The Mool mantra: Simplifying financial services for the masses

by Shweta Menon and Vishes Jena

Jun 14, 2022

6 min

In this blog, we chart Mool’s journey. Mool is a neo bank that enables Indians in the low- and middle-income (LMI) segment to take small steps toward saving and investing. Read on to see how Mool uses an interactive, easy-to-use platform to make customers save more and plan their financial lives better.

Mool is a startup under the Financial Inclusion (FI) Lab accelerator program’s fifth cohort. The FI Lab is supported by some of the largest philanthropic organizations worldwide—the Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

The genesis of Mool—a one-stop solution to help the low- and middle-income segments in India improve their financial health

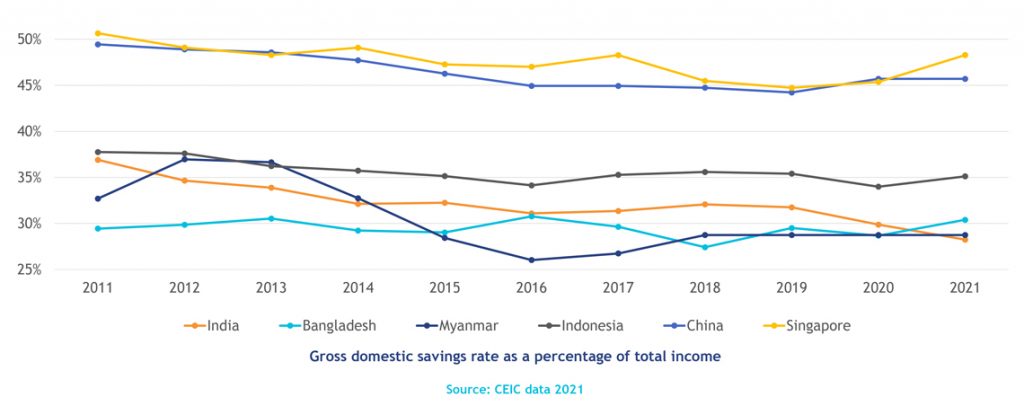

Major banking and economic reforms in India improved the condition of the average Indian household considerably in the past few years. However, CEIC data shows that the rates of gross domestic savings in Asian countries like Bangladesh (30.4%), Myanmar (28.8%), and Indonesia (34.1%) are close to India’s gross domestic savings rate of 28.2%. Yet, this number remains much lower compared to economically stronger Asian nations like China (45.7%) and Singapore (48.3%) (see figure below).

Abhinav always wanted to work for the betterment of the lower-income “Bharat” segment that typically lacks access to financial services. He used his experience in economic strategies and public policy to design a platform that can easily aggregate all financial aspects of a person’s life and help make sound financial decisions. Through his efforts, Mool came to life.

Mool’s offering—to advise the world’s largest cohort of new savers

Mool focuses on the low- and middle-income (LMI) segment of the Indian population. Households in this segment typically earn USD 2,300-15,000 each year and face several financial hardships due to the lack of money or mismanagement. Let us assume that LMI people in India save a decent share of their net income. Yet, which channels do they use for savings and investments? Some of their wealth resides in banks as savings bank accounts or fixed deposits.

In many cases, they invest a part of their wealth in real estate or physical gold. However, most of it sits in informal savings modes like rotating saving and credit associations (ROSCAs), with informal savings collectors like munshis (clerks), or as cash reserves at their homes. Overall, this savings and investment pattern should imply that Indians’ wealth has increased steadily, right?

Wrong. Here is why.

When we look at the interest earned on savings, we understand only one aspect of the equation. Currently, the maximum interest rate one can make on fixed deposits with a leading bank in India is about 5% for a year, while the average inflation is above 6%. The actual return on basic savings accounts at banks is around negative 3% even before we account for taxes levied on interest earned. Traditional bank deposits erode wealth. Even if we consider real estate and gold, one can earn up to 10% and 3%, respectively. The actual return decreases to 4% and negative 3%, respectively, when adjusted against inflation. However, we must note that most Indians do not wish to liquidate their gold and real estate investments. They invest in these only to ensure tangible asset ownership.

