Credochain: Lending solutions for a new India

by Vishes Jena and Maansi Sharda

Aug 16, 2021

6 min

Micro, small, and medium enterprise (MSME) borrowers and commercial lenders in India struggle with a steadily widening credit gap. This blog highlights the journey of a FinTech startup, Credochain, which assesses micro and nano enterprises for faster and better credit decision-making by capturing and analyzing their underlying business transactions and cash flows, among other parameters. In this blog, you will discover how Credochain has been building cluster-specific credit underwriting models for unserved or underserved businesses.

This blog is about a startup under the Financial Inclusion (FI) Lab accelerator program’s third and fourth cohorts, which receive support from some of the largest philanthropic organizations across the world—the Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

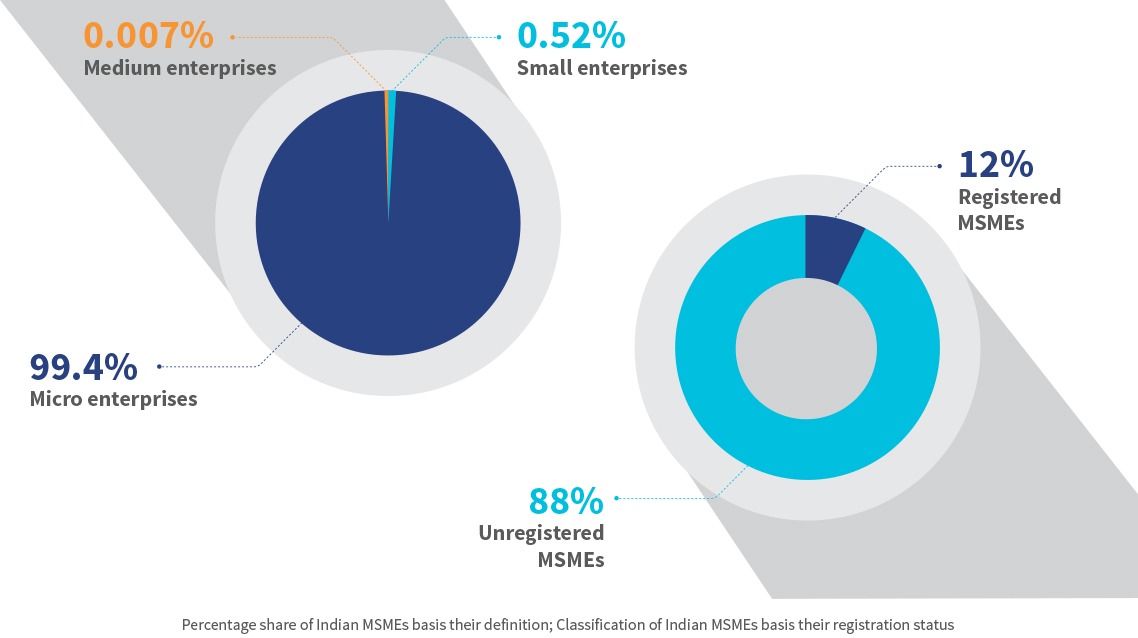

According to the latest report from the Government of India’s MSME Ministry, the MSME sector comprises 63.8 million units, of which 99.4% are micro-enterprises. However, only 9 million of these are formally registered.

Banks find it difficult to underwrite loans to MSMEs since 88% of them are unregistered and lack reliable financial footprints. The MSMEs that can provide some collaterals and supportive documents, approach non-banking financial companies (NBFC), whose rate of interest is 5%-8% more than what banks offer. The rest of the MSMEs are compelled to pursue other sources and generally end up taking loans from informal sources, such as moneylenders, who exploit them.

