COVID-19: A harbinger of consumer behavior shifts among FinTech users

by Anshul Saxena, Akshat Pathak, Anil Gupta and Devraj Hom Roy

Jul 20, 2020

8 min

The blog analyzes the impact of the COVID-19 on two major categories of FinTechs—credit and savings FinTechs. We analyze the immediate impact of the pandemic and the ensuing regulatory changes on FinTechs along with some long-term changes in consumer behavior that can have a systemic adverse impact. We close by recommending data-driven measures that credit and savings FinTechs should take today to control and arrest such adverse changes in consumer behavior.

“Decades of progress on reducing poverty and increasing financial inclusion—all of that is at risk.”

– Michael Schlein, Accion

38% of small startups have already run out of cash in India with more predicted to fall prey to the impact of the pandemic. If this seems ominous, FinTech entrepreneurs should brace for what is likely to redefine the principles of business in India as tailwinds of COVID-19 change consumer behavior. Can FinTechs do anything to manage this shift? The answer, as usual, lies in the power of collective and intelligent use of data.

Shock and awe: Immediate effects of consumer behavior for FinTechs

Based on discussions with a slew of FinTechs, investors, and industry associations, we identified significant impacts on both the lending and saving segments over the past few weeks.

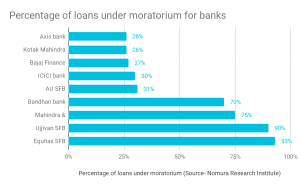

We can extrapolate these percentages to digital lenders who generally lend to even riskier borrowers. To add to the misery, digital lending NBFCs are now crippled with a liquidity crunch as banks have not extended the moratorium to them. This proved to be a double whammy for digital lenders, whose repayments have dried up while at the same time, they are forced to repay their loans. A co-founder of a large digital lender quips, “60% of our customers have opted for a moratorium while only around 40% of our lenders have offered us moratorium. The situation is likely to be far worse in smaller FinTechs.”

Fear and shirking in savings: Saving FinTechs or “WealthTechs” in India mostly offer returns higher than banks through market-linked products tailored to an individual’s assessed risk profile. For instance, they may offer ~6% interest in a liquid fund as compared to 4% in a savings bank account. Such demand rides on bullish markets and increasing disposable income. While the Indian stock market saw its worst single-day loss on 23rd March, 2020 as NIFTY50 fell by 12.98%, unemployment and pay cuts continued to drag down disposable income. April saw a 28% month on month (MoM) drop in the number of employed people, with around 27 million youth losing their jobs. Sure enough, the market meltdown and loss of employment resulted in mass redemptions with the mutual fund industry reporting USD 27.6 billion in net outflow. Uncertainty on the COVID-19 vaccine, opening up of the economy, and a volatile market collectively influenced consumers to hoard cash, which is perceived to be a safe haven. WealthTechs, which mostly earn revenue from trail-fee commissions as a percentage of their assets under management (AUM), have been left reeling in the wake of these redemptions and drying up of new investments.

Is there a risk of a deeper malaise?

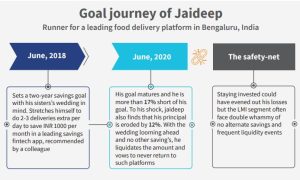

Savings FinTechs, supported by the Securities and Exchange Board of India (SEBI) and bodies such as the Association of Mutual Funds in India (AMFI), have put in more than a decade’s worth of effort to educate the upper-LMI segment on the benefits of capital market investments. The pandemic-induced market meltdown is likely to cut deep into the trust of the “new-to-investments” category. This segment is alien and averse to the idea of principal erosion. The infographic below explores what this means for Jaideep, who has worked as a runner for a leading food-delivery app since 2018.

Unlike savvy investors, most of the LMI segment experience frequent requirements of liquidity. This results in premature withdrawals and hence a realization of losses. For example, in case of a medical emergency, a migrant cab driver in Mumbai is likely to liquidate his investments while his current cash inflows go towards meeting the repayments for his car loan. Without any regard to the present value of his investments, the driver is susceptible to compromising his long-term plans. The wealthy, however, can afford to stay invested and time their exit when returns are at near peak. The current crisis could potentially decimate the newfound trust of people like Jaideep or our hypothetical cab driver in digital savings platforms and keep them out for years to come, thus setting us back by a decade.

