Finequs: Democratizing the lead generation of financial products to increase access

by Maansi Sharda and Smriti Misra

Jul 11, 2023

4 min

Finequs is a FinTech startup with a vision to deepen access to financial products, such as loans, credit cards, and other financial products, to low- and middle-income segments. It seeks to democratize the lead generation process for financial products through merchant channels. It uses the retail merchant channel to generate leads for financial products on behalf of formal financial institutions. It intends to make access to financial products as simple and convenient as going to the local market for grocery shopping. In this blog, you will discover how Finequs strengthens this merchant channel and motivates it to add more financial services to its offerings.

Introduction

The Pradhan Mantri Jan Dhan Yojna (PMJDY) in India increased access to formal financial accounts to 78%, providing significant benefits to low- and moderate-income (LMI) segments. However, the usage of these accounts among the LMI segment in access to financial products remains limited.

This blog highlights the journey of the FinTech startup Finequs. The startup works to deepen access to financial products, such as loans, credit cards, and other financial products, to increase account usage by the target segment. It seeks to democratize the lead generation process for financial products through merchant channels. In this blog, you will discover how Finequs strengthens this merchant channel and motivates them to add financial services to their offerings.

Finequs is part of the Financial Inclusion (FI) Lab’s sixth cohort. The Lab has supported 50 startups focused on the LMI segment as part of CIIE.CO’s Bharat Inclusion Initiative, with technical assistance from MSC. The Lab receives support from some of the largest philanthropic organizations worldwide—the Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, Omidyar Network, and MetLife Foundation.

Credit is a chronic need in India. However, only 11.8% of adults could borrow funds from formal financial institutions. Several studies, including MSC field analysis and Global Findex, highlight that lack of trust and access to financial products or distance from financial institutions results in low activity in financial accounts.

Finequs is on this journey to make access to financial products similar to going to the local market for grocery shopping—simple and convenient. It uses the retail merchant channel to generate leads for financial products on behalf of formal financial institutions.

The light-bulb moment

Former banker Krishnan Vaidyanathan founded Finequs in 2019 in Chennai, India.

