The Mor Committee report – The demand side conundrum

by Graham Wright

Feb 8, 2014

6 min

Analyzing the Mor committee report, the author argues how the committee has assumed low-income people’s demand for formal financial services is a given. Is this a fair assumption?

One of the most frequent criticisms of the Mor Committee’s report on “Comprehensive Financial Services for Small Businesses and Low-Income Households” is that it ignores the demand side. The report offers a sophisticated vision of the financial architecture and what one commentator describes as “financial services as a fundamental right” for all. It also provides the guiding principles for implementing the new approach. But the report seems to imply that low-income people’s demand for formal financial services is a given. Is this a fair assumption?

Recent history in India seems to suggest that this is a heroic and optimistic assumption. The poor take-up of No Frills Accounts gives cause for pessimism. But in many respects, No Frills Accounts were designed to fail. Banks were instructed to open these accounts without reference to their use – and so they did exactly that, and dutifully reported to the Reserve Bank of India. See “No Thrills – Dormancy in NFA Accounts”. But this does not mean that poor people do not want bank accounts –MicroSave’s research into this phenomenon revealed that there were a series of features to which poor people aspired and needs that they could clearly articulate … and that poor customers were, in the main, willing to pay for these services.

We know from “Portfolios of the Poor” that poor people have remarkably active financial lives, and need a range of simple formal financial services comprising (at the minimum): (1) a basic transaction account; (2) a recurring deposit account; (3) a working capital loan; (4) an asset acquisition loan; and (5) an emergency loan. See “Financial Services That Poor People Want”. This is broadly speaking the product range now offered under the much under-rated Grameen II programme, which has seen startling levels of demand for its savings and credit products. See “Lessons From The Grameen II Revolution”.

IFMR’s outstanding KGFS model, build on painstaking action research in three very different parts of India shows that there is demand for and active use of a range of around 15 financial products when they are delivered in a convenient, accessible and affordable manner. See “The Pursuit of Complete Financial Inclusion: The KFS Model in India”.

But both Grameen II and the KGFS model are “high touch” in nature, and involve frontline staff visiting clients in their villages – on a weekly basis in the case of Grameen II. Banks are unlikely to adopt such models. For this reason, business correspondent agents will be crucial for the success or failure of the Mor Committee’s vision for financial inclusion.

Outside of Somaliland, where the absence of credible formal banking system, Telesom’s salary and merchant payment focus and free service have yielded spectacular results, few deployments have generated more than 1-2 agent-based transactions per customer per month. And dormancy amongst mobile money accounts remains a perennial problem. This is in part due to poorly designed enrolment campaigns that reward agents based on customers signing up for the service rather than actually using the service, but it is also in part because transactions are expensive and/or because of the limited product suite on offer.

“There are two glaring facts the mobile money industry needs to face up to. First, digital accounts have very little value stored in them, and the practice everywhere is to withdraw any e-money received immediately and in full. This makes people not naturally inclined to pay electronically, except for remote payments for which people will take the trouble specifically to cash in. Second, there is surprisingly little systematic use of electronic payments by formal businesses, a space in which cash and especially checks prevail, even in Kenya”.

Ignacio Mas in “Beyond Making Payments: Managing Payments”

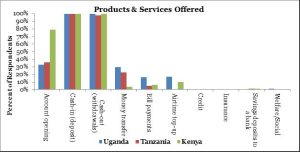

As can be seen in the graph below from the national representative Agent Network Accelerator research, the vast majority of agent-based systems continue to offer basic wallet and payments services, focusing above all on remittances, bill pay and airtime sales. Unsurprisingly, in the sub-sample of banks offering agent-based services in Kenya, 97% of agents offer savings deposits to a bank – but few banks have accounts and services designed specifically for the channel. To make agent-based digital financial services an integral part of poor household’s lives, we will need to re-engineer the product suite to offer a similar range of products offered by Grameen II and KGFS.

“What we need are service concepts that help people manage their financial lives the way in which they think about them. Customers need to give shape to their own user experiences. That means providers must think of products as tools which customers can use in different ways rather than as products that offer specific, inflexible services”.

– Ignacio Mas & Premasis Mukherjee in “Basing Product Development on Mental Models and Metaphors”

Ignacio Mas has also proposed a system of jam-jar accounting to allow users to set aside money for different needs, projects, and aspirations. This could be enhanced with SMS reminders to save and confirmations outlining how much more is required to achieve the user’s goal – thus facilitating the recurring deposits required to build up what Stuart Rutherford calls “useful lump sums”. The MetaMon project looked at how low-income people in India and Bangladesh think about managing their finances, with a view of identifying metaphors to better describe financial management systems on the mobile phone and thus make them intuitive for poor users.

A range of products will also require different types of agents. In addition to the typical cash in/cash out merchants that service traditional payments based system, providers will have to train and monitor a more sophisticated cadre of sales agents. Sales agents will explain and sell products and jam-jarring systems to prospective customers. This is alluded to on page 57 in the Mor Committee’s report.

The Mor Committee advocates one (presumably cash in/cash out) agent per square kilometer where there are 4oo households. But, given the international experience with basic wallet and payments systems to date, it is doubtful that agents will make adequate income from servicing 400 households. MicroSave’s experience worldwide suggests that an agent needs to service 650-1,000 customers (depending of course on how often they transact) to derive an adequate income. For this reason, too, broadening the product suite and encouraging regular use is essential.

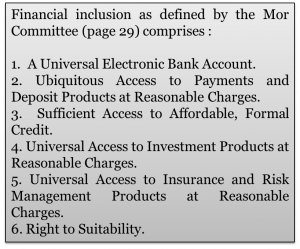

There is clearly latent and unrealised demand for financial services amongst low income households, but to achieve real financial inclusion as defined by the Mor Committee (see box) we will need to work hard to design and provide products tailored specifically for low income households and for agent-based delivery channels. The Universal Electronic Bank Account will be a good start as a “gateway” to the other products. But we should not under-estimate the challenges (and the opportunities) of creating a suite of intuitive and relevant products to help low income households manage their finances. Only when these are in place will we see the transaction volumes that both cash in/cash out merchants and sales agents will need to continue to provide their services.

Written by

by

by  Feb 8, 2014

Feb 8, 2014 6 min

6 min

Leave comments