Mool offers real value alternatives.

The neo-banking platform opens a digital bank account for its users with State Bank of Mauritius’ (SBM) support and provides them with financial advisory services. Moreover, Mool obtains users’ consent and uses preset conditions to automatically sweep funds from their savings account and invest the money in high-return mutual funds, enabling them to increase their wealth. The user can request to liquidate these funds immediately at any time. Mool also provides them with a credit score-builder card issued by SBM that doubles as a debit card. While the primary focus is on savings, Mool intends to expand to other financial products and services and offer a complete suite of banking products.

Mool’s unique pitch—helping LMI people in India make better financial decisions

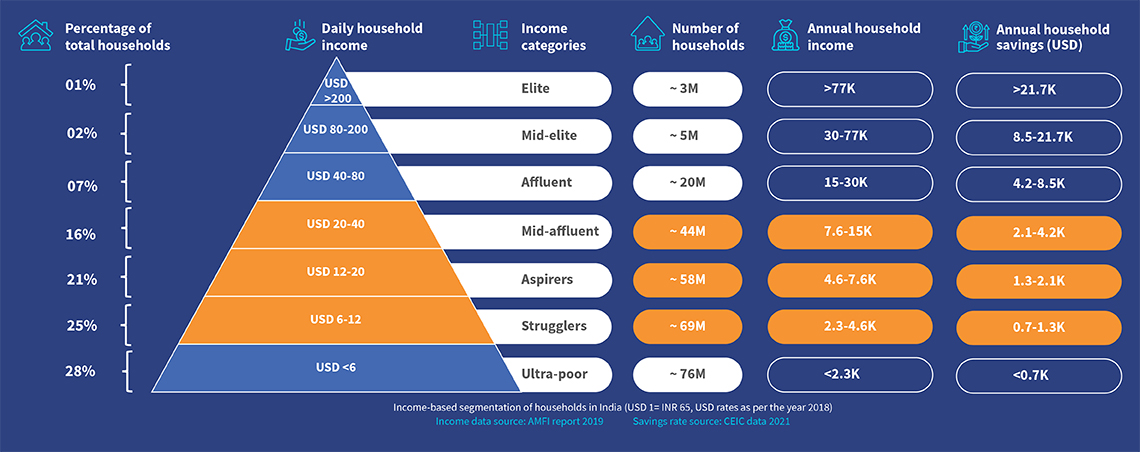

The LMI category has three main subsegments—strugglers, aspirers, and mid-affluent (see figure below). In its first phase, Mool targets acquiring users from the top two tiers of the LMI category: the “mid-affluent” and “aspirers.” These two subsegments find it easier to understand Mool’s sophisticated offerings.

Investments remain an aspirational goal for LMI people. They face many challenges, including limited disposable income to save, besides low awareness of formal financial instruments and access to them.

Source: MSC analysis

Currently, Mool has set a target to serve the 102 million households under the LMI segment with an annual income bracket of USD 4,600-15,000, with plans to cater to the “strugglers” sub-segment in its later phases. With a focus on this target segment and its challenges, Mool seeks to insulate its users against financial shocks by creating a better savings pool for each of them.

