Winter is coming: Key lessons on digital transformation for financial institutions

by Anup Singh, Christine Gachui and Zeituna Mustafa

Sep 10, 2018

5 min

In this blog, we look at the “how” – the detailed steps for digital transformation.

In the previous blog, we discussed the “why” – a business case for digital transformation. In this blog, we look at the “how” – the detailed steps for digital transformation.

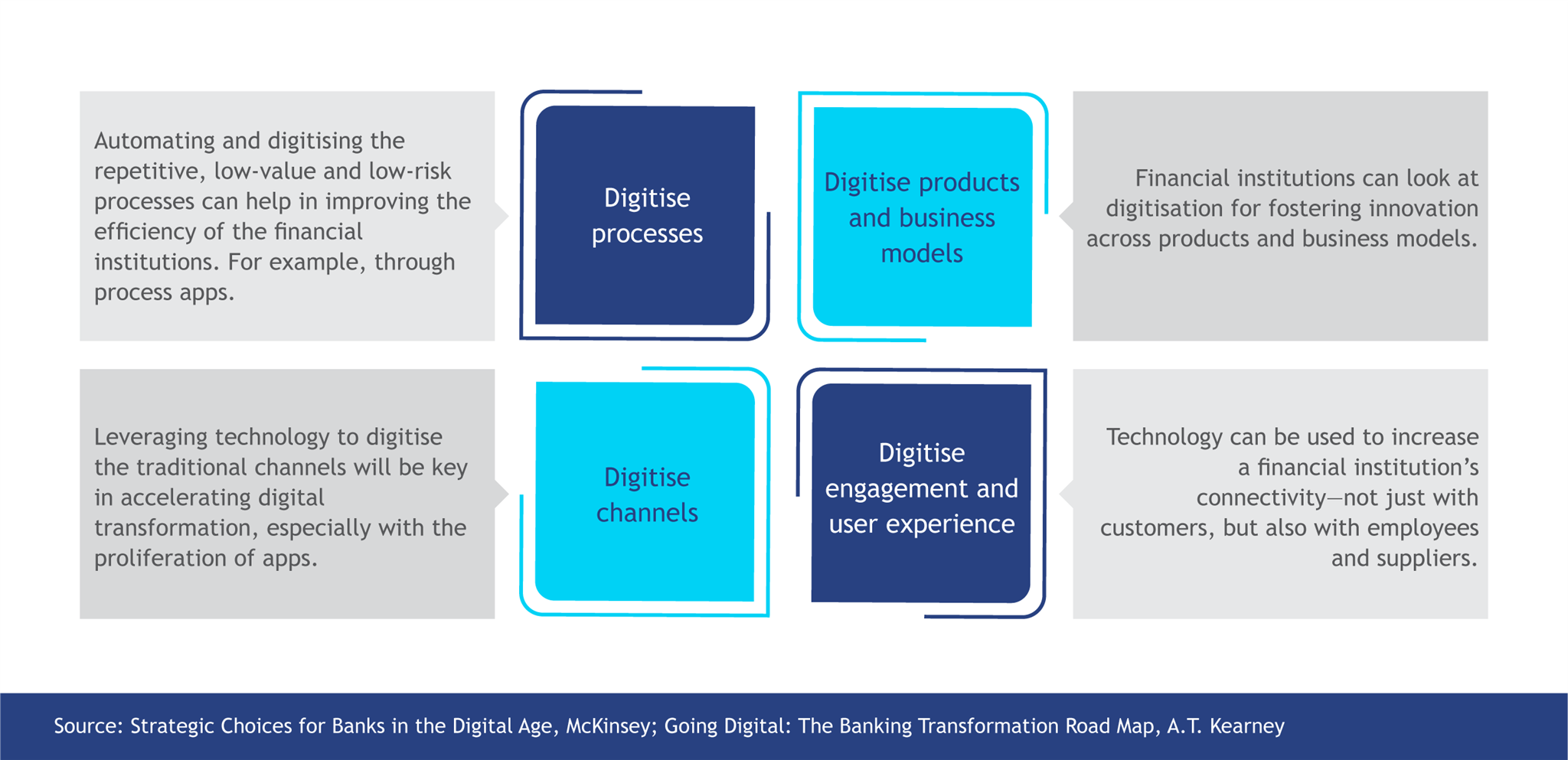

Digitise processes

Digital processes are quicker, more efficient and cheaper than manual processes. A digital transformation of processes reduces the cost and friction points of delivering service. It provides the data needed to supply a better service offering to end-users and, increasingly, to businesses. Improvements in efficiency made possible by digitisation can also help reduce the cost of sale for most products, thus providing opportunities for more competitive pricing.

