The need for providers to build strong relationships with agents to guarantee sustainable digital financial services

by Djitaba Sackho-Patel

Feb 6, 2019

8 min

The blog focuses on how strong and sustainable partnership agreements will be essential to improve the liquidity management of agents in the Democratic Republic of Congo.

“I am going to stop. I did it with [supplier x], I told his representatives not to come here anymore. I work with my own money and I am free to stop whenever I want,” exclaims Mr. Mataba, a non-exclusive agent who operates in the Kongo Central region in the Democratic Republic of Congo (DRC). He started his business as an agent six years ago, first with Airtel Money and then with other electronic money operators.

Like others, Mr. Mataba had been motivated by the lure of commissions but over time, he saw profits decline. He continues, “If the providers improve their services, I will continue and ask my friends who are agents to continue too. Otherwise, we will stop and they will lose customers as happened with the transfer agencies “Ami fidèle” and others…”

Mr. Matamba knows that many people in his region work as agents, and has been concerned about their working conditions. He formed an agent association, and as president, he brings agents’ complaints to the attention of the suppliers’ representatives. Yet he believes that he has not yet been heard, and has decided to stop working with one supplier and is in the process of moving away from the others.

In the DRC, the digital financial service market has been booming. Mobile money operators mainly dominate it—although recently, financial institutions have started to develop their offers. One such institution is FINCA RDC, which was a pioneer in this field.

MicroSave Consulting (MSC) conducted a qualitative study in the Kinshasa, Central Kongo, Katanga, Kasaï, and Kivu regions. The team met stakeholders of the distribution chain from the five major suppliers, comprising division managers, sector managers, super-agents, and agents. MSC focused its research on understanding the behaviors, perceptions, and attitudes of agents, based on our MI4ID approach.

The study identified a wide range of agent profiles and approach models. Indeed, agents have a central role in the service distribution chain. Not only are agents the points of contact for customers, but they also represent a major expense for providers, costing 40 to 80% of the revenue generated by the activity. Providers must, therefore, approach the development and operation of agent networks with a clear strategy to ensure sufficiently rigorous operational control. It is paramount for a provider to build and maintain an optimal relationship with its agents.

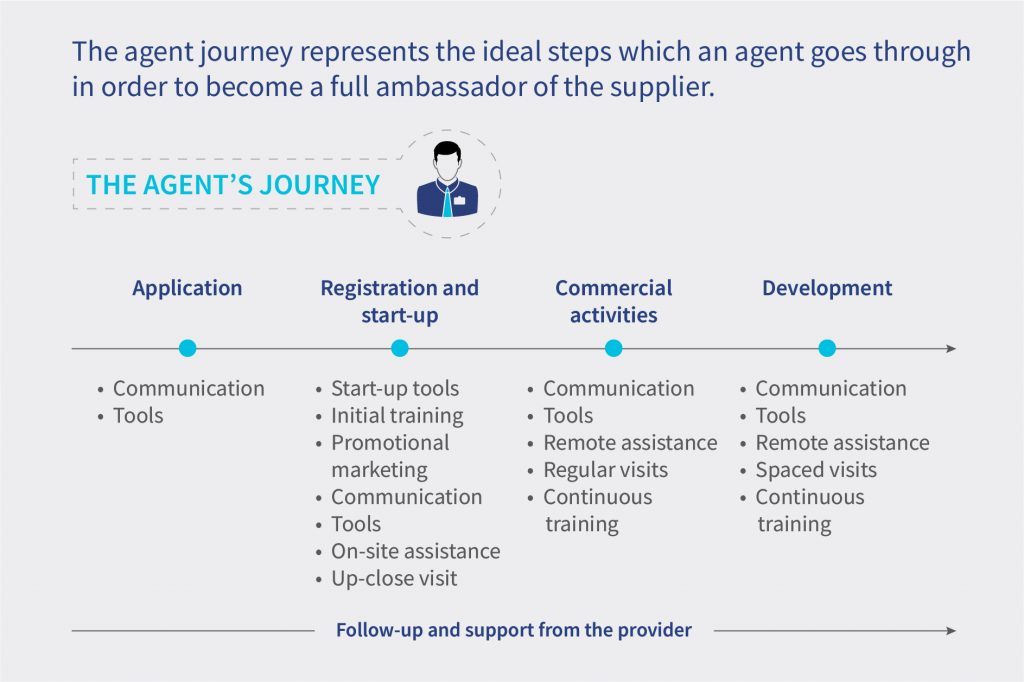

Using MI4ID approach allows to map the agents journey from the awareness stage to the development of the business stage, in order to understand what are the enablers and barriers to their success. The agent journey represents the ideal stages through which an agent evolves to become a full-fledged ambassador for the providers supplier. The support provided at each stage by the provider creates and boosts the agent’s loyalty. Agent path modeling makes it possible to capture and communicate an agent’s experience during a particular action or event.

An analysis of agents’ careers in the DRC has revealed key lessons that providers can use to improve their commercial relationship with agents and make them more accountable. The final objective is to guarantee a good level of service quality and reliability to clients.

1. From becoming acquainted with the function of agents to the application

Building knowledge and understanding the agent’s profession

From one prospective agent to another, the experiences of obtaining the right information concerning the role of an agent are different depending on the contact person. Family and close acquaintances who are already in the business play an important role in attracting the interest of a potential agent. They have a prescriptive role and are critical to winning the potential agent’s trust, especially with regard to the services of electronic money operators: access to the profession is perceived to be easy. No minimum level of education is required and it is possible to start an agency business with low investment in terms of equipment and location, and with low working capital in the form of liquidity.

