Competition in the Kenyan Digital Finance Market: Mobile Money (Part 1 of 3)

by Joyce Murithi and Mike McCaffrey

Dec 14, 2015

5 min

There has been a great deal of international discourse on the topic of mobile money after Kenya’s successful implementation of M-PESA, and as we recently wrote, the success is increasingly shared by banks. This is a clear victory for Kenyan customers, who now have more options to choose from. However it also means that the financial […]

We compared products in three categories in order to conduct an accurate analysis of the competition in the Kenyan digital finance market:

- Mobile Money

- Digital Deposits

- Digital Credit

Before entering into this analysis, we took a quick look at the pricing of GSM services between telecom providers, because for many Kenyans this will be the first decision they make determining which mobile/digital financial services they will use. It was interesting to note that of the four providers, Safaricom, Equitel and Airtel all had the exact same rates for voice and SMS services, while Orange prices were lower on voice, but equivalent on SMS. This shows that providers are generally not focusing on differentiating themselves on this dimension, and also there is no price advantage to the customer for selecting a provider with greater market share, because even the cross network pricing is standardized across providers.

In comparison, we see much more differentiated pricing schemes in the mobile money space.

All the telecom companies analysed offer mobile money services, and so do independent third parties like Tangaza and MobiKash. While most banks technically offer digital access to bank accounts, as opposed to mobile wallets, the service basically functions in the same way for cash-in, cash-out and money transfers, so Equitel and KCB Mobi Bank are also included in the analysis.

With mobile money, there are a number of important factors a customer should take into account when choosing a provider. In addition to a SIM card, you need a method for getting money into and out of the system, which is usually done through a network of retail agents. The Helix Institute conducted a survey of agents in Kenya in December 2014, and found that 79% of agents in the market were offering M-PESA, while 8% were serving Equity Bank, and 5% were serving Airtel Money. The remaining providers had lower percentages of the market. This means M-PESA agents are ten times more prevalent than agents for any other provider, and that is certainly a distinct advantage for customers.

We also examined the prices for the cash-in and cash-out transactions conducted through the agents along three generic bands (1,000 KSH [US$10]; 5,000 KSH [US$50]; 10,000KSH [US$100]). All providers offer the cash-in service free of charge. Interestingly, for cashing-out of the system through an agent, the KCB Mobi Bank service is the lowest price across all three values, and M-PESA is the most expensive across all values, whereas the other three services cost exactly the same. Therefore for transactions on the agent level, M-PESA is by far the most accessible, but customers must pay a premium to use it.

The person-to-person (P2P) transfers can occur within a provider’s network, or between provider’s networks. While the former is much more common, the latter is generally more expensive and providers have different pricing schemes for it, meaning the analysis for each must be done separately. In September 2014, InterMedia conducted a survey in Kenya and found that 58% of Kenyan adults actively used mobile money (on a 90-day basis). 99% of them used M-PESA, while 9% used Airtel Money, and 2% or less of the adult population used each of the other services. This was before Equitel was launched.

While it is clear that M-PESA offers customers a distinct advantage in terms of accessibility of agents, and number of users, the pricing of these services is complex and which service is the best deal still really depends on what a customer wants to do.

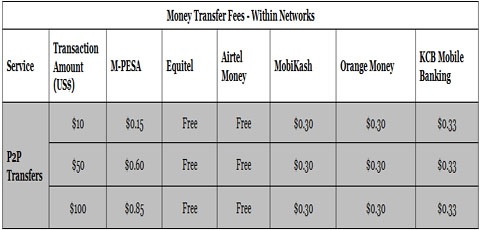

For transfers within a system, Equitel and Airtel Money offer free transfers right now to customers of their respective services. Beyond that, M-PESA has the lowest price for transferring US$ 10, but at the US$ 50 mark, M-PESA is the most expensive of the services, and MobiKash and Orange Money become competitive capping their fees at US$0.30.

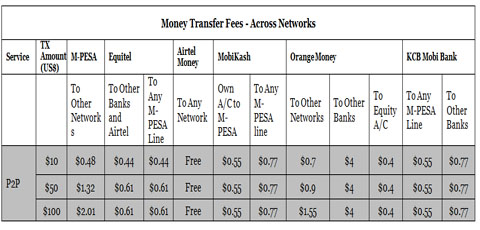

Transferring money across networks is much more complicated, and it is still unclear how important these pricing structures are given that 99% of users have M-PESA, and therefore may have little need to use another network. However, this is likely to change as banking services are becoming more integrated into mobile money, and competitors are investing in building agent networks that will make their products more accessible, likely eroding some of M-PESA’s market share.

Analysing the current pricing, Airtel continues to provide these services free of charge across all price bands to try and encourage people to use their SIM to send money. Equitel currently provides the most affordable option for transfers from mobile network operators (MNOs) to banks or vice versa. M-PESA is generally expensive for cross network transactions, especially at the higher transaction bands. It is also interesting that it is still beneficial for a customer to transfer to M-PESA using M-PESA, rather than use any other providers’ service besides Airtel, up to values of about US$ 50, at which point KCB Mobi Bank and Equitel become the lowest cost options.

Safaricom’s M-PESA is still by far the most accessible service in the country for cashing-in or cashing-out of the system. However, The Helix Institute 2014 Kenya Country Report did show that other providers are rapidly gaining ground. Currently, Airtel is the low cost provider, offering free transfers even to other networks. While this may help them gain market share in the short run, it seems unsustainable in the long run, and we predict these low prices will be temporary as they have been in the past.

For transferring money, in most cases the receiver will be an M-PESA customer, and for values up to around 5,000KSH (US$50), M-PESA will still be the preferred provider, except for the 9% of Kenyans with Airtel Money. However, services like Equitel and Airtel offering free transfers between users could be enough to increase their market shares, and that could put downward pressure on pricing for P2P transfers. For now, despite higher pricing in some categories, M-PESA still seems to be the obvious choice for Kenyans who like its accessibility, ubiquity and competitive pricing on the low transaction bands they use most.

In the second blog in this series, we examine digital credit services. Digital banking (deposits and credit) is potentially the most lucrative area of all, as digital loans and intuitive money management products are very attractive to customers and this can really drive increased usage and thus expand financial inclusion.

Note: These prices were collected in November 2015 by reviewing provider websites and advertisements; by reviewing terms and conditions; and by calling customer service centres when necessary. It is important to note that volatile market interest rates and dynamic competitive pricing schemes mean that prices change constantly. Further, in multiple cases we received conflicting information from providers on their pricing schemes, and did our best to resolve them.

by

by  Dec 14, 2015

Dec 14, 2015 5 min

5 min

Leave comments