or not—so soon Krishna Lal had another PMJDY account, and Devi had one too. But since neither Krishna Lal nor Devi could get employment under the MGNREGA program, their accounts remained dormant from the moment the accounts were opened. Devi continued with her beesi, primarily for its social function—she enjoyed the chance to sit around and exchange village gossip with her friends from time to time.

Of course, 2020 was also the year that the COVID-19 pandemic hit. Finally, Devi’s PMJDY account proved useful—after she reactivated it, a process that took multiple trips to the bank branch. Soon, she received four payments of INR 500 (USD 6.67) each from the Government of India.

In 2022, the pressing need to find another source of income emboldened Devi to borrow both from her SHG and a microfinance institution she had recently joined. With the INR 9,000 (USD 120), she could stock a small kiosk in a kutcha lean-to that Krishna Lal built adjoining their house. Furthermore, her son Abhishek went to Kolkata where he found work as a day laborer at a construction site. When he could send money back to his parents, they started to withdraw the cash from an ATM outside the bank branch in the market town eight kilometers away using the RuPay card attached to their PMJDY account.

“Farming has become such a lottery now that the weather gods are no longer our friends. Everyone in the village has sent their sons away to earn in the city—we have no other way to make ends meet”, sighs Krishna Lal. “Everything has changed.”

If we are to enable farmers like Krishna Lal to respond to the growing climate crisis, we will need to revolutionize financial services for agriculture to support both climate resilience and adaptation. The CIFAR Climate Resilient Agriculture (CRAg) working group has outlined what this will take and the central role that digital technology must play in this.

The Crag Virtual Club brings together innovative startups that work in climate-smart and climate-resilient agriculture alongside investors, international donor organizations, financial services providers, and implementation agencies. It enables the exchange of ideas to ultimately identify and upscale promising business models to strengthen climate resilience and adaptation for countless smallholder farmers, much like Krishna Lal. Join us!

[1] Krishna Lal is a composite archetype farmer derived from MSC’s extensive work in UP and Bihar on agriculture and climate change—his story is indicative.

by

by  Aug 8, 2023

Aug 8, 2023 6 min

6 min

Leave comments