The ambition to make financial inclusion accessible, inclusive, and democratic

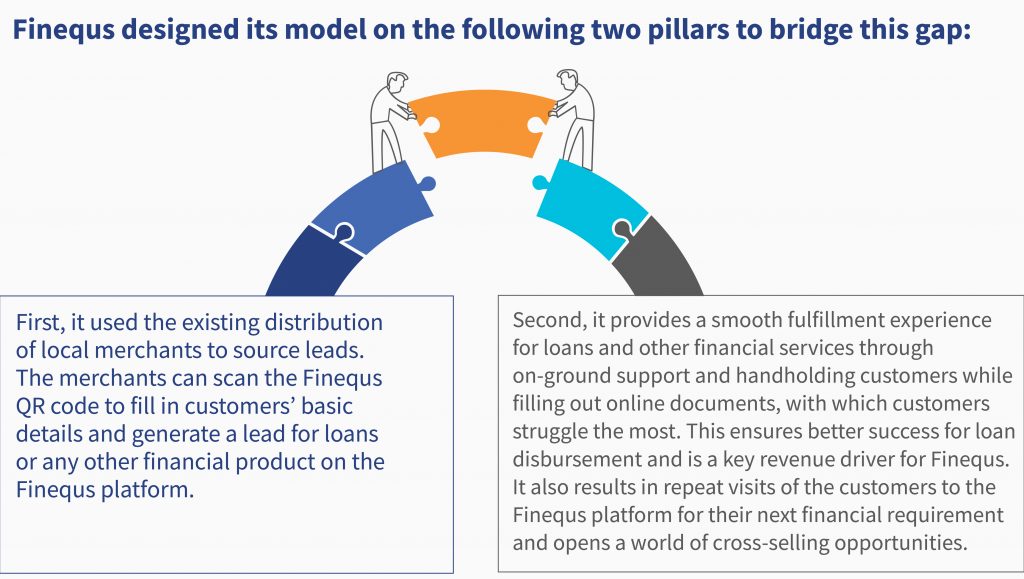

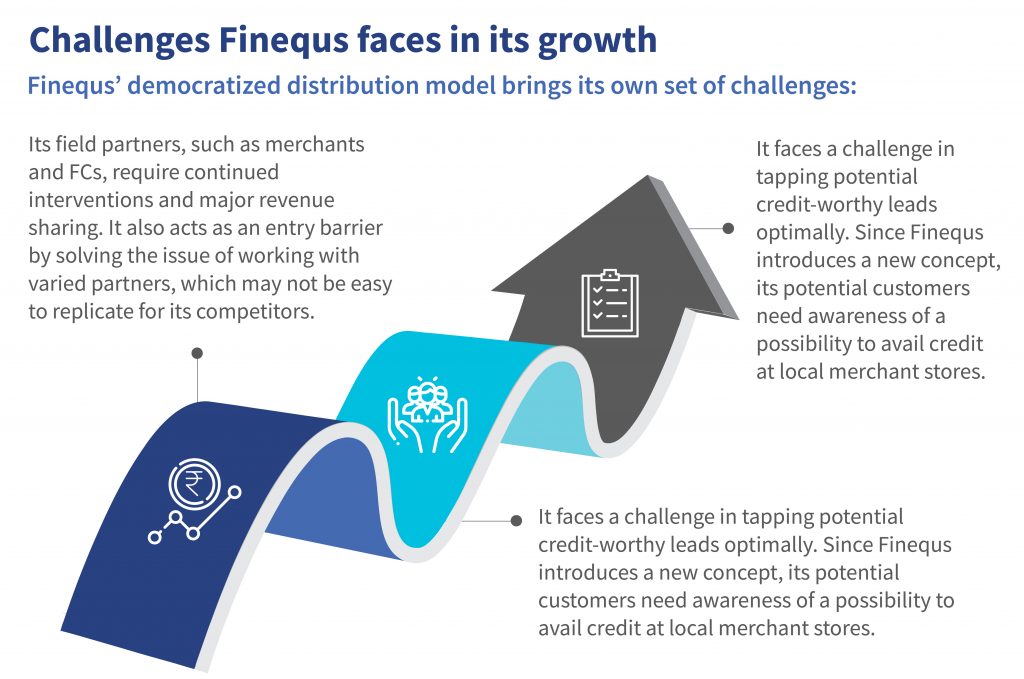

Finequs designed its system to serve customers with limited digital savviness. These customers may or may not own a smartphone and need assistance to complete a financial transaction digitally. A major gap persists between the complete digital journey desired by lenders and the customers’ capability and requirements.

Some of its target customers are new to credit or may have bad credit scores limiting their access to formal loans by partner lenders. To solve this issue, Finequs has also looped in services, such as gold loans and credit score repair, to bring these customers into the formal credit fold.

Finequs seeks to streamline these products among the underserved segments through its distribution channel, which primarily constitutes merchants. Merchants can add revenue for the lead generation efforts at practically no investment or stocking up of goods. Finequs confirms that merchants can add anywhere between USD 180 and USD 600 additional monthly income by associating with Finequs.

Merchants can increase user engagement by providing access to various financial services, such as instant loans, credit cards, and home loans. To date, merchants have disbursed loans amounting to approximately USD 7 million through collaboration with more than 50 formal lenders.

Finequs has also partnered with direct selling agents and other partners with on-field presence to serve as fulfillment centers. These fulfillment centers take the load of processing work from merchants and assist the customers in completing their forms and other documentation processes once they are registered in the Finequs platform as potential leads.

Support from the FI Lab

FI Lab’s support to Finequs included customized solutions to address its demand- and supply-side challenges. The FI Lab provided technical assistance and field insights into merchant operations, their relationship with partner entities, and potential leads onboard onto the platform.

Our team split the technical assistance into two levels. First, we focused on the merchant channel and recommended ways to strengthen its relationship with Finequs. We also suggested merchant classifications and incentive structures that could motivate merchants to work for Finequs. Second, we analyzed FCs and validated the model for scale-up. We suggested ways in which Finequs could use FCs to increase the success rate for loan conversions and the best practices to follow.

Continued innovation

Gearing up for instant loan disbursement at the merchant centers: Finequs partnered with a few lenders to provide timely loans and created an instant loan disbursement plan for a smaller sum of approximately USD 123- USD 183. Finequs will provide real-time information to the lenders using their algorithms on this data to underwrite instant loans.

Enabling platforms to disburse loans: Another major innovation from Finequs includes creating suitable application programming interfaces (APIs), which third-party platforms, such as enterprise resource planning modules (ERPs) in hospitals and schools, can use to provide credit facilities to their customers. Finequs’ motto is to partner with offline and online stores to offer credit facilities.

Big data analysis to help generate qualified leads: Finequs invests in developing its data capability to complement its partner lenders’ efforts. Finequs logic engine can improve the lead quality for lenders by including customer data and local knowledge, such as major occupation and seasonality of income. Krishnan sounds confident about the future, “I need to know my customer better and help lenders make the right decision, which will significantly increase Finequs’ value—beyond just generating leads.”

Written by

by

by  Jul 11, 2023

Jul 11, 2023 4 min

4 min

Leave comments