MSMEs in Kenya amid COVID-19: A question of survival

by Anup Singh, Diana Siddiqui and Aparna Shukla

Jan 19, 2021

7 min

In this blog, we present key insights from MSC’s research on the impact of the COVID-19 pandemic on micro, small, and medium enterprises (MSMEs) and their coping strategies. We conclude with recommendations for the government to formulate policy measures and for the donor agencies to support the recovery of Kenyan MSMEs and build their resilience.

“The biggest impact of COVID-19 on my livelihood is the closure of my primary business. The inter-county travel restrictions and curfews had hurt customer footfall and I was left with no choice but to shut my shop.” Philip, a furniture enterprise owner from Nairobi.

Social and economic disruptions brought about by COVID-19 are projected to contract Kenya’s economy between 1% and 1.5%. As per a World Bank report, since the pandemic struck, two million more people in the country have fallen below the poverty line and around one-third of household-run businesses have not been operating. The Central Bank of Kenya warned that 75% of businesses risk closure due to the lack of emergency funds and crisis in liquidity. Further, a study by BFA on COVID-19 indicates that more than 80% of Kenyan respondents reported a decline in income while 67% reported an increase in expenses. Along with the loss of livelihoods, remittances have fallen while few households have benefitted from direct cash assistance.

In this blog, we present key insights from MSC’s research[1] into the impact of the pandemic on micro, small, and medium enterprises (MSMEs). We conclude with recommendations for the government to formulate policy measures to support the recovery of Kenyan MSMEs and build their resilience.

Entrepreneurs face declining business revenues and increasing expenses, which have jeopardized the survival of micro and small enterprises

MSMEs play a vital role in the economic development of Kenya. The sector largely comprises micro-enterprises (98.3%)[2] and contributes approximately 40% to the GDP[3]. MSMEs employ 14.9 million people, of whom 12.1 million are employed in microenterprises. However, the sector remains highly informal as only 20% of the 7.4 million MSMEs operate as licensed entities.

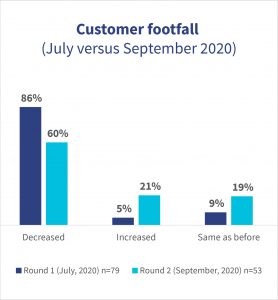

COVID-19 has had a significant impact on the general economy. Many enterprises have closed and people have lost their jobs. As a result, the purchasing power of consumers is constrained. Consumers spent less on discretionary expenses and limited their consumption to focus on essential goods. While the economy is gradually reopening and the restrictions have been relaxed, the consumers are diffident and have been spending cautiously.

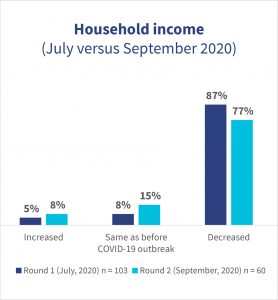

Furthermore, the household incomes of micro and small enterprise owners have generally declined, as members of the household have either lost jobs or seen a lower footfall in their enterprises. However, 32% of entrepreneurs in September, 2020 and 82% of entrepreneurs in July 2020 reported an increase in household expenses.

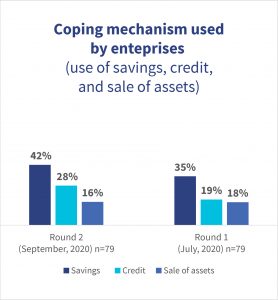

MSMEs operate with limited resources and hence are less able to absorb heightened costs that result from shocks like COVID-19. Most entrepreneurs mentioned that they have exhausted whatever little financial reserves and savings they had. The use and eventual depletion of savings

Some entrepreneurs turned to credit and sold off assets to meet household needs but these provided only temporary relief. More female than male respondents reported resorting to the sale of productive assets, especially those based in rural areas and involved in agricultural enterprises. Entrepreneurs who resorted to borrowing reported being trapped in a vicious cycle of repeat borrowing to manage repayments.

A squeeze on credit and limited access to capital has further diminished the ability of enterprises to survive the crisis

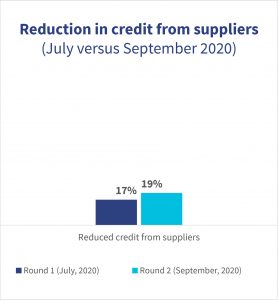

Two specific external sources of capital fueled enterprise value chains before COVID-19. These were loans from financial institutions and the provision of credit from suppliers. The reduction in access to credit from both sources has posed significant challenges for enterprises to maintain business liquidity.