The digitally-enabled processes improve:

- Marketing and onboarding through lead generation and e-KYC;

- Credit-scoring models through integration with the MIS, Credit Reference Bureau (CRB) checks, alternative data analytics, financial analysis, and loan utilisation checks;

- Turnaround time for loan disbursement, loan collections, and delinquency management;

- Internal controls and risk management through risk mapping, control breach alerts, and authentication;

- Client relationship management through client engagement and retention, targeted customer service, complaints and redressal, account opening, information, personal financial management, and financial education;

- Workflow management through documentation and filing, responsibility sharing, e-approvals, schedules and reminders, and data and information flows.

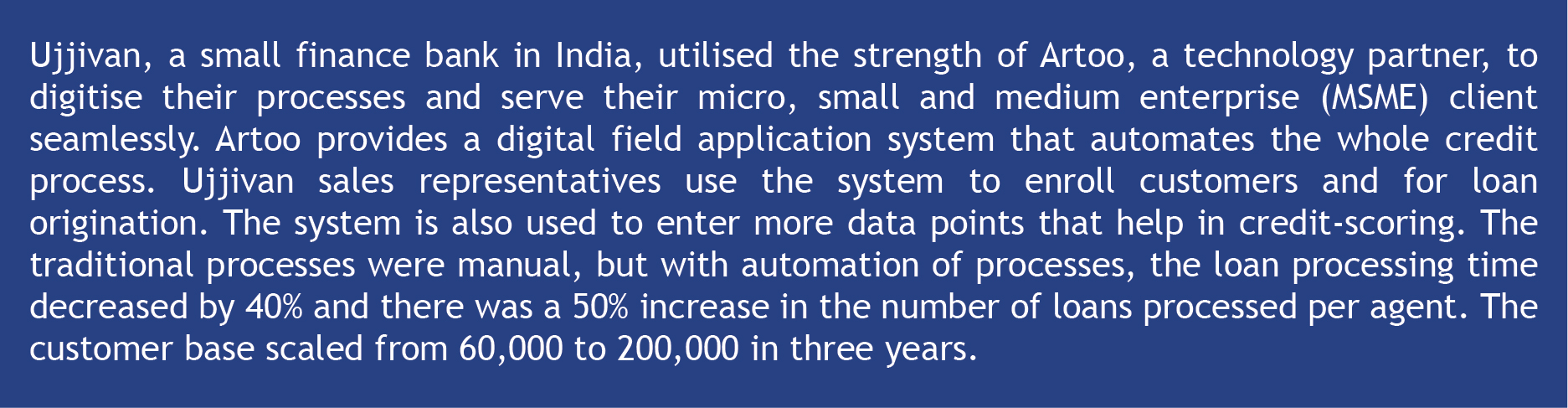

This case shows how digitisation can speed up and simplify back-end processes. It also has an important role as a design feature. From pre-populated fields on forms to automating how data is captured or how loans are processed, digitisation can fundamentally reshape the design of a customer’s experience to enhance efficiency, productivity, and profitability.

