Seven factors that determine the resilience and adaptive ability of smallholder farmers in Bihar

by Partha Ghosh, Rahul Chatterjee and Graham Wright

Jan 27, 2023

4 min

Smallholder farmers in the flood-prone state of Bihar need capital and support from system-level actors to increase their climate resilience. This blog identifies seven critical factors that can enable the building of climate resilience and adaptive strategies of smallholder farmers.

Our previous blogs examined the impact of climate change on smallholder farmers in India’s Bihar state and their coping strategies. We also looked at the traits of resilient and vulnerable smallholder farmers. These blogs highlighted the increasing vulnerability of these farmers to fluvial and pluvial flooding and looked at their struggles to adapt to the changing climate and weather patterns.

This blog extracts the seven factors critical to enabling resilience and adaptive strategies among smallholder farmers in the flood-prone state.

- The quality of available farmland:

The topography of the farmland and the availability of irrigation sources determine its soil quality and productivity. For example, low-lying lands are likely to remain waterlogged for longer, which leaches nutrients from the topsoil, particularly when the flooding is pluvial. Leaching gradually deteriorates the topsoil’s fertility. Similarly, farmlands located near river banks experience inundation during fluvial flooding but they also benefit from nutrient-enriched silts deposited by the river.

Farmers’ natural capital governs their ability to remain resilient against weather-related shocks, determined by the following metrics:

- Irrigated as against rain-fed lands;

- Low-lying as against elevated lands;

- Lands adjacent to river banks as against lands far away from river banks.

- Association with supporting institutions and cooperatives:

Our research found that female smallholder farmers who are members of the self-help groups (SHGs) formed under the JEEViKA program receive a range of support from the program. Such support includes information and advisory on farming practices, weather alerts, financial inclusion programs, livelihood diversification programs, and marketing assistance. The female members associated with JEEViKA appeared more confident in using innovative cultivation methods, improved variety of seeds, and new crops, among other areas.

Agriculture scientists of the National Agricultural Research System play a vital role in farmers’ climate resilience as they provide crucial advisory services through the Krishi Vigyan Kendra Knowledge Network. Therefore, association with supporting institutions such as cooperatives, producer organizations, and NGOs strengthen the farmers’ capability to adapt to a changing climate.

- Availability of timely and credible weather information and crop advisory:

In a related point, critical for male farmers and women not enrolled in the JEEViKA program, we learned that smallholder farmers have access to weather-related information for free. The Department of Agriculture Meteorology of the Government of Bihar has the infrastructure needed to provide the information. In addition to weather information, local agriculture advisory centers provide credible crop production and marketing advisory services.

- The ability to diversify their livelihood:

We found most young people are migrating to cities to work in the non-farm sectors. Respondents noted that an increase in the number of CICO agents in the villages has improved the ease and experience of cashing out these remittances and government benefits. We found that households whose migrant members remit money built pucca houses on elevated lands. Smallholder farmers in the farm sector diversify their income by cultivating vegetables and other cash crops. They also rear livestock. Over the years, farmers have diversified their income sources to mitigate the risk of crop failure due to adverse weather events. This diversification is a crucial strategy and offers a form of insurance against the changing and increasingly disruptive weather patterns.

- The ability to invest in non-farming assets:

While smallholder farmers recognize the importance of diversification, including into non-farm enterprises, they fail to save their income to invest in non-farming assets. Most of them reinvest what little surplus income they have in agriculture. However, during significant weather events, smallholders use their savings for consumption, which often compels them to borrow from informal sources to invest in agriculture for the following season.

