Why do so Few Fintechs Focus on the Mass Market?

by Mohit Saini, Charvi Gandotra and Graham Wright

Sep 20, 2018

6 min

The blog highlights why do so Few Fintechs Focus on the Mass Market?

Howls of disbelief and denial greeted the assertion in Can Fintech Really Deliver On Its Promise For Financial Inclusion? that “fintech is irrelevant for most villagers because providers have made little effort to tailor interfaces or use-cases for the low-income market.”

At the time of writing, the vast majority of fintech providers across the globe continue to develop solutions for the affluent and upper-middle classes. This makes logical sense – these segments have the money (and connectivity) to use the solutions. Moreover, fintech developers typically come from this background. They, therefore, understand the challenges this segment faces and thus the opportunities it provides. In contrast, when and if fintechs focus on the low-income segments, they tend to create solutions first and then look for problems to solve in preference to understanding the needs, aspirations, perceptions, and behaviour of the poor first.

But this is an inconvenient truth that is not without substance. In 2017, MicroSave conducted research with fintechs and FSPs across six markets for the MetLife Foundation – Bangladesh, China, Malaysia, Myanmar, Nepal, and Vietnam. The research identified the key challenges in financial inclusion for each market and assessed the readiness of the market for the supply and adoption of fintech.

This research reaffirmed what we had already seen in Africa – the enthusiastic app developers had a “limited understanding of the demand-side behaviour of rural customers”, a “lack of resources to prioritise business development and build new modalities – specific niche segments (for instance, SMEs)”, and were constrained by the “cost of serving low- and middle-income customers”. Furthermore, many were hampered by the disappointing realisation that, in the words of one entrepreneur, “most innovation labs are jumped-up office-sharing spaces” that offer little or no support services, and still less mentoring.

We had hoped that in India, as we studied the fintech landscape for the JP Morgan Chase Foundation and CIIE, we would find a different reality. But we found the same story here.

There are over 1,500 fintechs in the country at the time of the study – a number that has been rapidly growing. India has more than 350 active angel investors and more than 170 active venture capitalists across the country. Unsurprisingly, the fintech market in India is growing rapidly in terms of numbers, transactions, and reach.

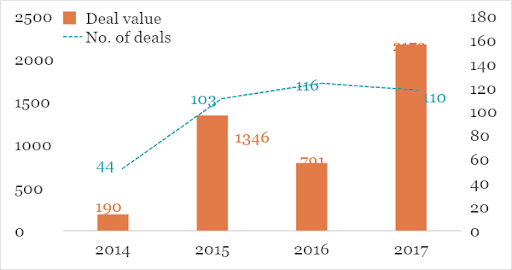

Investment in the fintech sector has also seen significant growth over the past few years, as seen from the adjoining graph.

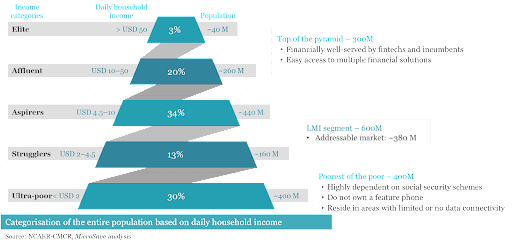

Most fintechs, however, serve affluent, tech-literate customers in the larger cities, leaving over 80% of the addressable low- and middle-income (LMI) market untapped. Fintechs in India typically focus on one of two market segments:

1. Millennials who seek financial independence:

• Active users of smartphones;

• Consume mobile Internet for multiple purposes;

• Value technology and prefer convenience;

• Largely from the salaried class.

2. Small and micro-entrepreneurs:

• Accept digital payments;

• Require affordable credit;

• Use smartphone for communication and entertainment;

• Explore the value proposition of fintechs.

Yet, as can be seen from the population pyramid below, this represents a minuscule part of the overall population.

So why do fintechs avoid the LMI market?

There are five barriers that fintechs face while serving the LMI segments.

- Lack of knowledge and understanding of the segment: It was clear from our analysis that fintechs come up against barriers because of a limited understanding of the LMI market and its potential to deliver profits. A staggering 82% are located in three main cities –Mumbai, Bangalore, and Delhi – and had little knowledge and understanding of or empathy for the LMI market.

