Addressing three key issues of BC agents in India for COVID-like challenges

by Sunil Bhat, Sharad Bangari, Anil Gupta and Pritam Patro

Jan 28, 2021

5 min

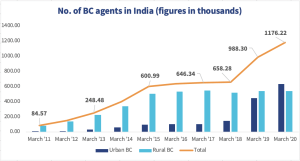

The network of business correspondents (BCs) has evolved into the backbone of financial inclusion in rural India. However, it continues to face challenges, which were further aggravated during the COVID-19 pandemic. This blog highlights three key issues that hinder the sustainability of the BC model.

Introduction

“It has been a memorable journey with challenges, solutions, and lessons along the way,” says Neelam when asked about her experience as a BC. Since the onset of the COVID-19 pandemic in India, Neelam has served her village relentlessly, providing essential banking services to her customers, including women and senior citizens.

BCs take center stage during COVID-19

On 24th March, 2020, the Government of India announced a nationwide lockdown to curb the spread of COVID-19. The government also announced a relief package worth INR 1.7 trillion (USD 23.17 billion) for the poor and vulnerable under the PM Garib Kalyan Yojana. As part of the package, an amount of INR 500 (USD 6.82) was transferred to more than 200 million PMJDY women’s accounts each month for April, May, and June. The government also front-loaded the first installment of INR 2,000 (USD 27.26) to all PM Kisan beneficiaries in April, covering around 87 million farmers. Senior citizens, widows, and physically handicapped individuals received financial assistance of INR 1,000 (USD 13.63) under the National Social Assistance Programme (NSAP).

“With most beneficiaries of the relief package residing in rural geographies, BCs acted as a bridge between them and the government,” says Neelam, who disbursed these cash benefits to numerous customers during the pandemic.

BCs faced numerous challenges during COVID-19

Nonetheless, BCs continued to face challenges, which were further aggravated during the pandemic. These issues prevent the BC model in India from performing to its full potential in response to such emergencies. The top three key issues and some potential solutions are:

- Liquidity management: Cash management is important for a BC, especially during the times of monthly remittances and transfer of government benefits, such as payments under the PM Garib Kalyan Yojana as well as pension and other benefits. Traditional BCs located in remote areas find it difficult to replenish cash. Providers can look at distributor-based liquidity management practices that new-age BCs have adopted in urban locations. For remote or rural locations, providers should allow preferential access to agents for rebalancing, if a distributor-based option is not feasible. According to Neelam, support with cash management would help her perform better, especially in times of high use, particularly emergencies, such as natural calamities or pandemics.

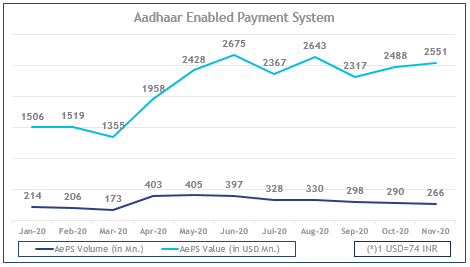

- Authentication failures with AePS: Transaction failure in any payment system can hinder seamless service delivery. According to a report, the average percentage of failed AePS transactions was 39% in April 2020. The numbers ranged from 10% to 62% across different providers. According to another report, a huge surge in cash-out transactions during the lockdown was one of the reasons behind transaction failures. Taking cognizance of the capacity of intermediaries, the regulators have advised banks and other service providers to follow best practices and reduce technical They have also revised the AePS architecture to balance the load on various servers. This raises concerns about the infrastructure capacity of intermediary providers. In addition, some issues continue to persist, such as the improper capture of fingerprints despite multiple attempts.

Our discussions with providers reveal that the measures taken have helped, and significantly reduced the technical decline of non-financial transactions. Nonetheless, some of the issues around business decline due to biometric mismatch limit breach, insufficient balances, and so on for financial transactions continue. Supply-side players can provide an additional biometric authentication option like an IRIS scanner to resolve one of the major issue. BCNMs like Stree Nidhi in Telangana have successfully integrated the IRIS feature with their Andhra Bank BCs. “While failure rates have improved significantly, transaction failures in AePS remain an issue,” says Neelam. After the announcement of the government’s relief packages, Neelam noticed a surge in non-financial AePS transactions at her outlet. “There were many occasions where transactions were declined because of authentication failure. So we started dissuading people from conducting non-financial transactions like balance enquiry – that seemed to take the pressure off the system,” says Neelam.

- Insurance cover for BCs: Unforeseen circumstances like COVID-19 and natural calamities leave front-line professionals vulnerable to the situation. BCs provide essential services to the people during these trying times, but face risks associated with their health and possibility of accidents as they visit bank branches and sometimes provide doorstep services. Supply-side players can consider provisions for both health and accidental insurance for BCs. Some BCNMs, such as Basix Sub-K provide the Hospicash (a small value medical insurance to cover hospitalization and related expenses, otherwise not covered) facility to their BCs, but many are yet to take concrete steps in this regard. Neelam believes an insurance cover for BCs will be a welcome move and suggests the possibility of sharing the insurance premium amount among the BCs and banks.

Concluding thoughts

The BC channel in India is one of the most effective ways to provide the underserved segment with low-cost banking and payment services. However, the model struggles with many prevailing issues, including its agility to cope with emergency scenarios like COVID-19. BC agents are essential for the last-mile delivery of financial services across the country, as has been made clear by their role in DBT transfers during the pandemic. Acknowledging their importance, the government, regulators, and other supply-side players need to find feasible solutions for the key issues mentioned above. This will help not only committed agents like Neelam to prosper but also enable the underserved segments in remote locations to access better services.

by

by  Jan 28, 2021

Jan 28, 2021 5 min

5 min

Leave comments