Frameworks to consider while developing non-CICO (cash-in cash-out) use cases

by Nikhita Jindal, Vineet Anand and Ayushi Misra

Sep 17, 2024

4 min

This blog discusses strategies to develop non-CICO use cases to sustain business correspondent (BC) agents in India. It introduces a framework for financial service providers to identify and implement use cases that increase agents’ revenue. The blog highlights successful examples, such as microinsurance products, and emphasizes the potential for innovative solutions to enhance BC agents’ economic viability.

Blog 1 in the series indicated the need to diversify use case offerings for Indian business correspondent (BC) agents so they can become economically viable and, hence, serve as a long-term sustainable model. In this blog, we will delve into possible ways to achieve this.

MSC has worked with many prominent financial service providers for the past 25 years. We have developed a framework that can help financial service providers identify ways to enhance their use case offerings through BC agents and make them suitable for LMI customers. This framework is based on the experience and insights generated from multiple behavioral research studies with agents, low- and middle-income (LMI) customers, and financial service providers, such as banks, payment banks, rural banks, FinTechs, and business correspondent network managers (BCNMs).

What are non-CICO use cases?

Cash-in and cash-out (CICO) refer to cash deposits and withdrawals from one’s bank accounts or mobile money wallets. LMI customers primarily use BC agents to deposit the wages they often receive in cash into their bank accounts through digital financial services. They sometimes also deposit cash at the agent point to transfer money to their families and withdraw DBT (direct benefit transfer) funds or salaries from their bank accounts to use the money for daily needs, such as groceries.

Besides this, customers also use BC agents to open bank accounts, conduct balance inquiries, and process insurance registrations, airtime top-ups, utility bill payments, and travel ticket bookings. These transactions or activities are classified as non-CICO products, where the customer obtains essential services through BC agent points beyond cash deposits and withdrawals. As per MSC’s Agent Network Accelerator (ANA) research (2018), providers and BC agents had a limited uptake of these non-CICO use cases. MSC’s extensive fieldwork since then suggests only marginal improvements in adoption in India. While innovative use cases like EdTech and logistics have been introduced by a few providers, their uptake remains limited to specific agents of these providers. However, a comprehensive ANA survey is needed to quantify the changes over the past six years.

