Green financing solutions for housing in Africa: Paving the way for sustainable development

by Pauline Katunyo, Emma Odera and Julius Mutia

Oct 11, 2024

6 min

In this blog we explore green financing mechanisms that can help bridge Africa’s massive housing deficit and simultaneously promote sustainability and climate resilience.

Can we build household resilience among the unhoused without accelerating climate change?

MSC supported Habitat for Humanity’s recent studies. The findings revealed a substantial unmet demand for affordable housing across Africa. The research revealed a deficit of 2 million units in Kenya and more than 1.5 million units in Zambia. These numbers illustrate a continent-wide challenge. The growing impacts of climate change further exacerbate this issue. They lead to intensified poverty and increasingly unaffordable housing. Frequent climate-related shocks have damaged existing housing infrastructure, and the strategies that informal settlements have relied on have failed under environmental change pressures.

The building sector generates 37% of energy-related greenhouse gas emissions, a significant contribution largely due to conventional methods that rely heavily on fossil fuels. These conventional methods include the use of energy-intensive materials such as concrete and steel, inefficient heating and cooling systems, and poor insulation, which lead to excessive energy consumption and higher emissions. In many urban areas, especially in developing regions, substandard buildings are often constructed with inadequate materials, and poor design, which makes them vulnerable to climate impacts, such as extreme weather events and rising temperatures. The situation will worsen if we continue to address housing needs through conventional methods and increase the demand for energy as global temperatures rise. As we work toward the provision of affordable housing, we must recognize that conventional approaches will likely aggravate the climate crisis. Two things become clear: We must address the housing deficit and ensure it is sustainable and resilient against climate impacts.

Although green homes offer a solution, their construction is often expensive for most households. Additionally, the government will need to increase its spending on green homes. Thus, we must focus on innovative solutions that balance affordability with sustainability to address these challenges. Green financing presents a significant opportunity. It can make housing more affordable and provide governments with the funds needed to finance affordable housing initiatives.

The need for affordable, green housing

Africa’s housing crisis sees an estimated shortfall of 51 million housing units. Millions of people live in substandard conditions, particularly in countries like Nigeria, where the housing deficit is 28 million units. The Democratic Republic of the Congo and South Africa face deficits of 3.9 million and 3.7 million units, respectively. These figures are made worse by Africa’s rapid urbanization, which has outpaced both housing development and economic growth.

Africa is experiencing the fastest urbanization growth globally but has the least developed housing finance. Unlike other regions, Sub-Saharan Africa has not matched its urbanization with economic growth or housing investment. Over the next three decades, Africa will see 1.2 billion more urban residents. With the population growing at 4.1% annually, which is double the global rate, the situation will deteriorate further unless stakeholders take action.

Many households struggle with limited access to affordable housing finance when they try to secure decent homes. Traditional financial products often do not align with sustainable housing needs, as high interest rates and stringent qualification criteria create substantial obstacles. While financial challenges persist, the housing sector faces an additional burden—climate change’s ever-growing impact.

Climate change intensifies housing challenges in several ways. Firstly, it increases the frequency and severity of extreme weather events, such as storms, floods, and droughts. These events can cause significant damage to homes, particularly those built with inadequate materials and poor construction practices. Floods, for example, can destroy entire neighborhoods, displace thousands of people, and cause substantial economic losses. Secondly, rising temperatures increase the demand for energy to cool homes. This escalates energy costs and contributes to higher greenhouse gas emissions. This issue is particularly problematic in regions with already-strained energy infrastructure.

The convergence of these pressing challenges underscores an urgent call to action for innovative and comprehensive strategies, particularly to develop affordable and green housing solutions, reduce environmental impact, and provide safe and healthy living conditions. The path forward lies in the integration of sustainable construction practices with cutting-edge housing designs and pioneering financial solutions. The following section explores solutions to make this vision a reality.

