Digital payments in India—unlocking an opportunity worth USD 10 trillion

by Manali Jain, Shweta Menon, Akshat Pathak and Pramiti Lonkar

Oct 3, 2023

5 min

Digital payments in India are about to reach an inflection point where we expect a threefold growth in value to USD 10 trillion by 2026, with every two out of three payments being non-cash. Our two-part series highlights the evolutionary and revolutionary initiatives in India that are currently driving the growth of digital payments.

The digital payments ecosystem in India has emerged as a silver lining as the COVID-19 pandemic seems to be receding. The country’s digital payments landscape has transformed dramatically in the past five years. While Unified Payments Interface (UPI) hit record-high numbers, the Aadhaar-enabled Payment System (AePS) transformed how beneficiaries access subsidies. Meanwhile, Bharat Bill Pay System (BBPS) consolidated the recurring bill payments industry under one payment system, and QR codes continued to drive the merchant acceptance network nationwide.

As a result, India clocked ~197 million daily digital transactions in FY 2021–2022. The Reserve Bank of India’s (RBI) digital payments index, which has 2018 as the base year at 100, has risen to 377.46 in March 2022. Visit the PIN Rails site, which features a dashboard that tracks the evolution of India’s payments system.

Several factors led to this transformation including improvements in payments infrastructure, information and communications technology disruptions, a responsive regulatory framework, a conducive policy environment, and a greater focus on customer-centricity. Moreover, black swan events, such as demonetization and the COVID-19 pandemic, have further accelerated India’s digital payments journey by spurring a behavioral shift among the masses toward digital payments. We have discussed these in detail in our report on “How digital payments drive financial inclusion in India” and blogs on “The evolution of payments in India—the state of play and looking ahead.”

Unlocking the threefold growth and USD-10-trillion opportunity

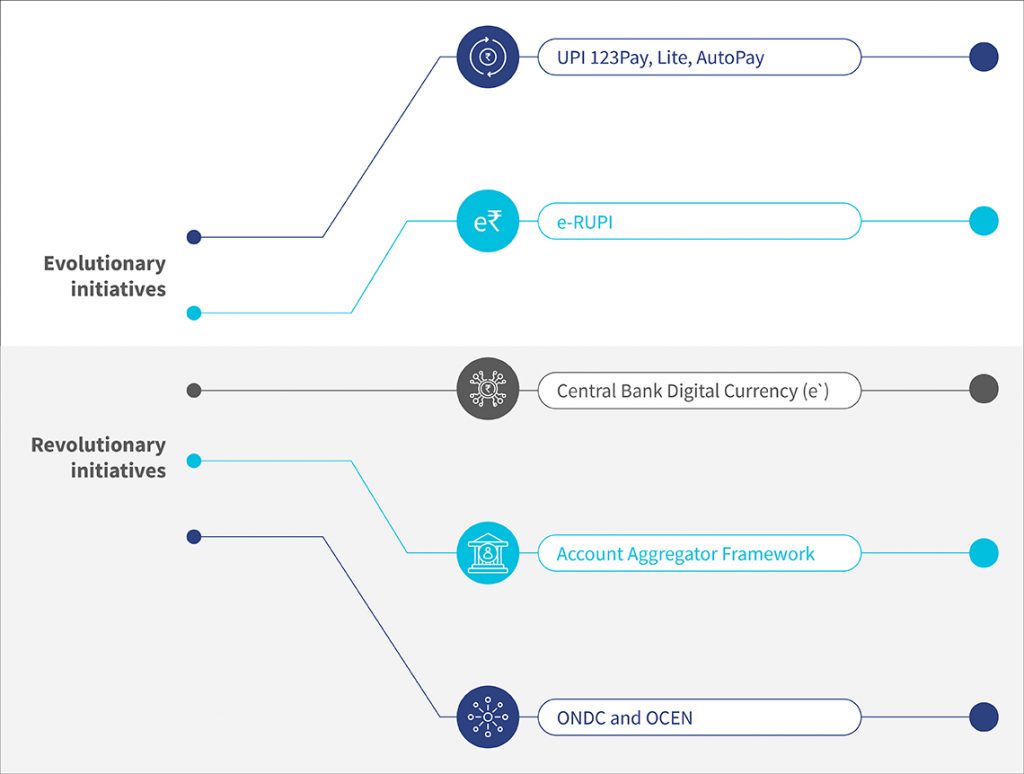

Digital payments in India are about to reach an inflection point. We expect a 3X growth in value to USD 10 trillion by 2026, with every two out of three payments being non-cash. However, unlocking this opportunity requires the introduction of several evolutionary and revolutionary initiatives along with improvements in acceptance infrastructure.