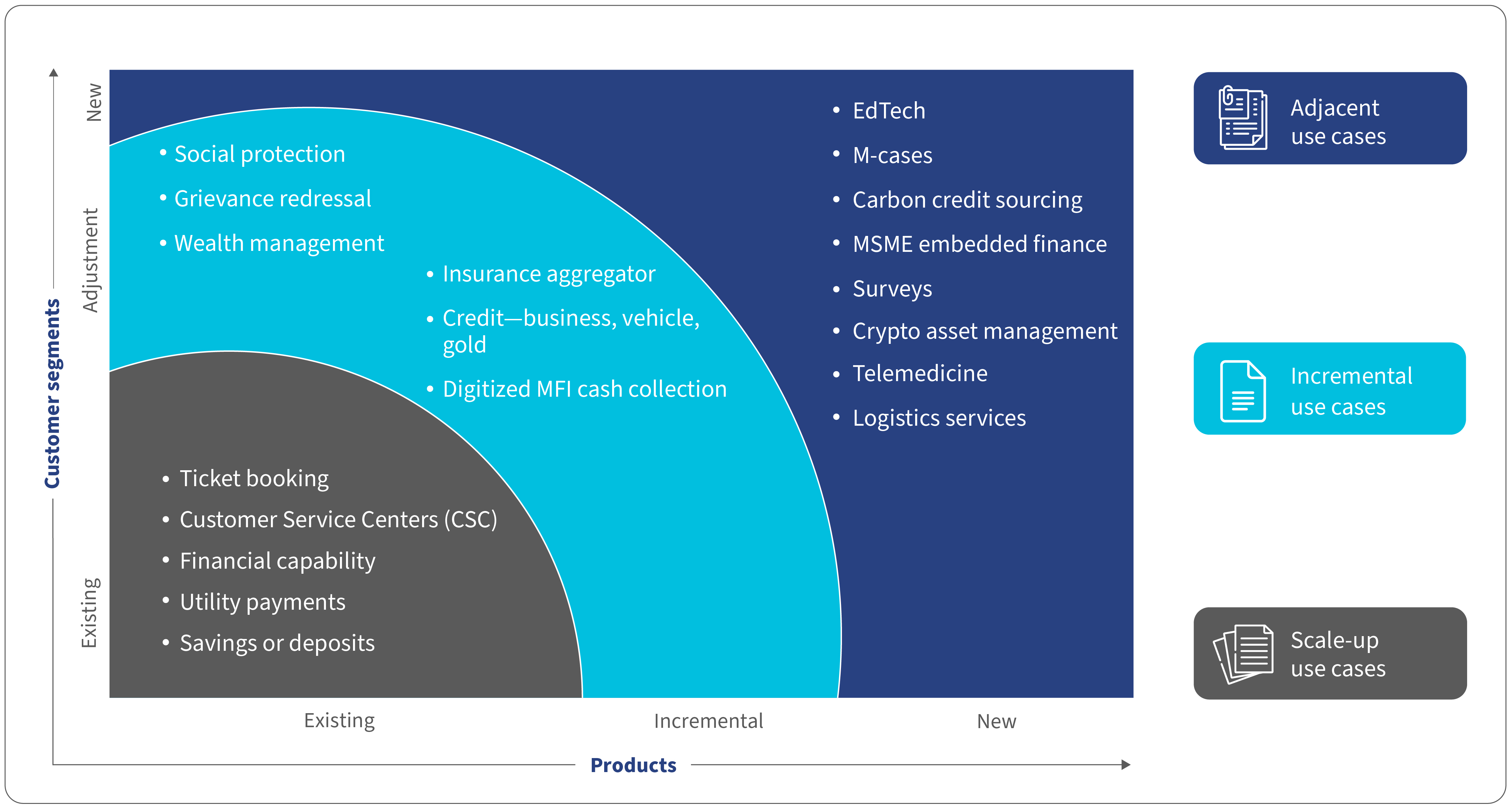

MSC has classified non-CICO use cases into three categories based on the complexity of the products and their requirement for the LMI customer segment:

- Scale-up use cases: These refer to the use cases that BC agents have offered for some time, such as utility payments, customer service centers (CSC), and ticket booking. While these use cases potentially generate significant revenue for agents, insufficient provider support has hindered their widespread adoption. Diversification to these use cases helps providers immensely as it does not require extensive research, has a predefined customer base, and uses the providers’ existing capabilities. Therefore, providers can adopt them quickly and effectively.

- Incremental use cases: A few providers have experimented with these use cases. However, the development of such use cases requires qualitative and quantitative research. This would allow them to offer tailored products, such as social protection, grievance resolution, and wealth management, to improve relevance and uptake. Providers can, therefore, explore solutions for high-commission use cases to create new opportunities for growth and expansion. Such use cases include logistics, insurance aggregation, and digital credit products.

- Adjacent use cases: Businesses have significant opportunities to explore new customer segments and innovative use cases, such as EdTech, telemedicine, and MSME-embedded finance. CICO agents can expand their reach and grow their market share if they understand these customers’ latent needs and the incentives that drive them. These are potentially innovative and revolutionary use cases.

Successful scaling up of non-CICO use cases

MSC’s preliminary research on non-CICO use cases available in the market reveals some interesting, successful case studies. Eko’s partnership with EnglishBolo, an English learning app, is a rare success story among adjacent use cases. 150,000 agents were used to extend EnglishBolo’s services through the partnership to those who lacked access to digital payment mechanisms. Similarly, a few providers, such as Vakrangee, have been working to provide logistics services to underserved communities through its BC agents.

More recently, providers, such as Airtel Payments Bank and FINO Payments Bank have launched a range of microinsurance products. These include hospicash, a small-value medical insurance product to cover hospitalization and related expenses, alongside insurance, which cater to LMI needs. Airtel Payments Bank could scale up its hospicash insurance product to more than 600,000 LMI customers in the past year (2023-24) alone. This highlights the demand for such innovative products in the market. The uptake among customers has also directly led to an increase in the agent’s commission. Such examples are few and far between. However, they highlight the importance and potential of the successful launch of new and innovative use cases through BC agents.

How can providers identify which use case is a perfect fit for them and their agents?

