Follow the money approach: Introducing a powerful strategy tool for your mobile money/banking initiatives (Part II)

by Krishna Thacker

by Krishna Thacker Jan 4, 2018

Jan 4, 2018 4 min

4 min

In this blog, the author explains MicroSave’s in-house developed framework – Follow the Money Approach – to help institutions raise their market share.

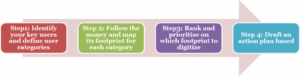

In the previous blog in this series, we discussed the first two steps of the four steps under the Follow the Money Approach (FMA).

Now we consider the next two steps.

Step three: Rank and prioritise

By now, you have 1) identified your key user segments 2) a clear picture of their financial ecosystem along with the value and frequency for each of the footprint or transaction.

The objective of this activity is to collate the key transactions identified into a single analysis framework to help us select the best transactions/footprints to focus on and plan accordingly for the short, medium and long-term.

Following is a sample analysis framework with some suggestive attributes, each of which needs be assigned a score on a scale of 1 to 5 based on its impact and relevance. The score then will be totaled in the second last column to help prioritize.

Priority matrix: Use Case 1, Rural, farm and other mix sources of income household

A couple of useful points to remember during this step:

- It is essential to extrapolate these anecdotal numbers for the larger market to assess the size of the market you are dealing with. Once you do so, triangulate it with other industry-level data sources to ensure that you are on the right track. What may look like a small value, simple transaction (e.g. top up) may actually be a highly profitable transaction for you in the initial phase, once these numbers are put into context.

- Please note that the remarks and comments section is extremely crucial. It is important to describe the footprint by providing more details such as the following:

- How do they pay currently and what are their challenges and limitations. Very often you may/will actually have to go and meet them up for more details.

- What are the reasons we may or we may not be able to digitize it and/or bring it into our fold?

It does sound difficult to pursue several types of transactions at the same time and it is easy to just focus on one and be the best. True, in the short run. But, basing your entire business model on only one or two footprints has several critical disadvantages:

- It is very easy for clients to switch and move to a competitor. M-PESA could be the next Blackberry or Nokia if it does not diversify.

- Lost opportunities to cross-sell and up-sell to the same client.

- Higher risk from the external environment in terms of changes in trends, policies, and disasters.

And, there is not much point making only payments easy if clients have to make a lot of effort to bring/convert their inflow on your platform and likewise if it is difficult for them to make payments or withdrawals from your platform. This is not to say that making payments (or for that matter a single transaction) easy for end users is not important. But, it is to say that making just one footprint in the ecosystem convenient without looking at the entire ecosystem will not add sustainable value to the client and therefore ultimately the service provider. It makes the service provider very vulnerable to competition and other external factors.

Step four: Draft an action plan based on the above

This last step is simple. A bit too simple that one and may want to skip it entirely. However, converting priorities into actionable activities is an extremely crucial step to convert all the efforts made so far into some useful action and thus results. Therefore, a simple but quick action plan and roadmap is developed based on the above priorities. The action plan will ideally contain activities such as developing a customized offer/business models for various partnerships, arranging meetings with them, designing process flows, upgrading so and so module of the technology etc.

Make it yours. Use it. Share.

If you have been a part of the strategic planning process for your digital finance deployment, you would have surely thought about many of these points or issues. But, this framework helps you to be a bit more methodical and structured in your approach. It also helps you look at the larger picture and decide where you want to stand. In our experience so far, this approach has been immensely helpful in providing a great deal of clarity is often a very complex and rapidly evolving environment.

The idea is to share and spread what works and test its wider applicability. It is to encourage and challenge you to use it in your own institutions and context. Feel free to customize and modify it. We would be extremely happy to hear from you and listen to your thoughts, opinions, and feedback as well as to be of any help we can in providing more clarity on this approach.

Leave comments