25 years on: What makes MSC different?

by Graham Wright

by Graham Wright Jan 29, 2024

Jan 29, 2024 5 min

5 min

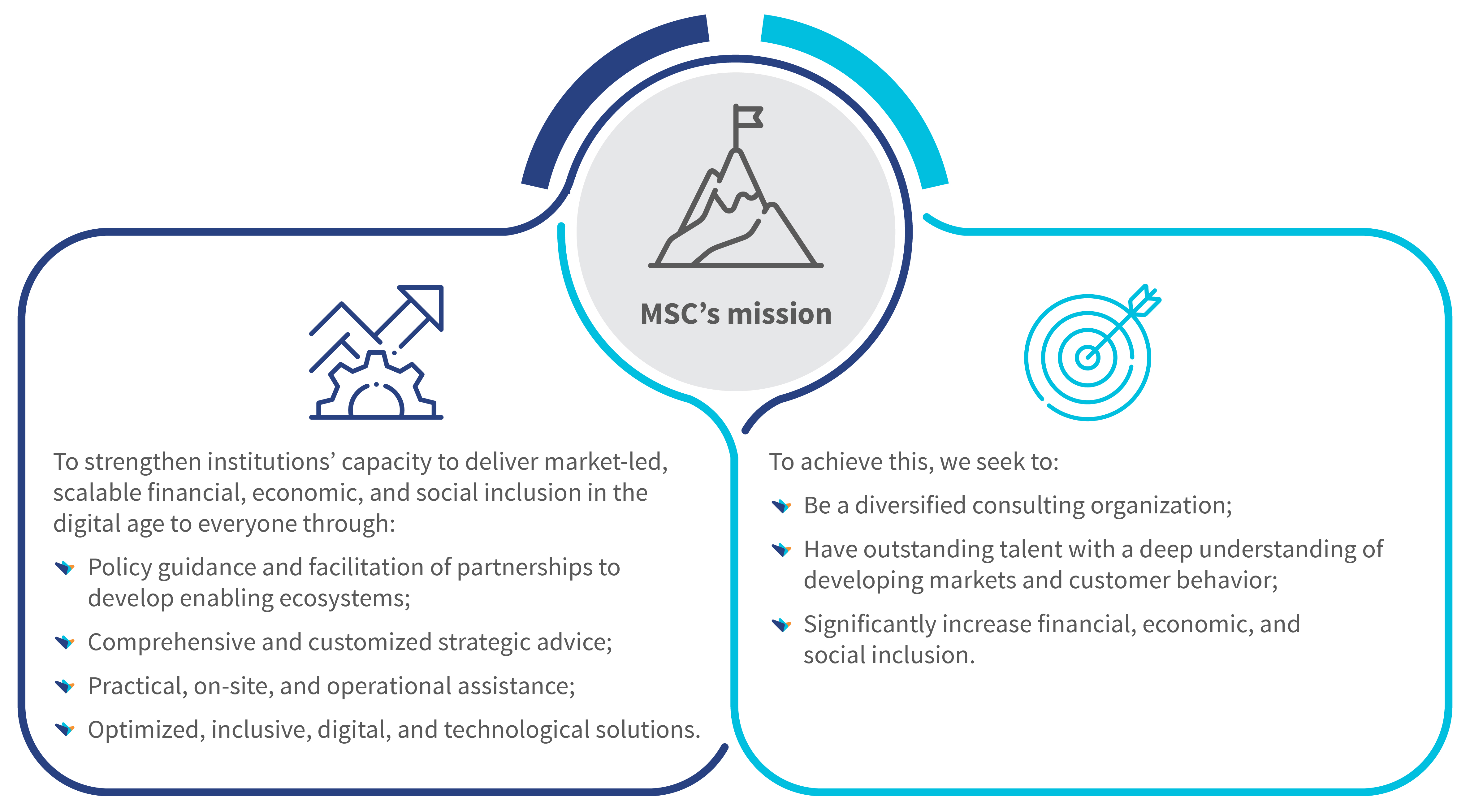

MSC celebrates its 25th anniversary with the tagline “International vision, local precision, for real impact.” More than 99% of its 300 staff are local and provide deep insights into the needs of the communities they serve. MSC’s commitment to place end-users at the forefront extends beyond financial services. We also offer training for local empowerment. Throughout our history, we have challenged industry norms, pioneered qualitative research, and addressed emerging challenges. Read on to learn about our evolution and path ahead as we turn 25.

We are celebrating MSC’s 25th anniversary with the tagline “International vision, local precision, for real impact.” These are not empty words. More than 99% of our 300 staff are from the countries where we operate. They understand the language, the political economy, the social norms, and the markets we serve. And they are recruited for their understanding of MSC’s mission and commitment to it. This is essential because so much of MSC’s comparative advantage lies in our ability to sit with, understand, and empathize with those who are too often simply “the target market.” Our ability to derive deep insights into the needs, aspirations, perceptions, and behaviors of poor people and vulnerable communities allows MSC to enhance the reach of communications, the uptake and usage of products and services, and their impact.

