After 25 years, we live in “interesting times”: Technology and climate change

by Graham Wright

by Graham Wright Jan 25, 2024

Jan 25, 2024 5 min

5 min

As MSC turns 25, this blog looks at our journey amid developments in technology and climate change. It traces our evolution as an organization at the forefront of driving positive change through effective financial and social inclusion solutions. We also examine the support low-income and marginalized groups need to use technology and financial services to improve their lives and livelihoods, especially considering the risks posed by climate change on these vulnerable communities.

Twenty-five years since its inception as “MicroSave,” MSC has made remarkable progress. Yet, we continue to contend with two powerful forces—technology and climate change. Both these forces can potentially create substantial change worldwide. However, while technology and climate change present many opportunities, they also pose significant existential risks.

We need to think creatively outside the norms and silos that constrain us. The clock is at one minute to midnight. We must act before it is too late.

The technological revolution has allowed MSC to broaden its work to answer the long-ignored, elephant-in-the-room question: “Financial inclusion for what?” Access to a bank account is not useful by itself, particularly if the customer does not fully trust the formal or digital financial system. We must design and deliver financial services that poor people want and can use to manage their money better. We must use FinTech front ends to offer financial services in a way that corresponds to their mental models and aligns with them. Moreover, these financial services must integrate with the real economy and facilitate participation in it, so that people are not just financially – but also socially and economically – included.