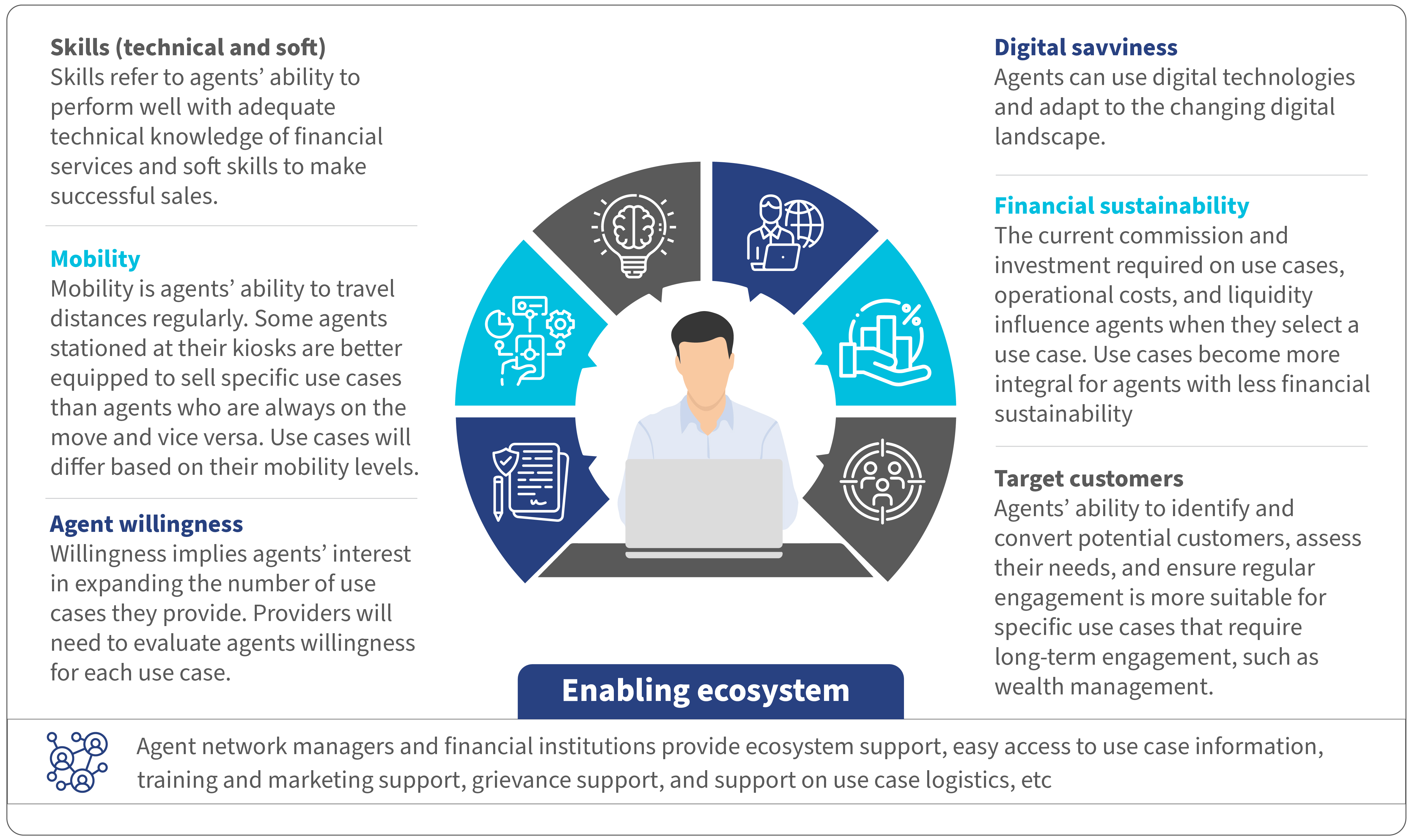

The identification of the perfect use case for agents is crucial for financial service providers (FSPs) to enhance their service offerings and ensure agent effectiveness. Providers can use MSC’s and the enabling ecosystem to determine the most suitable use case. This can be seen below:

Providers must analyze their current market position and infrastructure to identify suitable use cases. This involves qualitative and quantitative research on the customer base to understand their needs, aspirations, perceptions, and behaviors. Providers can identify the most suitable use cases for their agents and customers through the integration of these insights with the seven-factor outline.

The way ahead

Looking forward, financial service providers can use this structured approach to expand their service offerings strategically. It will ensure they meet LMI customers’ evolving needs.