The result is a strong demand from prospective agents that suppliers cannot meet, and the development of a market for the sale of SIM cards. Providers would do well to pay attention to how information is communicated to prospective agents and the channels used, given that the experiences of agents in the field are highly varied.

The purpose: Integrating the agent’s role

To reassure hesitant prospective agents, it is important that the provider’s sales representatives meet the prospective agent to confirm that the candidate matches the required agent profile. A prospective agent may have an existing relationship with the provider either as a credit customer, that is, as an agent for financial institutions or as an airtime credit reseller. For such prospective agents, the opportunity of becoming an agent through a rigorous selection process gives them a sense of importance and is crucial in establishing a sound relationship.

Obviously, the main source of motivation for prospective agents is the commission earned, and this usually means obtaining a regular but not necessarily high income. For non-dedicated agents, the possibility of stimulating the growth of the main activity is an important factor. When potential agents receive better and more realistic information from providers, they can get a sense of the working conditions and benefits expected through this activity more accurately.

2. Registration and launch of activities

In DRC, agents who work for electronic money operators but lack the official documents have to complete the registration process through an information sheet, which simplifies the procedure for setting up an agent account. However, this information sheet does not explain the rights and duties of an agent. Agents are not informed or trained in detail about what is expected of them in terms of work, how to carry out this work, and what to do in case of difficulties. It is essential to establish the principles of a partnership relationship with the agents because this will inform the choices that will guide the agents’ behavior during the implementation of the activities.

A second problem that agents face stems from the shortage of a start-up kit in the form of transaction booklets and marketing material, which some agents experience. This fosters a sense of inequality between agents and a supposed lack of consideration on the part of the provider. As a result, agents incur additional expenses, and this increases their expectations about the profitability of the activities. Agents with potential may also lose interest in the activity or fail to comply with the rules.

The providers could improve the stock management policy to ensure proper distribution of marketing materials to agents. They could also improve the tools for monitoring those in charge of supporting new agents and thus ensure better management of agents from the very beginning.

Agents need training that goes beyond simply learning how to do transactions. Such training would help them understand the intricacies of their role and help them succeed in the business. Providers should support agents throughout their careers through initial and continuous training that is diversified according to the agents’ capacities and aspirations. For agents of electronic money issuers, obtaining the status of agent issuance of the agent SIM card, equipment, and activation should be systematically pegged to the successful completion of the initial training. By incorporating practical exercises into the training, the agent will be able to assimilate the tasks expected of them.

3. Business management and development

Agents face a number of obstacles that prevent them from developing their activities successfully. First, the value proposition faces a challenge from the agents’ dissatisfaction with the commissions earned. The frustrations of agents and the predominance of transactions at the counter result in additional fees to clients, a loss of interest in this activity, and diminished quality of customer service.

Secondly, the frequency of payments and delayed payments by agents erodes their confidence in the supplier. Difficulties in managing commission payments compound the inability to grow capital and lead to attrition. Lastly, a lack of incentives discourages agents from selling the services. The provider should propose an economic model and value proposition for the agent that reflects market dynamics. The rewards must be a clever mix of monetary and non-monetary incentives.

Furthermore, in terms of the management of operations, the agents have mixed perceptions about the quality of support they receive from providers. To avoid making mistakes, some agents in the DRC allow customers to write down the account number on the transaction book or on the mobile phone, which increases the risk of fraud. Then in case of an error, it takes a long time to deal with the complaint. Moreover, poorly trained agents who are not familiar with the support mechanisms have to bear the costs by reimbursing customers. Therefore, the providers should invest in more sophisticated interfaces to reduce agents’ margins of error and shorten the time required to process claims.

Another challenge is liquidity management. Agents lack the capacity or willingness to invest capital into their float, and liquidity supply mechanisms are insufficient. As a result, they use informal strategies to compensate for this shortfall. The agent is forced to keep clients waiting indefinitely for them to replenish the float. They cope by either refusing a type of transaction, by dividing a transaction between several agents, by transfer of money between agents, and by keeping the client’s money until sufficient funds are available. However, informal procurement strategies can create risks of fraud and breach of trust. To avoid the lack of liquidity, the provider must ensure a greater variety of supply distribution methods, such as fixed and mobile points, and set a satisfactory level of supply service.

Lastly, there is the problem of business development: the agent as a partner must contribute to customer development and needs support from the supplier to deal with customer complaints properly. The supplier needs to encourage agents to recruit prospective clients and manage customer relations. The management of an agent’s career seems to be an area that is lacking in the partnership relationship.

Although the Congolese agents interviewed planned to remain in the business for an indefinite period, some agents have the ambition to move up the distribution chain ladder but do not have a direct relationship with the suppliers and are neither informed nor supported to achieve their objectives. The provider should step up support to agents to foster motivation and success. In short, a study of the agents’ journeys in the DRC highlights not only the opportunities available but also the bottlenecks that curtail the agents’ progress towards success and ultimately encourage agent attrition.

For suppliers, the improvement of the relationship with agents hinges on the win-win principle, which is guided by an understanding of agents’ aspirations because the agent needs to feel included. To establish good relations, the provider must also define and implement a strategy on agent satisfaction management. This entails not only setting up a more tailor-made system of agent segmentation and management but also strengthening the quality of the network and systems to monitor communication with agents. These measures are necessary because agents are the pillar of customer relations. An investment, therefore, guarantees the growth of digital financial services.

Written by

by

by  Feb 6, 2019

Feb 6, 2019 8 min

8 min

Leave comments