How can digital financial services accelerate community resilience in locally-led adaptation initiatives in Africa?

by Brian Owino and Njeri Macharia

by Brian Owino and Njeri Macharia Jul 12, 2024

Jul 12, 2024 6 min

6 min

Africa’s vulnerability to climate change calls for comprehensive action. This blog emphasizes the critical role digital financial services (DFS) play to accelerate community resilience through locally-led adaptation (LLA) initiatives in Africa. It discusses how DFS can enhance accessibility, efficiency, and transparency to manage climate finance. Read on to find out how the integration of DFS with climate finance enhances LLA efforts to support sustainable adaptation strategies in vulnerable communities.

The urgency to accelerate locally-led adaptation (LLA)

Currently, the 10 countries most vulnerable to climate change are all from Africa. Additionally, Africa’s adaptation bill increased to 5-15% of its GDP in 2022. The continent will be hit hardest by droughts, floods, and other catastrophes in a 2⁰C temperature rise scenario by 2050, which will cost up to USD 50 billion per year to adapt to. Therefore, the escalating impacts of climate change demand immediate and comprehensive action to mitigate and adapt to these effects. The urgency of LLA to accelerate climate resilience cannot be overstated.

LLA is crucial for climate action It empowers communities to devise and implement relevant and sustainable adaptive strategies and focuses on local knowledge, cultural context, and grassroots participation. The Global Center on Adaptation proposes eight LLA principles to enhance the design and implementation of initiatives through a community-centric approach so that these strategies can be deployed effectively.

MSC introduced the role LLA plays to enhance community resilience in a series of conversations. We looked at the value of equitable engagement and indigenous knowledge when we shed light on the role financial inclusion and local governments play to empower pastoralist communities. This blog delves into the foundational elements of how digital financial services (DFS) can accelerate community resilience within LLA frameworks. We explore areas where the integration of digital financial approaches can strengthen climate adaptation and resilience.

Why do we need digital financial services to deploy climate finance?

Climate finance is essential to drive LLA. Our earlier research on enabling and financing locally-led adaptation shed light on how finance is vital to community resilience. It has to be deployed at the required scale for community-led initiatives. Effective climate finance mechanisms for LLA require robust accountability and transparency frameworks to ensure that funds are used efficiently for their intended purposes. It also builds trust among local communities and other stakeholders, which encourages continued investment and support for adaptation initiatives.

