Beware the OTC trap: Are stakeholders satisfied?

by Pawan Bakshi

by Pawan Bakshi May 18, 2014

May 18, 2014 4 min

4 min

Preceding the sentiments presented in the previous blog on over the counter (OTC), our interactions with various stakeholders indicate that not all are actually happy.

We presented in our earlier blog how over the counter (OTC) was growing in leaps and bounds due to various reasons. However, our interactions with various stakeholders indicate that not all are actually happy.

“We have found the process of shifting users from OTC transactions to EasyPaisa mobile wallets to be slow.” – Nadeem Hussain in “The “EasyPaisa” Journey from OTC to Wallets in Pakistan”

This is one of the many statements that we’ve encountered that indicate that the MNOs are not really satisfied and they want the customers to begin using wallets and self-initiated transactions! Mobile network operators (MNOs) are not “really” interested in the money business, but in the mobile money business. It’s therefore important to look at why MNOs want to offer mobile money services?

There are broadly two reasons for an MNO to start the mobile money business:

- Firstly it believes that it can engage with its existing customer base and get a larger share of their wallet – as customers start spending on P2P and merchants, rather than just their spends on talk-time leading to higher revenue, “A closer look at Vodacom Tanzania shows that they made significant progress in 2013 and saw M-PESA’s contribution to the company’s total revenues increase from 12.6% in September 2012 to 18.7% in September 2013. Other operators such as Millicom (Tigo) and MTN have started to publish growth in revenues from mobile financial services as well.” – Arunjay Katakam in The State of Mobile Money Revenues – is there really any money in mobile money?

- Secondly – reduction in churn. MNOs really care about customer “stickiness”, and the mobile money business helps them achieve this. They believe, and rightly so, higher mobile usage will reduce churn and increase their revenues. It’s no surprise that almost all MNOs spend significant dollars to rein in customer churn triggering a slew of activities through their “Usage & Retention” departments. The logic is that to retain a customer is cheaper than acquiring a new customer and customer profitability increases the longer he stays on the network. Customer initiated mobile money transactions can help them achieve the objective. “MTN Uganda’s MobileMoney witnessed that while the churn rate for regular customers was roughly 4.5% per month, the churn rate for active mobile money customer was no more than 0.2%” – Paul Leishman in MMU’s “Is There Really Any Money In Mobile Money”. This is a significant result, most MNOs would dream of achieving this, somehow.

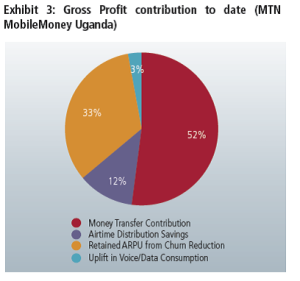

“For MTN Uganda, these numbers are exciting. We found that indirect benefits unique to MNOs – including savings from airtime distribution, reduction in churn, and increased share of wallet for voice and SMS – combined to account for 48% of MobileMoney’s gross profit to date” – Paul Leishman in MMU’s “Is There Really Any Money In Mobile Money” – see chart.

“For MTN Uganda, these numbers are exciting. We found that indirect benefits unique to MNOs – including savings from airtime distribution, reduction in churn, and increased share of wallet for voice and SMS – combined to account for 48% of MobileMoney’s gross profit to date” – Paul Leishman in MMU’s “Is There Really Any Money In Mobile Money” – see chart.

The question, therefore is, will OTC ever be able to deliver these results? The answer is definitely not. Unless the customer sets up his own wallet and transacts himself, none of the benefits mentioned above are triggered. Without the wallet, there is no customer loyalty, scale or the additional revenues that we mentioned earlier. However, there is definitely a cost involved (in terms of marketing & communication) to get the customer to transact continuously and obviously the resulting returns are well deserved.

On the other hand, very few customers are actively thinking about how the mobile wallet could revolutionize their lives. The target segment is such that the regular above the line /below the line marketing methods are unlikely to be noticed by them (remember the customers who need this the most, often don’t have televisions or are literate enough / have access to a newspaper). So they don’t know how this budding revolution is going to change their lives and impact their future. What’s surprising is that often no one is telling them, especially since they hold the key to the success. Agents, who are the closest to the customer, are just too busy to educate the customer necessary to drive uptake and usage.

Everyone agrees that Mobile telephony products and Mobile financial services are both at different stages of evolution. Despite that most MNOs are not marketing the services according to the stage of evolution, most often than not they are just extending the Telecom brand/characteristics to Mobile financial services, where the intended customer just fails to identify himself with it. Furthermore, most MNOs are still unwilling to invest significant amounts in putting feet on the street to educate potential customers – not least of all because of the first mover disadvantage inherent in making a new market.

Besides marketing, there are three other critical success factors that need to be addressed: (1) managing the agent network; (2) having a relevant product offering; and (3) sustaining senior management commitment. Only these three working together will provide any Mobile Money deployment the air-cover that it needs to successfully penetrate its customer segment and reap the rightful benefits.

So we have established that the stakeholders are not completely happy with OTC because the benefits resulting from self-initiated transactions have not materialized and also may not unless the stakeholders think about what to do to reduce the popularity of OTC?

Watch out for this space as we share a few ideas on what may work!

Leave comments