Access to finance alone will not save youths from unemployment. What will? Part 2

by Shalom Mbugua and Adama Diaby

Dec 5, 2023

6 min

Access to finance is essential to address the challenge of youth unemployment. However, nonfinancial assistance like business development assistance, the creation of a business-friendly environment, and the provision of opportunities for capacity building are also pivotal to empower young people to make strides in economic advancement. This blog sheds more light on this.

As our previous blog shows, youth unemployment in Africa is a multifaceted challenge—exacerbated by several factors, which include macroeconomic instability, educational mismatches, and social biases. These problems hinder young individuals’ potential and impede the continent’s economic and social development. They call for comprehensive solutions as diverse and complex as the problems themselves.

These solutions offer a roadmap to empower Africa’s youth, from policy reforms and educational alignment to breaking social barriers. We can turn the tide on youth unemployment and unlock Africa’s young population’s immense potential through environments conducive to job creation, skill development, and inclusive practices. This blog discusses how we can manage youth unemployment challenges in Africa, what has worked, and what lessons these experiences offer.

How can we address the youth unemployment challenge in Africa?

We must acknowledge that no one-size-fits-all solution can address Africa’s youth unemployment challenge. Different contexts require different approaches. Employment comes in two forms: Wage and self-employment. As per the World Bank announcement in October 2023, Africa has 12 million new young job seekers and only 3 million jobs. This gap of 9 million unemployed, which represents 75% of new young job seekers, will likely worsen if we do not take action, as the number of applicants could reach 100 million by 2030. This blog focuses on self-employment and entrepreneurship. It recognizes their significance to address the escalating youth unemployment crisis in Africa, given the widening gap between job seekers and available positions.

Youth employment in Africa cannot rely solely on scarce salaried jobs. This presents a significant challenge as relying solely on such jobs is not a viable solution for youth unemployment. Entrepreneurship is a credible alternative to tackle employment difficulties. However, this journey is filled with pitfalls, especially for young people who face numerous challenges to set up and develop their businesses. A frequently faced challenge is access to finance—the ability to obtain sufficient and accessible funds to launch, manage, and grow a business.

Several initiatives were developed to address this challenge. The Kenyan government’s Youth Enterprise Development Fund sought to support youth enterprises. The Nasira program was born of a public-private partnership to set up a youth loan guarantee fund. The Africa Growth and Innovations Initiative project is another similar initiative. These programs provide young people various forms of financial support, such as grants, loans, equity, guarantees, and subsidies.

The Youth Enterprise Development Fund program enabled many young people to access finance and create or develop their businesses. Despite this, youth unemployment in Kenya has continued to rise from 6.9% in 2006, when the program started, to 13.4% in 2022. Only 10% of the youth employment programs in Africa have positively and significantly impacted employment outcomes. These statistics suggest that access to finance alone is not enough to solve the youth unemployment problem in Africa. What is missing, then?

The Challenge Fund for Youth Employment (CFYE) is an initiative that takes a different approach to create, match, and improve jobs for young people in Africa. It emphasizes private-sector participation and youth engagement. It encourages innovative job creation strategies beyond the promotion of financial access to create jobs, as reported by the Palladium group as part of the CFYE initiative’s success story.

