Connecting India to Bharat through P2P lending

by Neha Parakh, Anil Gupta and Anshul Saxena

Jun 22, 2020

5 min

A digital P2P marketplace that connects credit-worthy borrowers with lenders has come as a blessing for small business owners whose loan applications typical banks would otherwise reject. In this blog, we trace RupeeCircle’s journey so far including the impact of COVID-19 pandemic on it

This blog is about a start-up in the Financial Inclusion Lab accelerator program, which receives support from some of the largest philanthropic organizations across the world – Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

For small borrowers like Indumathi, this problem is insurmountable. A typical bank finds it costly to assess a small borrower and difficult to underwrite them as they have limited or no credit history. Start-ups like RupeeCircle look at these opportunities and wish to capitalize upon them. RupeeCircle is a digital marketplace that connects these kinds of underserved, credit-worthy borrowers with investors.

The company claims that a typical nationalized bank rejects more than 70% of the loan applications it receives due to the high costs of underwriting. On the other hand, the loans from microfinance institutions are of low value, usually require a group, and do not always meet a borrower’s requirements. Faced with such barriers, many people are forced to borrow from the informal sector at exorbitant interest rates, which increases their financial burden and impedes their growth. Often, they are caught in a vicious cycle as they are forced to take one loan to repay another.

The pitch: New age underwriting

RupeeCircle came into being when Ajit, an engineering graduate from IIT Bombay, noticed this vicious cycle, having spent several years with major banks doing risk and data analytics. His friend Abhishek, who is an Engineer with CFA and MBA degrees, realized that they could use technology and data science to underwrite and manage the risks. They understood that they could disrupt the traditional intermediation of banks and link the borrowers to net savers who seek better risk-adjusted returns. Their classmates, Ashish and Piyush, joined Ajit and Abhishek and started the journey of RupeeCircle.

Fueling the aspirations for growth of the LMI segment

As a digital peer-to-peer (P2P) lending marketplace, RupeeCircle connects credit-worthy borrowers with investors who seek faster and better returns on their investments compared to traditional instruments, such as fixed deposits or liquid mutual funds. The company uses proprietary credit-scoring models to assess and underwrite loan requests, uses new technology to process the applications, and matches borrowers to investors (lenders). It uses a variety of alternative data points to assess a borrower’s ability to pay back even when they lack traditional credit history.

RupeeCircle reaches out to borrowers from the salaried and self-employed low to middle-income (LMI) segment who earn less than INR 30,000 (USD 400) per month. RupeeCircle has developed an in-house loan origination and loan management mobile app and backend systems to onboard borrowers and lenders through a step-by-step assisted digital process. Once an investor applies and completes the Know Your Customer (KYC) processes, they get an overall view of all the registered borrowers. They can also see detailed reports of any borrower and can accordingly decide the amount they would invest in them.

The RupeeCircle system categorizes all the borrowers based on their risk profiles. This categorization helps investors to diversify their risks and hand-pick suitable borrowers for themselves. The step-by-step assisted digital approach has helped RupeeCircle take its proposition to the doorsteps of people from the under-banked segments. They comprise many who are first-time users of the app or may even be nascent digital users and include house cleaners, drivers, factory workers, and security guards.

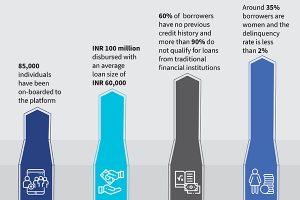

Recently, Reserve Bank of India (RBI) sought comprehensive financial data from all the NBFC P2P players in the market. The P2P business works on volume as operational costs are high. RBI used this data and decided to increase the lending cap from INR 1 million (USD 13K) to INR 5 million (USD 65K). This gives a fillip to the business of companies like RupeeCircle, which has already made considerable progress within two years, as highlighted in the figure below.

The evolution: Strategy to increase business in existing areas and to expand to new areas

RupeeCircle started its services in 2017 and was part of the second cohort of the Financial Inclusion Lab. Before joining the Lab, RupeeCircle faced the challenges that a start-up typically faces—primarily sporadic growth and unpredictable declines in revenue. Hence, its challenge was to arrive at sustainable go-to-market and scale-up strategies. It also wanted to understand its market potential based on various segments that it could target across geographies. Boot camps, diagnostic sessions, and clinics conducted by CIIE.CO and MSC helped RupeeCircle to identify these challenges and strategize its expansion plans in a more stable, sustained, and structured manner.

The MSC team helped RupeeCircle build a city-selection matrix based on a group of selection parameters for Indian cities, ranging from smartphone penetration to a city’s susceptibility to natural disasters. The start-up used this matrix approach while expanding its market and customer segments in Chennai and Kochi. A better understanding of the target customer segment helped RupeeCircle to rethink and redesign the product. The team mentored RupeeCircle to amplify its reach using better and create targeted digital marketing strategies by tailoring them for relevant social media outlets, search engine channels, and content to address specific target segments. Besides gaining wider visibility, the company was also able to overcome operational challenges by making use of the India Stack.

Weathering the COVID-19 pandemic

The coronavirus pandemic has put both the lenders and borrowers of RupeeCircle under stress. Many borrowers have lost their livelihoods and consequently their re-payment capabilities, for the time being. The lenders prefer to save in very low-risk financial instruments for the metaphorical “rainy day” amid the crisis. To survive this, RupeeCircle plans to:

- Onboard borrowers from the “essential goods and services” sector, such as delivery boys of the grocery-delivery companies—at least for the short term. This sector is booming and will continue in this trajectory due to the ongoing mobility restrictions and lockdowns for the general population in many Indian states. As a result, the employment opportunities and incomes of delivery boys is on the rise. By onboarding borrowers from this sector RupeeCircle will be able to retain some of the existing lenders as well as scout for potential lenders by mitigating the risk of default.

- Further automate and digitalize the borrower and lender on-boarding process to the best extent possible, thereby reducing physical touchpoints and maintaining social distancing.

- Re-calibrate its credit rating and lender-borrower matching algorithms to adapt to the current situation.

The long-term goals

Looking past the pandemic, RupeeCircle wants to be the “Amazon of Credit” that connects the under-banked segments of India with the new-age millennial investors of India. It is currently operational in Mumbai and Chennai but has plans to have a pan-India presence. Its future objective is to scales up to serve the generation of 500 million “credit-invisibles” and “credit-unscorables” in the country. To supplement its borrowers, RupeeCircle also plans to undertake various marketing and public relations activities to project P2P lending as a high-potential, alternative asset class that offers favorable risk-adjusted returns to suit the burgeoning high-income millennial population in India. With its customer-centric model, data science, technology, and continuous innovation, its ambition is to disrupt the banking system as we know it today.

This blog post is part of a series that covers promising FinTechs that are making a difference to underserved communities. These start-ups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll, #BuildingForBharat

by

by  Jun 22, 2020

Jun 22, 2020 5 min

5 min

Leave comments