Green housing finance mechanisms

- Green mortgages are designed to incentivize energy efficiency and environmental sustainability in housing. Green mortgages are home loans for homeowners who plan to buy energy-efficient homes or retrofit existing homes to improve energy efficiency. These mortgages often come with lower interest rates and longer repayment terms, which makes them more accessible to low-income families. Homeowners can save on utility bills through reduced energy consumption, which can make housing more affordable in the long run. Green mortgage programs that encourage energy-efficient houses have been implemented, for instance, in the Philippines, Uzbekistan, and Peru.

- Green bonds are debt securities issued to finance projects with positive environmental benefits. Governments and financial institutions can issue green bonds to raise funds for the construction of affordable green housing. These bonds attract investors who want to support sustainable development and provide a steady flow of capital for housing projects.

- Construction and mortgage loan guarantees are government-backed programs to support housing development and expand access to mortgage finance, particularly for first-time buyers and those with smaller deposits. These guarantees incentivize local financial institutions (LFIs) to finance the construction and purchase of affordable, green homes. These guarantees reduce the risk for lenders and, thus, make it easier for developers to access financing and help low-income families obtain mortgages. This mechanism fosters a self-sustaining housing finance ecosystem. Examples include:

-

- Construction support or guarantee: This guarantee provides construction lending and technical assistance to local developers, such as Peru’s Market Accelerator for Green Construction (MAGC) program. It includes construction guarantee facilities lending programs to developers and construction loans for innovative green home designs.

- Mortgage support or guarantee: This guarantee provides technical assistance to LFIs to integrate alternative credit assessments and expand mortgage access. Mortgage guarantees encourage lenders to offer higher loan-to-value mortgages through government support and backing and, thus, expand access to mortgage finance.

- Grants: These provide technical assistance for housing developers and LFIs to support increased housing supply, provide market research and feasibility study assistance, and offer training on sustainable building practices and energy efficiency.

- Community financing mechanisms involve pooling resources from community members to fund housing projects. This approach empowers local communities to take charge of their housing needs and ensures that the solutions are tailored to their specific contexts. Examples include savings groups, cooperatives, and microfinance institutions.

The blame loop

Although we have an opportunity to shape green financing, we face the paradoxical challenge of the blame loop. The persistent demand-supply gap cycle leaves energy-efficient options underutilized as a market disconnect widens between the demand for energy-efficient homes and the supply of financing and construction options.