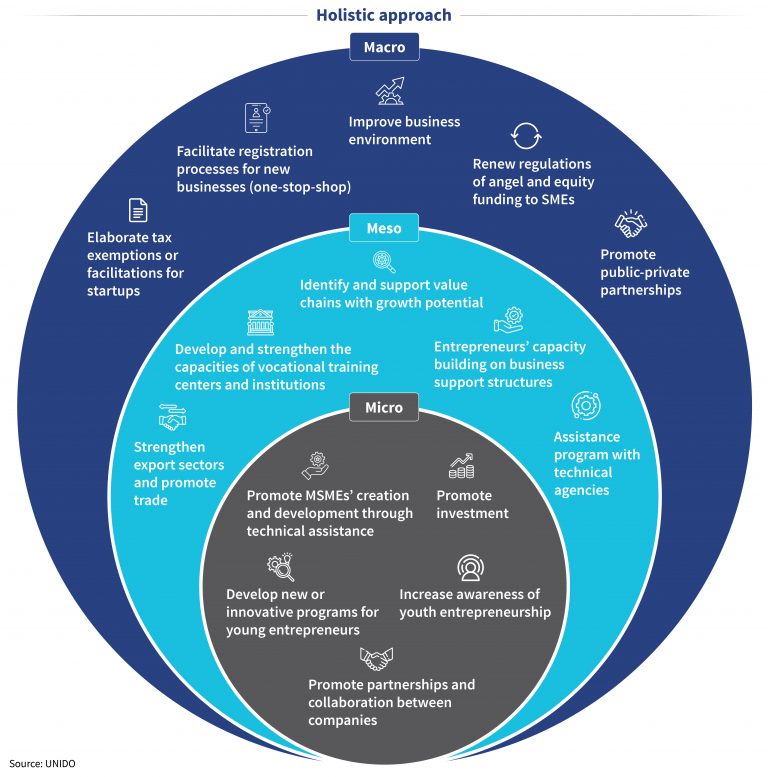

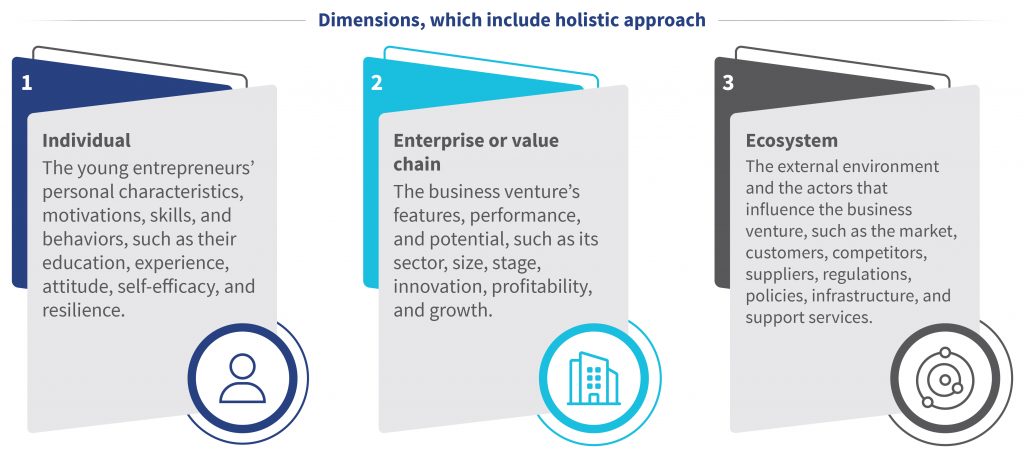

These findings suggest that we must adopt holistic approaches that consider the several dimensions that affect African youth entrepreneurship. These dimensions include individual, company or value chain, and ecosystem. This is further explained below.

Some regional development organizations, such as AGRA, have recognized the benefits of a holistic approach to youth employment programs. AGRA has developed the Youth Ecosystem Development Framework (YEDF) with MSC’s support. YEDF is a framework to analyze the youth employment ecosystem to foster collaboration and accelerate youths’ access to economic opportunities in food systems. This framework has helped redefine AGRA’s strategy to create sustainable jobs for young people in Africa’s food system. AGRA has been working to create 1.5 million jobs in food systems for young people across Africa over the next five years.

A holistic approach, such as that undertaken by AGRA and CFYE, recognizes that young entrepreneurs need non-financial support along with access to finance. This non-financial support includes business development assistance, a business-friendly environment, and capacity-building opportunities. It recognizes that stakeholders must design financial services to meet young people’s diverse and dynamic needs and preferences. Moreover, it advocates a systemic approach to youth employment that promotes collaboration and coordination between actors from the public and private sectors, civil society, and academia.