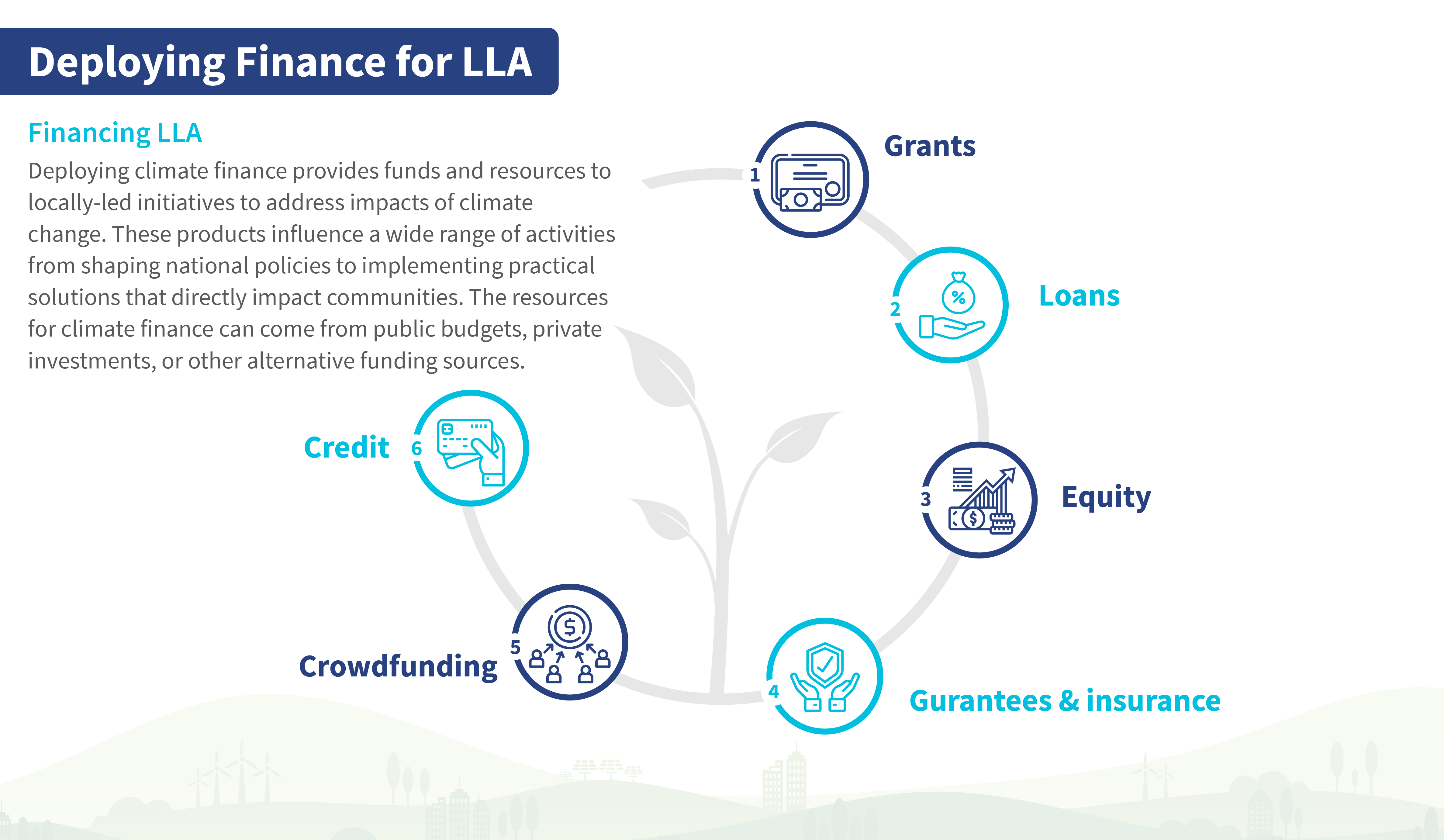

Climate finance products for LLA initiatives include various financial instruments designed to empower and support community-based efforts to address climate change impacts at different stages of climatic shocks. Climate finance varies in typology based on the needs of an individual or community to finance their adaptation strategy. These products encompass:

- Grants, which provide non-repayable funds for capacity-building and pilot projects;

- Concessional loans, which offer favorable terms to finance adaptation projects;

- Equity investments, which inject capital into local enterprises focused on adaptation practices;

- Guarantees and insurance mechanisms, which reduce risks for investors and protect against climate-related losses;

- Dedicated climate funds, such as the Green Climate Fund, which provide targeted financial support for local resilience; and

- Crowdfunding and philanthropic contributions, which further enable grassroots initiatives.

The combination of these instruments with DFS provides an avenue to quickly empower communities, enhance resilience, promote inclusivity, facilitate innovation, and strengthen partnerships between climate financiers and digital financial providers. Our previous research highlights the need for devolved climate finance, also called decentralized finance, to address climate change locally and help poor people cope with its impacts. DFS is critical to enable the participation of such communities through outreach to the most vulnerable. These are some illustrations of how DFS is important to drive resilience:

