Riskcovry: Insurance-in-a-box

by Diya Chatterjee, Anil Gupta and Anshul Saxena

Jun 19, 2020

7 min

This blog highlights the journey of Riskcovry, an InsurTech startup that provides customizable insurance through its online portal and benefits the low- and middle-income (LMI) segment. It also talks about how the COVID-19 crisis has opened new opportunities for the startup.

This blog is about a startup in the Financial Inclusion Lab accelerator program, which is supported by some of the largest philanthropic organizations across the world – Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation and Omidyar Network.

“Why should I pay for an unnecessary insurance bundle when I just need one or two products?” asks Kumar, the owner of a fabric shop in Delhi. Like many of his fellow traders, Kumar runs a small shop in a crowded, narrow street of Chandni Chowk, one of India’s oldest markets. Low-hanging, rundown electric wires line the alleyways of the market. This elevates the chances of an electrical malfunction, which may result in a fire that can easily spread and burn down many shops, harming lives and properties in an instant. Chandni Chowk has suffered many such man-made calamities, including one where a fire broke out, gutting more than 40 shops and destroyed goods worth thousands of dollars.

Despite being aware of these risks, shopkeepers like Kumar are reluctant to buy insurance to safeguard themselves or their properties. This is because insurance brokers or companies usually try to sell them generic insurance products that are more expensive and cover irrelevant risks, such as coverage against floods.

Kumar needs access to an insurance product that is customized to the risks that concern him and his shop, such as fire-related hazards.

The light-bulb moment

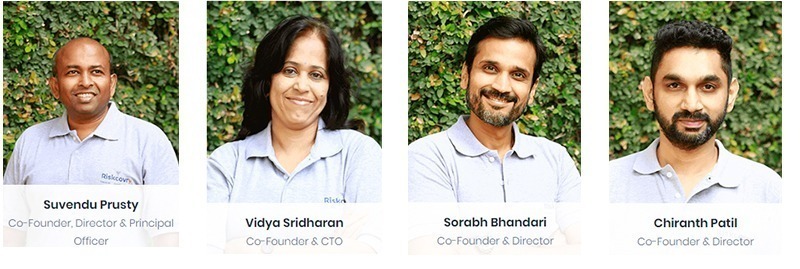

Suvendu, Vidya, Sorabh, and Chiranth (Figure 1) used to meet frequently at various insurance industry-related forums and seminars, where they shared their pain points and experiences. They had all experienced the complexities involved in the identification and purchase or sale of insurance products. Soon, these discussions turned more intense and passionate and they realized their common desire to solve the problems that plagued the insurance sector through technology and analytics. Hence, the idea of Riskcovry was born in February, 2018.

The unique pitch

According to reports from the Insurance Regulatory and Development Authority of India (IRDAI), India’s insurance penetration is 3.7% of its Gross Domestic Product (GDP), which is half of the world’s average. Moreover, the insurance density of India is just USD 74, way below the global average of USD 638. These statistics indicate a significant gap in the insurance market of India in terms of customer outreach and insurance products owned per customer, respectively. From an entrepreneur’s perspective, this is a big opportunity to make a proverbial “dent in the universe.”

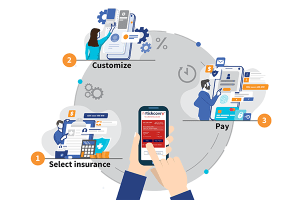

To address this market gap, the Riskcovry team provides personalized insurance products for shop-owners like Kumar. Riskcovry carefully designed an efficient user experience (UX) journey and implemented it through a well-thought-out user interface (UI) for its online insurance portal. Through this, Riskcovry managed to transform the entire cycle from the selection of relevant insurance products to its online purchase into a quick process that involves four to five steps and does not take more than a few minutes to complete.

Riskcovry has thus set itself apart from its competitors by enabling the customization of insurance products and providing a simple and speedy process for customers to buy them online.

The impact on LMI segments

Riskcovry currently works on both relevant data points and trust, something that the low- and medium-income segment lack.

- Riskcovry collects financial and non-financial data points through its online portal. Its in-house data analytics team then identifies risky but potential LMI customers who otherwise do not have enough formal data to have insurance. Riskcovry sells to these customers at a reasonable price that ranges from INR 20 (less than USD 0.5) to INR 1,500 (USD 20) and varies based on the type of insurance cover, such as life, health, or asset, as well as the duration—three months, six months, or annual.