During the nationwide lockdowns due to the COVID-19 outbreak in India, MSMEs curtailed their production activities and their revenues suffered. To support this segment, the Government of India launched several initiatives, such as the Emergency Credit Line Guarantee Scheme (ECLGS) for unsecured lending, a relief package worth USD 60.4 billion, and other loan waiver or moratorium programs. However, several studies showed that most MSMEs are unaware of these programs and those who approach lenders to inquire about these schemes face heavy scrutiny from lenders. Since 2020, lenders have become risk-averse. Now, the quality and proper documentation of portfolios are of utmost priority to prevent credit defaults. While non-performing assets (NPAs) for most lenders are under control, for now, RBI predicts an increase in the gross NPA ratio for the rest of the financial year.

These factors have created a significant gap in the market and an opportunity for new-age FinTech lenders. One such startup is Credochain, which uses alternative data and proxies to support underserved businesses. It extends its application programming interfaces (APIs) to commercial banks, which in turn leverage it to offer relevant products and services to the underserved MSMEs. Credochain seeks to add value to the Indian business ecosystem by serving micro and nano enterprises with addressable credit requirements.

a) The light-bulb moment

Vaibhav Anand conceived the idea of Credochain while working as a consultant in the FinTech vertical for Deloitte, India. During his stint there, he realized that more than 80% of Indian small businesses sought working capital support but incumbent financial institutions denied them. He felt that since small businesses largely lack proper documentation and credit history, lenders either deny loans or at best offer smaller loan amounts. This gap in credit supply held immense opportunities for FinTechs that can facilitate credit to non-formal and semi-formal businesses. Credochain’s vision was strengthened further when Vaibhav’s wife Shivani Sharma, an ex-private equity professional, joined hands to pursue this opportunity.

They initially started with the idea of analyzing e-way bills to shape a credit facilitation business model but it did not gain much traction in the market. After some rethinking, pivoting, and effort, the two finally zeroed in on a unique business problem to solve—cluster-based lending to small enterprises.

India accounts for around 20 million manufacturing MSMEs spread across 5,500 clusters. Several traditional institutions have tried to underwrite credit to the cluster-based businesses but failed, mainly due to the absence of credible data of these clusters. Generally, MSMEs fail to adequately document information around inventory cycle, payments, lending, borrowing, and bookkeeping. This makes it difficult for potential lenders to establish the worth of the business and its ability to repay. To solve the issue of assessing creditworthiness, Credochain has worked to build cluster-specific credit underwriting APIs.