We are celebrating MSC’s 25th anniversary with the tagline “International vision, local precision, for real impact.” These are not empty words. More than 99% of our 300 staff are from the countries where we operate. They understand the language, the political economy, the social norms, and the markets we serve. And they are recruited for their understanding of MSC’s mission and commitment to it. This is essential because so much of MSC’s comparative advantage lies in our ability to sit with, understand, and empathize with those who are too often simply “the target market.” Our ability to derive deep insights into the needs, aspirations, perceptions, and behaviors of poor people and vulnerable communities allows MSC to enhance the reach of communications, the uptake and usage of products and services, and their impact.

MSC consistently puts end-users at the center of the work we do. Even when we address supply-side challenges, we believe the initial work should focus on the customers first. For example, when we work on process improvement, we start with the customer journey to understand how the people who matter most experience the process. After all, market-led services are the most successful and impactful. This is particularly important in responding to the climate crisis, where we have a clear consensus that localized solutions are essential.

MSC delivers training and skill transfer as an integral part of our commitment to empower local capability and develop local talent wherever possible. Doing so allows local public and private sector institutions to break free from their dependence on external consultants and to develop and drive their own agendas with the knowledge and tools they acquire by working alongside MSC staff on a project. Inevitably, this depends on our clients’ willingness to take this approach and invest in capacity building. At the turn of the millennium, this was a priority for donors but seems to have become less important in recent times. Given the localization agenda, this decreasing emphasis on hands-on experiential learning to build indigenous capabilities seems shortsighted.

MSC prides itself on its commitment to, and history of, asking tough questions in the face of consensus or groupthink and taking the lead to shift paradigms within what is often a somewhat incestuous industry. We are always ready and willing to challenge norms or received wisdom. Our deep in-the-field approach to our work makes us particularly well suited to this role.

- In 1998, we began to use qualitative research techniques that blended focus group discussions with participatory rapid appraisal tools to derive deep insights to build client-responsive products and services for poor people. This approach preceded the use of human-centered design for financial services by more than a decade. Indeed, industry leaders repeatedly told us to use quantitative research methods. Nonetheless, MSC’s “Market Research for Microfinance,” now Market Insights for Innovation and Design, rapidly became the go-to resource and source of training for practitioners across the globe. Today, more than 875 million people across the globe use products and services designed or refined by MSC with the use of these qualitative techniques.

- Soon after MSC set up an office in India in 2006, it was clear that MFIs were expanding faster than their processes and systems could control to pursue “meaningless growth.” Furthermore, it was clear that many government-led financial inclusion programs , particularly the self-help groups (SHGs), were being challenged by the larger loan sizes and the more stringent delinquency management of these joint liability group-based MFIs. MSC foresaw and predicted a significant problem for microfinance in India as most commentators celebrated the arrival of private equity funds and the proposed IPOs of MFIs. The prediction was not difficult given the three dress rehearsals for the main event of the Andhra crisis, but we were largely a lone voice of caution in the chorus of approval that supported the commercialization and rapid growth of MFIs.

- Soon after the M-Shwari digital nano-credit product was launched, we could offer constructive suggestions on how it could be made more customer-centric. However, amid the industry-wide excitement about digital credit, MSC’s further research and observations in the field raised red flags about how digital consumer credit was being perceived and used in Kenya. We had to ask “Digital Credit – Have We Not Been Here Before With Microfinance?” and outlined ways that digital credit could be delivered in a more customer-centric and profitable manner. Our pioneering analysis of credit reference bureau data confirmed our fears.

- Despite the demonstrable impact on trust, fraud and consumer protection in digital financial services did not receive serious attention until more than a decade after M-Pesa’s takeoff. MSC tried to flag the challenges of fraud and consumer protection for many years, particularly for women. However, only relatively recently have these issues shed their “inconvenient truth” status and started to receive the attention they deserve.

- Similarly, the industry scarcely acknowledged the digital divide as it celebrated the digital revolution and all it would do for low-income people. MSC was once again at the forefront of efforts to highlight that amid the exuberance and optimism, we were overlooking on-the-ground realities poor people in rural areas face. We asked, “Can Fintech Really Deliver On Its Promise For Financial Inclusion?” and then looked at access to mobile phones, 3G coverage, and how we might overcome the digital divide using agents.

MSC’s decentralized approach, local capabilities, and finger on the pulse of markets across Africa and Asia have positioned it well to both catalyze significant change for good and be a dissenting voice amid the clamor of consensus and groupthink. MSC’s significant achievements and contribution to the rapid evolution of financial inclusion, and now in digital governance, agriculture, climate change, gender equality, and health and nutrition, are inspiring. I hope you will forgive me for being a tiny bit proud of the outstanding teams, past and present, which have worked so hard to deliver on our inspiration, “A world in which all people have access to high-quality, affordable, market-led financial, economic, and social services in the digital age.”

Written by

Leave comments