Digitise products and business models

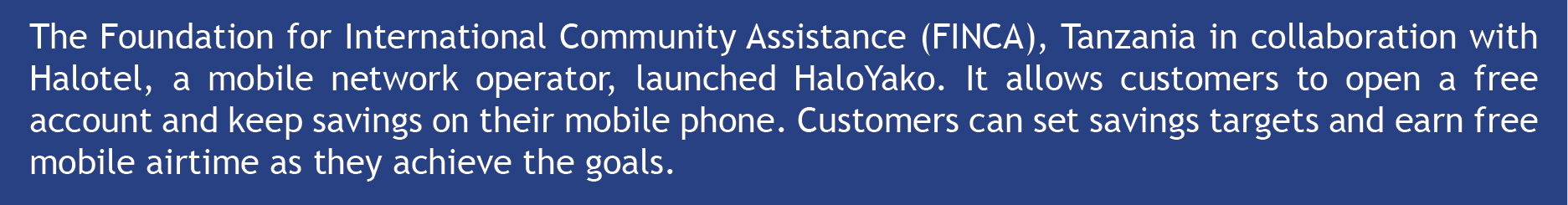

Any product innovation involves utilising technology and partnerships to introduce specialised products and services. The digitisation of products requires developing solutions that resonate with customers through addressing pain-points rather than digitising use-cases. There are significant opportunities for product-level innovation as the existing products are not adequate; so, clients are forced to take up semi-formal and informal products. They seek to derive additional value from their financial service providers (FSPs), and in many cases, are willing to pay.

Financial institutions may benefit from utilising existing digital data trails and ecosystem players to deliver new products and services to clients. This brings in opportunities to enhance the capabilities of clients as a way of innovative services bundled with the products offered. The digitisation of products clubbed with an analysis of behavioural patterns may lead to hyper-customisation of products to meet the specific needs of clients.

Digitise channels

The digitisation of channels involves using technology platforms to improve customer acquisition and user experience while transacting. The emergence of digital platforms and alternative channels has profoundly changed the way customers do their banking. Only a few customers are willing to step into a bank branch. The more access points they have, the better the user experience.

