Five Recommendations to Address Insurance Mis-selling: Rural customers in India face information asymmetry, high premiums and poor returns

by Sukhpreet Kaur and Arshi Aadil

Oct 15, 2024

5 min

Insurance mis-selling is a prevalent issue in India, particularly in rural areas, where customers are often misled by agents who prioritize high commissions over customer needs. Pushing complex, high-premium plans while concealing critical information about surrender costs can lead to significant financial losses for policyholders. Read the blog to know about five key recommendations to curb mis-selling practices.

Kishan, a farmer from northern India, met with an insurance agent and purchased an endowment plan – a type of life insurance policy that pays the full sum assured to beneficiaries if the insured dies during the policy term, or provides the sum assured upon maturity if the policyholder survives the term. The insurance agent talked up the potential returns and assured Kishan that the premium payments would be manageable within his budget. Kishan trusted the agent and signed the insurance form without fully understanding the implications of the premium payments. Over time, he struggled to meet the premiums. After three years, he finally surrendered the policy, hoping to salvage some value. To his dismay, he discovered that he could not recover even half of what he had paid in premiums.

Kishan’s case highlights systemic issues of information asymmetry and mis-selling in insurance, where sellers misrepresent crucial details, leaving vulnerable individuals financially exploited.

Widespread mis-selling of insurance plans

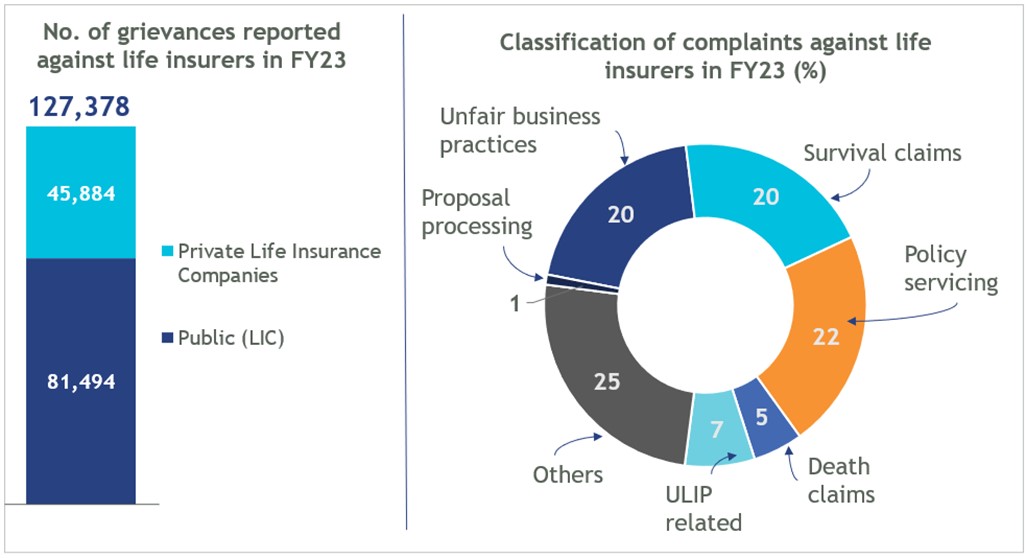

Insurance-related mis-selling is rampant in India and, we suspect, in many other developing countries as well. As per the Council for Insurance Ombudsmen’s Annual Report 2022-23, mis-selling-related grievances for life insurance accounted for 58% of the total entertainable complaints of the year. Further, in 2022-23, the Insurance Regulatory and Development Authority of India (IRDAI) received around 124,000 complaints against life insurance providers, with 20% related to unfair business practices.

Source: IRDA Annual Report 2022-23

Sales agents often employ pressure tactics and push life insurance plans that offer poor returns and inadequate insurance coverage despite high premiums. They tend to make this push without a thorough understanding of the customer’s needs. To make matters worse, opaque policy terms and complex fine print from insurers, along with misrepresentation or omission of critical information by insurance agents, create confusion and potential pitfalls for customers.

Agent incentives don’t match customer needs

Higher commissions lure some agents into such tactics. Commission levels are set by insurance companies, within the IRDAI regulatory framework, as a percentage of the premium paid by policyholders. Therefore, agents often try to sell endowment policies with higher premium rates in order to get the higher commissions. Additionally, agents receive significantly higher commissions from the first-year premium compared to subsequent years. To maximize their earnings, some agents encourage policyholders to prematurely surrender existing policies and sign up for new ones, thus earning another first-year commission. This practice, known as churning, burdens customers with surrender costs they are often unaware of.

Under current IRDAI regulations, a policyholder who surrenders a policy early receives a surrender value much lower than the total premiums paid. For example, if a policyholder surrenders in the second year, she receives only 30% of the premiums paid up to that year, bearing a surrender cost of 70%.

Unethical practices like churning, concealing surrender costs and pushing high-premium, low-return plans, stem from agents’ incentives tied to the high first-year commissions. The gain for the agents contrasts with the loss to the policyholders, who are at a disadvantage due to lack of transparency around surrender values and costs.

Diminishing consumer trust in insurance agents

Individuals like Kishan buy insurance expecting financial protection. Rural customers tend to trust sales agents and rely on them as the primary channel for purchasing insurance. However, this reliance can be concerning when combined with a low level of awareness of consumer risks in insurance. Most low-income customers are unable to discern unfair sales and marketing tactics used by agents, exacerbating their vulnerability. Without clear information about costs, premiums and surrender policies, these clients face increased financial risks, diminishing their trust in insurance and driving negative word-of-mouth publicity for the entire insurance industry.

“It is better to invest money in a fixed deposit than to purchase insurance,” said Kishan, when he cited his experience of low returns and poor customer support from a private insurance company.