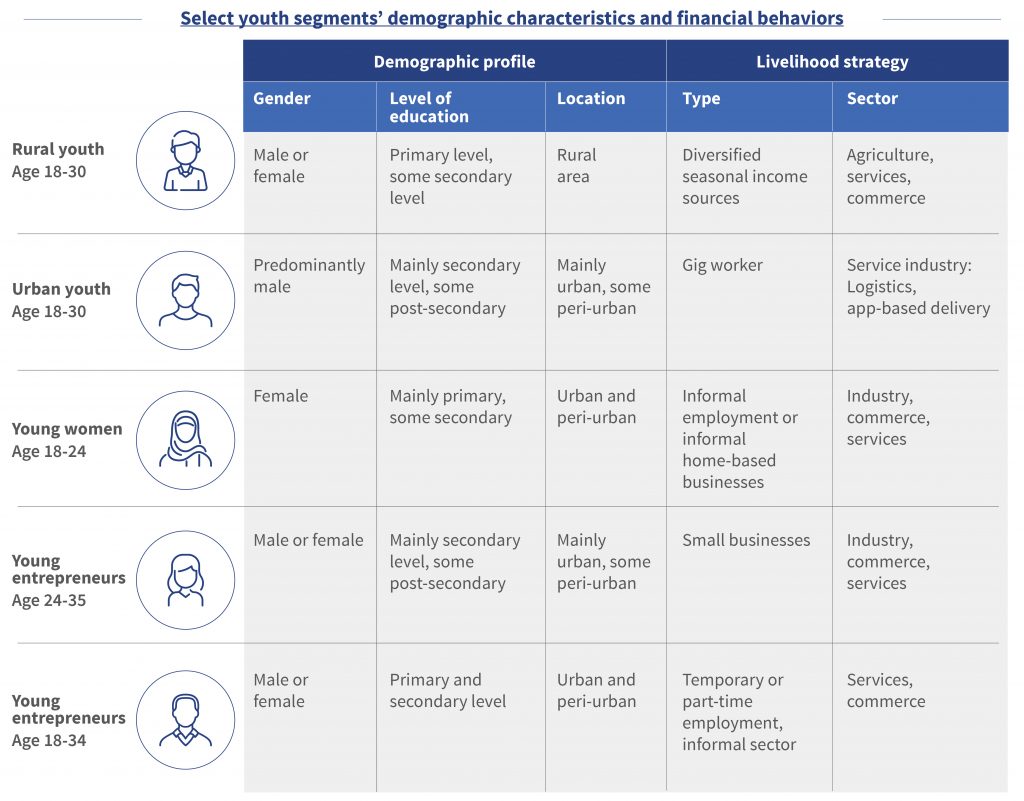

A holistic approach acknowledges that financial services should cater to diverse youth needs. Young people are not a uniform group but are varied and dynamic. Our field research shows that youth preferences vary. Some favor savings over loans, require different loan amounts, repayment terms, or collateral conditions, and have varied risk appetites and aspirations. Development partners have recognized the need to understand youths and have taken steps to make this information available. For instance, MSC helped FMO and Making Cents International develop a compendium of global good practices as practical guidance to financial service providers (FSPs) to understand the youth market, improve their products, and broaden and deepen their institutional strengths, priorities, and resources to serve the youth better. MSC also helped Opportunity Bank Uganda Limited (OBUL) develop financial products for the youth. OBUL can now better address the unique financial needs of young entrepreneurs in Uganda through dedicated products.

The approach would promote coordination, complementarities, and partnerships among different actors, which include:

- Policymakers and regulators, such as governments, ministries, and agencies, to formulate and implement policies and regulations that affect young entrepreneurs;

- Research and education institutions, such as universities, think tanks, and media, to generate and disseminate knowledge and information on youth entrepreneurship;

- Financial institutions, such as banks, microfinance institutions, and FinTechs, to provide financial products and services to young entrepreneurs;

- Business development service providers, such as NGOs, foundations, and incubators, to provide non-financial assistance to young entrepreneurs;

- Youth organizations and networks, such as associations, clubs, and forums, to represent and advocate for young entrepreneurs’ interests and needs.

However, a holistic approach also has several risks, such as:

- Divergences in interests and priorities of different stakeholders can hinder effective coordination and collaboration;

- Information and power asymmetries between young entrepreneurs and other stakeholders can limit people’s access to opportunities and resources;

- Institutional and regulatory constraints, such as bureaucracy, corruption, and entry and exit barriers, can discourage or hinder youth entrepreneurship;

- Challenges in the measurement of youth employment and entrepreneurship programs’ impact and performance can affect interventions’ quality, relevance, and effectiveness.

A holistic approach would emphasize the need for youth involvement through a participatory approach. A participatory approach recognizes young people as critical actors in development and not passive beneficiaries in program design, implementation, and evaluation. It ensures the programs are relevant, responsive, and effective for the target beneficiaries. Youth involvement would also empower and inspire young people to take ownership of their entrepreneurial journey and contribute to develop their communities and countries.

The path ahead

The challenge of youth unemployment in Africa is an immediate and pressing issue that demands urgent action. Although access to financing is crucial, it is only a part of the solution. A comprehensive and holistic approach is essential to truly make a difference—one that addresses the problem’s multifaceted nature.

We recommend that stakeholders recognize the youth population’s diverse and dynamic nature, and design financial services tailored to their specific needs and preferences. This design will consider different financing options, repayment schedules, and risk appetites. Additionally, stakeholders should prioritize nonfinancial support. Collaboration and coordination among various actors, such as financial institutions, business development service providers, policymakers, research and educational institutions, and youth organizations, are also essential. We must also consider risks and challenges in the implementation of strategies and include a participatory approach of youth in interventions.

In summary, we propose a holistic approach that considers the individual, business, and environmental dimensions of youth entrepreneurship, practical recommendations, and a critical review of risks and challenges to address the problem of youth unemployment in Africa. We can solve this pressing problem and contribute to the continent’s transformation through a conducive and supportive environment, youth’s involvement at every stage, and usage of their potential and the strengths of the financial sector and the broader ecosystem.

This blog was written with inputs from Willis Ogutu.

by

by  Dec 5, 2023

Dec 5, 2023 6 min

6 min

Leave comments