ChitMonks: Simplifying chit funds

by Saborni Poddar, Anshul Saxena and Anil Gupta

Jun 12, 2020

7 min

A story of four “monks” using private commissioned blockchain technology to improve accountability in a registered chit fund and how they are impacted by COVID-19

This blog is about a startup under the Financial Inclusion Lab accelerator program, which is supported by some of the largest philanthropic organizations across the world – Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation and Omidyar Network.

Vijay Babu—a 45-year-old entrepreneur, Gowri—a 29-year-old house help, and Venkata Garu—a 57-year-old government employee, are residents of the same city. These individuals have another thing in common—they save through chit funds. An Indian “chit fund” is a traditional financial instrument that combines savings and borrowing. It has the perks of a personal loan, a beesi, and a recurring deposit all rolled into one. In a classic Indian chit fund, several people pool their money and the lowest bidder in the auction held amongst group members claims the amount.The rest of the amount gets distributed equally among the other members.

In India, chit funds come in three variants—those offered by the state governments, those started by registered companies, and those that are unregistered. The last variant is an informal chit fund that can be started between friends, families, and acquaintances. The first two are comparatively safer avenues for customers or subscribers to engage in. Chit funds allow bidders like Gowri to borrow any time during the chit period and set that off through regular monthly contributions until the end of the chit.

The light-bulb moment

Also, since the chit funds run by state governments or registered companies have large groups, many group members do not know each other, leading to a trust deficit among them.

Most registered chit funds do not follow best practices and maintain sloppy, physical transaction records of the group. These records are difficult to audit by the regulators and so, the anomalies and corrupt practices of the chit fund companies often go undetected until the scams such as the ones mentioned earlier, come to light.

These factors above have led to a generally negative public perception about business operations of registered chit fund companies.

Founders of Chit Monks

Pavan, Malla, Sridhar, the founders of Chitmonks, and Praveen wanted to solve these problems and bring transparency and order to the chit fund industry by digitizing it. These four founders or “monks” left their regular jobs and used their experience in banking and information technology to devise solutions.

The unique pitch

Technology can lend transparency, which is what the chit fund sector needs to be more efficient and accountable in its operations. ChitMonks uses private commissioned blockchain technology across the entire life cycle of a registered chit fund to record the sequence of events immutably. The digitization starts from the registration of a chit fund company with the regulator and goes on to onboard and track the transactions of users subscribed to the chit fund. Besides, information on every event of the activities of the registered chit funds is visible to all related parties. This ensures transparency and integrity of the entire chit fund process on the blockchain. Since 2016, ChitMonks has used a smart contract-enabled blockchain platform to create solutions for the following three key issues that plague the sector:

- Arbitrary guarantor requirements: To hedge against the risk of default in payments by the subscribers, chit fund companies insist on three to five guarantors instead of just one. This is to pressurize the subscribers into making timely payments. However, it makes the subscribers uncomfortable to join chit funds because they fear these companies will divulge their delinquencies to their guarantors and harm their reputation in the community.

- Lack of transparency: The movement of funds at different stages is generally opaque in chit funds. This adversely affects the customers’ perception of chits. Despite the availability of flexi and quick loans, subscribers often wait for months to get the money they bid for.

- Limited visibility for local regulators: State-level regulators have limited visibility in chit operations and therefore lack the ability to solve the grievances of subscribers.

ChitMonks is one of the few startups that attempts to solve these issues from a “regulatory-first” perspective.

The roadblocks

One of the key challenges for ChitMonks is to bring about behavioral changes in the way things have been done for decades. While its services have the potential to alter the course of the chit fund sector, ChitMonks faces several headwinds, mainly based on the traditional way of doing business. A few challenges are listed below:

Challenge faced by ChitMonks

- The chit fund companies are largely family businesses that are reluctant to change their operating procedures. This attitude is common and hinders the end-to-end digitization of chit operations.

- Subscribers need a guarantor to claim the bid money as they will have to continue to pay into the chit for the remainder of its rounds even after they have won the bid prize. Agreeing to be a guarantor is based more on trust rather than the real willingness to pay in case of a default. Subscribers are hence wary of digitizing this aspect of chit funds, as they fear it will be relatively more difficult to convince a guarantor to sign on a permanent digital record.

- Many state regulators are still paper-driven organizations. The blockchain implementation of chit fund processes is not just a digitization of existing processes but also a paradigm shift that involves a completely new suite of technologies. This is why most state regulatory bodies are reluctant to adapt to it.

- The state governments procure new technologies through a bidding system based on request for proposals (RFP), which requires a minimum of three bidders to compete. Since it is one of the very few companies with such a technology and there are not sufficient number of bidders, the RFPs frequently get cancelled. Therefore, ChitMonks finds it difficult to secure the required government approvals to implement its solutions across India.

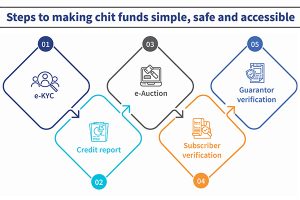

Support provided by the FI Lab

CIIE.CO and MSC organized boot camps, diagnostic sessions, and clinics to build robust strategies and identify challenges that ChitMonks needs to overcome in order to scale its business. Through consulting support, ChitMonks understood several pain points to help its customers and companies in the long run. These included the provision of customer e-KYC to reduce the time taken to claim the prize money, along with e-auctions to improve accessibility and serve the customers better. The companies stand to gain from the digital verification of guarantors to assess their authenticity and reliability. In the long term, ChitMonks realized that a credit report based on chit repayments can act as an alternate scorecard to potentially secure loans from the bank. It also understood how to analyze the commitments of subscribers across the registered chit funds to help companies gauge the risk quotient of a potential subscriber.

The program also extensively mentored the team to build its investment readiness and enhanced its profile through evangelizing efforts. The support provided by the lab also helped the team assess and plan the rollout of these services in a phased manner, as elaborated in the section below. Overall, the FI lab acted as an extended co-founding member of the ChitMonks team.

Supporting chit fund companies and subscribers in times of Covid-19

Realizing the new world order with a focus on social distancing, the Chitmonks team is in the final stage of building an appropriate B2B solution for its platform. They will roll out new feature within a month. It will:

- Digitize the process for collections from subscribers

- Automate and digitize the auction process. Chit funds can hold auction without any physical presence of either the subscribers or their representatives

For the subscribers, Chitmonks plan to roll out a mobile application which will:

- Enable online Know-Your-Customer (KYC) through e-verification using Aadhaar

- Integrate payment gateway(s) so that a subscriber can make presence-less payments to the chit fund companies

The long term goal

Steps to make chit fund simple, safe and accessible

Once the pandemic is over, based on the recommendations from the program, ChitMonks will offer five value-added services. They will roll out these services, as illustrated in the adjoining figure, in a phased manner based on ease of execution and stakeholder acceptability. The services will not only help chit fund companies make their day-to-day operations more efficient, but also serve to improve their public image.

The founders of ChitMonks are aware of the pitfalls of the sector as well as the opportunities it offers if the issues are addressed. The digital services of the firm can potentially put chit funds back on the map alongside favored products, such as mutual funds, credit cards, and recurring deposits. With the steady headway ChitMonks has made in re-engineering this veteran product, and its rapid entry in the states of Andhra Pradesh, Telangana, and Tamil Nadu, the face of chit funds is set to change for the better.

This blog post is part of a series that covers promising FinTechs that are making a difference to underserved communities. These start-ups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll, #BuildingForBharat

by

by  Jun 12, 2020

Jun 12, 2020 7 min

7 min

Leave comments