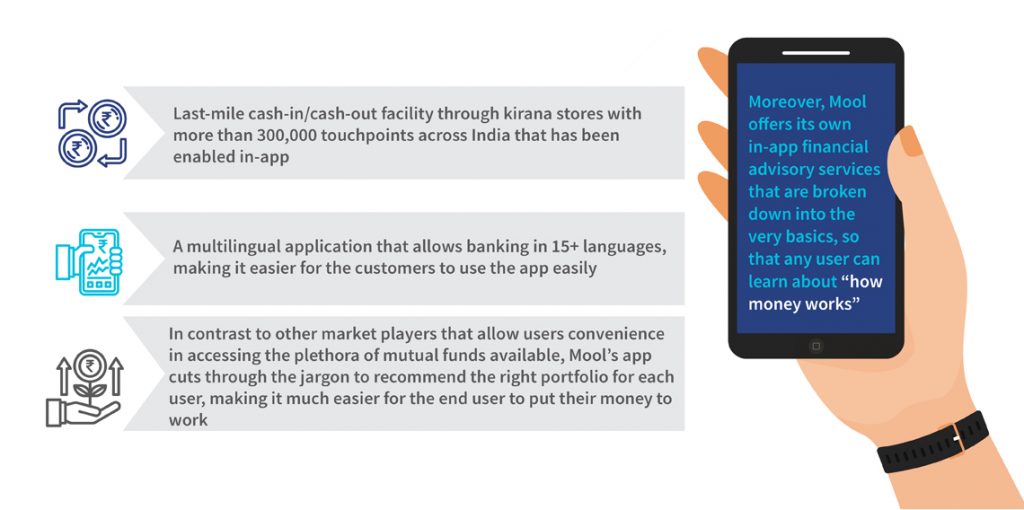

FinTech platforms offer several financial services to the LMI segment. These piecemeal solutions are available across silos scattered throughout the ecosystem. None provide a full-stack banking, investment, lending, and insurance system under a single umbrella in a way that the LMI segment can comprehend easily. This is where Mool distinguishes itself from other FinTechs (see figure below).

Trials and tribulations along the way to becoming a breakthrough platform

In an age where people do not recognize the importance of financial health, a significant challenge is to nudge them toward products and services that can improve it. Currently, over 100,000 potential users have signed up for Mool’s early access program as the product is yet to launch But it needs to overcome specific challenges to become a major player.

First, Mool should bring down the users’ trust barrier and develop a good relationship with them. It must ensure a friendly UI and UX for the target demographic to transact on the app. Many users in the LMI subsegments belong to the “oral” category. These users need to feel comfortable using the app and trust it. Such users may even require an interactive voice response (IVR)-based model to work with, as some may struggle to operate Mool’s app-based UI.

Second, it must create an effective distribution network to reach the hinterlands easily. Mool’s upcoming nationwide network will prove crucial to ensure maximum outreach in the future.

Support from the FI Lab

As part of the Lab’s accelerator program, Mool received comprehensive technical assistance (TA) that included mentor hours, grant capital, and field studies in consumer and market insights led by financial inclusion experts. Our insights will help Mool launch its product at scale after it validates its hypothesis, understands the LMI segment’s growing needs, and designs suitable interventions to address them.

MSC also helped Mool identify potential high-priority sectors to tap into for its B2B2C customer onboarding strategy. These findings will help Mool explore partnerships with suitable employers seeking to extend the services to their employees. The findings will also help Mool scale up and expand its reach organically.

Where is Mool headed?

Mool currently focuses solely on providing customers with savings, investment, and insurance options. Its roadmap for future products includes account aggregation, personalized financial planning, and credit services. Mool also intends to grow its agent network from 300,000 kirana stores to 1 million by 2022 through partnerships with business correspondent networks. Mool has also been reaching out to thousands of small and medium enterprises (SMEs) to provide lifetime free salary accounts, payroll management, and financial wellness solutions for their employees. Mool has set on a path to empower up to 45% of the total Indian households and improve India’s financial landscape, one citizen at a time.

Listen to our podcast to know more about Mool and its plans to help the LMI segment discover better economic opportunities for its savings.

This blog post is part of a series covering promising FinTechs making a difference for underserved communities. These startups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative, co-powered by MSC.

#TechForAll #BuildingForBharat

Written by

Shweta Menon

Manager

by

by  Jun 14, 2022

Jun 14, 2022 6 min

6 min

Leave comments