- The LMI is a challenging market segment: Addressing the LMI segment is indeed challenging. LMI customers are expensive, not just to acquire, but also to serve. As we have seen in multiple studies, LMI customers struggle to understand or trust digital financial services – particularly when they are either unreliable or the systems for resolving grievances are poor or both. The segment prefers cash – not least of all because it is more intuitive, particularly for those who are “oral”, that is, illiterate or innumerate.Finally, many of them, particularly women, do not have access to a feature phone, let alone a smartphone, on which to transact. Estimates from eMarketer indicate that only 20.8% of India’s population used a smartphone in 2017. The penetration rate of mobile phones of any type – feature or smartphone – was only 57%.Finally, most entrepreneurs feel uncertain about the long-term value – which investors define as up to two years – that LMI customers offer. The entrepreneurs were concerned by the limited digital footprints of LMI customers to inform fintech algorithms. Besides, there are still plenty of opportunities for fintech in India’s larger cities. It has not only been easier to raise funds to serve these segments, it is also easier to get the media coverage to promote the service.

- Lack of investor interest in the LMI segment: Investors, too, are wary of the LMI segment. They have a limited understanding of the segment and have a clear preference for established models.

This is amplified by the fear of missing out.So when the approach of a fintech to a specific problem – say credit for SMEs – is deemed to be working, then investors are keen to rush in as quickly as possible. Until models are demonstrated, they are unsure of the LMI segment, its potential, and market-readiness.Perhaps most of all, there is a mismatch between the size and timing of returns on investment. Investors look at unit economics and want quicker returns than serving the LMI segment is likely to deliver. Nonetheless, as fintechs that serve the LMI segment prove their worth, investors will increase their limited investments in fintechs serving this segment.

- Lack of access to investors: Unsurprisingly perhaps, given educational and social norms in India, very few fintech entrepreneurs are from the LMI segment. Furthermore, those that do come from the LMI segment typically have a remarkably poor awareness of investment options to finance their ideas and prototypes. This is in part because of limited knowledge of how to pitch to investors and in part because they lack access to potential investors.

- Lack of adequate or appropriate mentoring: Not only do fintechs lack familiarity with the LMI segment, they also have a limited or no access to mentors and inadequate support from the incubators and accelerators in which they work or simply share office space with. This may be because only 15 of the 140+ incubators in India specialise in fintech.Most Indian incubators are sector-agnostic, and the 15 that focus on fintech are typically run by incumbent financial service providers that have their own agendas. Sector-agnostic incubators struggle to provide expert – and thus valuable – advice, mentorship, or links to financial service providers. Instead, entrepreneurs are offered standardised, generic packages of inputs on how to run build and run a business, how to pilot and pivot, etc.

A completely different type of approach is needed for fintechs to cater to the LMI segments effectively. We envisage this in the form of an innovation lab that can address the five barriers outlined above. The lab will not only specialise in and be firmly focused on fintech for the LMI segment, it will also offer:

1. Assistance and opportunities for entrepreneurs to deep dive into the market to understand their needs, aspirations, perceptions and behaviours – and thus the problems for which solutions can be developed;

2. Support to understand and comply with the complex legal and regulatory environment that governs the provision of financial services;

3. Significantly higher levels of expert and dedicated mentoring;

4. Links to, and alliances with, financial service providers serving the LMI market; and

5. Introductions to angel investors and venture capitalists interested in the LMI market.

Click here to read about the innovation lab in greater detail.

by

by  Sep 20, 2018

Sep 20, 2018 6 min

6 min

This is amplified by the fear of missing out.So when the approach of a fintech to a specific problem – say credit for SMEs – is deemed to be working, then investors are keen to rush in as quickly as possible. Until models are demonstrated, they are unsure of the LMI segment, its potential, and market-readiness.Perhaps most of all, there is a mismatch between the size and timing of returns on investment. Investors look at unit economics and want quicker returns than serving the LMI segment is likely to deliver. Nonetheless, as fintechs that serve the LMI segment prove their worth, investors will increase their limited investments in fintechs serving this segment.

This is amplified by the fear of missing out.So when the approach of a fintech to a specific problem – say credit for SMEs – is deemed to be working, then investors are keen to rush in as quickly as possible. Until models are demonstrated, they are unsure of the LMI segment, its potential, and market-readiness.Perhaps most of all, there is a mismatch between the size and timing of returns on investment. Investors look at unit economics and want quicker returns than serving the LMI segment is likely to deliver. Nonetheless, as fintechs that serve the LMI segment prove their worth, investors will increase their limited investments in fintechs serving this segment.

Leave comments