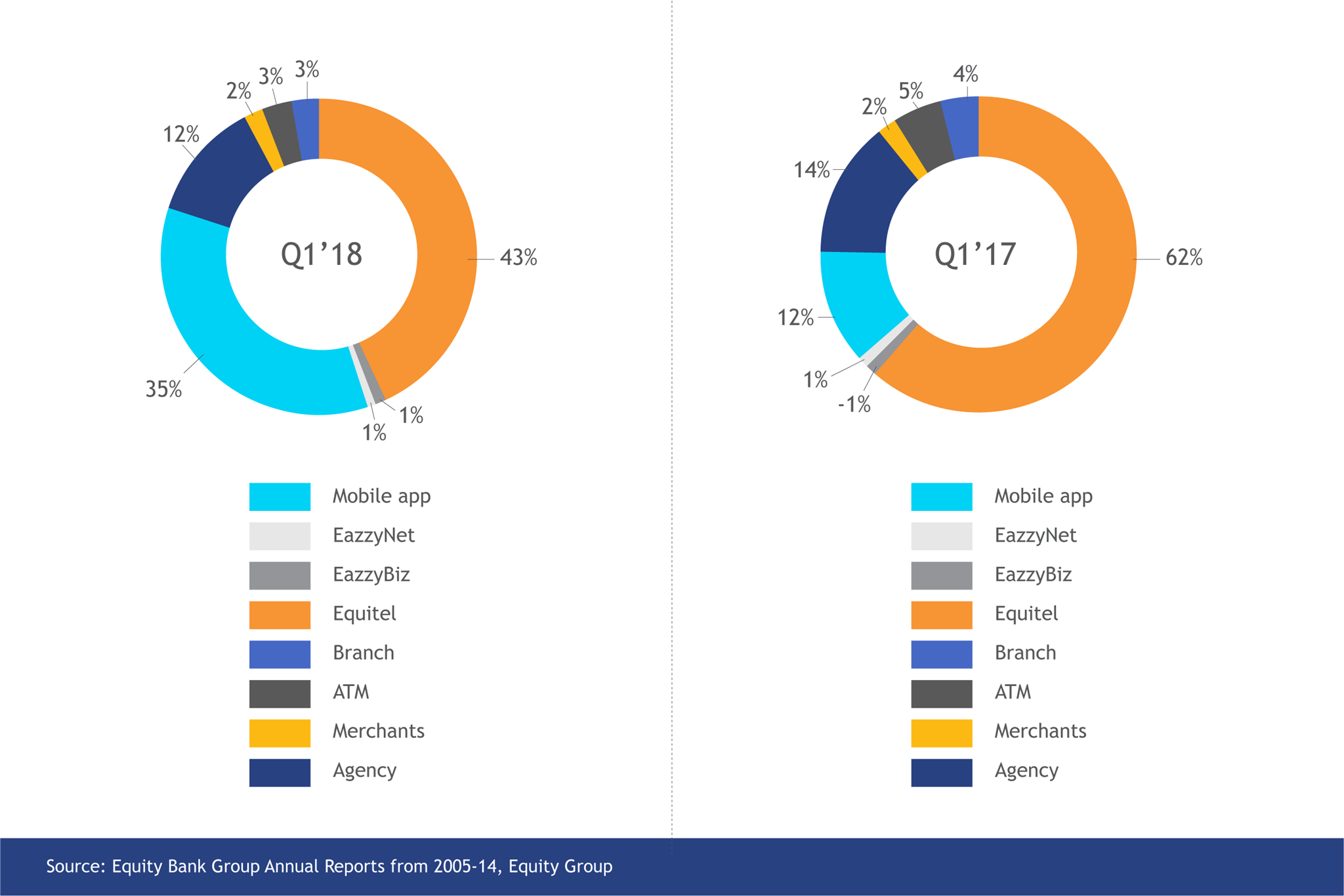

As just a single traditional channel does not resonate with the new breed of customers, there is a need to shift to an omnichannel presence where customers can interact with a myriad of distribution and delivery channels. They prefer self-service technology platforms that give them freedom, choice, and control. In 2018, the Equity Bank Kenya customers carried out 97% of their transactions outside the bank branches, as shown in the graph below.