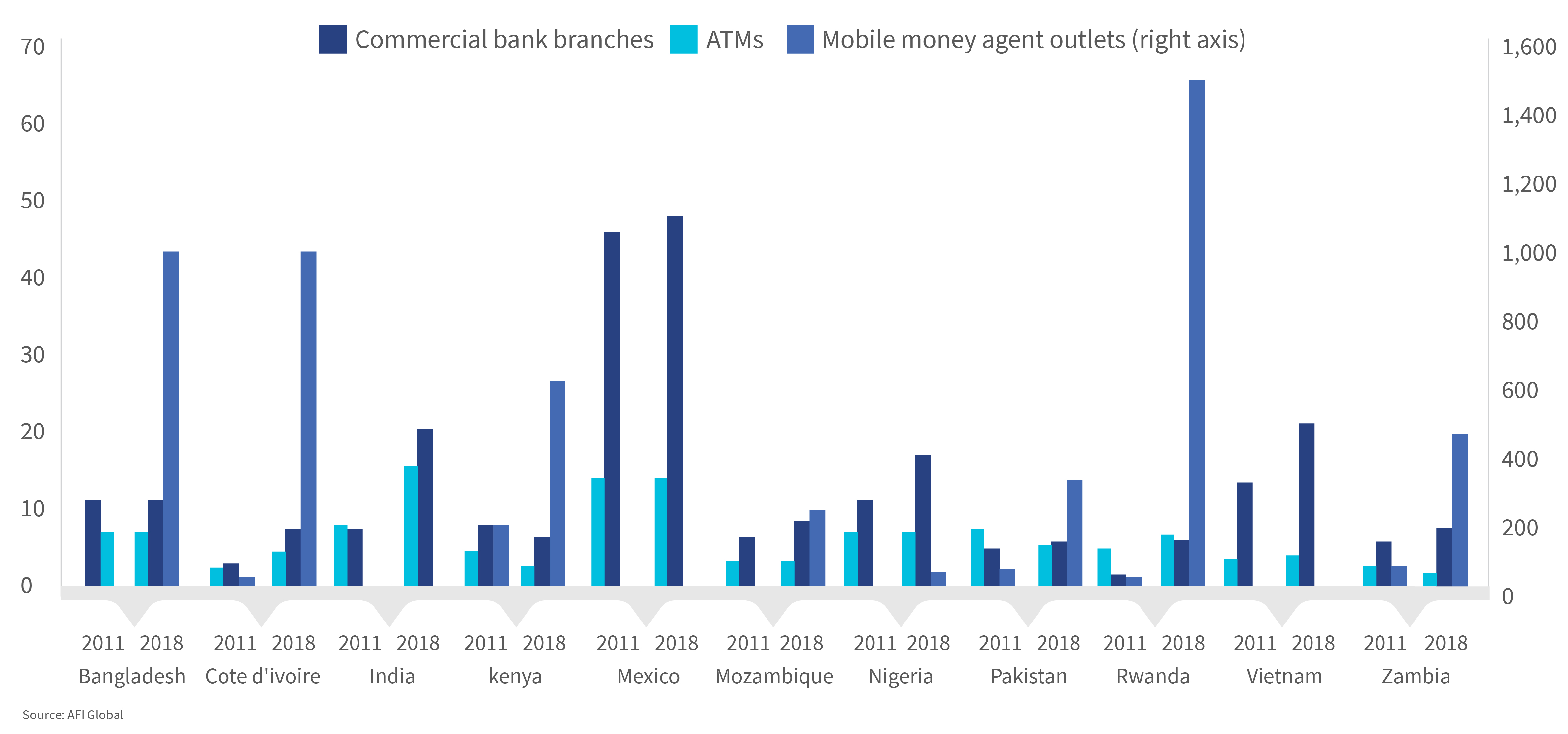

- Firstly, DFS increases accessibility, enhances efficiency and speed of transactions, supports the financial inclusion of marginalized groups, and ensures transparency and accountability in adaptation projects. An example of this is M-PESA in Kenya. It facilitates secure financial transactions through mobile phones, which enables local communities to manage funds for adaptation projects and rapid disaster relief. The figure below shows access points of financial services per 100,000 adults in selected African countries. This highlights the greater penetration of mobile digital financial services compared to traditional banks.

- Secondly, key aspects include mobile banking and payment platforms, which permit financial transactions without physical bank branches. Additionally, digital microfinance and credit solutions offer small loans and financial services to individuals and small businesses often excluded from traditional banking systems. For example, Tala provides instant credit via a mobile app through alternative data to assess creditworthiness in Kenya. This service empowers local community members to access loans for climate-resilient agriculture, minor improvements to infrastructure, and other adaptation activities.

- Digital retail payment platforms, particularly mobile money services, are vital to protect vulnerable populations against climate risks. These platforms, rolled out predominantly by telecom operators and BigTech firms, have enhanced financial inclusion as they provide a dense and extensive network of financial access points that surpass traditional financial institutions. Mobile money is an informal yet vital risk management tool against climate-related economic shocks for low-income and rural households. Additionally, person-to-person (P2P) remittances allow families and communities to pool and transfer risk affordably, reliably, and flexibly.

- Regulators may view mobile money primarily as a payment service, but its role extends far beyond that. It acts as a financial safety net that enables households to manage climate shocks effectively. Governments have been increasingly using this digital infrastructure to disburse government-to-person (G2P) payments to reinforce the financial resilience of vulnerable populations, particularly in the aftermath of natural disasters. Thus, mobile money has dual functions—it facilitates everyday transactions and provides critical financial support during crises. This underscores its importance as the first line of defense against climate risks in these regions.

