Can we design affordable housing products for Kenya’s low- and moderate-income people?

by Martin Aketch, Pauline Katunyo and Albert Bundi

Oct 14, 2024

6 min

In this blog, we explore innovative financing solutions, housing support services, policy recommendations, and practical steps that stakeholders can take to promote affordable housing in Kenya.

Mary is a small trader in Nairobi who aspires to own a home one day. She earns a consistent income, yet the barriers to homeownership are daunting as the costs are high and her financing options are limited. Her modest income is sufficient to cover her daily needs but not enough to buy a home in Nairobi’s skyrocketing property market. MSC’s recent research commissioned by Habitat for Humanity International highlights that Mary’s situation is far from unique.

Like Mary, many Kenyans face hurdles when they seek access to affordable finance tailored to their needs and income levels to construct, improve, or expand their existing house. Lack of collaterals and proof of consistent income, high interest rates, upfront contribution fees, and the stringent requirement to access financing have demolished her dream of owning a home, either in Nairobi or in her rural village.

This blog addresses the challenge of designing affordable housing products for low- and moderate-income earners in Kenya, where rapid urbanization has outpaced the housing supply. Innovative financial solutions that focus on affordability and build the capacity of financial institutions are essential to serve this segment effectively. We explore new strategies to highlight how institutions can create sustainable housing products that meet the real needs of people from this segment and deliver tailored solutions to them.

The housing landscape

Kenya faces a significant housing deficit, with an annual demand of 250,000 units and a supply of only 50,000, among which 49,000 units target the upper-middle and high-end market segments. This shortfall has led to the growth of informal settlements and overcrowding in urban areas like Nairobi. High construction costs, limited access to affordable financing, and outdated building codes further complicate the situation. The Bottom-Up Economic Transformation Agenda seeks to address these challenges by prioritizing affordable housing as a key pillar. The plan intends to build 250,000 new housing units annually through government investments worth KES 50 billion (USD 386 million) and an additional KES 200 billion (USD 1.56 billion) from private investors. The goal is to increase affordable homes from 2% to 50% of total housing, expand the mortgage market from 30,000 to 1 million through low-cost mortgages, and, in turn, create jobs and boost economic growth.

However, this plan faces significant pitfalls, including the controversial housing levy that has met with public resistance, as many citizens feel overburdened by mandatory contributions. Moreover, the initiative may fail to deliver long-term solutions unless it addresses structural issues, such as land ownership challenges, outdated building codes, and high construction costs. While the plan may boost short-term construction jobs, it risks not solving the underlying housing affordability problem if financing remains inaccessible for most low- and moderate-income earners in the long run. The initiative’s success hinges on overcoming these barriers and ensuring that the financial mechanisms are truly accessible to those who need them most.

Supply-side challenges for financial institutions in housing finance

Financial institutions in Kenya face substantial hurdles when they seek to develop housing products for low- and moderate-income earners. A significant challenge is the perception that lending to this segment is risky. About 83% of Kenyans work in the informal sector. They earn irregular incomes and lack formal credit history and collateral. As a result, these informal sector workers often do not qualify for traditional mortgage products, severely limiting their access to housing finance.

According to the Central Bank of Kenya, the mortgage market faces difficulties, with a 12.5% non-performing loan (NPL) rate for mortgages. These NPLs primarily result from borrowers who, despite having formal loans, struggle to meet their repayment obligations due to various economic pressures. Housing finance remains inaccessible to many, as average mortgage interest rates range between 12% and 14%. SACCOs, which offer slightly lower rates of around 10-12%, provide some relief but struggle due to limited access to long-term capital.

High construction costs make up 50-60% of housing prices. These costs constrain financial institutions and limit them from offering affordable mortgages. Strict compliance under the Banking Act raises costs for financial institutions and holds back innovation in housing finance. In rural areas, limited digitization makes credit risk assessment difficult, while SACCOs struggle to secure long-term financing. These barriers limit their ability to offer sustainable housing loans for low-income earners.

Key strategies for affordable housing design for financial institutions

In the section below, we outline three key strategies and innovative approaches that can help financial institutions develop effective housing finance solutions:

