Gender-intelligent banking (part 1): A practitioner’s perspective on designing financial services for women

by Ayushi Misra, Akhand Tiwari and Abdullah Al-Rafi

Nov 11, 2024

5 min

Women in Bangladesh hold 37.2% of bank accounts and 33.5% of deposits but face barriers in accessing credit, limiting their financial independence. MSC’s Women Business Diaries research offers insights to create gender-intentional products addressing these challenges.

Women in Bangladesh own 37.2% of bank accounts and hold 33.5% of the country’s total bank deposits, per the Bangladesh Bank’s WFID Dashboard as of Q1 2024. Yet, they continue to grapple with significant barriers when they seek access to credit. They hold only 20% of bank loan accounts, which represents 19% of the total loans by value. The limited credit availability restricts women’s financial agency and business growth and undermines their potential contributions to economic growth.

MSC’s Women Business Diaries research, which involved around 500 business owners in Bangladesh, offers valuable insights into the development of gender-intentional products for women and women entrepreneurs. This two-part blog series discusses the challenges practitioners face in the creation of gender-intentional products and services.

We studied access to credit in-depth and spoke with multiple bankers from bank head offices, branches, and credit officers about their experiences and approaches to lending to women entrepreneurs. This blog summarizes our discussions with them and the challenges they face when they design financial products and services for women entrepreneurs.

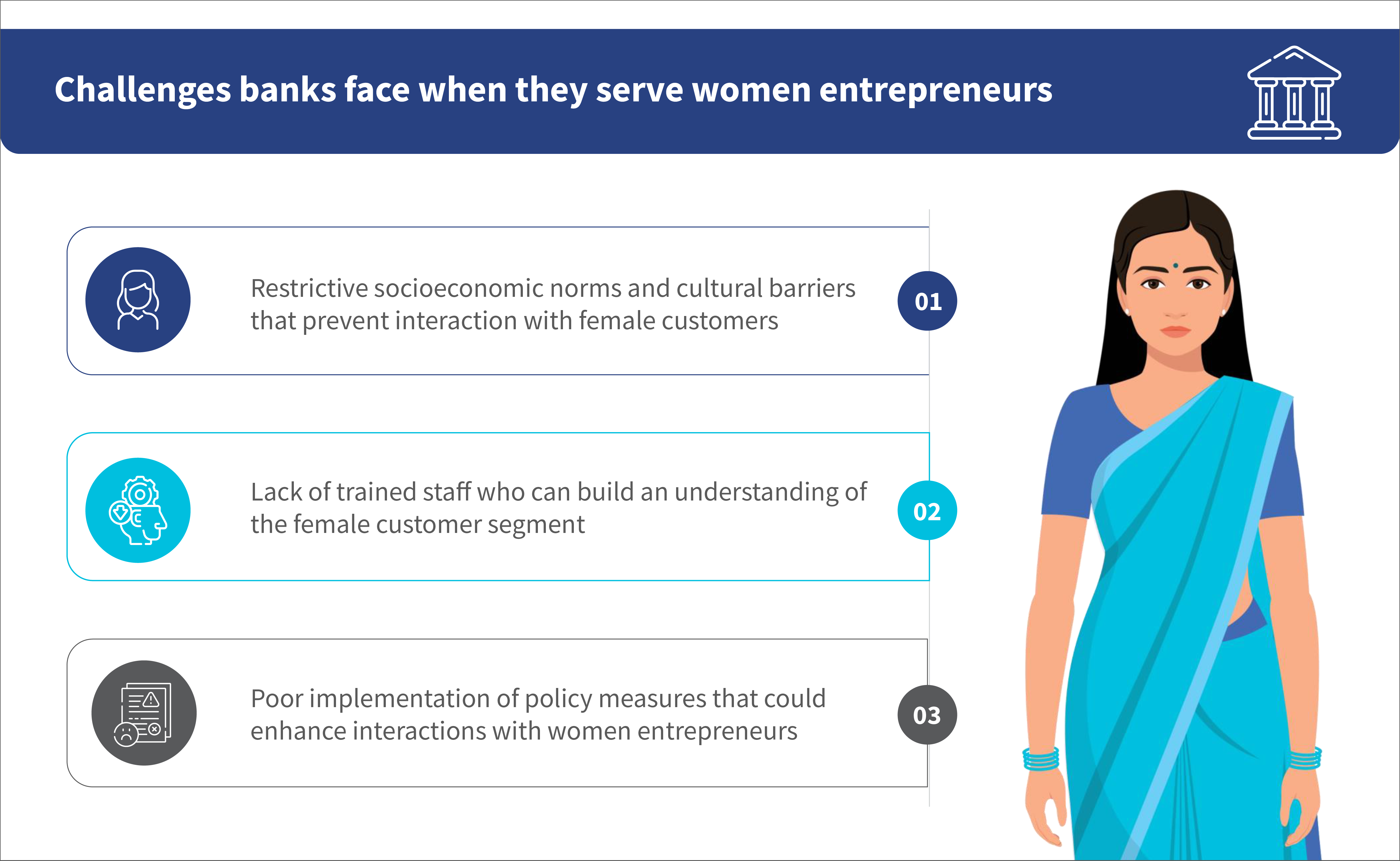

Restrictive socioeconomic norms and cultural barriers that prevent interaction with female customers

Bankers acknowledge that social norms hinder women’s access to formal financial products and services. Women entrepreneurs often struggle with limited financial independence and decision-making power due to restricted mobility, lack of control over resources, and traditional gender roles that confine them to domestic responsibilities. While women may legally own businesses, male household members frequently make the financial decisions. A credit officer from a prominent bank observed that despite the establishment of dedicated women’s banking desks, interactions with female account holders are often dominated by male relatives, particularly in loan negotiations. Due to security concerns and social norms, bankers and female customers prefer to speak with the husbands or men in the household. This dynamic limits women’s ability to express their financial needs effectively. In many instances, it leads to a situation where women prefer to avoid the use of formal bank accounts altogether.