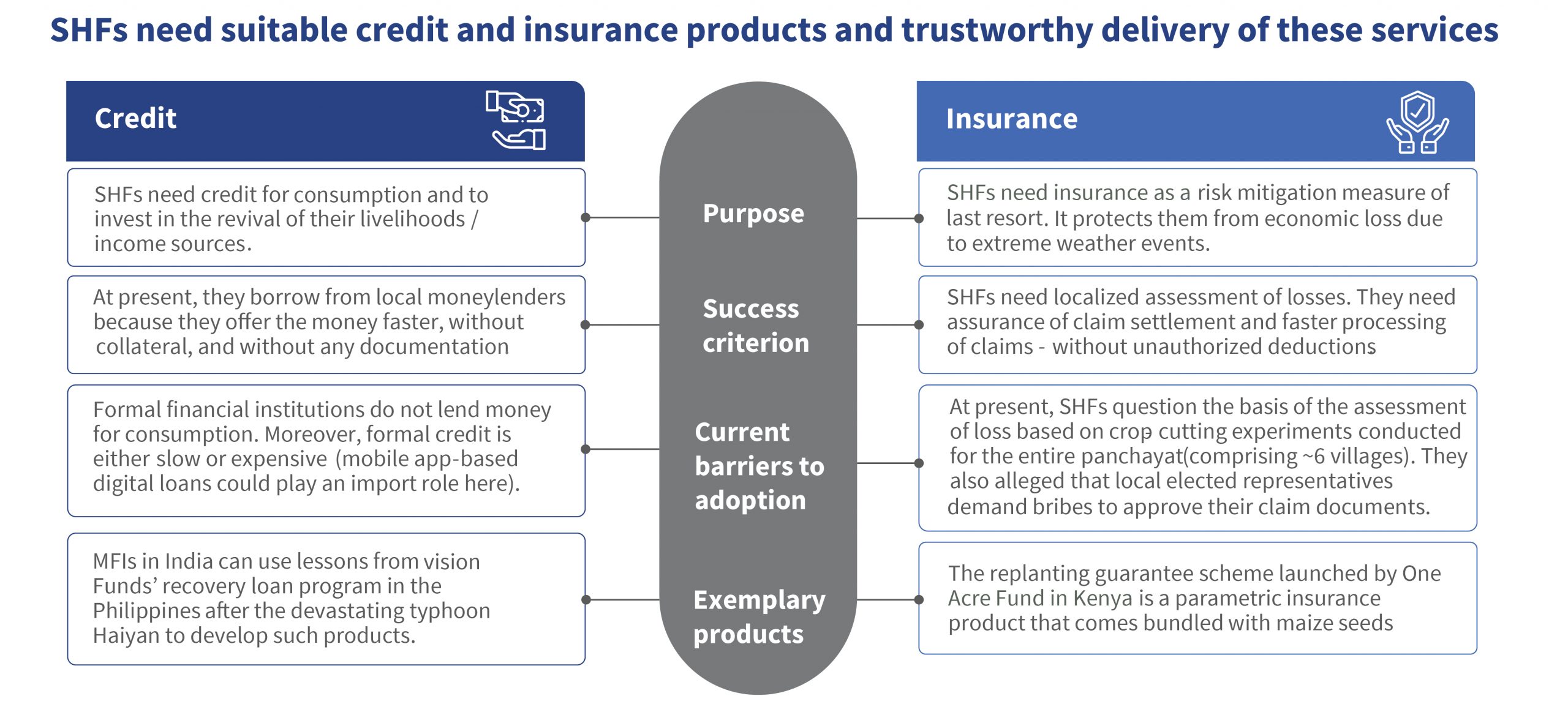

- The availability of timely and affordable credit:

As noted above, smallholder farmers often rely on borrowing to revive their livelihoods after a major weather event. They fall back on informal credit because it is accessible and timely. No other institutions lend for economic recovery, compelling smallholders to resort to informal credit. However, the JEEViKA program is a major provider of loans through its SHG networks. While the SHG network suffers from lengthy credit delivery systems and processes, it has significantly enhanced farmers’ income and ability to access credit. Therefore, in the absence of insurance, a key factor of climate resilience is the availability of timely and affordable credit to reconstruct and revive livelihoods—which are ideally diversified.

- The availability of suitable and trustworthy insurance products:

Smallholder farmers understand that insurance can help them recover from the economic impact of weather events. However, they stated that lodging claims is a tedious process and typically involves bribing local officials—up to 20% of the amount claimed. Moreover, farmers feel insurance companies should assess damages at the individual farm level. However, insurance companies currently measure the productivity loss of an entire cluster of villages—a panchayat—to determine the extent of damages they should pay to each insured farmer. Therefore, an effective and trustworthy insurance product could enable the uptake of insurance products designed to protect farmers against major perils and reduce their dependence on informal moneylenders.

The graphic below highlights the critical success factors for credit and insurance products that could bolster the resilience of smallholder farmers in Bihar.