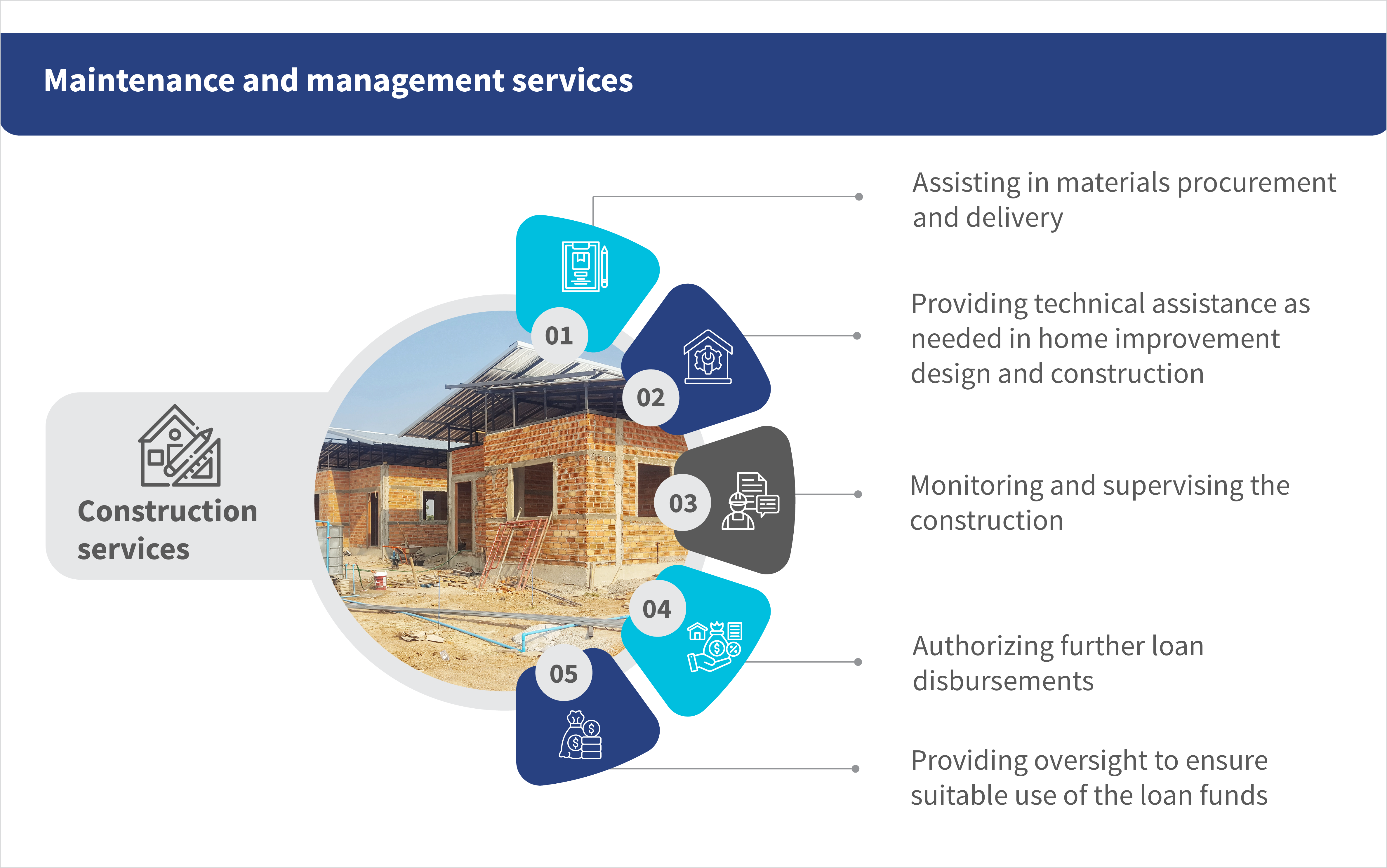

- Integration of housing support services: Housing support services should be at the forefront of efforts to enable low- and moderate-income earners to access and sustain affordable housing. These services offer crucial assistance, including construction oversight, guidance on material procurement, and supervision of loan disbursements to ensure effective fund use. This comprehensive approach helps mitigate risks for financial institutions, builds trust with borrowers, and ensures housing projects remain sustainable in the long term.

- Tailored financial products and innovative design approaches: Financial institutions must develop flexible housing finance products, such as micro-mortgages, income-based repayment plans, and incremental housing loans to cater to the specific needs of low- and moderate-income earners, particularly those with irregular incomes. An example is the Nyumba Smart Loan of the Kenya Women Microfinance Bank (KWFT), which has successfully expanded access to affordable housing, particularly for underserved populations and women. Incremental housing loans like the Nyumba Smart Loan allow borrowers to build homes in stages as they disburse smaller, flexible loans for each phase of construction. This phased approach reduces financial strain, aligns with cash flow, and makes homeownership more achievable for underserved groups. Alongside innovative, cost-effective housing designs, these products provide sustainable solutions that expand access to affordable housing without compromising quality or essential services.

- Risk-sharing facilities (RSFs): RSFs reduce risk for borrowers through guarantees or cover potential losses, which help financial institutions lend to low- and moderate-income earners. In Kenya, the Kenya Mortgage Refinance Company (KMRC) uses RSFs to help lenders offer affordable mortgages to informal sector workers with irregular incomes, which helps reduce the cost of loans and makes them more accessible.In West Africa, the Caisse Régionale de Refinancement Hypothécaire (CRRH) provides liquidity to banks that allows them to offer lower-cost mortgages to low-income households. Loan uptake increases as a result. However, these initiatives still need more technical assistance and resources to reach a wider group of low-income earners. Currently, the Tanzania Mortgage Refinancing Company (TMRC) has partnered with two financial institutions to develop affordable housing products with support from HFHI and MSC. After the pilot phase, the TMRC plans to offer refinancing solutions to these institutions to scale the products and make housing finance more accessible to low- and moderate-income borrowers. This approach demonstrates how RSFs can enhance lender confidence and expand affordable housing opportunities.

Conclusion and recommendations

The development of housing finance products requires time and resources, which makes partnerships essential. Collaborations between FSPs, MFIs, governments, and development organizations create scalable solutions for low-income earners. Examples include partnerships, such as TMRC with HFHI and KMRC with the World Bank and IFC, which work to expand affordable housing financing. These collaborations are vital to enhance financial inclusion and build a sustainable, accessible housing market for underserved communities.

Governments should play a leading role by establishing clear regulatory frameworks and offering targeted subsidies to break down barriers to affordable housing finance. Development partners must contribute funding and technical expertise to drive innovation and ensure financial products meet the needs of low- and moderate-income earners. The KMRC can play a crucial part to create tailored refinancing strategies that address this group’s unique challenges, such as irregular incomes and limited collateral. Financial institutions, governments, and development partners must collaborate urgently to bring real progress, transform these solutions, and close the housing finance gap. Now is the time to build a sustainable, affordable housing market that truly includes the underserved.

by

by  Oct 14, 2024

Oct 14, 2024 6 min

6 min

Leave comments