Agtechs and financial institutions: Financing farmers in India

by Shweta Menon, Mohit Saini and Anil Gupta

Jul 15, 2020

6 min

This blog, the third and final piece in this series, focuses on partnerships between AgTechs and financial institutions to improve access to finance for farmers. It also offers recommendations to improve the AgTech ecosystem in India.

AgTechs are the missing link that can facilitate financing for SMFs

Financial institutions in India have historically lacked the expertise or capacity to generate granular farm and farmer-related data needed to offer credit to farmers. However, the digital revolution in India has paved the way for banks and other financial institutions to use technology to target and service customers, reduce costs and reach previously untapped segments such as SMFs.

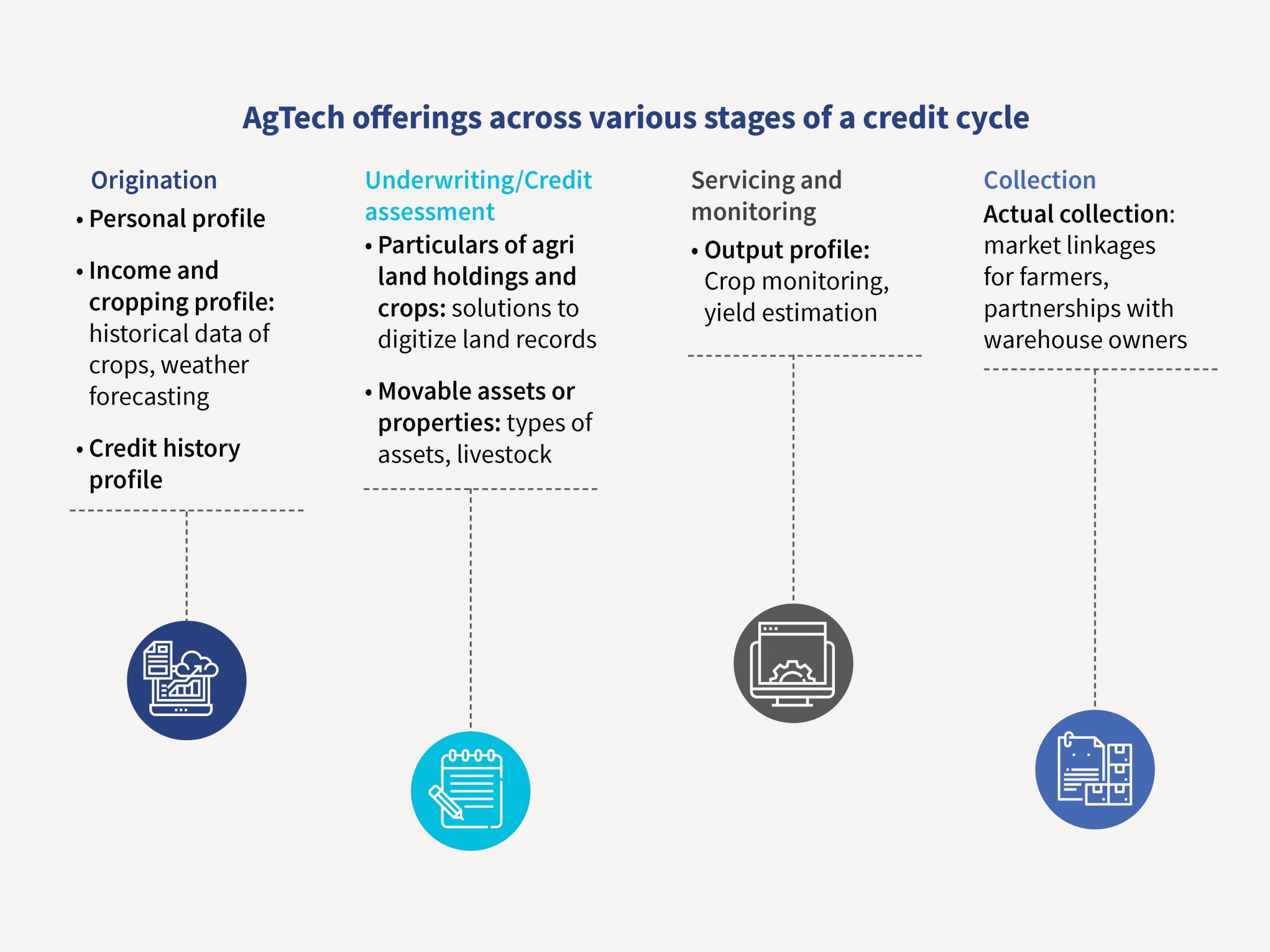

A typical financial institution’s credit cycle consists of four stages: loan origination, underwriting or credit assessment, servicing and monitoring, and collection. AgTechs have the ability to provide financial institutions with data and technology at various stages during the credit cycle as illustrated below.

Upon loan origination, financial institutions are primarily concerned with client details such as the borrower’s personal information, income details, and credit history—if available. AgTechs like FarmGuide, Jai Kisan, PayAgri, and Skymet support financial institutions in this process by undertaking data collection including historical data on crop type and quality, weather forecasting, and soil quality assessments.

For the underwriting or credit assessment process, financial institutions require details about the agriculture land holdings and crops, as well as information on the movable assets or properties held by the farmer. AgTechs like FarmGuide and Jai Kisan have a unique role to play in developing solutions to digitize land records and gathering farmer-specific data. Moreover, they can also tap into their existing physical networks such as their field staff or other local partners, who deal with farmers, to source further information.