Digital lenders, on the other hand, are battling with changes in the repayment behavior of borrowers. Information asymmetry and deteriorating repayment discipline in the face of the announced moratorium are the driving factors behind this shift. Confused borrowers in hinterlands regard the moratorium either as a waiver or repayment holiday with no interest accrual. The ill-effects of farm-loan waivers on the credit culture of farmers are well documented and it is only a matter of time before the credit culture of digital credit borrowers suffers the same fate. Overall, the moratorium could result in an alarming increase in NPAs once it is lifted. We may also see a fall in repayment discipline for new loans, forcing lenders to either increase the interest rates of loans or shy away from the LMI segment altogether.

What can the FinTechs do today?

FinTechs must take advantage of this shift in consumer behavior with the help of the most potent weapons in their arsenal—data and technology. They can use the following four-point actionable tactic in the fight against the effects of this pandemic:

- Digital lenders should approach customer segments differently: Depending on whether they lend to the elite and the affluent or the LMI segments, digital lenders can choose an opt-out or opt-in strategy to provide moratoriums. The lender can make the moratorium applicable on all loans by default, unless the borrowers explicitly opt-out or vice-versa. An opt-out strategy for the LMI segment has two core benefits:

- The LMI section is the most severely affected. An opt-out strategy puts borrowers under moratorium by default without requiring any action. This can help the households improve their long-term financial health and establish the lender’s brand as a preferred source of credit for future needs. However, this would require clear, consistent communication to ensure that borrowers are aware of default and its consequences.

- A double whammy of income loss and information asymmetry within the LMI segment means that borrowers are unlikely to take any action on their own. Hence, unless they explicitly opt-out, cash-strapped borrowers will be under the moratorium, which can save lenders from potential mass NPAs.

- Transparency is an ally for digital lenders: Digital lenders should use high-engagement channels, such as WhatsApp to inform borrowers about the interest accrued if any. They should follow it up with reminder countdowns that lead up to the end of the moratorium. This prevents potential shocks for the borrowers and helps them mentally account for an extended repayment schedule.

- Tailoring to stimuli: Saving FinTechs should triangulate consumer data points and identify consumers with fragile financial health. The FinTechs can then educate these consumers proactively and offer them overnight and money-market mutual funds. On the other hand, consumers from the savvier section with a significant wallet share should be educated on the adoption of an averaging strategy in bearish equity markets.

- A nudge-based approach: Taking a leaf out of Nobel laureate Richard Thaler’s book, FinTechs with goal-based savings should tap into behavioral economics. A few strategies for them could be as follows:

- Loss aversion– FinTechs should quantify and display the potential loss if users withdraw now. FinTechs should also consider displaying the loss-amount as a label of the “withdraw button” in the app; and

- Nudges- FinTechs should map the call to actions on their apps through a choice architecture to nudge the users to the right actions. This would essentially involve layering actionable buttons with decision points that arrest inertia and force the user to stop and evaluate options. A few examples could include moving the “withdraw button” to secondary screens in the app so that users do not see it as a prominent call to action button or route the users through alert windows before committing to withdraw funds. FinTechs should place positive reinforcement texts on primary screen buttons that encourage to value-invest during bearish markets.

While the former should accentuate loss of utility and dissuade the user from liquidating; the latter should encourage the users to stay invested if not invest more funds.

The ecosystem can survive the current pandemic and come out stronger only if all FinTechs engage in cross-company dialogue and share best practices and pitfalls. Investors and accelerators also play a tremendously important role in the dissemination of best practices that go beyond portfolio companies. The potential adverse effects of any shift in consumer behavior are likely to have a whiplash effect as they move through the layers of digital financial services unless the industry collectively moves to arrest them today.

Through holistic research on FinTechs and their ecosystem partners across multiple geographies, MSC will continue to track and assess policy, regulatory, and industry responses, review the investment climate, and determine the coping strategies of FinTechs.

Our objective is to design programmatic interventions to support FinTechs, especially the ones focused on LMI segments, to survive, rebuild, sustain, and grow. We will continue to equip regulators, policymakers, ecosystem partners, and investors with our findings to empower these FinTechs to function effectively and play a positive role during the pandemic.

Stay tuned for more updates on www.microsave.net.

This blog is a part of a COVID-19 research study conducted in the Financial Inclusion Lab accelerator program. The lab receives support from some of the largest philanthropic organizations across the world, including the Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

The FI lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC.

by

by  Jul 20, 2020

Jul 20, 2020 8 min

8 min

Leave comments