Kaarva: A micro salary advance for a micro expense

by Anshul Saxena, Anil Gupta, Sunil Bhat and Meenal Malik

Jul 15, 2019

4 min

This blog highlights the journey of Kaarva, a fintech start-up that provides salaried people from the low-and middle-income segments with early access to a portion of their earned salaries for the month without charging any fees.

This blog post is part of a series that covers promising fintechs making a difference to underserved communities and supported by the Financial Inclusion Lab accelerator program. MSC is a partner to the FI Lab, which is a part of CIIE’s Bharat Inclusion Initiative.

| Ram drives an Ola cab from 8am to 8pm across Bengaluru and makes about INR 50,000 each month. After spending on fuel, car maintenance, and the usual family expenses he barely manages to save any money. To add to that there are those medical expenses that come up every few months and Ram inevitably starts looking for a little money to tide these over. Banks and MFIs cannot give Ram one-off micro-loans at a short notice or at an interest rate that he can afford. Friends and family are not always a dependable option. What can be done to solve Ram’s dilemma? |

Hardworking Indians like Ram need easy, early access to their salary. Kaarva’s interest-free finance solution does exactly this for them.

Khusbhoo Maheshwari had just graduated from Harvard Business School and Agam Goyal from IIT-Mumbai when they met through an alumni network. They soon discovered that they shared a passion to solve the financial problems of tech-savvy, low-and-middle income (LMI), employed youth.

Recent studies1 estimate that there are 121 million emerging Indian households who can be categorized as low to middle income. They will need INR 218 trillion (USD 335 billion) in credit by 2025. Kaarva’s own research shows that 30 million of these Indians make less than INR 20000 per month (USD 3,600 each year) and need INR 1000 to INR 5000 (USD 15-70) in ‘sachet’ credit from time to time. The problem is real and deep for India’s LMI segment – young people often use up their salary early in the month and then run out of money to pay bills before the next salary comes through. Available alternatives, such as pay-day loans threaten the financial well-being of this segment. Kaarva was born to break the 30-day salary cycle and in effect make salaries available on demand.

Kaarva – the hindi translation for caravan – is a name befitting a company that aims to be a fellow traveler in the financial journey of Indians in the low-income segment.

The pitch: Your salary. Your right.

Our Ola driver Ram has a job that pays a regular salary and a bank account in which it gets deposited. He can raise a request for an advance salary with Kaarva and instantly receive that in his bank account – no fees or hidden charges. What’s more, Kaarva will not prescribe an interest rate or a fee for the loan but will allow Ram to choose the contribution he wishes to voluntarily make to support the service.

Khushboo believes that “Fees are inherently transactional. They give power to the person who sets it and demands compliance from the people who pay it. All companies should ask themselves—if you let your customers choose the price, would they continue to pay you?” –

The process: Radically quick turnarounds with simple technology

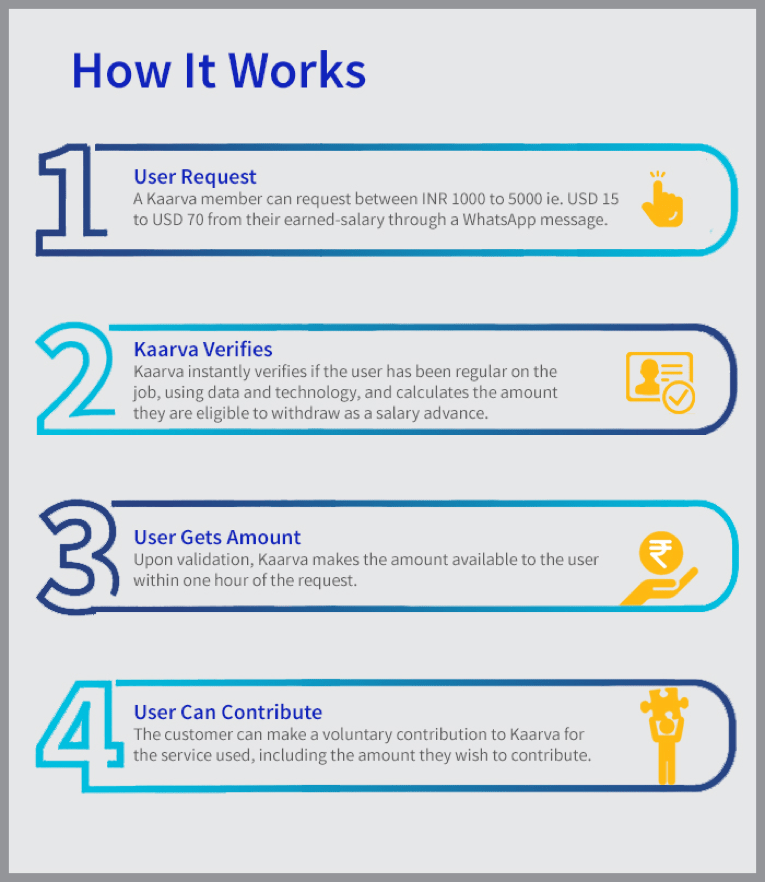

All Ram has to do is to download Kaarva’s mobile application. On the chat, he provides his last three income statements, his photo ID card, and a written undertaking that he will replay the salary advance amount the next time he receives his salary. If approved, he will get the money in an hour.

Kaarva is the perfect solution for employers who wish to provide a better financial future for employees.

The evolution: Overcoming roadblocks with support from the Financial Inclusion Lab

Kaarva competed with over 200 applicants to be selected in the first cohort of the Financial Inclusion Lab where boot camps, diagnostic sessions, and clinics helped them think through their business, product, and technology bottlenecks and build sound business strategies for success.

- Getting to the right customers

LMI groups in India vary across regions, industries and age groups. There is no set pattern or ‘one-size-fits-all’ formula for success. MicroSave Consulting (MSC) helped Kaarva address its biggest pain-point: identifying the right target customer segment, understanding their needs based on occupation, industry, age, and geography. Kaarva now knows that aggregated cab drivers are the best potential customers for it in the next 6-18 months.

- Scaling up at low cost and reshaping customer perception

After nearly a year of operations, Kaarva has on-boarded over 1000 customers. They now need to build a low-risk model to appeal to both, employees and employers, in order to expand. Publishing the app in vernacular languages will help scale up product adoption to millions, at a low cost. Kaarva will also need to shake off the skeptics’ perception of being ‘too good to be true’, owing to its ‘pay what you like’ model.

The future looks bright and fair for all.

“Kaarva is on a mission to help millions of hard-working Indians attain their financial goals. We believe in creating a future where money works for all.” – Agam G

Kaarva aims to make money smarter and work better for people. It means building a society where people work together to support products that help them. After all, it is not people who cannot keep up with bills and expenses; it is the existing systems that hold people down when they are at their most vulnerable. Thankfully, it does not have to stay this way.

“We can create a system built on generosity instead of greed. We can shape a future where people help each other, and companies value people over profits” – Kaarva.

Follow #TechForAll and #BuildingForBharat to stay updated on fintech start-ups driven to bridge the social, financial and economic inclusion gap.

1 https://www.linkedin.com/pulse/decoding-indias-consumer-lending-opportunity-bala-srinivasa/

by

by  Jul 15, 2019

Jul 15, 2019 4 min

4 min

Leave comments