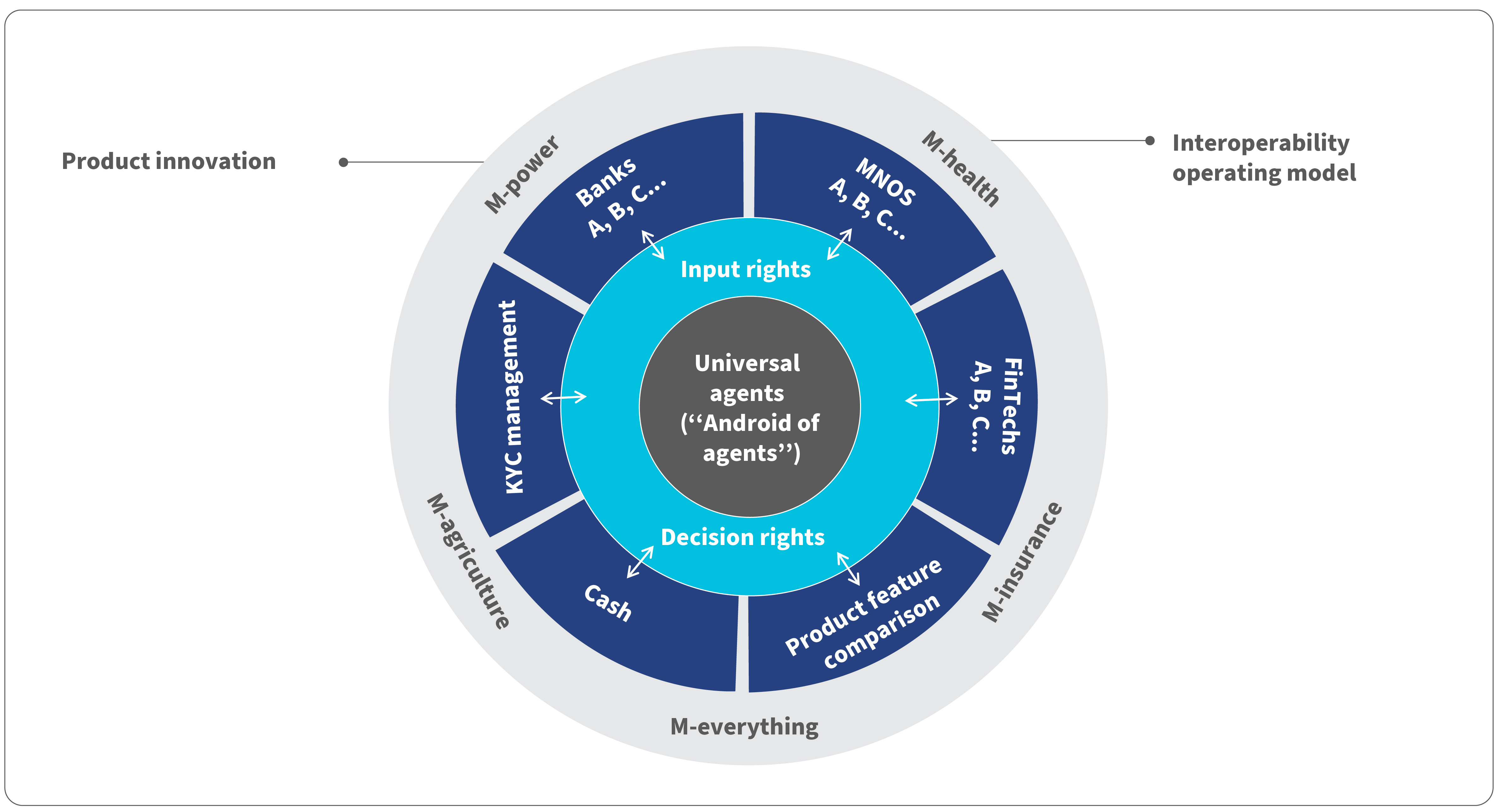

Additionally, it is time for the industry to view BC agents as more than just facilitators of financial transactions and recognize them as “distribution service providers.” As many agents are in underserved and unserved areas, they can enhance access to essential products and services, such as M-health, M-power, M-insurance, M-agriculture, and M-everything. This not only improves accessibility but also fosters economic growth through the integration of rural populations into the broader market through “universal agents.”

by

by  Sep 17, 2024

Sep 17, 2024 4 min

4 min

Leave comments