- Riskcovry identified “trust” as an important pull-factor for such customers. Since these customers prefer to buy insurance through people they know, Riskcovry distributes through local agents. It skills unemployed youth and women at block levels to work as insurance agents and sell relevant products to their shopkeeper friends, acquaintances, and family members. As a part of its “Mission Maharashtra” project, Riskcovry has already activated 5,000 entrepreneurs across 355 blocks in Maharashtra.

The roadblocks

Like any startup, Riskcovry faced its share of difficulties. The team did not take long to launch its online portal for its target customers—small shopkeepers. However, it soon realized the need to have an agent-assisted model where an insurance agent helps the customer buy the right product by walking them through the company’s online portal. This model was critical for Riskcovry as its customers were skeptical about the purchase of insurance without a “human” talking them through it. However, as a start-up, the sales team of Riskcovry was small and unable to scale up to meet the growing demand of these customers.

Moreover, another problem challenged the team at Riskcovry—it had no brand value yet. Therefore, customers who wanted to purchase insurance were reluctant to consider Riskcovry.

To overcome these challenges, the start-up sought the help of the FI lab.

Support of the FI lab

The FI lab comprises CIIE.CO and MSC, its knowledge partner, along with some prominent donors. It provides portfolio support, technical assistance, boot camps, demo days, diagnostics, support calls, and clinic sessions to each of the startups in every cohort.

Riskcovry was facing challenges concerning its inability to reach out to customers and enabling the appropriate product channels. The sales team of Riskcovry was unable to reach out to its end customers efficiently due to its small size. Besides, its end-customers had some concerns regarding trust.

The FI Lab helped build a strategy to convert Riskcovry’s B2C business model to a B2B2C model. This new model used the existing customer relationships of retail chain stores and Business Correspondent Network Managers (BCNMs). This business model addressed Riskcovry’s customer outreach problem and mitigated customer concerns regarding trust. In addition to providing market connections, the Lab also helped Riskcovry to build its pricing models and refined its pitch to help convert these connections.

The FI Lab also helped identify the appropriate product channel for Riskcovry’s customer segment of small shopkeepers. This meant reaching out to cooperative banks to use the assisted model to sell life insurance to customers. It also meant bundling loan products with insurance and using small finance banks and MFIs as channel partners.

The FI Lab helped identify the appropriate product channel for Riskcovry’s customer segment of small shopkeepers and helped strategize the appropriate channel for the relevant product. This meant reaching out to cooperative banks to use the assisted model to sell life insurance to customers. It also meant bundling loan products with insurance and using small finance banks and MFIs as channel partners.

Since the small sales team of Riskcovry was inadequate to reach out to its end customers, the FI lab helped build a strategy to convert Riskcovry’s B2C business model to a B2B2C model. The new model used the existing customer relationships of retail chain stores and Business Correspondent Network Managers (BCNMs). This business model not only solved Riskcovry’s customer outreach problem but also mitigated the concerns of its end customers regarding trust. In addition to providing market connections, the Lab also helped Riskcovry to build its pricing models and to refine its pitch to help convert these connections.

Riskcovry has forged industry partnerships with some of the top grocery retail chains and BCNMs as enterprise partners and has worked to reach numerous customers in tier II and tier III cities. Through these partnerships, the Riskcovry team has cut down the time needed to market to end customers or insurance beneficiaries from months to weeks. It has also scaled up its reach from a few customers to a few hundred customers.

Creating opportunities from the COVID-19 crisis

No one anticipated the pandemic and the health, financial and economic hardships it would bring. Hence, there was no specific insurance cover for it, anywhere in the world. The quick spread of the disease has overwhelmed many insurance companies, which took time to adapt and build policies to cover it. This is where Riskcovry’s agility and capability have come to the fore.

The startup has been quick to sense the situation and has been rapidly building customized, Do-It-Yourself (DIY) insurance coverage offerings from its insurance policy suppliers. It has recently launched insurance covers against COVID-19, which cover hospitalization and other medical expenses. You can read about it here.

By sharing APIs with non-financial service providers, such as EdTechs and AgTechs, Riskcovry is also exploring how to integrate its relevant insurance products with their product offerings.

Plans for the future

In the longer term, beyond the current pandemic situation, Riskcovry plans to promote its novel insurance idea in emerging markets across the globe. The objective is to make its distribution channels more robust, promote quick insurance products, and make insurance exciting.

Follow #TechForAll and #BuildingForBharat to stay updated on fintech start-ups driven to bridge the social, financial and economic inclusion gap

This blog post is part of a series that covers promising FinTechs that are making a difference to underserved communities. These start-ups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll, #BuildingForBharat

by

by  Jun 19, 2020

Jun 19, 2020 7 min

7 min

Leave comments