For servicing and monitoring, financial institutions typically require details about sowing and harvesting along with information on historical cropping patterns to generate yield estimates. AgTechs like CropIn, SatSure, AgroStar, and Gramophone generate data on overall yield estimates, forecast demand, monitor crops to predict non-performing assets and use of farmer credit—all by analyzing satellite imagery and agri-input data based on farmers’ online purchase patterns.

Finally, to collect their loans, financial institutions need visibility on crop harvest and prices to estimate the repayment capacity of farmers. AgTechs like NinjaCart, Jumbotail, and Agricx play a significant role in this process by offering forward market linkages and grading and sorting produce for farmers thereby allowing them to sell their produce at the market price and generate a sufficient return. Banks can then use this information on pricing captured by AgTechs to estimate the repayment capacity of farmers.

Despite the potential, several challenges limit meaningful partnerships between AgTechs and financial institutions

Collaboration between AgTechs and financial institutions are at a nascent stage and will require time to scale primarily due to the following hurdles:

- Lack of a full stack solution for banks: Most AgTechs offer independent solutions that solve a small part of a larger problem along the agri value chain. Banks, however, want to partner with AgTechs that offer a “full stack of solutions,” thus eliminating the need for them to partner with multiple AgTechs.

- Challenges with the non-risk-sharing model of AgTechs: Banks want to work with AgTechs that share the associated risks and resulting liability of agri financing. Since financing farmers, particularly SMFs, entails the provision of data and the assumption of risk, banks hesitate to forge partnerships or conduct pilots with AgTechs that want to be indemnified from assuming liability.

- Limited understanding of AgTech solutions: Most banks have a limited understanding of the solutions offered by AgTechs and believe that AgTechs are only confined to generating data points using satellite imagery. Banks are not aware of the value proposition and potential of AgTechs to inform their credit cycle and, hence, often disregard their solutions.

- Limited trust of data captured by AgTechs: Traditional financial institutions are dependent on their staff and their local-level understanding for sourcing and verifying information related to farmers and their crops. Since AgTechs collect most data using technology such as satellite imagery, spectrometry, etc., banks are skeptical of the reliability of data that AgTechs generate. Moreover, banks require historical trends and data points over the past four to five years to gain a reliable picture of their borrower; however, nascent AgTechs are not yet capable of providing such historical data points.

Suggestions to improve the AgTech ecosystem

The recommendations below address the myriad challenges AgTechs in India face, as individual players in the agriculture ecosystem and in collaboration with other AgTech players. These recommendations should serve to enhance opportunities for AgTechs to finance the untapped SMF segment:

- Build an AgriStack model: AgriStack is envisioned as a public, digital platform that offers access to all farmer-related information at three levels: farm, farmer, and crop(s). AgTechs, banks and other ecosystem players could use the AgriStack platform to generate precise farmer and farm-level data to design products, solutions, and policies/schemes targeted toward the welfare of farmers, particularly SMFs. An enhanced AgriStack, with the fourth element around the market, could also pave the way for AgTechs to develop a full stack of solutions based on the farm, farmer, crop-level data, and market access.

- Create digital GPS-tagged land boundaries: Currently, only a few states have digitized their land records. The government, both central and state, should take the lead in creating GPS-tagged boundaries and digital records to help identify the rightful land owner thereby guaranteeing land title. Open APIs[I]could be shared with AgTechs to harvest this government-owned data to create lending solutions for financial institutions and promote access to finance for SMFs. This would also ensure that banks trust the authenticity of the data and solutions provided by AgTechs as the Government of India (GoI) would be the original source of the data.

- Create a single-window approach to address AgTech concerns: State governments could set-up a “single window” approach for AgTechs to raise their concerns, receive responses to their questions, and resolve grievances around delayed payments for government projects undertaken by AgTechs. This approach will streamline the communication between AgTechs and government bodies thereby encouraging effective partnerships.

- Creation of a separate fund for financing SMFs: Development financial institutions should come together to offer capital to financial institutions lending to SMFs or explore the creation of a separate fund similar to the Rural Infrastructure Development Fund (RIDF)[I]. This would enable financial institutions lending to SMFs to borrow capital at a low cost, which they could ultimately on-lend to SMFs at a lower cost.

India could become a global hub for Agri-FinTech innovations

With the recent spate of investment deals, the AgTech sector has come into the spotlight. It is an opportune time for ecosystem players to capitalize on this renewed attention. With increasing traction, AgTechs will continue to provide viable solutions to farmers by making use of innovative technology. However, creating new collaborative platforms, such as AgriStack, is of utmost importance so there can be seamless sharing of data among multiple stakeholders including governments and financial institutions, as well as a culture of transparency and accountability across the agri value chain. Effective partnerships between financial institutions, the central and state governments, and AgTechs present an opportunity to conduct pilots and Proof of Concepts (PoCs) while addressing the dearth of financing available to SMFs. Such collaborations could also reinforce India’s emergence as a global hub for digital financial service solutions for farmers.

About the blog series

This is the third blog in a three-blog series for a study entitled the “Role of tech-enabled formal financing in agriculture in India” conducted by MSC (MicroSave Consulting) and ThinkAg, with support from Rabo Foundation. Blog 1 and Blog 2 of this series can be found here and here, respectively.

[1] Open APIs are publicly available software that allows developers to communicate with each other and share data freely. They allow universal access to data, thus promoting the creation of innovative solutions.

[2] RIDF was set up by the Government of India to provide loans to state governments and state-owned corporations to finance rural infrastructure projects. The fund is maintained by National Bank for Agriculture and Rural Development (NABARD).

by

by  Jul 15, 2020

Jul 15, 2020 6 min

6 min

Leave comments