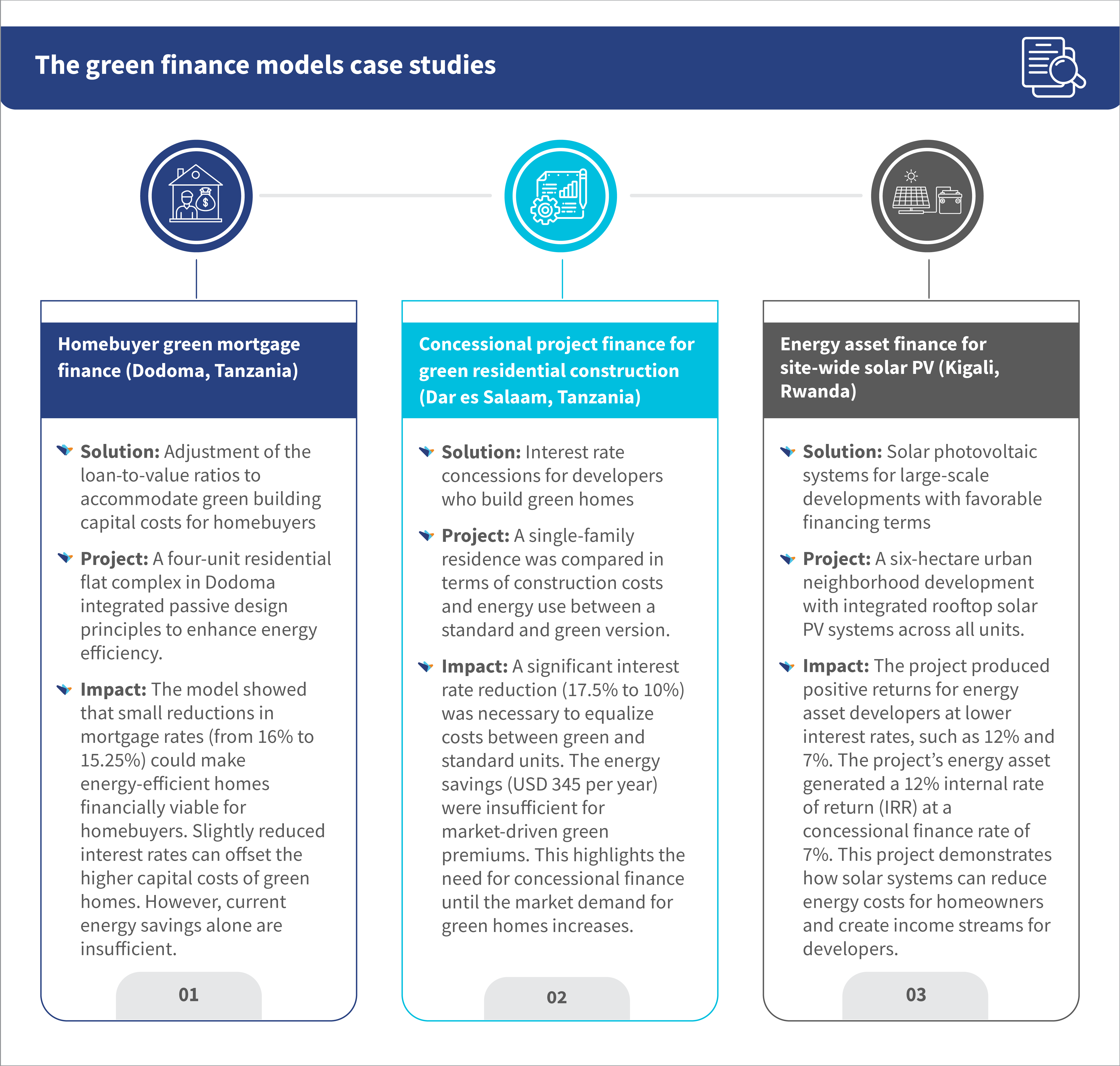

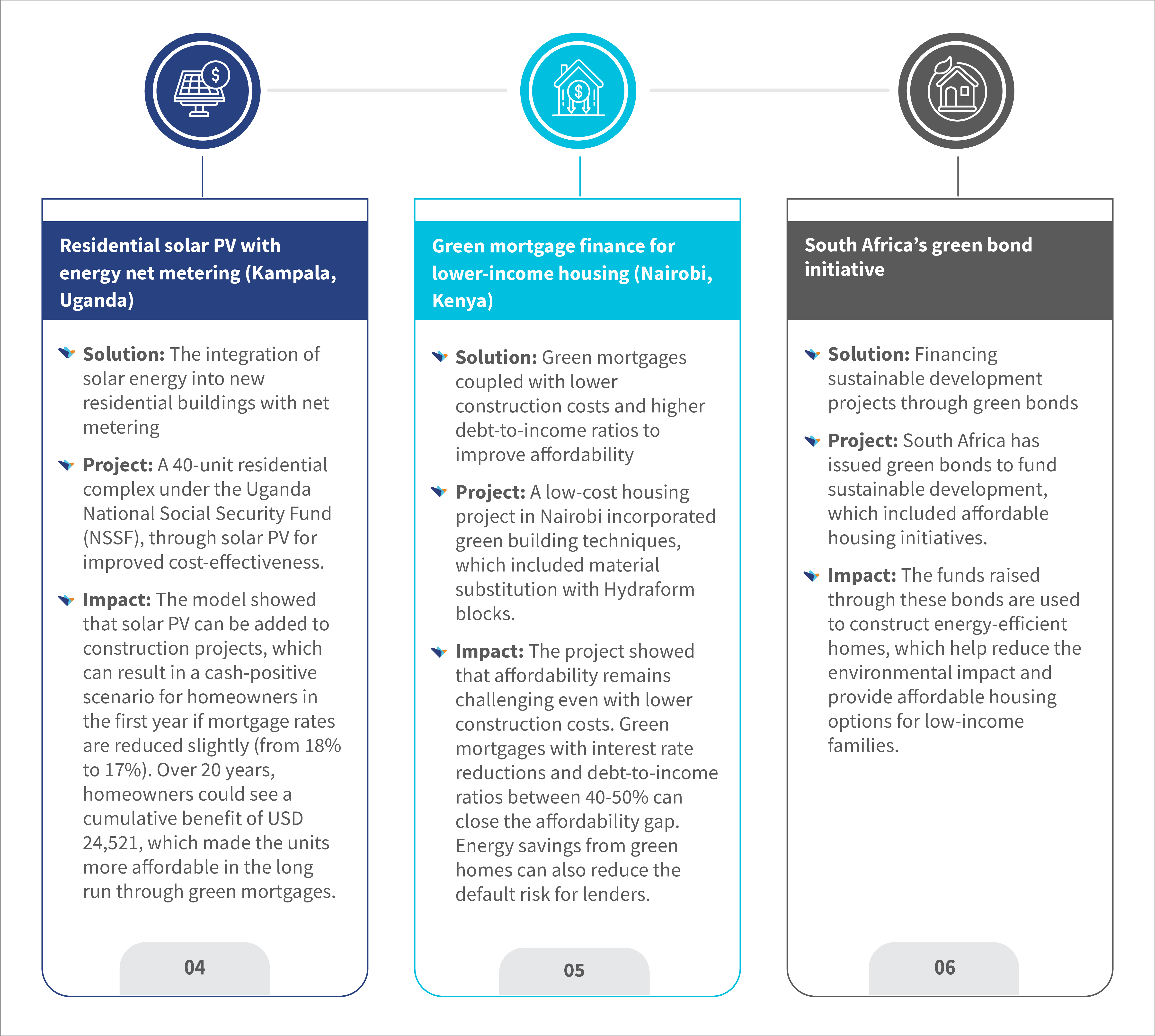

Case studies: Green finance models in Africa

The infographic below explores emerging practice case studies in Africa that evaluate the capacity of various finance products to reduce barriers to green building and enable value creation among all housing finance market players.

Affordable green housing finance can deploy decentralized credit enhancements to local financial institutions. It can, thus, catalyze, normalize, and scale private construction and mortgage lending. The mechanisms can be tailored to establish a self-sustaining ecosystem that supports the construction of affordable green homes and long-term homeownership.

Conclusion and recommendations

The development of affordable green housing in Africa presents a transformative opportunity. However, several significant challenges impede it. These include limited access to financing for both developers and potential homeowners, the high initial costs of green construction, and the lack of awareness and expertise in green building practices. Despite these obstacles, the need for affordable, climate-resilient housing continues to grow as urbanization accelerates across the continent.

We must take concrete action to bridge these gaps and use the potential of green housing finance. Our previous research, commissioned by Habitat for Humanity International (HFHI), HFH-Kenya, and HFH-Zambia, has laid the foundation for understanding affordable housing needs. The next step is to explore how green financing mechanisms can be adapted and scaled to meet the African housing market’s unique challenges.

Donors and stakeholders can play a pivotal role here. We can answer key questions that remain by funding targeted research:

- What innovative financial products can make green homes more accessible to low-income households?

- How can we reduce the financial risks for developers and lenders in the green housing space?

- What policy interventions would incentivize private sector investments in affordable, green housing?

- How can large multilateral climate funds and blended finance instruments help catalyze private capital to scale affordable green housing initiatives?

Green financing must gain traction through systemic coordination, collaboration, and value creation across all market players. The answers to these questions will help us build a compelling case for green finance and ensure it becomes a cornerstone of Africa’s sustainable housing agenda.

by

by  Oct 11, 2024

Oct 11, 2024 6 min

6 min

Leave comments