Have the Portfolio Diversification Strategies of Kenyan Microfinance Banks Failed?

by Karan Garg and Angela Mutua

Sep 17, 2017

5 min

The blog discusses how the diversification strategies of Kenyan microfinance banks are working.

Since the enactment of the Microfinance Act 2006 in May 2008, there have been marked changes observed in the microfinnce

In addition to the microenterprise segment, MFBs in Kenya now target the Small and Medium Enterprises (SME) segment with targeted products, such as cash flow and asset loans, savings and current accounts, and fixed deposits accounts. Despite these initiatives, almost all performance indicators in the industry, such as profitability, non-performing loans (NPLs), and portfolio-at-risk (PAR) deteriorated in 2016. To understand this trend, MicroSave analysed[1] the financial performance of five leading MFBs[2] in Kenya over a span of five years. The five MFBs share 95% 0f the market between them[3].

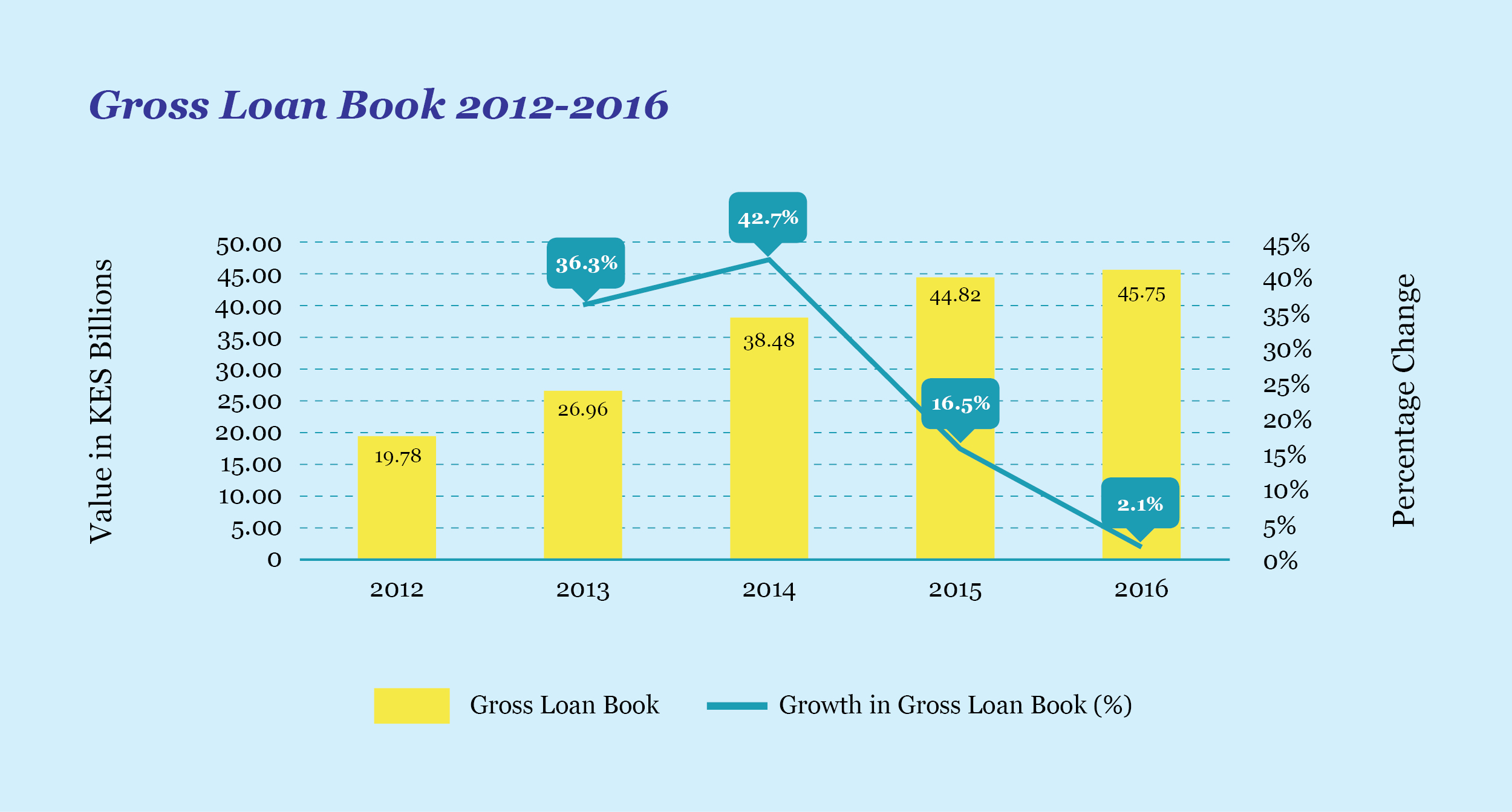

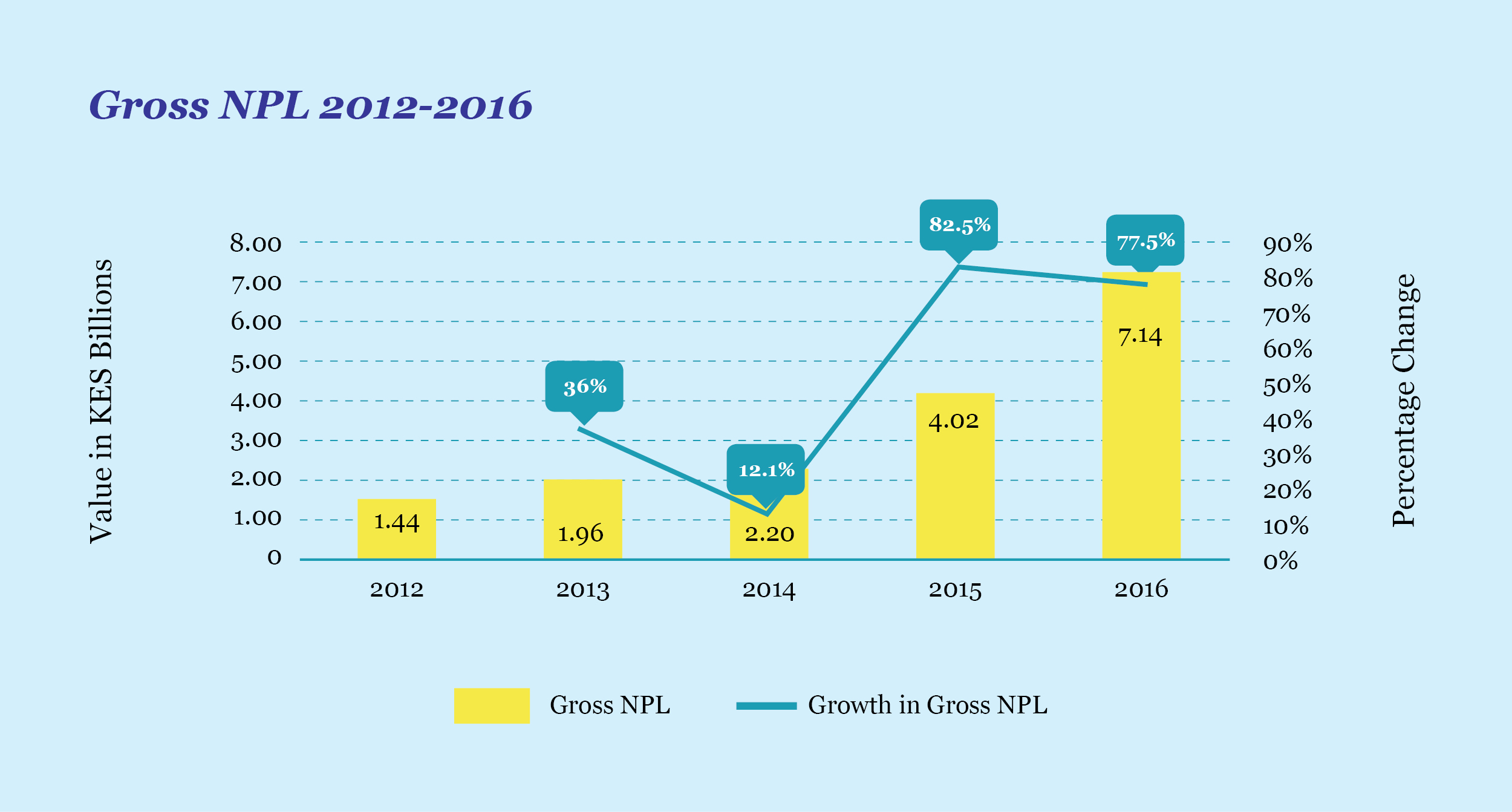

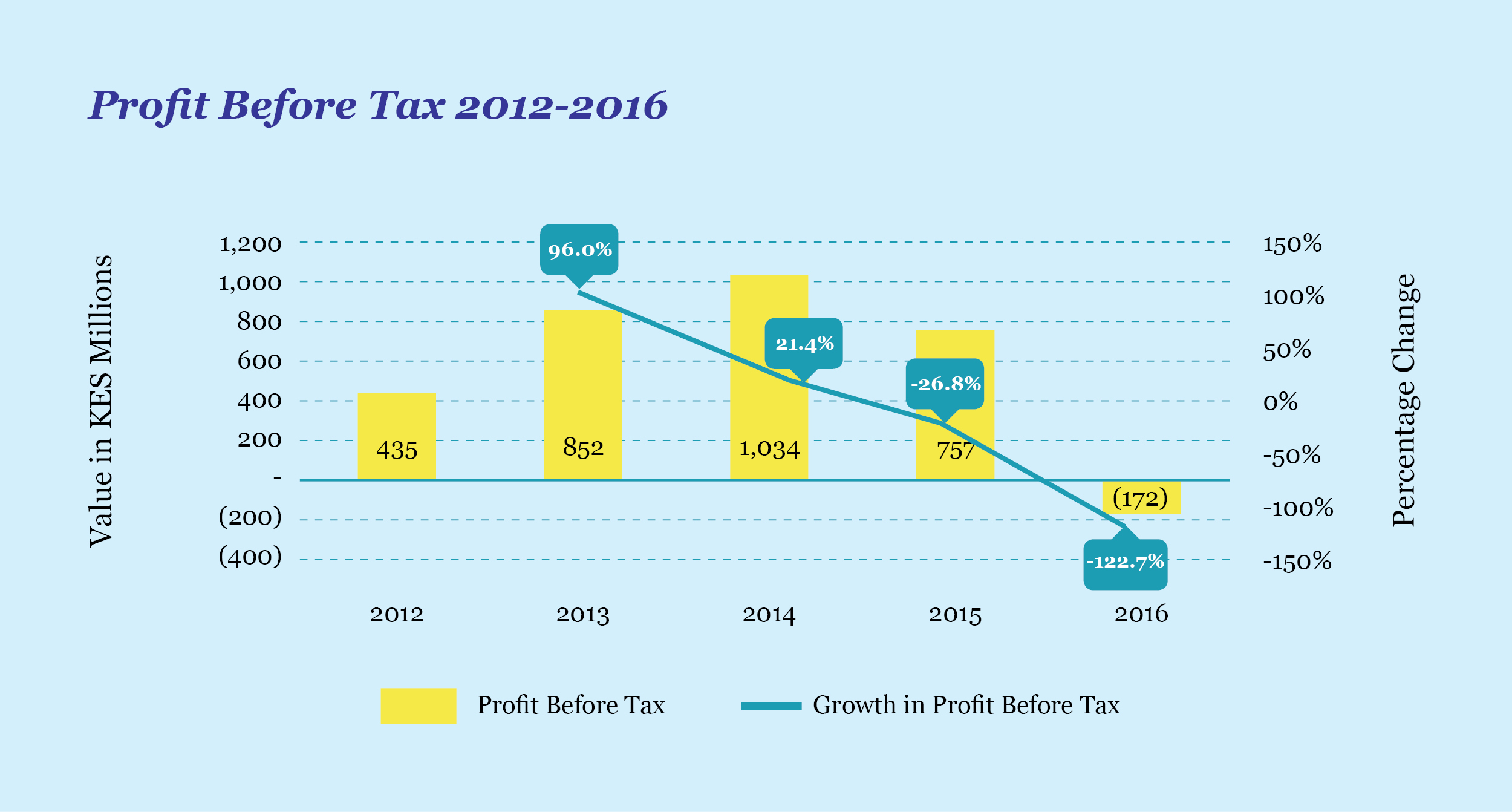

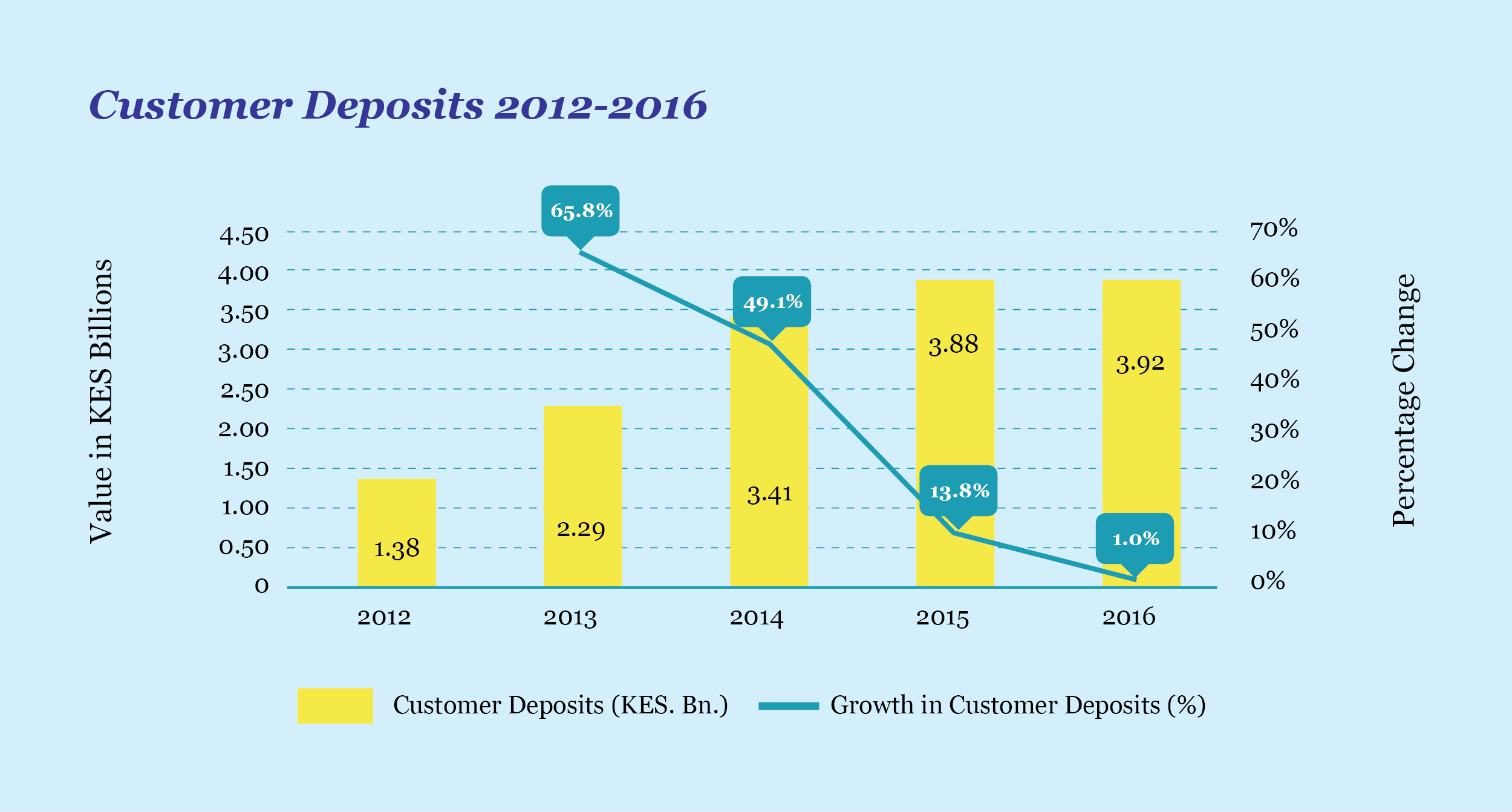

In the past five years, the gross loan book of these five MFBs has grown by 131% to KES 45.7 billion (USD 457 million). In line with this growth, NPLs have also increased by 394% to KES 7.2 billion (USD 72 million) and average PAR steadily increasing from 7% in 2012 to 16% in 2016.

The industry has maintained a declining growth in gross loans and deposits and deteriorating PAR in the years under review. In 2015, the industry realised negative growth, which led to losses in 2016.

With most MFBs holding relatively young SME portfolios, coupled with the fact that they are still stress-testing new systems and structures for this target market, this was perhaps expected. However, the trend still needs to be addressed. With the micro-enterprise portfolio traditionally considered to be less risky, more focus should be placed on stabilising the newer SME portfolio, which carries greater risk. In addition, the International Financial Reporting Standard (IFRS) 9[4],which comes into effect in 2018, requires the reclassification of loans by making higher provisions to absorb shocks. This may consequently contribute to greater losses in the industry. What, therefore, are the underlying factors that increase these risks among MFBs in Kenya?