Case studies: Opportunities for digital financial services in climate resilience

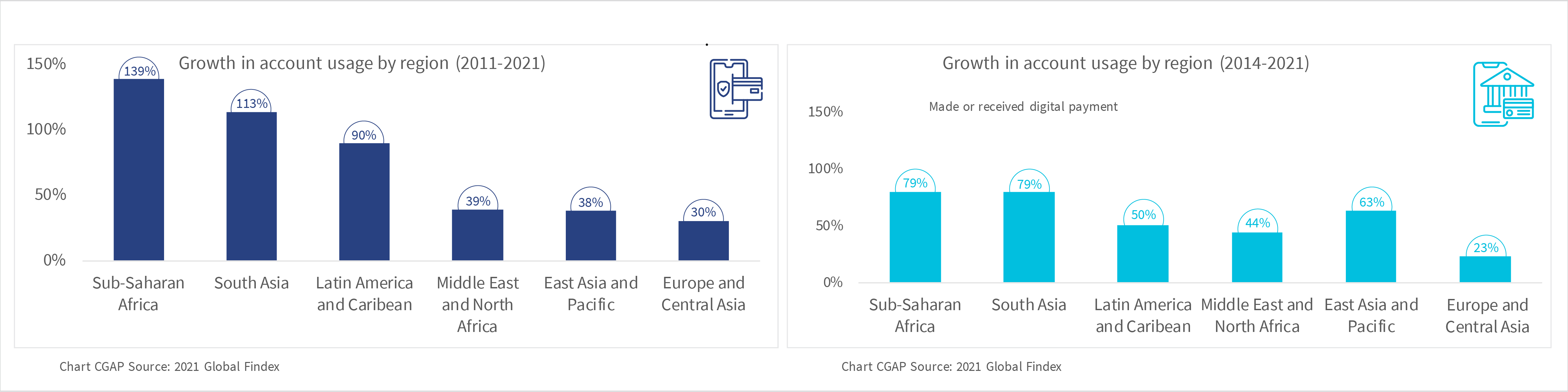

Africa has witnessed the fastest growth in DFS account ownership globally, from 23% in 2011 to 55% in 2021. Mobile money has particularly emerged as a vital tool that drove this impressive rise. It facilitates a wide range of transactions beyond simple person-to-person payments. These include cash transfers, merchant payments, utility bill payments, savings options, and even government-to-people services. Notably, up to 33% of Africa’s adult population own mobile money accounts. This highlights its extensive reach and diverse use cases.

DFS can provide access to financial tools, such as savings accounts, insurance, and credit, to help individuals and communities better prepare for climate-related events and respond to them. It also enables them to recover from these events. The case studies below show how DFS addresses the adaptation needs of vulnerable populations. This can happen when they prepare for climate shocks before, during, and after them.

Our recent research in Nigeria and Bangladesh draws findings fromvulnerable households’ actions when they face climatic events and the financial products they use to cope with them. The evidence shows that with climatic events’ increasingly unpredictable and frequent nature, low-income households use financial products readily available and accessible within shorter time frames.

Therefore, financial service providers should understand how low-income households in climate-stricken regions use financial services to prepare for severe weather events and recover from them. This would enable the strategic structuring of these services to reach the most vulnerable. This understanding can also inform when and where DFS, such as mobile money, work best for this population, which presents a lucrative opportunity to deploy climate finance to these households to become climate resilient.

- Before climatic shocks: DFS has the potential to provide the necessary financial resources faster than traditional financial systems before climate shocks through microloans, savings products, and insurance tailored to the needs of vulnerable communities. Such preemptive financial planning helps communities build resilience before disasters strike.

- During the shocks: Our study findings in Nigeria indicated that farmers who face severe climate events often have limited financial options. They rely heavily on informal savings and loans, which may prove insufficient during extreme weather events. Digital financial services, such as digital weather index insurance and digital emergency loans, can provide more reliable and accessible financial tools to bridge such gaps and help farmers manage risks better.

- Post-disaster funding: Digital platforms can expedite the disbursement of aid and insurance payouts to ensure timely support to affected individuals. This reduces the recovery time and financial strain on communities. In Kenya, mobile money services have allowed households to save and access credit quickly during emergencies. Such services have been particularly beneficial during climate-related events, where rapid access to funds is crucial.

The path toward enhanced inclusivity and financial resilience

DFS enhances inclusivity and can advance resilience for vulnerable households. Moreover, investments in green technologies through mobile money platforms transform individuals from mere victims of climate change to active participants in the combat against its effects. These platforms enable households and businesses to adopt resilient practices as they channel funds into sustainable projects and technologies that contribute to the broader fight against climate change.

This dual approach to enhance financial resilience through digital products and promote investments in community resilience creates a more robust and proactive economic environment for vulnerable populations. This signifies the potential to increase resilience in a continent where more than 110 million people faced climate-related hazards in 2022 that caused more than USD 8.5 billion in economic damages. The integration of DFS with climate financing will enhance LLA efforts through accessible, efficient, and scalable financial services, which can help vulnerable communities cope with climate events, build resilience, and enhance adaptative capabilities.

Leave comments