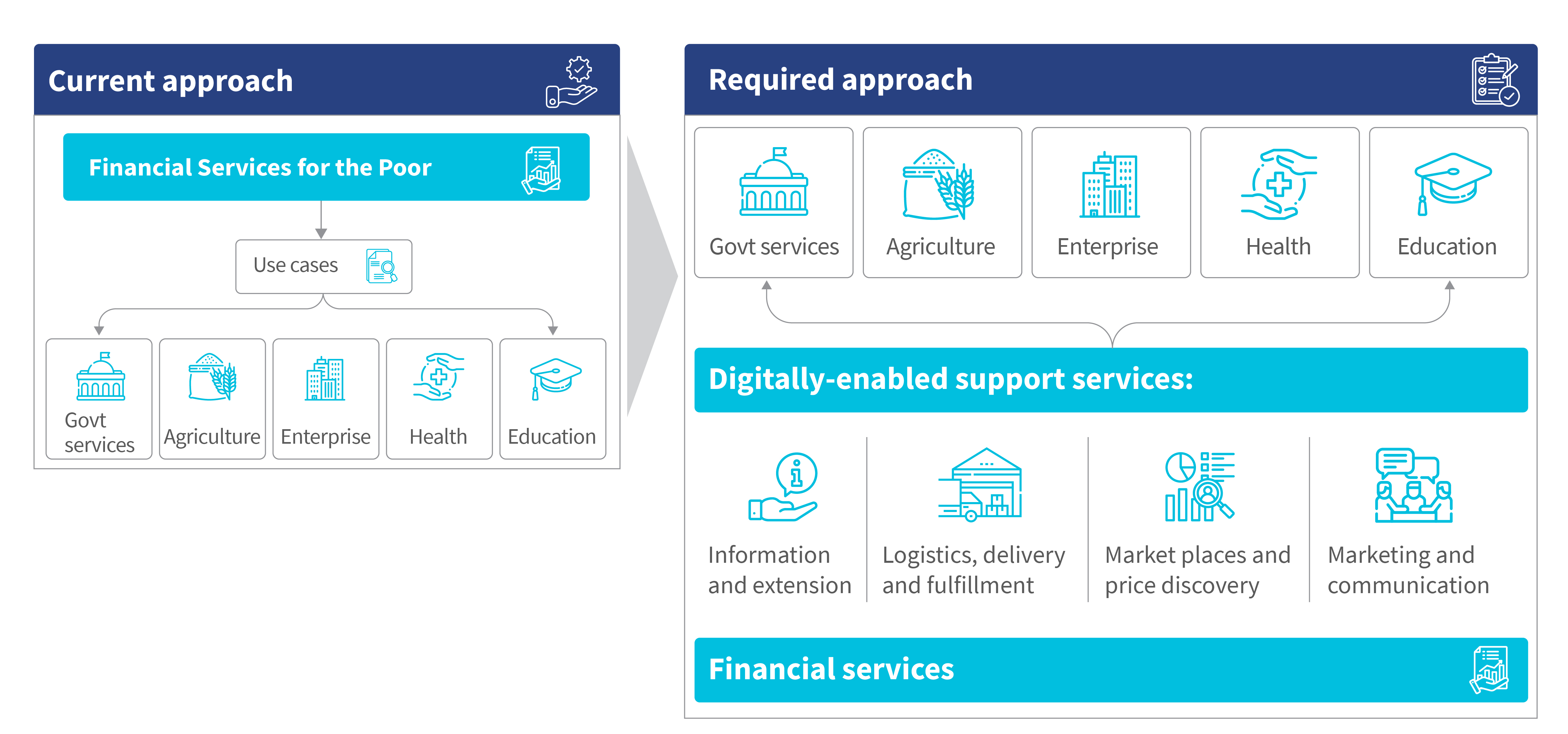

The digital revolution provides the opportunity to do this. This means that instead of viewing inclusive financial services for the poor as a vertical, we need to view them as an enabler. Financial services are a small but important cross-cutting support component of larger, digitally-enabled, real-world economy activities if viewed this way. Thus, financial services become an enabling ancillary function driven by real needs that arise from the real economy—for which digitally enabled support services play an increasingly important role.

This approach also allows us to deliver real value to poor and vulnerable communities who face profound changes in their livelihoods due to the climate crisis. MSC’s recent work with CGAP, Decodis, and FSD-Africa examined climate change’s impact on poor farmers in Bangladesh, India, and Nigeria. The findings were shocking. Droughts and flooding are increasing in frequency and intensity, often within the same cropping season. Slow-onset desertification and salination are inescapable. Smallholder farmers are facing a relentless erosion of their income and asset base, and lack the resources to adapt to increase their resilience to these changes.

