The need to expand and diversify use cases of cash-in and cash-out (CICO) agents and its potential: A case study of India

by Nikhita Jindal, Vineet Anand and Neha Mallick

Sep 16, 2024

6 min

This blog highlights BC agents’ declining profitability in India due to competition from digital payment platforms such as UPI. Despite their crucial role in financial inclusion, agents face low commissions and several operational challenges that add to their long-term sustainability issues. This blog explores potential solutions for CICO agents to enhance their income and maintain economic viability.

“I have been an agent for a Payments Bank for more than six years. My business correspondent (BC) business has reduced since people started to use UPI (Unified Payment Interface). I used to earn more than INR 10,000 (USD 121) a month from the BC business, and now I only earn around INR 1,500 (USD 18) to INR 3,000 (USD 36) in a month. This paltry amount does not help me run my household. I have stopped paying much attention to the BC business and only focus on selling groceries.”

– A payments bank agent, rural Odisha

MSC’s recent qualitative interviews with agents in Delhi National Capital Region, Bengaluru, Sambalpur (Odisha), Ranchi (Jharkhand), and Raipur (Chhattisgarh) shed light on the low profitability of the CICO business for CICO agents. It revealed that rural agents, on average, earn INR 8,000 (USD 97) per month, which varies from INR 600 (USD 7) to INR 20,000 (USD 243). Agents who earn higher incomes of more than INR 15,000 (USD 180) are located in prime areas within districts with high migrant traffic and a relatively higher volume of daily transactions.

Most CICO agents have failed to make ends meet through CICO agent business due to low profitability and competition from emerging technologies, such as user-friendly UPI, QR-based payments, and internet banking, among others. As a result, CICO agents scout for alternate income streams and lose interest in the CICO business, which leads to higher dormancy rates.

The profitability problem

An analysis of the agents’ unit economics reveals that this business provides limited economic benefits to agents. Traditional agents typically reach breakeven in seven to eight months due to higher setup costs. In contrast, new-age agents achieve breakeven within two to three months. Further, as illustrated in the infographic, MSC’s cost-benefit analysis for new-age BC agents in India shows a monthly profitability that ranges from INR 4,000 (USD 48) to INR 11,000 (USD 131). In contrast, traditional agents earn around INR 7,000 (USD 85) to INR 15,000 (USD 180) monthly. However, these traditional agents have to make significant investments of $600-2,400 for capital expenditure to set up their outlets. When these investments are amortized, even over five years, the profitability of traditional agents is significantly eroded. Indeed, many are making losses.

* Traditional agents incur higher one-time setup cost ( USD 600- USD 2400), whereas the operational expenditures remain similar for all agent types with minor variations depending on the bank’s model; Source: MSC, 2022

The profitability for both agent types indicates they do not earn high incomes, especially if we consider the effort and operational costs involved. The profits generated by these agents are modest and may not prove beneficial for long-term financial stability. The market saturation, evolving customer needs, and increased competition contribute to their struggle for profitability. Moreover, the need to hold large amounts of liquidity for CICO operations introduces an opportunity cost, as this capital can potentially earn higher returns if invested in other ventures, such as a grocery store business.

The retail digital payment sector in India has experienced impressive growth, with transaction volumes increasing at a CAGR of 50.84% from 2017 to 2023. However, the BC channel’s use remains limited, with transactions at BC agent outlets comprising only 3% of the total digital payment transactions. More than 80% of the transactions at the agent outlet comprise basic CICO transactions, which earn the agents less than 1% commission on the transaction value.

Most agents manage 10 to 50 daily transactions, especially in rural areas, with a maximum transaction value of around INR 50,000 (USD 595). On average, an agent earns 0.10% commission on a transaction of INR 1,000 (USD 12). Based on this, the agent’s monthly commission is around INR 3,000 (USD 35) to INR 5,000 (USD 60). Agents must conduct transactions worth INR 30 million monthly (USD 0.35 million) to earn at least INR 30,000 (USD 365). Such a high volume of transactions is restricted to certain areas and districts and depends on agents’ financial capability – is how well they invest in and manage liquidity, and soft skills – such as clear communication that builds customer trust.