b) The unique pitch

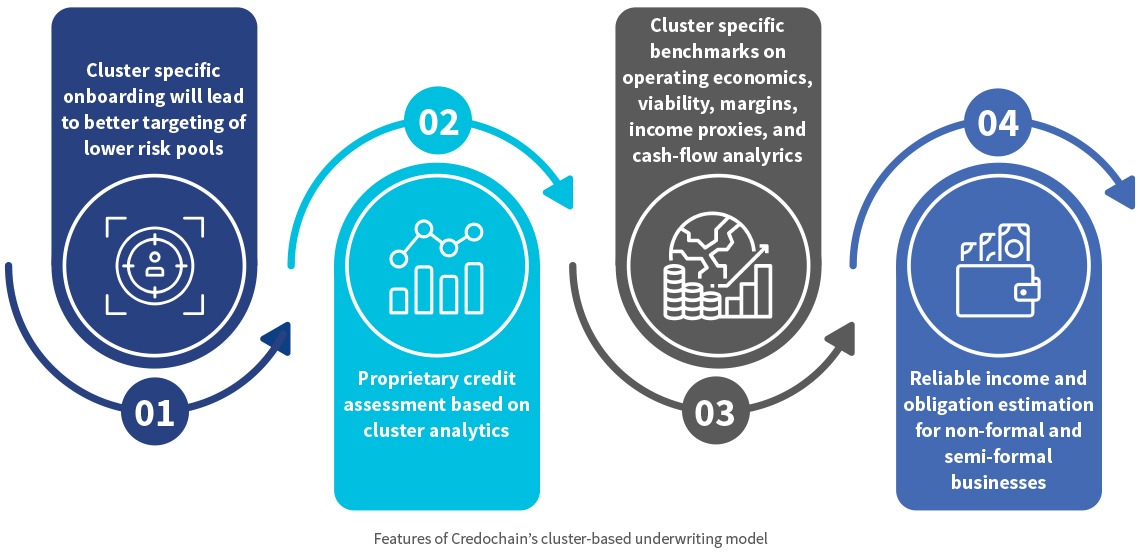

Credochain is committed to building market linkages between commercial lenders and semi-formal and non-formal enterprises that lack proper documentation. Credochain intends to analyze the cluster businesses at the atomic level by taking each cluster independently. They understand that a “one-size-fits-all” assessment model cannot cater to the different clusters or geographies in India. Hence Credochain built a customized assessment approach for each cluster depending on the cluster business.

Credochain follows a top-down approach to generate alternative cluster-specific data to shortlist semi-formal and non-formal businesses and build low-risk lending pipelines for commercial lenders. It uses cash-flow data, inventory data, bill of materials, and operating economics, among other possible proxies at a granular level to identify the business potential of these enterprises. To collect these data points, it relies on a “phygital” (combination of physical and digital) model, where a business is onboarded via assisted digital modes but is validated physically—by a Credochain officer who visits the business as a part of the follow-up process. Credochain will tweak this model and optimize it to assess semi-formal and non-formal businesses in different clusters and digitalize the processes to the extent possible.

c) Impact on LMI segments

In 2021, Credochain onboarded 600+ micro-businesses on its platform for loan pre-qualification and is set to disburse INR 5 crore (USD 684K) later in the year. Extending working capital at the right time can help businesses address their operational needs and manage their finances better, pay laborers on time, and grow sustainably. In the long run, this will help improve the lives of all the LMI families that are associated with these businesses.

d) COVID-19 along with several ecosystem-related roadblocks made the path ahead seem much longer

Cluster analysis is cumbersome as it requires extensive on-field analysis to understand the cluster map. Accordingly, Credochain aligned its model to physically assess business inventory and capture its production capabilities and other relevant indicators, before assigning a credit-like assessment score to the business. Due to the pandemic, Credochain’s physical operations and assessments were delayed significantly and it was forced to carry most of its assessment digitally.

Credochain initially ran into difficulties as it tried to establish business relationships with commercial lenders—even those with a successful model. Closing business-to-business (B2B) deals in the FinTech ecosystem is a challenging and time-consuming process. Moreover, considering the pandemic situation, commercial lenders have been more risk-averse in lending to prevent loan impairments. This limits Credochain’s focus to data-rich prospects.

Despite these challenges, Credochain has onboarded a few banks on its platform and has also been in active discussions to partner with more lenders.

e) Support provided by the Financial Inclusion (FI) Lab

In collaboration with MSC, CIIE.CO organized boot camps, diagnostic sessions, mentoring support, and technical assistance (TA) to build robust strategies and identify the challenges for Credochain. We also carried out a competitor analysis for Credochain against other digital lenders to enhance its operational model, identify gaps in solutions provided in the market today, and recommend implementable strategies.

MSC developed cluster maps for the Agra and Ludhiana-based clusters that are into footwear, hosiery, and cloth manufacturing. The analysis helped Credochain identify its target segments, gauge the addressable market size, and build a sustainable business model. We also designed a credit assessment framework that can use the bill-of-materials data of non-formal and semi-formal businesses, among other inputs. It enabled Credochain to focus on businesses that lack proper documentation and records to support their revenue statements. The tool helps scale up Credochain’s business model.

The way forward

Credochain intends to onboard 28,000+ semi-formal and non-formal businesses spread across different manufacturing clusters in Ludhiana, Jaipur, and Agra while also looking to expand to a few clusters across Panipat. Credochain’s vision is to originate INR 50 crore (USD 7 million) by 2022 and help small enterprises build their businesses based on a lower cost of capital.

This blog post is part of a series that covers promising FinTechs that are making a difference to underserved communities. These start-ups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll #BuildingForBharat

Written by

Vishes Jena

Assistant Manager

by

by  Aug 16, 2021

Aug 16, 2021 6 min

6 min

Leave comments