Were countries adopting digital payments financially resilient during COVID-19? The data suggests so

by Aakash Mehrotra, Chinmay Dabhade and Monica Dutta

Nov 25, 2022

4 min

The COVID-19 pandemic spurred the growth of digital payments worldwide. MSC’s studies revealed the increase in scope and intent of digital payments among LMI groups and MSMEs. We analyzed data from World Bank in 2020 and the Global Findex Database 2021 to probe the relationship between the adoption of digital payments and the economic resilience of countries. We analyzed data from 11 countries. The research proved the hypothesis that the adoption of digital payments in developing economies has a positive correlation with financial resilience.

The COVID-19 pandemic has spurred financial inclusion by increasing digital payments and expanding formal financial services. The Global Findex Database 2021 provides data on the growth in access to digital financial services and their use during the pandemic. The average rate of account ownership in developing economies increased from 63% to 71%. In the low- and middle-income (LMI) economies, excluding China, more than 40% of adults made in-store or online merchant payments using a card, phone, or the internet for the first time since the pandemic.

The increase in scope and intent of digital payments among LMI groups and MSMEs is also evident from MSC’s studies, where we examined the impact of COVID-19. Building on this work, we sought to understand correlations between the adoption of digital payments by an economy and its financial resilience to cope with the pandemic. We used The global Findex Database 2021 and the World Bank 2020 data to investigate.

The Global Findex Database 2021 data has indicators on first-time users of digital payments, including in-store or online merchant payments and utility payments during the pandemic. We used indicators related to income, coping capacity, and awareness of government policy from the World Bank dataset. After an exploratory data analysis of both datasets, we finalized four indicators corresponding to financial resilience and the adoption of digital payments from each dataset for this purpose.

Here is the list of indicators we used in our analysis:

Data were missing for many indicators in most countries. We selected only those countries for which the complete data was available, or only one indicator value was missing. We created a Digital Adoption Index using Findex data and a Financial Resilience Index using the World Bank data for 14 countries across different regions.

The Index is inspired by the method Mandira Sarma used in ICRIER’s working paper on the Index of Financial Inclusion. We used the simple weighted average method to create indices.

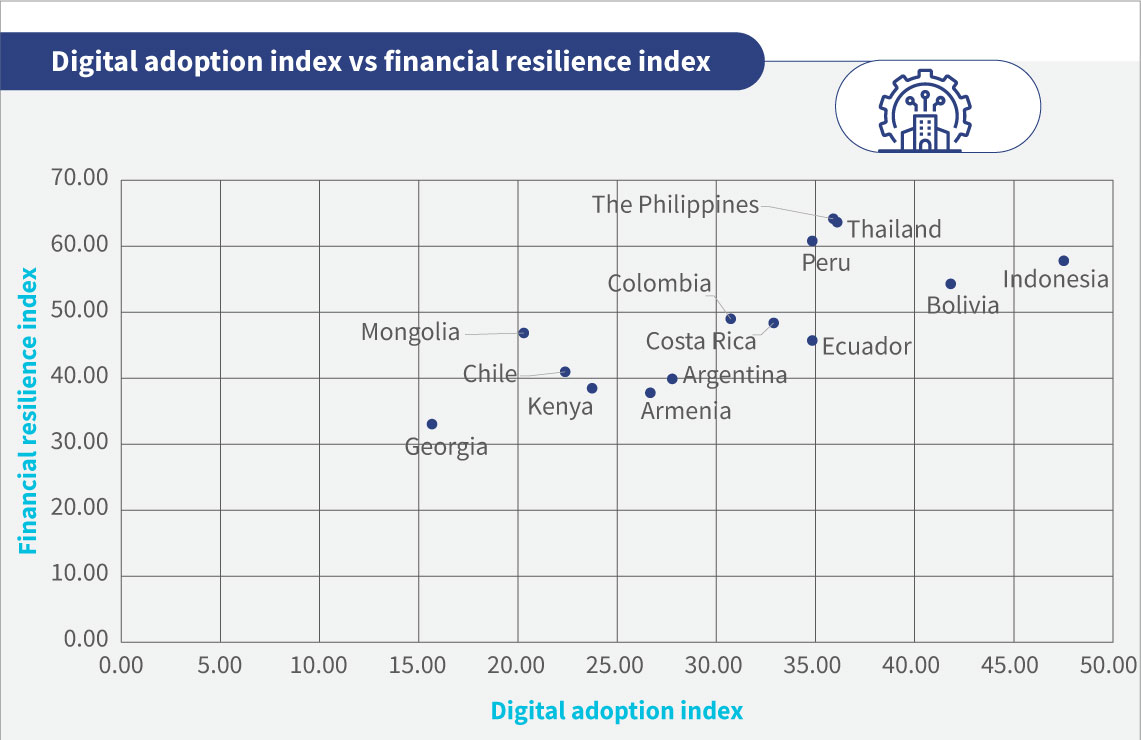

The graph given below shows the relation between the two indices:

The scatter plot shows a strong positive correlation of 0.73 between the indices, implying that countries with high digital adoption at the start of the pandemic also showed higher financial resilience.

Increased financial resilience could have emerged from governments using digital channels to transfer benefits directly to beneficiaries’ accounts. Beneficiaries could use this amount digitally whenever and wherever they needed it. For example, people in cities could send money to their relatives in the villages. Digital payments sped up the transfer of money in the challenging times of the pandemic.