Most financial institutions have reduced their exposure to the MSME segment given its higher levels of vulnerability and lower resilience. Some lenders asked for additional collateral or priced the loans higher than usual, which reflects the higher perceived risk associated with MSMEs. Such conditions have made loans expensive for MSMEs and thus have limited their ability to use additional loans to reestablish business.

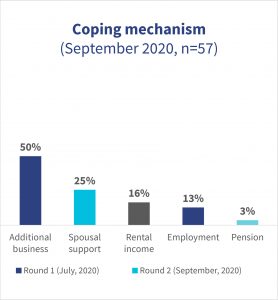

Coping mechanisms by entrepreneurs include diversification of income and businesses

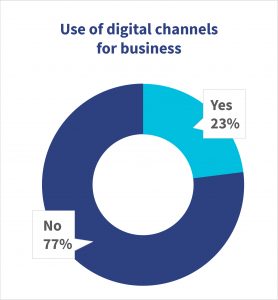

The uptake of digital platforms and technologies by enterprises, particularly micro and small enterprises, has been limited

Recent times saw digital transactions in the country rise, buoyed by the Central Bank of Kenya’s directive that waived the fee on mobile money transactions of less than KES 1,000 (~USD 10) and bank to mobile wallet transfers. While digital merchant payments witnessed a net decline of 16%[4], enterprises in sectors, such as agriculture and food and grocery experienced an upward trend in digital payments.

Measures that the public and private sector can take to support this segment to tide over the crisis

To support the entrepreneurs and enhance their income from their enterprises:

- The government may mobilize funding from multilateral agencies to provide one-time emergency relief cash support to enterprises, preferably to women-owned enterprises.

- The government may review and suitably modify procurement guidelines to encourage and support local enterprises, especially women-owned enterprises.

- The government can establish a multi-agency platform and collaborate with the private sector to support enterprises with access to digital technologies, and use e-commerce and social commerce, digital payments, and alternate modes of financing—including those from the private sector.

To support the entrepreneurs and reduce the burden of expenses of their enterprises:

- The government may formulate forward-looking policies that combine incentives and tax-reliefs to revive the sectors affected most by the restrictions. Such policies will reduce the overall operating costs and provide the much-needed revenue and liquidity for enterprises.

- Donor agencies may support the financial industry by promoting concessionary financing modalities, such as guarantee funds for specific enterprise sectors that have been affected by the pandemic. These will enable and encourage financial institutions to provide loans with generous terms and conditions to help enterprises continue their business.

To support the entrepreneurs and boost access to finance for their enterprises:

- Donor agencies may fund technical support to financial service providers, including fintechs, to develop innovative products for enterprise finance, such as business interruption solutions, as well as bundled savings, credit, and insurance products.

- The government and the central bank may run an awareness campaign to encourage enterprises to seek refinancing and restructuring options from their lenders so that in case of non-repayment, the suspension of listing the negative information[5] of borrowers would not affect the entrepreneurs’ credit scores.

To benefit enterprises in the informal sector:

- The Micro and Small Enterprise Authority as the nodal agency can consider providing support to enterprises for business continuity and recovery by preparing them to adapt the delivery of products and services in line with the prevailing business environment and changing customer demands. The government may allocate a budget to extend this support.

- The government should increase the formalization of informal enterprises by encouraging them to register and by supporting them to comply with regulatory requirements.

- Donor agencies may assist financial service providers to offer advisory support to help enterprises develop mid- and long-term risk mitigation strategies. This in turn can help financial institutions earn customer loyalty and improve the quality of their loan portfolio by stemming rising defaults.

Enterprises have faced severe disruptions in demand and payment cycles, considering their limited net worth, low backup of savings, and a squeeze on their access to finance. The micro and small enterprises sector needs appropriate responses at all levels to support its recovery in the aftermath of the crisis.

[1] The sample size of the research is, clearly, too small to be representative and therefore the percentages reported throughout should be seen solely as indicative.

[2] KNBS MSME survey 2016

[3] KAM-Focus on SMEs-

[4] FSD Kenya: How COVID-19 has affected digital payments to merchants in Kenya

[5] In April, 2020, the CBK suspended listing of negative information of borrowers on the Credit Reference Bureau by commercial banks. This was to cushion borrowers who were unable to repay their loans due to the effects of the pandemic, such as job loss or disruption in business. The CBK however, lifted the suspension in October, 2020 due to rising loan defaults that affected the financial sector.

by

by  Jan 19, 2021

Jan 19, 2021 7 min

7 min

Leave comments