Using tech to leapfrog to unique users and acceptance infrastructure

Access to content in local languages and the rise in video streaming apps continue to drive internet usage in India’s rural areas. The penetration of smartphones among Indians has increased from 26% in 2014 to 65% in 2022. The growth of 4G services has also added many first-time users. Rural India saw a 45% increase in new internet users since 2019. On average, a wireless internet subscriber in India consumes 14.97 GB per month at INR 9.91 (~USD 0.13) per GB, which remains the cheapest internet worldwide.

Furthermore, QR codes have fast-tracked the expansion of merchant acceptance of digital payments as they are easy to use and involve low setup and maintenance costs. More than 30 million merchants now accept QR code-based payments, a 12x increase from five years ago. QR code acceptance has driven the share of merchant payments to overall UPI transaction volumes from ~12% in 2018 to ~46% in 2023.

We expect new generations of mobile-first internet users to try digital payments, spurred by comprehensive 4G coverage, stable and low-cost internet access, and affordable smartphones. These new users will add to the existing base of approximately 845 million registered smartphone users[1] and 761 million mobile internet users. While Tier I and Tier II locations (typically locations that are more developed and have a higher population density) in India will continue to drive usage, we expect the subsequent wave of growth in new users and merchants from Tier III to Tier IV regions in India. Policy initiatives, such as the Payments Infrastructure Development Fund (PIDF) and waiver of merchant discount rate (MDR) in UPI and RuPay debit cards, are designed to deploy QR codes and integrated POS solutions rapidly. The use of QR codes and POS solutions will onboard underpenetrated merchant segments.

Evolutionary initiatives

UPI 123Pay, Lite, and AutoPay

UPI saw 8.69 billion transactions amounting to INR 14 trillion (~USD 172.43 billion) in March 2023. It has emerged as the preferred choice of payment for digitally savvy Indians. Transactions conducted through UPI also create digital data trails for users. However, UPI’s penetration is limited mainly to the urban segments that enjoy high smartphone and mobile internet usage. UPI 123Pay and UPI Lite will further expand UPI’s reach and bring convenience for customers to make voice-based payments with ease and overcome barriers of age, literacy, disability, and lack of internet connectivity or smartphones. These offline payment innovations offer massive growth opportunities among the ~400 million users of feature phones that are inexpensive and highly scalable for adoption.

Furthermore, UPI AutoPay, offers an opportunity to 64 million borrowers of microfinance institutions and 6.74 million SHG members, typically women from low-income households in rural locations, to repay loan installments digitally. Customers can enable an e-mandate using any UPI application for recurring payments and pause and start their mandates as per their needs of payment tenure and timelines.

e-RUPI

e-RUPI, a one-time closed-loop payment mechanism that currently finds use among the beneficiaries of specific government programs. e-RUPI takes the form of a person- and purpose-specific cashless e-voucher designed to ensure that the stored money value reaches its intended beneficiary. These vouchers can only be used for the specific purpose for which it was designed at a merchant outlet. The beneficiaries do not need a bank account, card, digital payments app, or Internet banking access, as e-RUPI transactions can occur through a simple SMS or QR code.

e-RUPI ensures an easy, contactless, two-step payment and redemption process that does not require users to share personal details. It is also operable on feature phones and saves the hassle of handling cash or cards, which empowers beneficiaries with limited digital and financial readiness and ability. The National Health Authority, National Health Mission, and state governments of Karnataka, Madhya Pradesh, Odisha, Rajasthan, and Tripura, along with 21 banks, are live on the e-RUPI API gateway platform. These partners use e-RUPI to facilitate benefits under Ayushman Bharat—the country’s national health insurance coverage program, cashless scholarship fee payment to students, and seed and agriculture equipment distribution. e-RUPI can effectively aid beneficiaries and the government in administering G2P payments at scale.

While these evolutionary initiatives intend to facilitate access to and usage of digital payments to the unserved and the underserved segments, their uptake will depend on how effectively are the current financial needs of these segments are met and the use-cases offered. In the next blog, we highlight a slew of revolutionary initiatives led by India’s central bank and regulator to promote wide-spread inclusion by democratizing financial services for the masses.

[1] Multiple SIM ownership means that this does not indicate unique users, and also includes smart-feature phone users.

by

by  Oct 3, 2023

Oct 3, 2023 5 min

5 min

Leave comments