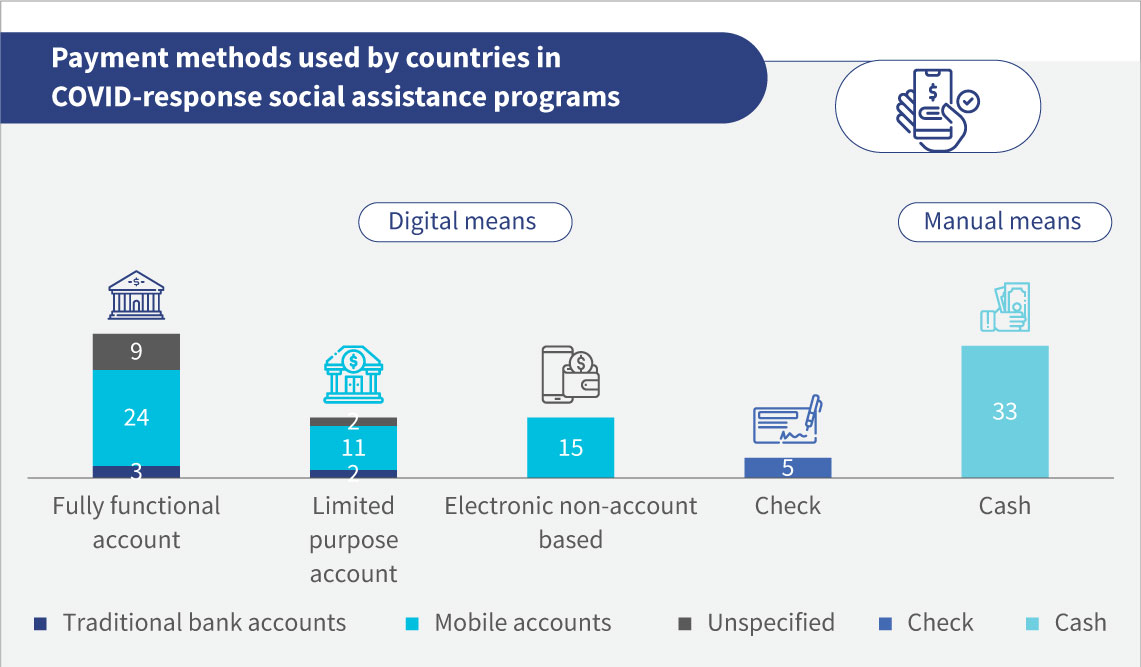

A World Bank tally of policy responses to the pandemic in 2021 found that at least 58 governments in developing countries used digital payments to deliver COVID-19 relief. Of these, 36 countries made payments into fully functional accounts, and only 33 governments used manual modes to deliver COVID-19 relief.

Payment methods used in COVID-response social assistance programs across a subset of 58 low- and middle-income countries (Source: The impact of COVID-19 on financial inclusion, a report by the World Bank and Global Partnership for Financial Inclusion (GPFI))

According to data from the World Bank, 84 countries reported changes to their social protection systems in response to the pandemic. Of these, 58 countries scaled up cash transfer programs. In many developing countries, the scale of these payments was unparalleled. For instance, new programs covered one-third of the population in Argentina, Pakistan, and Peru, and more than 70% of households received emergency transfers in the Philippines.

At the same time, the private sector also shifted to digital payments. Despite the contraction in economic activity, GSMA, in its “State of the Industry Report on Mobile Money,” reported that mobile money grew twice as fast as had been forecasted for 2020, at 12.7%, reaching 1.2 billion accounts. Global credit card giant Visa reported that more than 13 million users made their first-ever online transaction in early 2020.

However, we noted a few exceptions to this general pattern observed across countries— particularly Bolivia and Indonesia—where the Financial Resilience Index lags in growth compared to the Digital Adoption Index.

In Indonesia, the adoption of digital payments grew during the COVID-19 pandemic. Of all the people who made digital in-store merchant payments, 47% did so for the first time after the pandemic. Similarly, 54% of all people who made digital merchant payments used digital payments for the first time after the pandemic started.

However, this did not reflect high financial resilience in Indonesia. Almost 50% of people in Indonesia reported reduced consumption of goods to cope with the pandemic. At least 10% had to sell their assets to pay for daily living expenses. A possible explanation for that could be limited use-cases in the country, as indicated in our latest study on QRIS implementation in Indonesia.

While COVID-19 prompted increased use of digital finance, all communities or consumers were not in a position to pivot rapidly toward digital financial products and services. People need connectivity, including ownership of a mobile phone, access to the internet, and digital skills to use digital financial services, which are not distributed evenly among the population. Besides, vulnerable segments tend to have limited access to these technologies.

Despite these challenges, most countries in our study showed a high correlation between resilience to the pandemic and the adoption of digital payments. Findex 2021 data suggests countries that adopted digital payments were financially resilient during the COVID-19 pandemic. However, our analysis was based on a restricted dataset due to the lack of data availability, and the results might change if we explore a richer dataset. The data shows how driving financial inclusion and digital payments can help build the resilience of nations in times of global disasters, such as the COVID-19 pandemic.

by

by  Nov 25, 2022

Nov 25, 2022 4 min

4 min

Leave comments