Catalysing Digital Financial Services Through School Fees Payments

by Isaac Holly, Vivek Gupta, Priyank Mishra, Amit Joshi and Puneet Chopra

Mar 8, 2018

5 min

The blog states digital solution to address the many challenges related to school fees payments in Solomon Islands.

Timothy works as a Supervisor at a Hotel in Honiara, the capital of the Solomon Islands. Due to the demanding nature of working in the tourism industry six days a week, Timothy is unable to leave work to carry out personal errands during work hours.

Previously, he had to take time off work to travel to an ATM or the bank where he must stand in a long que to withdraw money, then que in line at his daughter’s school awaiting his turn to pay her school fees. Carrying out a simple task as paying school fees can cost a considerable amount of money on public transport and a good portion of the day is lost traveling.

Paying his son’s school fees takes extensive travel planning and saving. He must catch a boat to Honiara, which takes around six to eight hours depending on weather conditions and costs him USD 25 one way. Jonathan must also keep aside extra money for lodgings and meals to stay overnight in the capital. Jonathan explains that if he has not saved enough for the journey, he must delay paying the fees which incurs him additional charges and the possibility of his son being expelled from the school rolls.

Proposed Solution to Address Pain-points

ANZ Bank, the Pacific Financial Inclusion Programme (PFIP) and MicroSave designed, developed and tested a digital solution to address the many challenges related to school fees payments. Parents can now pay school fees conveniently using ANZ goMoney, the mobile banking platform of ANZ Bank. The platform is presently active in select schools in Honiara. Parents do not have to go to the schools to pay the fees any more. This reduces the efforts required to arrange cash or take a day off from work. They find the value proposition for digital fees payment compelling.

Another great feature that this digital platform allows is payments in instalments at their convenience. They can now plan and save to pay the fees and avoid late payment charges. Though there have been similar such experiments for digitising school fees in other geographies, it is the first time that school fees payments have been digitised in the Pacific region.

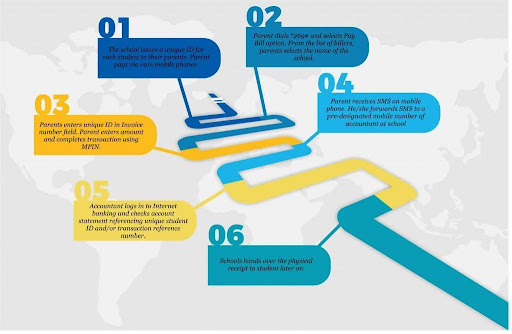

Schools issue unique IDs to identify each student to track payments efficiently. Parents and schools use this student ID for each digital transaction. This will help schools in tracking the student fee payments efficiently.

Approach and Lessons Learnt

To prepare schools for the transition, ANZ Bank started teaching the schools about the goMoney platform and how to use it. The bank then added schools to the Pay Bill menu of the platform and activated Internet Banking for the school bank accounts. Simultaneously, the project team spoke to the parents from these schools. The value proposition of the digitised system instantly resonated with the parents too, as it addressed their pain-points satisfactorily. ANZ Bank supported the parents to become platform-ready by opening their ANZ goMoney accounts or activating dormant accounts.

As stakeholders are in early stages of this digital learning journey, intensive handholding support is essential. However, as stakeholders become acquainted with the new system, their comfort level increases and a demonstration effect takes root, the handholding and support required will go down significantly. Creative approaches such as developing points of contact at schools to facilitate the process, and educating and training parents during parent-teacher interactions will accelerate the process of building trust and learning.

Process standardisation and training have also enhanced the capabilities of agency banking staff members. Project champions have been identified and provided with tools such as documents to discuss the value proposition and simple guides to enable them to educate, build trust, and on-board additional schools and parents, to assist in scale up.

In due course, we will explore avenues for the automation of several processes with the active involvement of stakeholders, including the Ministry of Education. Automation of alerts and reconciliation of data for schools will lower barriers, enhance utility, and catalyse adoption.

Success Stories from the Pilot

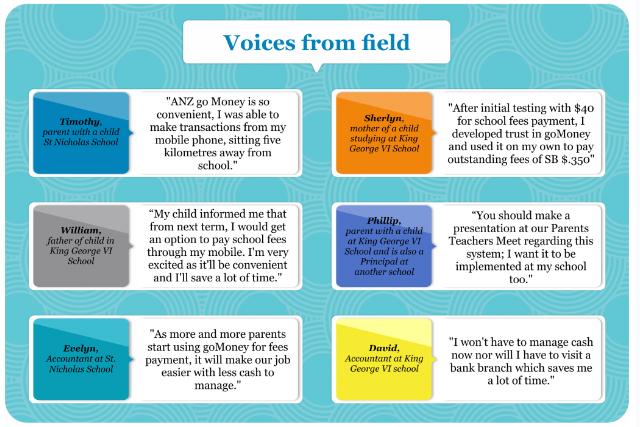

Parents who tried the new system expressed great satisfaction and excitement in using mobile banking to pay for school fees.

This digital school fees payment solution has created a win-win situation for parents and school authorities alike. David, the accountant at King George VI School, does not need to manage cash now. He feels this system will significantly ease his life by simplifying the process as he does not need to visit the bank branch to deposit the collected cash or to get a bank statement for reconciliation. The fees go directly into the school bank account and he can now reconcile bank statements sitting at his office. Evelyn, the accountant at St Nicholas School, also echoes the same sentiments about the new system and process.

School fees are an expense for almost every household in developing countries around the world. It can be a flagship use case for digital payments, with a significant potential to accelerate adoption of additional digital financial products. Digital school fees payments can be catalytic for parents, as it forms their first experience of digital payments. This would, therefore, open the door for them to gradually learn and adopt additional use cases for digital finance. It is also an easier use-case to drive adoption, as school authorities and wards can play a vitally influential role to bring about a behavioural change to move away from cash to digital modes of payments. Moreover, it can have widespread impact, as it is relevant to nearly every family in any country, where parents, and not the state, pays school fees.

The blog was originally published by PFIP in Jan 2018.

by

by  Mar 8, 2018

Mar 8, 2018 5 min

5 min

Leave comments