Unpacking the ground realities—what are we beginning to learn about women-owned businesses in Bangladesh?

by Rahul Chatterjee and Sadia Shahnaz

Jan 17, 2023

4 min

The first of a series, this note explores who can we call a true woman business owner, whether they are a homogeneous group, and what challenges they face.

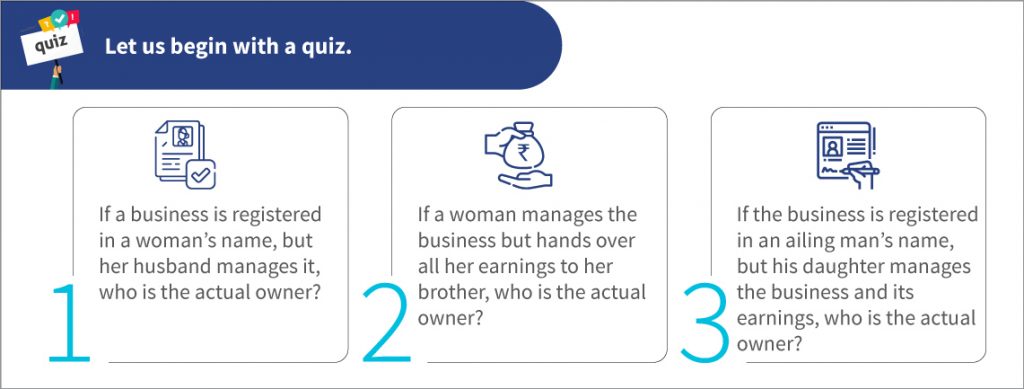

We had to reflect on these questions multiple times as we tried to define women business owners for the Women Business Diaries research in Bangladesh.

During the conceptualization and preparation phase of Women Business Diaries research, we considered these questions and picked “control of the business” as the defining criteria of ownership. However, we also captured data on the registration of the business.

We decided to use four objective proxy indicators on decision-making and control to define “women business owners:”

Among all women-run businesses, how many of them are women-owned?

We asked these questions to ~800 enterprises in eight districts[1] across four divisions[2] of Bangladesh. About 85% of those enterprises were women-run. Here is what we learned:

- Women own only a portion of women-managed businesses.

Only 53% of women who managed businesses were business owners, as per our definition. However, among men, this proportion is 84%. The gender gap increased further in decision-making on loans and business management. We observed the following:

- 65% of women and 95% of men make final decisions on day-to-day business management activities, such as purchasing supplies;

- 59% of women and 93% of men make final major business management decisions, such as investing or changing suppliers, opening new outlets, and starting new business lines;

- 59% of women and 87% of men make a final decision regarding taking a loan for business;

- 70% of women and 95% of men decide how to use the money they earn from the business.

- Six in 10 women-owned businesses lack the required documentation.

We checked the availability of the most basic documentation—a trading license—an indicator of formalization in Bangladesh. About 60% of the women business owners, who fit our definition, lacked a trading license. This proportion is just 19% for men.

- A third of the businesses licensed in a woman’s name are not women-owned.

About 33% of all businesses with a trading license in the name of a woman are not really owned by the woman, as per our definition. This proportion is lower for men. Out of all the businesses with a trade license in the name of a man, the man is not the actual owner in only 14% of the cases.

Evidence shows that women-owned businesses are not a homogenous group. We find that:

- Locations influence the choice of enterprise by women: Our sample highlighted significant geographic differences in the businesses that women own. In the Khulna division, 35% of women-owned businesses were agri- or livestock-based, whereas only 4% fell into these categories in the Rangpur division. In contrast, service-related enterprises dominate the women-owned businesses in Dhaka by 56% and 50% in Chattogram. About 66% of women-owned businesses are retail or wholesale trading in the Rangpur division.

Open questions: Are the differences because the geo-political and social dynamics in the regions restrict certain business types and promote other business types, or is it something else? We will unpack these questions during our Financial Diaries research.

- Business management practices vary across business types: Maintaining an inventory ledger is most common among agri- and livestock-based businesses (30%) and least common among manufacturing businesses (19%). Some form of bookkeeping or maintaining accounts is most common in the trading business (80%) and least common in the manufacturing business (33%).

Why do manufacturing businesses have such limited records and bookkeeping? That is another question for us to unpack.

What challenges do women-owned businesses face?

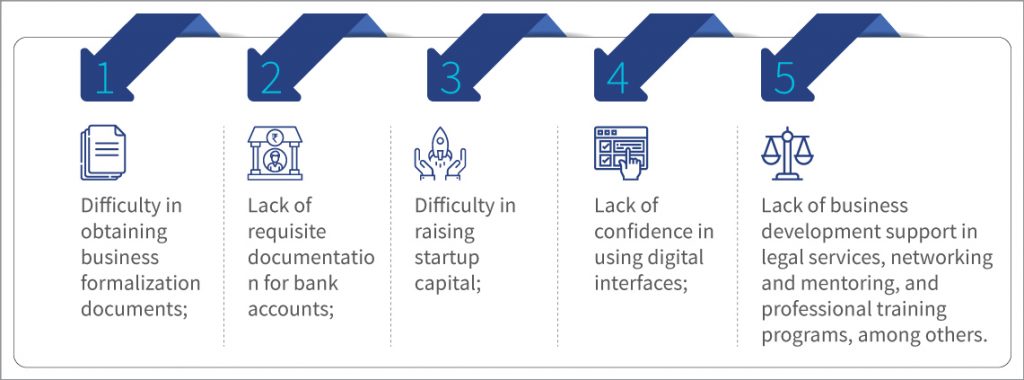

From the early discussions with our diarists, our findings reinforce that women-run businesses face disproportionate barriers due to gender-discriminatory social and cultural norms. They have limited access to financial services, poor access to information, little technical support on business development, and smaller business networks. Some other barriers that women business owners face include the following:

[1] Dhaka, Munshiganj, Chattogram, Feni, Rangpur, Nilphamari, Khulna, Satkhira

[2] Dhaka, Chattogram, Rangpur, Khulna

Limited access to finance, mainly due to a lack of collaterals and institutional perceptions that view women business owners as high-risk, leads to under-capitalization of businesses, negatively impacting their income and living standards. During their entrepreneurial journey, women face the usual range of gaps in financial services that include:

We will delve more deeply into these as the research progresses.

Further, social norms also pose a challenge for women-owned businesses. The socially accepted gender roles, such as unpaid care work, make it mandatory for women to balance household duties with their enterprises. Moreover, women are expected to prioritize unpaid care work at home over income generation.

Many unanswered questions

This note is a sneak peek into the lives of women business owners in Bangladesh. However, so many questions are still unanswered. For example, the Bangladesh market offers no definitive way to describe whether a business is formal. Further, ownership of a trading license is the most commonly used metric for business ownership. But does having a trading license help a business? If yes, then how? Does it ensure more access to finance? What about the tax implications? Does the cost of being formal outweigh its benefits?

Stay tuned as we attempt to answer these questions and more in the future editions of our “The big smalls of Bangladesh” insights series.

Please write to us at rahul.chatterjee@dev.microsave.net to share your thoughts about the insights presented in this edition or send us a burning question in the Bangladesh market.

by

by  Jan 17, 2023

Jan 17, 2023 4 min

4 min

Leave comments