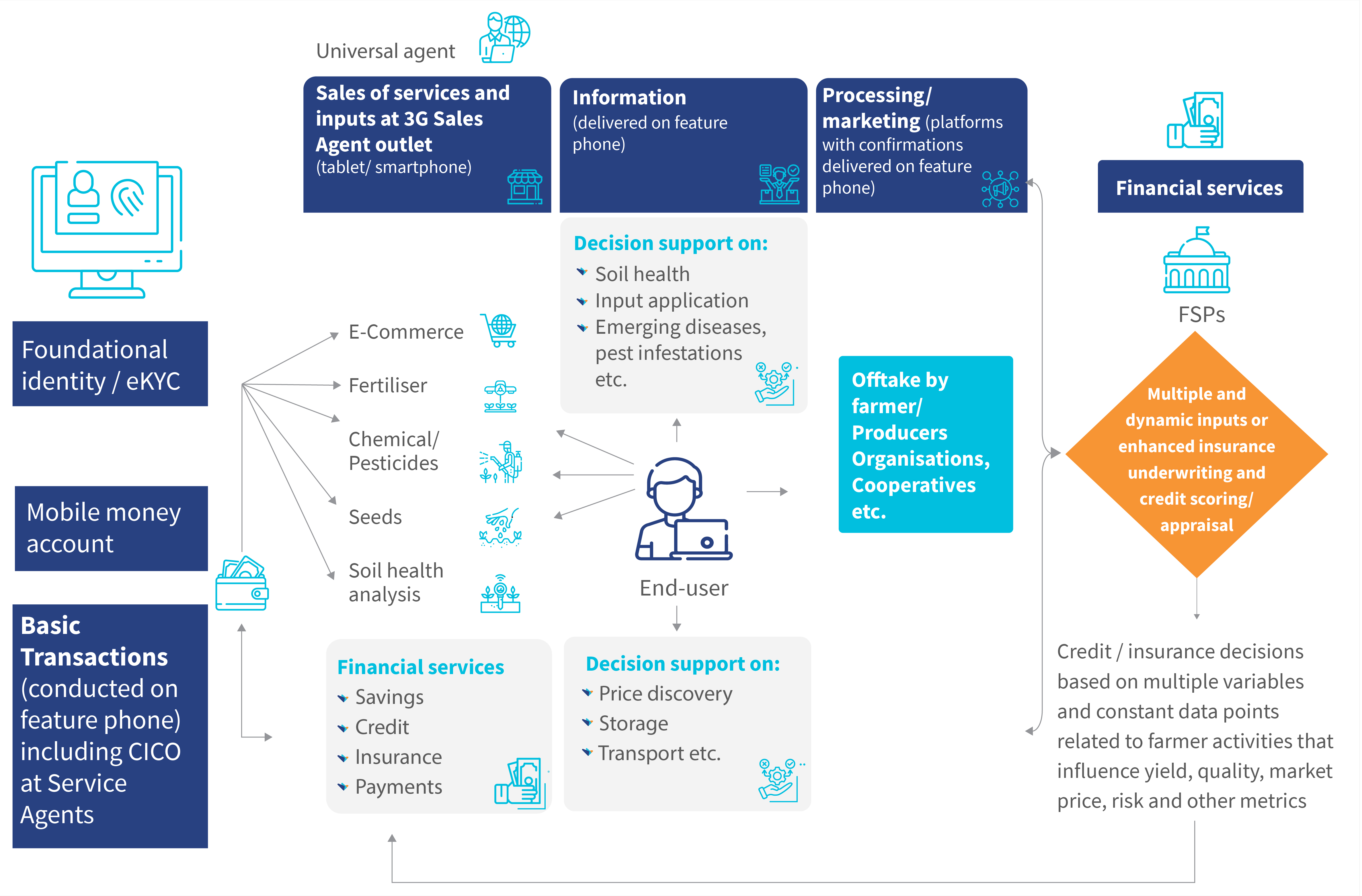

Technology and financial services must be accessible, suitable, and affordable for marginalized farmers located in remote areas often untouched by the technological revolution to successfully transform agri-food systems. We must not exclude these communities from the fourth industrial revolution. “Universal” or sales agents and “transaction” or service agents must combine forces to ensure this. While sales agents will help vulnerable and excluded communities access technology-based products and services, service agents will allow them to use these services daily.

This type of approach depends on effective digital public infrastructure. Foundational digital identity allows a digital “agri stack” to track farmers’ land holding or rental, soil health, and crops, livestock, or both. Based on this, it can provide a range of farmer-specific information to support input and output processing, marketing, and alerts on emerging pests, diseases, and more, as well as how to best respond to these. This type of integrated stack can then provide data to financial service providers and help farmers access the credit, insurance, payments, and savings services they need.

Although it seems easy, it is not. Farmers are notoriously, and understandably, risk-averse and often unwilling to change. However, it is not entirely impossible. MSC has been working with the Federal Ministry of Agriculture and Farmers’ Welfare in India to implement Agri Stack. We have also been working with the Government of Bihar to design and implement the Digital Farmer Services (DFS) platform. The DFS will integrate and diffuse innovations, use and build on shared data and complementary services, create a digital public infrastructure, and use open architecture.

India has a remarkable digital ecosystem that gives it a head start to transform agri-food systems to help farmers. Many core digital technologies and biotechnologies are already available to help farmers increase productivity and adapt to climate change. However, the real challenge lies in the diffusion of these innovations – how we enable and drive their uptake and usage – which will require a deep understanding of farmers’ needs, aspirations, perceptions, and behaviors.

However, the climate crisis will also require farmers to adapt. We will need a localized and participatory approach to ensure that planned and autonomous adaptation strategies complement rather than conflict and bring truly beneficial and transformative change. Household-level autonomous adaptation will require investments that poor households typically cannot afford. Even when smallholder farmers have access to credit, it is usually short-term and limited in value. Thus, such credit is unsuitable and inadequate to finance significant adaptation that will result in long-term resilience.

If we cannot use technology and the long-promised-but-rarely-delivered international climate adaptation funds to deliver higher value and longer-term finance, farmers will only be able to afford limited measures. Many of these limited measures will prove to be maladaptive. They will provide some short-term alleviation but compound the long-term problem. We must reimagine financial services to take a systems perspective that encompasses all four major elements found in most economies: (i) the formal financial sector; (ii) embedded finance; (iii) informal or community-based finance, and; (iv) state finance, which includes international funds.

Technology and climate change will not only affect agriculture. Similar challenges and opportunities already exist for enterprise, health, education, and government services. The key to addressing these challenges will be to understand and involve local communities as they define the problems and potential solutions.

And MSC is responding accordingly. We have been investing significant resources to build our internal capability and add value in this rapidly transforming landscape. We have been deepening our partnerships in response to the complexity of climate change and its potential impact on vulnerable communities. We have been adapting our acclaimed Mi4iD tools to incorporate the perspectives of vulnerable communities, and to support localized, participatory responses to the emerging and rapidly evolving realities they face. We have been scaling up our Center for Responsible Technologies team. This team is specifically focused on the role of artificial intelligence (AI)—both to deliver AI-enhanced value to our clients and projects and to improve the quality and speed of our internal processes to deliver first-class reports and client delight.

It is a very interesting time to be alive… to all the possibilities.

Written by

Leave comments