Call to action

Regulators and providers must enhance customer protection in the insurance industry. Transparent practices, ethical sales tactics and responsive customer support are essential to build trust, protect customers and sustain the insurance industry’s growth. Here are some strategies that can be implemented:

1) Enhance monitoring and auditing: Customers are overreliant on agents when they purchase insurance, so regulators and providers should ensure regular audits and compliance checks to ensure adherence to regulatory standards. Although the IRDAI has established a code of conduct for insurance agents and intermediaries, its compliance should be monitored. Insurers should be mandated to monitor sales patterns, analyze complaints and detect mis-selling. The regulator will need to take corrective action against insurers found violating norms.

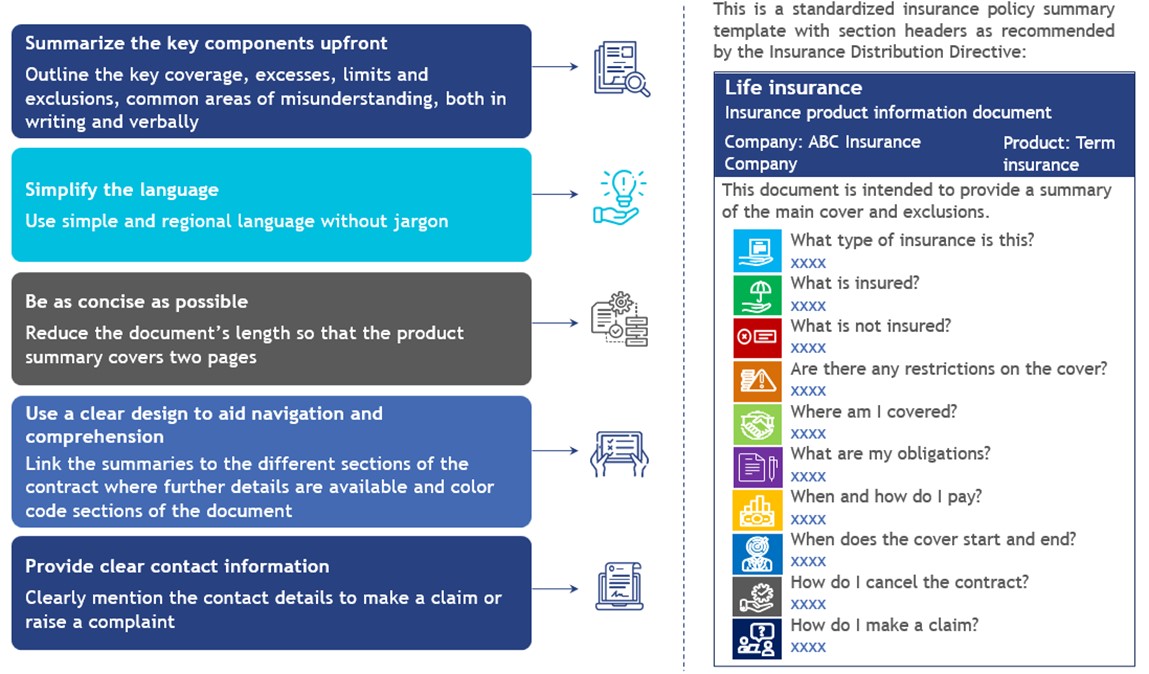

2) Standardize policy information: Policy documents are complex, lengthy and filled with jargon, making them difficult for people to understand. This leads to widespread information asymmetry. Insurance companies should share key information on premiums, surrender values, exclusions, claim rates, customer support and more in standardized, user-friendly templates. These should accomodate language preferences, communication modes and intuitive design for clarity and accessibility.

The infographic below illustrates a comprehensive insurance policy document’s key features alongside a standardized insurance policy summary template. This template is designed to simplify and clarify the key components of an insurance product. It includes section headers per the Insurance Distribution Directive’s recommendation and color-coded icons for easy navigation.

Source: Lloyd’s “Easy to understand insurance policies: Guidance”

3) Balance customer interests: Most Indian life insurance companies opposed a 2023 draft proposal which would have set a limit on policy surrender charges. The IRDAI’s recent decision to scrap this proposal benefits the insurance companies but not the customers. High surrender charges can be perceived as a tactic to lock in policyholders, eroding public trust in the insurance industry. Therefore, the regulator must allow some flexibility to balance the interests of both insurers and policyholders.

4) Promote customer support and grievance resolution channels: Although the IRDAI has developed an integrated grievance management system (IGMS) to handle and resolve complaints efficiently, customer awareness of this system remains limited. Customers rely on their agents to register grievances, thus depending on the very people who may have mis-sold policies in the first place. This process delays resolution. Therefore, the IRDAI should widely promote IGMS and push insurers to speed up claim resolution and response times.

5) Enhance customer understanding of insurance through gamification: Gamification can simplify complex subjects, and makes learning about insurance policies, policy types, benefits and conditions engaging by integrating quizzes, story-based adventures, role-playing and virtual simulations. This approach helps customer retain information better, ultimately empowering them to make informed decisions while enjoying the process.

Insurance providers can incorporate gamification into their mobile apps, enabling customers with smartphones to learn independently. For low-income customers without smartphones, internet access or technical proficiency, insurance agents can guide them through gamified modules and offline resources during in-person consultations. Additionally, SMS can be used to deliver quizzes, tips and educational content.

Protecting insurance customers is increasingly important as risks and complaints are rising. These steps will lead to better financial outcomes, reduced distress, and a more responsive, competitive insurance industry. We can empower consumers to make educated decisions with robust regulatory standards and transparency.

The blog was first published on the FinDev Gateway website on 23rd August 2024.

Written by

Sukhpreet Kaur

Associate

by

by  Oct 15, 2024

Oct 15, 2024 5 min

5 min

Leave comments