Bridge2Capital: Instant supplier credit in three clicks

by Maansi Sharda, Anil Gupta and Anshul Saxena

by Maansi Sharda, Anil Gupta and Anshul Saxena Jul 16, 2019

Jul 16, 2019 5 min

5 min

This blog highlights the journey of Xtracap, a fintech start-up that provides extended credit to low- and middle-income merchants in India towards their daily working capital needs through its flagship technology platform—Bridge2Capital.

This blog post is part of a series that covers promising fintechs making a difference to underserved communities and supported by the Financial Inclusion Lab accelerator program. MSC is a partner to the FI Lab, which is a part of CIIE’s Bharat Inclusion Initiative.

|

Yash is a readymade women’s wear shop owner at Krishna Market, Chandigarh, clocking daily sales ranging from INR 10,000 (USD 145) to INR 12,000 (USD 175). Every week, he buys his stock from regular suppliers in Delhi and Ludhiana and also picks a few pieces from other retailers. His average supplier invoice is between INR 30,000 (USD 436) to INR 40,000 (USD 580) – which he pays through a combination of cash and bank transfer, including for the balance amount, after two to three weeks. However, he is still often unable to buy enough stock due to insufficient capital.

This has an adverse impact on his business as his sales are seasonal and managing stocks as per the season is challenging. Is there a better solution for Yash?

Small business owners like Yash do not get adequate support from existing providers like banks and micro finance institutions (MFIs) so, they have to rely on informal financial service providers. A new digital credit platform can address their short-term working capital needs. Read further to find how.

Capital in need is capital indeed

During their Basix years (from 2010 through 2015), both Mohammed Riaz and Nishant Singh partnered to set up various distribution channels for the Indian government. Their experience of dealing with small merchants and microfinance institutions made them realize the acute need for liquidity for mom-and-pop stores, also known as kirana stores, to support the burgeoning consumption-led demand. The founders saw a business opportunity to offer bill discounting to small-town merchants. Further, major changes in the Indian financial landscape such as demonetization, digital India campaign and introduction of Goods and Service Tax (GST) bolstered the idea. That’s when Riaz and Singh put their vision of helping millions of small businesses to practice and thus, Bridge2Capital was born.

Bridge2Capital’s mission is to solve the core problem of small merchants: access to capital to grow their business.

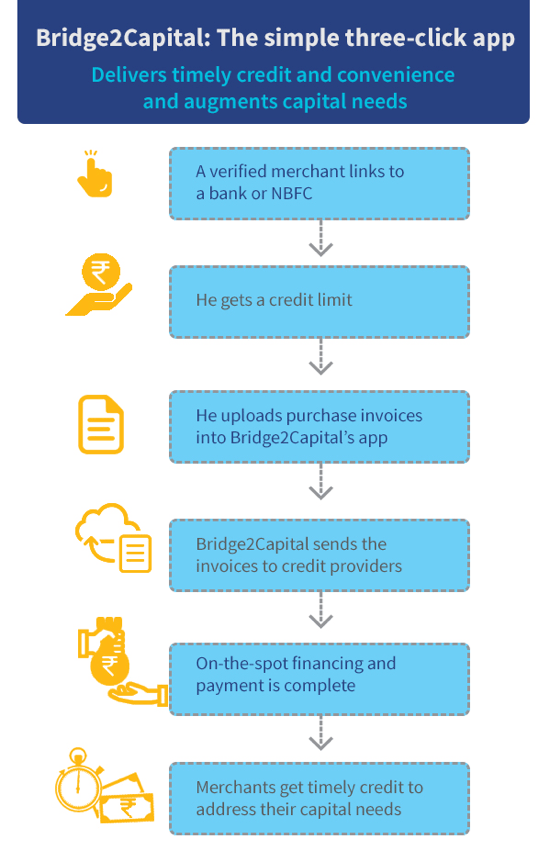

Bridge2Capital facilitates small merchants to avail credit limit through a mobile application-based paperless interface. Within five minutes, a verified merchant can be linked to a formal credit provider, such as a bank or an NBFC, and get a credit limit. Once linked, the merchants can start uploading their purchase invoices into Bridge2Capital’s app without leaving their premises. The infographic below describes the entire process flow of the app in detail. The merchants are then required to repay the amount that Bridge2Capital has paid to their respective suppliers on their behalf, in four weekly instalments within a month.