The dependence on men is not limited to interactions. A product manager notes that even when women seek credit independently, their limited collateral and credit history often require male relatives, who usually control family assets, to co-sign loans.

The implications of this dependence on men result in many more challenges. For example, it undermines bankers’ trust in women’s financial decision-making and business management skills. Further, bankers’ limited experience interacting with women complicates their ability to evaluate women’s business potential and design tailored financial products. For instance, savings bank accounts in Bangladesh often require a minimum deposit of at least BDT 10,000 (USD 84), which is prohibitive for marginalized women who have small and irregular savings. This forces them to store money informally, which increases the risk of loss or theft.

A lack of understanding of female customers also affects credit services. Most women know that banks require lengthy documentation and take time to process applications but are unaware of credit guarantee programs that could ease access. Only 31% of female business owners know about programs that facilitate access to credit. Furthermore, bankers assume women do not maintain business records, yet our study finds that 63% of women entrepreneurs keep inventory records, while 68% track income and expenses.

Lack of trained staff who can build an understanding of women’s customer segments

By default, banks generally train their staff in banking and helping male customers. Many bankers have preconceived notions about women’s financial roles. Most banks do not have a gender-aware training system. They also lack female representation. As of December 2023, women comprised only 16.37% of the total workforce in Bangladesh’s banking industry. This amounts to 33,346 female employees compared to 170,350 male employees. This underrepresentation extends to decision-making levels. The proportion of women on bank boards declined from 14.22% in 2022 to 13.51% in 2023.

Moreover, more than 16% of women in banking left their jobs in 2023, which indicates a growing trend of female professionals who seek opportunities outside the sector. These statistics highlight a precarious environment where female customers have limited access to female staff for support and guidance and lack representation in leadership roles to advocate for their financial needs. As a result, banks are often perceived as male-dominated spaces and are not the first choice of cottage, micro, small, and medium enterprises (CMSMEs) when they apply for loans.

Most entrepreneurs want credit from banks. In our study, 72% of women and 76% of men seek credit from banks. However, microfinance institutions (MFIs) frequently outperform banks as they offer more accessible and relevant solutions focused primarily on female borrowers.

Poor implementation of policy measures that could enhance interaction with women entrepreneurs

Despite policymakers’ efforts, women in Bangladesh face barriers to financial inclusion, such as legal frameworks that restrict independent access to banking services or loans without male consent. Women find it particularly challenging to obtain a trade license due to complex bureaucratic procedures and gender bias. These barriers further restrict their access to formal financial services.

The Bangladesh Bank’s efforts to bridge the gender gap

The Bangladesh Bank (BB) has launched several initiatives to improve women’s access to formal finance. Key measures include:

- The establishment of the Women Entrepreneurs Development Unit (WEDU) and dedicated desks in bank branches;

- The introduction of a 1% cash incentive for timely loan repayment by women;

- A mandate for banks to allocate 10% of their CMSME loan portfolio to women, which increased to 15% in 2024;

- The provision of low-interest loans through a refinancing fund worth BDT 30 billion (USD 250.8 million) and the prioritization of women in other refinancing programs;

- The reservation of 10% of the credit guarantee fund for women and the allowance of loans up to BDT 25,00,000 (USD 20,900) without collateral;

- The simplification of loan applications and the development of financial literacy guidelines focused on women and;

The launch of entrepreneurship development programs with at least 30% female participation.

Despite Bangladesh Bank’s various initiatives to improve access to formal credit for women, their impact at the grassroots level remains minimal. For example, the regulator has relaxed the requirement for personal guarantors through multiple circulars. However, the lack of practical enforcement of these regulations and the absence of viable alternatives to personal guarantees has led banks to demand multiple personal guarantees. This has become a significant barrier for thin-file borrowers when they seek access to formal credit. However, bank staff and credit officers maintain that such practices are necessary to safeguard the bank’s interest and ensure the timely repayment of loans.

Designing financial products for women must begin with a gender-intentional approach

The banking sector’s failure to engage with the female segment and understand it limits its ability to serve it effectively. A clear, streamlined, standardized, and action-oriented framework to assess the potential for services and their impact can complement efforts to develop gender-sensitive approaches within banks.

The process of designing financial products for women entrepreneurs must be both intentional and nuanced. These may include targeted initiatives, such as gender sensitization for staff through gender-disaggregated data, to create evidence-based strategies and adopt design thinking in product and service development.

Insights from our work have helped commercial banks in Bangladesh gain a deeper understanding of the women’s MSME segment. This has led to product innovations. We discuss this in the second part of this series: Gender-intelligent banking (part 2): Small changes, big wins: How small changes by FSPs can result in big wins. Read the next part here to learn more.

by

by  Nov 11, 2024

Nov 11, 2024 5 min

5 min

Leave comments