Firstly, regulatory factors have affected the MFB sector in the past couple of years. The Central Bank of Kenya, in its mandate, to ensure that financial institutions comply with financial regulations, placed three banks (Imperial Bank, Dubai Bank, and Chase Bank) under receivership between 2015 and 2016. As a result, Rafiki MFB, a subsidiary of Chase Bank, suffered immense reputational damage. Low depositor confidence in Rafiki led to an overall shrinkage in the deposit base by 29% in 2016. Similarly, Rafiki’s loan portfolio also shrunk by 17%. At the end of the fiscal year 2016, the MFB reported a gross loss of approximately KES 461 million (USD 4.6 million) before tax. This has significantly contributed to the industry’s pre-tax loss of KES 337 million (USD 3.4 million) in 2016.The Rafiki factor also lowered customer confidence in the MFB sector, which led to lower growth in deposits, at least for 2016.

5-Year Performance Analysis Of Five Leading MFBs in Kenya

Secondly, the SME business model that MFBs adopted has stretched their institutional capacities and skills. Their collective portfolio diversification strategies in new markets and customer segment (SME) might have proved riskier than estimated. Some of the performance challenges that MFBs face could be attributed to the factors highlighted below.

a. Investor influence: Many MFBs have resorted to equity and debt financing to adequately grow the lucrative SME portfolio. This came with pressure to generate profits for the stockholders. It led to rapid, large-scale loan disbursement to new client segments in order to absorb the financing. These client segments were those that the MFBs did not have time to build relationships with. At the time of writing, MFBs continue to find the management of this new breed of clients difficult.

b. Culture: The model and culture of micro credit lending still influence many transitioning MFBs, from credit-only to full-service microfinance banks. The capacity of the SME segment to meet the demands and needs is still under development, both in the governance and operational levels. MFBs are therefore exposed to risks while serving SMEs, both at the credit origination phase and the monitoring phase. This has contributed to the deteriorating quality of the portfolio.

c. Segmentation: With a wide variety of SME segments targeted, MFBs need more clarity and understanding of the various seasonality and cash-flow patterns associated with each sector. Lack of this clarity has seen some MFBs disburse construction and mortgage loans in one tranche, or venture into sectors like agriculture and education, thus exposing the MFBs to portfolio risks where the cash flows are irregular.

d. Inadequate product suites: Most MFBs are not a one-stop shop for their clients. Due to limited capacity, they are unable to offer a combination of linked products as per their clients’ demands. For instance, an SME client with a corporate account would want the convenience of paying its staff online or view their accounts in real-time. Most MFBs can comfortably offer current and fixed accounts to corporate customers. Salary processing is usually handled by another (commercial) bank because of the MFBs’ limited ATM and agent networks and inability to provide real-time statements. Such SMEs, therefore, end up being multi-banked and multi-borrowed, which hinders their efficiency in loan repayments. Clients tend to be loyal to the institution that serves them with most of their needs hence might not provide real value to MFBs in the long run.

The Way Ahead for the Industry

To capture and even reverse these worrying trends, MFBs in the industry may have to focus on continuous institutional re-invention and capacity-building, from the level of the board to the client-facing staff. MFBs should formulate a detailed strategy that focuses on growing healthy portfolios and outlining risk-mitigation procedures. A customer profiling and segmentation exercise could also be conducted to inform MFBs on risk profiles in each segment targeted, hence improve their lending decisions.

In addition, there is a need to refine lending methodologies and develop a credit-risk management framework for the new segments. A customer relationship management system could also be developed to enhance customer engagement and thereafter boost loan-repayment. Products and services should be reviewed to ensure that they are customer-centric and are able to enhance customer choice, uptake, and usage. For deserving non-performing loans, a restructuring exercise could be conducted, following institutional policy and regulatory guidelines. Please see our publications on issues and solutions in the financial and MSME sector in Rwanda, Uganda, and Malawi for more details.

With the lessons learnt over the past five years, a second transformation in the MFB sector in Kenya may be on the horizon – but that would require hard work and attention to detail.

[1] Analysis based on Annual CBK Supervision Reports and published MFB financials.

[2] KWFT, Faulu Kenya, SMEP, U& I, and Rafiki

[3] Based on a weighted composite index comprising assets, deposits, capital, number of deposit accounts, and loan accounts.

by

by  Sep 17, 2017

Sep 17, 2017 5 min

5 min

Leave comments