The pitch: Offering on-the-spot funding for small merchants

By enabling small business owners to avail credit limit from financial institutions through an intuitive mobile app, Bridge2Capital offers several more benefits:

Makes access to capital easier, which helps small merchants do more business and increase income

Provides better business possibilities and encourages livelihood opportunities closer to the community

Impacts the behavioral aspect of small merchants by transforming their business dealings from relationship-based to rule-based

Inculcates discipline in finances to allow merchants to manage their businesses better in a sustainable manner

The evolution: Introducing a novel platform to avail credit

The Centre for Innovation Incubation and Entrepreneurship (CIIE), along with MicroSave Consulting (MSC), conducted clinics, a boot camp, and diagnostic sessions. Subject matter experts from digital credit and marketing departments guided the startup during the sessions. It helped Bridge2Capital gain better understanding of the Indian financial ecosystem and build sound business strategies to complement it. Further, MSC also supported the Bridge2Capital team to streamline its field operations model. Thus, the team was able to craft the app’s business approach and troubleshoot business, product, and technology bottlenecks such as:

- Gaining the trust of end-consumers: The merchants still adhere to traditional business models and manually driven systems and processes. Since the Bridge2Capital business proposition is new, small merchants are wary of adopting it. Further, it required the merchants to switch from a cash-dependent business which they were habituated to, to the new age digital mode. The lack of infrastructure or technology was a valid concern but belief in the existing familiar processes was the biggest obstacle.MSC conducted a behavioral research study of small merchants focused on the key barriers that prevented the merchants from adopting the Bridge2Capital app.

- Familiarizing them with organized financial lending: Due to prevalent relaxed norms of informal lenders, the merchants had grown to feel that they could utilize the funds for whatever they want, even for personal consumption. The behavioral research study conducted by MSC helped Bridge2Capital better understand merchants’ financial behavior in managing their businesses.

With Bridge2Capital, Yash is able to check and procure stock from multiple suppliers without much trouble. His suppliers now offer him a 5% additional discount as they receive on-the-spot digital payments. With added convenience and discounts, Yash’s business is growing. With a boost in customers and income, he credits Bridge2capital for his better business.

Capitalizing on the future

The business model of Bridge2Capital has been evolving to achieve the best fit with market requirements and financial viability. It has successfully completed beta testing of its technology, with glitch-free and positive ratings of its mobile application by existing customers.

Within the overall market size of over 50 million small merchants pan India, Bridge2Capital intends to reach out to 2 million merchants across 1,500 towns and cities[1]. Today it supports 20 transactions every 30 minutes.Their dream is to support one transaction request a minute.

In a bid to use higher capacity, the company will explore models to achieve a higher conversion of merchants with optimal distribution costs. It aims to create a self-sustaining model that breaks-even at the distribution level – by enhancing user experience on the front end while creating seamless workflows at the backend.

Bridge2Capital will also focus on training and optimizing its field team. The company has chosen its way-forward revenue model and is aligning its teams and systems accordingly.

Post the FI lab support, Bridge2Capital has divided MSC’s recommendations into short-term and long-term actions and has been working towards implementing them to strengthen their business.

In the near future, Bridge2Capital seeks to ensure near-real-time disbursements, real-time reconciliation, and efficient collection processes to safeguard and deliver the “wow” factor to its customers.

[1] As per Bridge2capital’s analyses

Follow #TechForAll and #BuildingForBharat to stay updated on fintech start-ups driven to bridge the social, financial and economic inclusion gap.

Leave comments