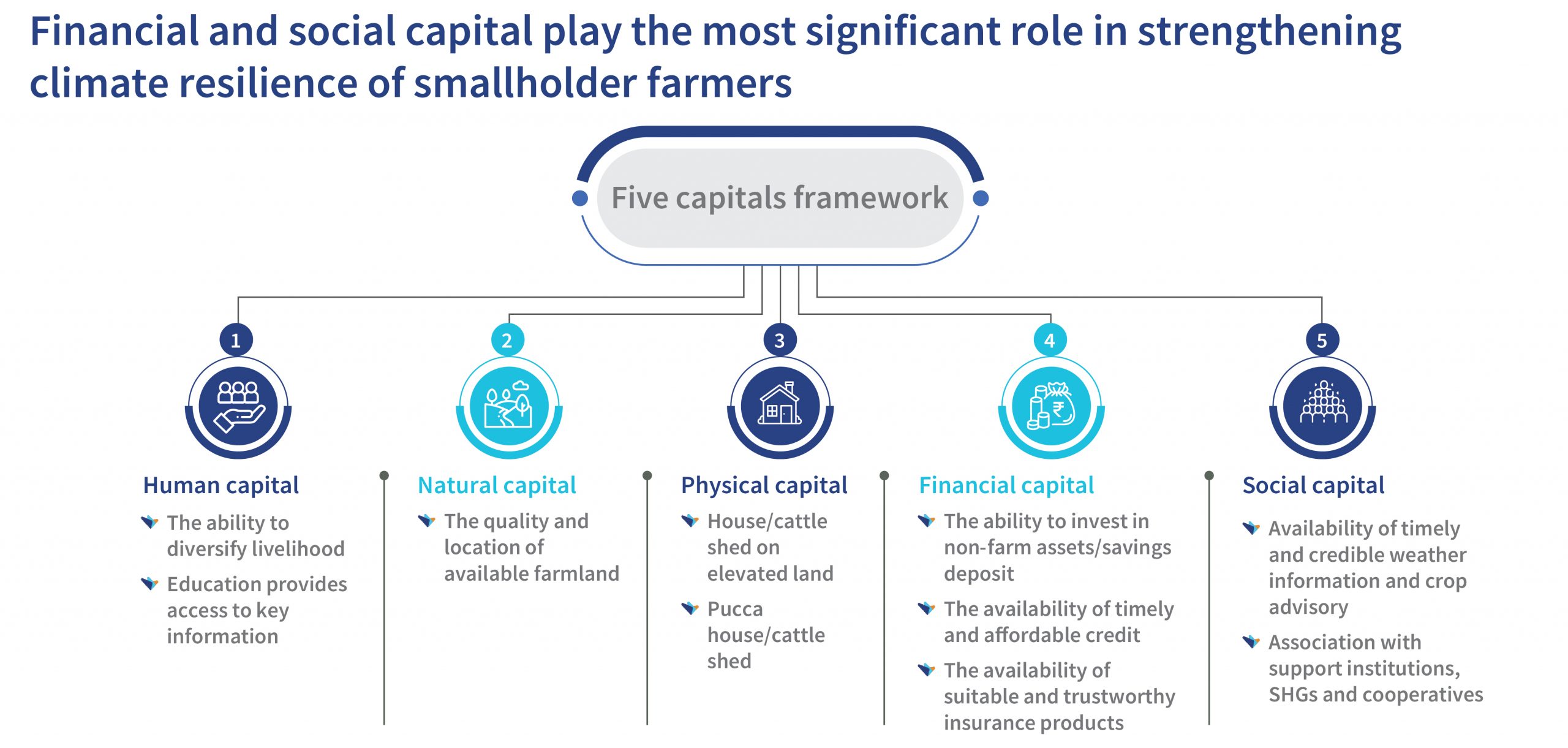

The DFID Five Capitals Framework provides a concise way to summarize the drivers of smallholder farmer resilience and climate adaptation in Bihar. Clearly, the key determinants are the quality and location of farmland owned and the ability of farmers to diversify their farm and non-farm revenue streams. However, this framework highlights the importance of information, extension, and other services delivered by government and non-government actors in the ecosystem and the catalytic and protective role that well-designed financial services could play.

by

by  Jan 27, 2023

Jan 27, 2023 4 min

4 min

Leave comments