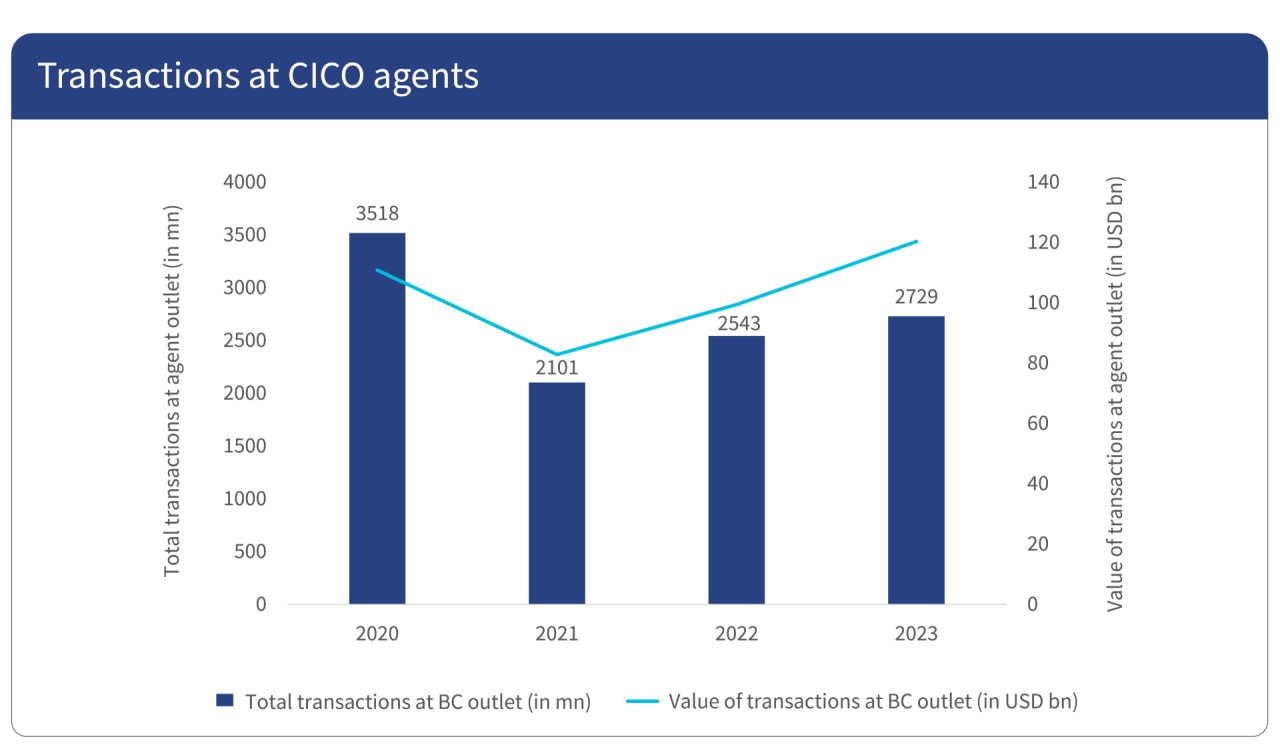

Graph 1: Volume and value of transactions at agent points

Source: RBI annual report (2023-24)

The Reserve Bank of India’s annual report, 2023-24 (Graph 1), reveals that the value and volume of transactions at BC agent points have grown since the dip in 2021. Still, the total transaction growth has been limited to 11% per year, while the growth of the volume of transactions is at 40%. This has had limited economic benefit for the agents as the percentage of commissions earned on transactions has reduced over the years. MSC’s market intelligence has revealed that the banks have reduced agent commissions on several services due to mergers of public sector banks, high cost of intercharge fees, and oversaturation of agent points in key geographies/markets. This makes it difficult for agents to sustain the BC business and meet the rising cost of living. Low commission and profit-earning potential make it difficult for agents to cover operational costs, especially in rural areas where transaction volumes may be high, but the value per transaction is low. This led to a net decline in the number of CICO agents by approximately a from 2022 to 2023.