Digitise engagement and user experience

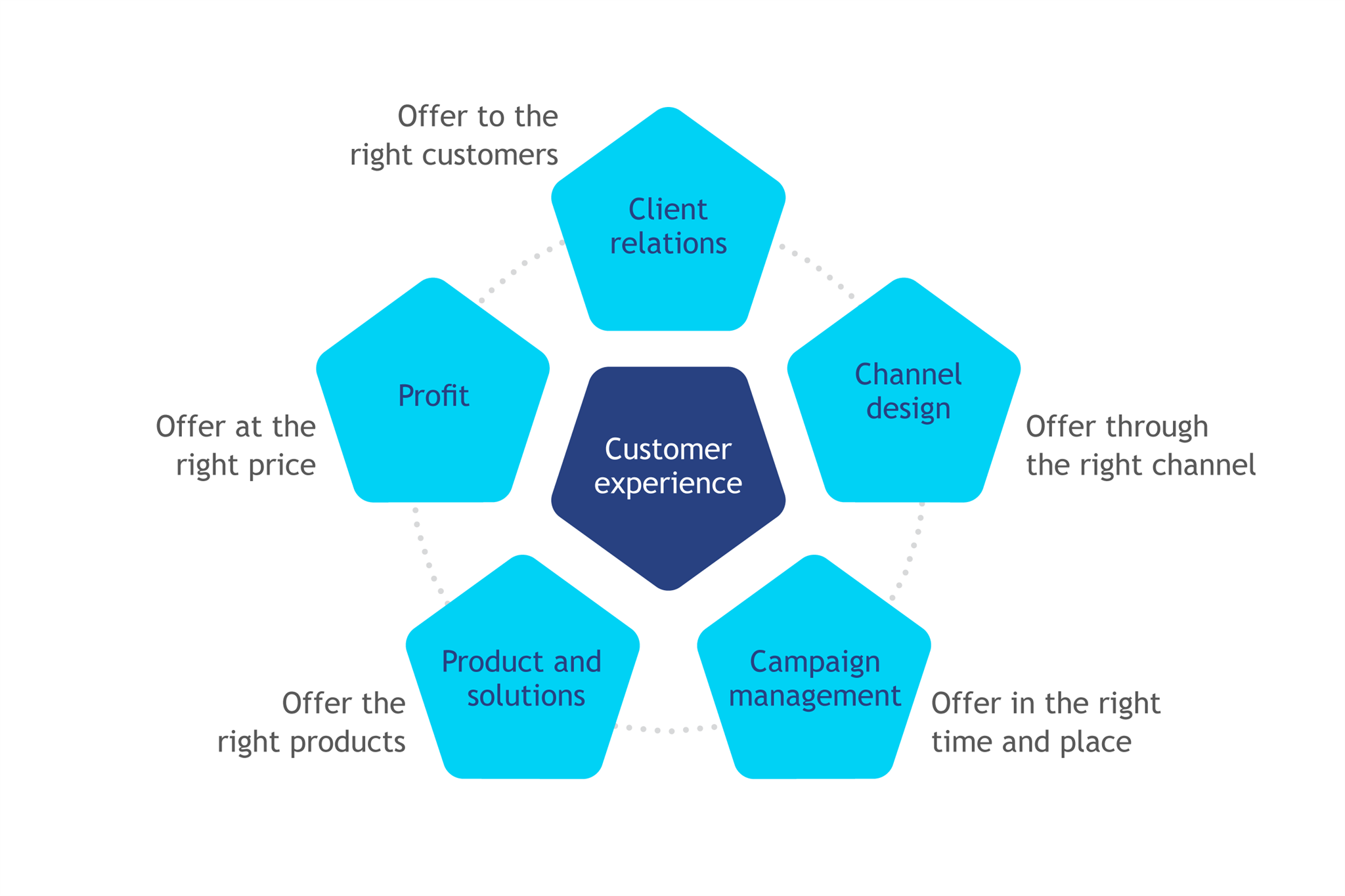

An effective digital transformation delivers a great customer experience that includes the following:

A great user experience involves solutions and the manner of their delivery that mimic the behaviours and attitudes of users. The provision of services is clear, obvious and intuitive for the end-users. To build a customer-centric solution, focus on user experience, assess the users’ bottlenecks, incorporate the customer journey approach, embed the progressive learning curve of the users, implement design thinking, and personalise the user experience.

In addition, addressing people dynamics among the staff is fundamental if the financial institution has to make technology work. This can be done by forging inclusive digital teams within the institutions. A mindset transformation to “think digital” will take shape when combined with skills, structure, incentives, and performance management. This involves creating a competency centre that drives the whole institution to talk and walk the digital transformation agenda. Transforming institutions will equip the executive management with an expertise in technology, championing the initiatives. Meanwhile, change management will clearly paint the new digital reality to the employees and secure their buy-in. This will include managing their expectations of how they spend their time and how they work alongside the new technologies along with some clarity on what technology competencies they need to develop.

Conclusion

In most cases, digitisation has an impact on the traditional financial services business model radically. Institutions that make large-scale investments required to transform digitally benefit from: 1) enhanced competitive advantage through new products, better service and competitive pricing, 2) increased revenue from new products, distinctive digital sales and using data to cross-sell, 3) lower operational costs from automation or digitisation and transaction migration, and 4) increased outreach and improved portfolio quality.

As we close the discussion, we will also like to dispel five myths about digital transformation.

- Digital transformation solves all organisational problems: Digital transformation is not a silver bullet. It helps in enhancing the efficacy of processes and systems. However, it may not be a solution to operational challenges and issues faced by an organisation. If existing products, processes, systems and models did not work previously, just digitising them will not solve these problems.

- Digital transformation is “cool”. Every other organisation is transforming; so we should also do so: Do not transform an organisation just because every other institution is doing so and it is “trendy” to transform. Unless there is a clearly defined business case, digital transformation is not worthwhile.

- Every process, product, system, and business model needs to be digitised: It is important to remember that not everything can be and should be digitised. Every business has subtle nuances that are inherent to the business model and requires human intervention. Indeed, there is a growing body of evidence highlighting the importance of blending human touch with technology to serve the mass market effectively.

- Technology for digital transformation should be disruptive and cutting-edge: As an organisation transforms, it is important to decide on the technology not based on how disruptive it is, but based on how useful and effective it is to the organisation.

- Digital transformation yields results immediately: Realising the benefits of digital transformation takes time. It is an expensive, time-consuming, inexact and painful process. Transforming organisations need to recognise that cultural shifts and change require proactive management.

To make digital transformation work for your institution and for your end-customer, a clear strategy of starting with one option or combining many options to achieve scale and improve reach to the underserved populations is a must. The end goal is for a financial institution to meet the need while leveraging technology. Indeed, winter is coming. So, are financial institutions prepared for the digital onslaught?

by

by  Sep 10, 2018

Sep 10, 2018 5 min

5 min

Leave comments