What’s Undermining India’s Financial Inclusion Progress?

by Pawan Bakshi, Graham Wright and Manoj Sharma

Jun 8, 2015

3 min

The blog recommends that the government set an adequate rural DBT commission rate of at least 3% for the first few years of PMJDY.

The Government of India is undertaking the most ambitious financial inclusion drive in history. The effort has two key elements: the financial inclusion plan called Pradhan Mantri Jan Dhan Yojana (PMJDY) and direct benefit transfer (DBT) payments from the government into beneficiaries’ bank accounts. The success of these efforts hinges on one factor above all: the quality of the last-mile banking agent (Bank Mitr – “friend of the bank”) networks that will disburse DBT payments and enable customers to access their bank accounts.

The Ministry of Finance’s Department of Expenditure released an Office Memorandum (OM) on 16thJanuary 2015 that fixes commissions for banks distributing DBT payments for rural areas at 1% (and even less for urban areas). For Bank Mitrs, this means that, currently, processing DBT payments result in a loss.

With such low commissions, there is no business case for Bank Mitrs to distribute these government subsidy payments. Therefore, the low commissions could potentially derail the entire financial inclusion effort. Indeed, the Task Force on Aadhaar-Enabled Unified Payment Infrastructure estimated in its 2012 report that a 3.14% DBT commission would be needed to ensure a robust rollout of Bank Mitrs.

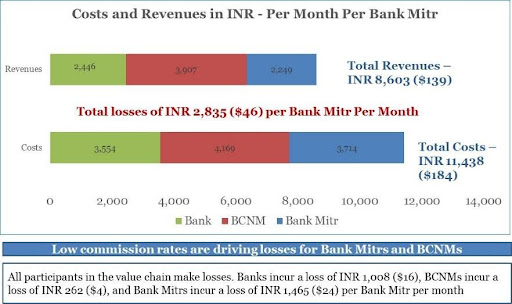

A new MicroSave costing exercise found that the cost to banks of processing transactions through the agent network is at least 2.63% of each transaction – and (since this is an average) considerably more in remote rural areas.

Banks have been losing money when handling DBT pay-outs. Based on our on-the-ground research and analysis of costing data from the Bank Mitrs and Business Correspondent Network Managers who manage the Bank Mitrs, we concluded that a 3% DBT commission would be needed to ensure a viable distribution channel.

While the cost to the government of paying DBT commissions may seem high, it should be evaluated in light of the significant savings that the government will realise through reduced administrative costs and reduced payment leakages to unintended recipients. A 2011 McKinsey & Company analysis of India’s government payment system, estimated it to be Rs.100,000 ($22.4 billion) annually.

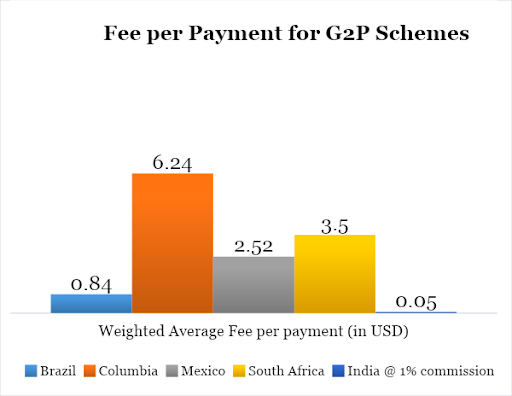

The 1% commission rate is also remarkably low in the international context. We re- analysed data from CGAP’s “Social Cash Transfers and Financial Inclusion: Evidence from Four Countries,” and found that India’s weighted average fee per transaction (basis calculations using MNREGA income support, public distribution system food subsidy and LPG subsidy payments) was just 6% of the next lowest country (Brazil). Of course, this is in part driven by the low value DBTs made in India, but the costs of conducting the transactions, whether large or small, are largely the same.

Another point to consider is that the government need not pay 3% commission to Bank Mitrs in perpetuity. According to MicroSave estimates, as the network of Bank Mitrs expands and more DBT programs flow through these accounts, the cost of processing DBT payments through an agent could potentially fall to as low as 1.4%.

In Policy Brief #12, we recommend that the government set an adequate rural DBT commission rate of at least 3% for the first few years of PMJDY. This would help ensure quality services and build a Bank Mitr network that is more sustainable. Over time, as payment volumes increase and the cost of processing DBT payments decreases, market forces and the bargaining capacity of banks will lead to lower commissions

(The blog was first published on CGAP)

by

by  Jun 8, 2015

Jun 8, 2015 3 min

3 min

Leave comments