Stiff competition from other modes of payment

In 2021, during the COVID-19 pandemic, UPI saw a significant surge in its usage as digital payments became more prevalent. Innovations, such as QR codes, made digital transactions more accessible to low- and moderate-income (LMI) groups.

As of 2024, India has 884 million Internet users with a 52.4% Internet penetration rate. The increase in Internet users has led to a significant uptick in digital transactions, with a colossal average daily volume of transactions worth INR 480.47 million (USD 5.7 million). UPI’s instant money transfer capability has reduced the reliance on BC agents.

Can BC agents dream of a brighter future?

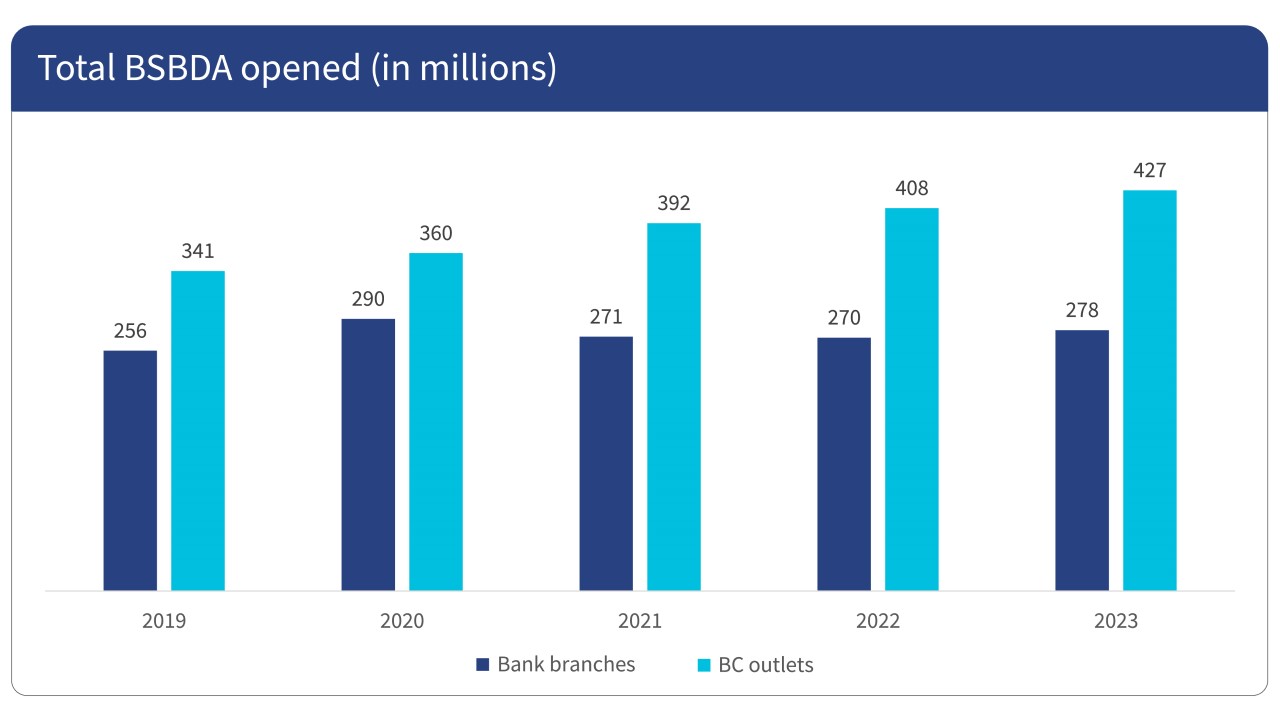

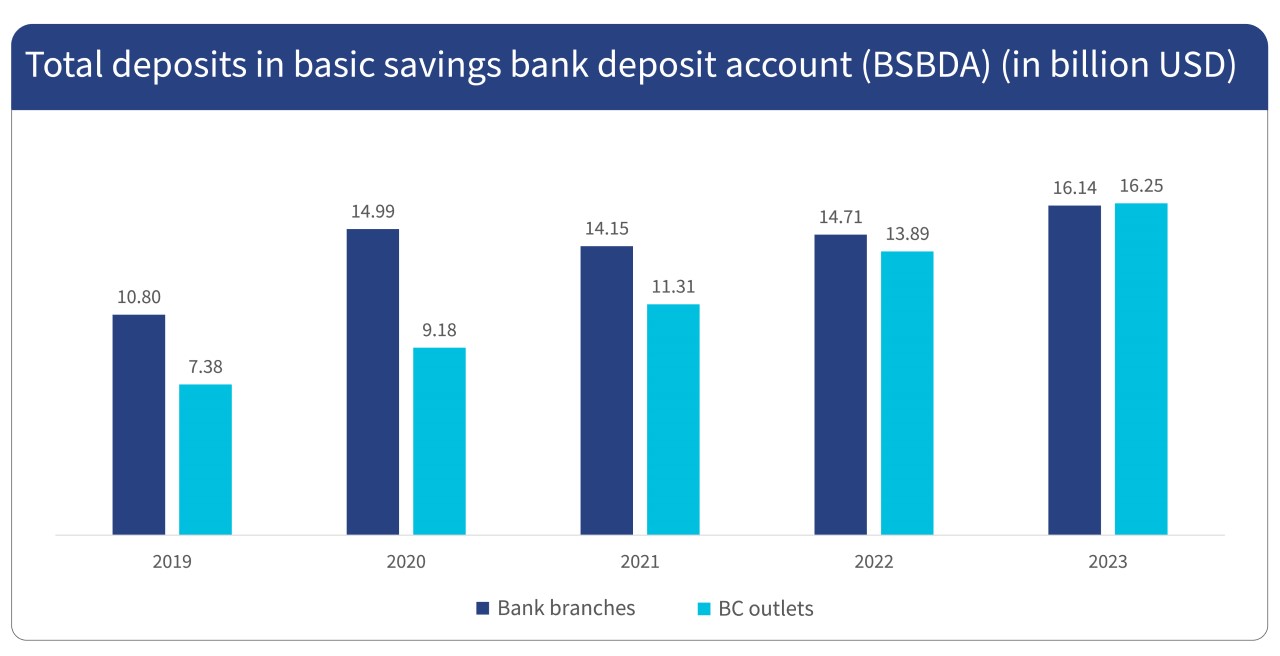

An analysis of the total savings accounts opened at bank branches versus BC agent outlets reveals that BC agents have consistently opened more accounts than bank branches (Graph 2). This proves their relevance to the expansion of financial inclusion. Per the RBI’s Annual Report 2023-24, the total basic savings account opened by BC agents is 427 million. However, deposits made at BC agent outlets are on par or slightly lower than those made at bank branches (Graph 3). Therefore, while CICO agents open more accounts, they do not get enough “cash-in” transactions, which serve as an important source of income for agents.

Graph 2: A comparison of savings accounts opened at bank branches and BC agent outlets

Source: RBI annual reports (2019-24)

Graph 3: A comparison of deposits made at bank branches and BC agent outlets

Sources: RBI annual report 2019, 2020, 2021,2022, 2023

Agents are crucial in the delivery of essential formal financial services to underserved communities from the LMI segment. However, they find the current overreliance on basic CICO transactions economically unsustainable due to low commissions. Agents can earn more through a broader range of non-CICO use cases, such as savings, deposits, insurance, and utility payments. Although providers, such as public sector banks and payment banks, offer some of these services through their agent networks, the uptake among agents remains limited. This is due to a lack of clear value propositions and insufficient training and support from banks and business correspondent network managers (BCNMs).

Providers must, therefore, invest in the development of innovative, LMI-friendly products with higher commission structures and provide uniform training on these non-CICO products to ensure BC agents’ economic viability. By doing so, agents can better serve the growing number of LMI customers they enroll in formal financial services. For instance, they can open basic savings accounts while they increase their income by selling non-CICO products. This strategy also provides banks a valuable opportunity to decongest their branches, as well-trained BC agents can handle more transactions and allow branches to focus on more complex and higher value banking services.

Blogs 2 and 3 in this series delve deeper into these two critical aspects: The development of innovative LMI-friendly products and the tailored training required for different agent segments to sell non-CICO products.

by

by  Sep 16, 2024

Sep 16, 2024 6 min

6 min

Leave comments