Aggois: Creating robust liquidity for farmers

by Amit Joshi, Sunil Bhat and Mitali

Aug 9, 2021

7 min

Aggois is an AgTech startup that provides short-term credit solutions to farmers in India against the sale of their produce. It has identified a critical financing gap that farmers face between the time they harvest one crop and sow the next. This blog explains how the startup has worked to mitigate this gap and uncover opportunities and challenges.

This blog charts the story of Aggois, a startup that is a part of the Financial Inclusion Lab accelerator program, which is supported by some of the largest philanthropic organizations across the world—Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

58% of India’s households and more than 41% of the country’s labor force depends on agriculture and allied sectors as their primary source of income. However, these sectors continue to struggle. About 82% of the farmers in India are categorized as small or marginal. They struggle to find a decent price for their produce, access finance and get optimal market linkages. Aggois’ work focuses on solving one of these problems—lack of access to finance.

Learning question:

Sixty-two-year-old Kamla Bai is a marginal farmer from Kodli village in north Karnataka. Her intermittent income, which comes from agriculture, is barely enough to meet regular expenses, and savings are inadequate to take care of unforeseen expenditures, such as illnesses and other life events. So she frequently resorts to borrowing money, mainly from informal sources, to make ends meet.

Kamla Bai’s situation is common amongst most farmers in India. Prominent markets for farmers include Agriculture Produce Market Committees (APMCs, which are government-regulated mandis); private traders and processors; and MSP based procurement by government agencies.

The rates offered and timelines for payments vary across these channels. For example, private traders and APMCs provide farmers with timely payments, but usually at lower rates than the MSP.

While the MSP is mostly higher, the lag between procurement and payment ranges from two to eight weeks on average. Yet most farmers need some money, almost immediately, to prepare for the next crop cycle. Thus, farmers borrow from informal sources such as moneylenders or traders, at 3-6% per month, as they cannot access formal lending institutions.

What did Aggois decide to do about this?

Turn-around-time (TAT) between the sale of produce and receipt of payments, typically for MSP procurements, was a major pain-point for farmers. Aggois fills this gap by providing farmers with financing support during this period. The government does large-scale MSP procurement for various crops. This, therefore, presents a huge market opportunity for Aggois.

What does Aggois offer to farmers?

Aggois provides farmers with short-term credit in proportion to the sale value of their produce under MSP procurement. The startup captures personal details of the farmers and details of the produce sold on the platform to set up farmers’ profile. After the sale of produce at the MSP, the loan amount is disbursed in the farmer’s bank account. Aggois recovers repayments automatically from the farmer’s bank account through NACH mandates once a farmer receives payment from procurement agencies.

What makes Aggois unique?

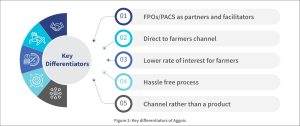

Aggois differentiates itself from other credit providers in multiple ways:

- Most financiers provide credit through farmer aggregations as a B2B service. In contrast, Aggois provides credit directly to farmers and therefore works as a B2C service.

- The PACS that undertake MSP procurements act as partners for customer acquisition and facilitation of the process. In the future, Aggois intends to partner with Farmer Producer Organizations (FPOs) as well.

- The process of disbursal and repayment that Aggois offers is relatively hassle-free compared to the cumbersome processes required by many financial institutions. Aggois disburses the loan directly into the bank accounts of farmers and automatically recovers from the same account through technology integration and payment instruments. This mitigates the credit risk for Aggois, without a workforce for collections.

- Through its solution, Aggois connects directly with farmers and introduces them to formal finance. Once this channel with the farmers is established, other financial institutions will have the option to offer different products to farmers who have digital footprints.

How does Aggois make the lives of farmers better?

Let us look at how Kamla Bai’s life transformed to understand the impact of Aggois’ initiatives.

Before taking the final decision between receiving immediate payments or selling at MSP, Kamla Bai visited the Kodli society, which introduced her to the Aggois team. It explained to her the value proposition of associating with the startup.

Kamla Bai decided to sell her produce at Kodli society at MSP. Against the MSP of INR 60,000 (USD 820) per quintal, she got a short-term credit of INR 37,000 (USD 500) from Aggois. She was able to pay-off all her current debts and prepare for the next sowing season using this credit. She received her payment after around three weeks. With her consent already taken at sign-up, Aggois deducted the loan amount from her account digitally.

Aggois’ path to success is challenging

As Aggois started operations, the major roadblock it faced was the lack of farmers’ trust of a privately owned business that was largely unknown in their region. The team collaborated with PACS to overcome this issue. PACS have been around for decades and almost every farmer is a member. These organizations provide farmers with services including credit, agri-inputs, and marketing.

Despite overcoming the trust deficit by collaborating with PACS, Aggois faces other significant challenges:

- It struggles to ensure a steady line of credit from financial institutions at viable rates of interest.

- The TAT for the loan disbursals is prolonged by the paper-based NACH system, which takes about 10-12 working days for the approval and disbursal of loans. With a short window of opportunity spanning 45-50 days, this time lag is quite significant. This lowers the value proposition of Aggois’ solution for the farmers.

- The onboarding of farmers is completely manual, which makes the process laborious and time-consuming.

- Currently, due to its small team size, and restricted mobility due to the COVID-19 pandemic, Aggois operates in a limited geography and focuses on a handful of crops that the MSP covers. Hence, it is unable to conduct continuous operations all year round, thereby inhibiting the optimal utilization of its staff.

Aggois can expand its customer base rapidly, if it is able to address these issues and move forward.

How has the FI Lab supported Aggois so far?

The FI Lab supported the startup to develop a business continuity plan. After widespread stakeholder consultation, the Lab assessed the business model from a strategic and operational perspective. It studied numerous financing gaps along the value chain and considered the potential of the respective actors to identify opportunities for intervention.

Partnerships are important for the streamlined functioning of business and hence the Lab has been assisting Aggois to find the right set of partners to take its business to scale.

The Lab has also analyzed and recommended potential geographies and crops for Aggois to scale up its business in the near term. It recommended Aggois an optimal organizational structure to fulfil its current business needs. The lab looked at operational aspects and suggested improvements to enhance efficiency and effectiveness.

The lab also helped Aggois to capture the nuances that apply to UI/UX (user interface /user experience) while designing a farmer-facing mobile app. The app will help digitize the entire process right from onboarding to the financing of farmers and achieve scalability.

With this, the team no longer needs to visit every farmer personally to onboard and they can easily scale to many geographies in time to come.

The future is bright

The past few months have been hard work for Aggois’ team. It had to build the technology platform and develop a healthy rapport with the target PACS. Having delivered results for its initial set of farmers, Aggois now rides on network effects for expansion—as the beneficiary farmers have started recommending it to their peers.

This network effect will spread the word among the larger farming community and instill confidence not only in them, but also among the lending financial institutions. This should help the Aggois team to expand its customer base geographically, as well as for multiple crops, and ensure a steady line of credit to the business from financial institutions.

In the medium to long term, Aggois intends to expand vertically by providing complementary and supplementary services and products through the initial connect created with the farmers. It plans to take a regional approach by saturating a region through provision of multiple products and services to all farmers in a region. With its hard work and passion to serve the farmers, we fully expect Aggois will live up to their expectations.

This blog post is part of a series that covers promising FinTechs that are making a difference to underserved communities. These start-ups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll, #BuildingForBharat

by

by  Aug 9, 2021

Aug 9, 2021 7 min

7 min

Leave comments