Working Together To Fight DFS Fraud

by Maha Khan and Vera Bersudskaya

Nov 7, 2016

5 min

Fraud is one of the major threats to the emergence and sustainability of the DFS ecosystem. Uganda’s DFS market has long been plagued by fraud. The Helix 2015 ANA Uganda Report revealed that 53% of Uganda’s mobile money agents have experienced fraud within the last year – either personally or through one of their employees. At the recent launch […]

At the recent launch of the report, stakeholders in the Ugandan DFS industry called for collaboration to combat fraud. But what would such collaboration entail? This blog discusses whom and what it would take to establish effective collaboration among industry players, provided they are willing and committed.

What does collaboration mean?

It is often said that strength lies in collaboration, teamwork and unity and the DFS industry is no exception, particularly when it comes to fighting fraud. Collaboration involves different stakeholders working together on identified priorities, towards a shared goal – in this case, reduction in DFS fraud in Uganda; and preferably with clear targets to achieve.

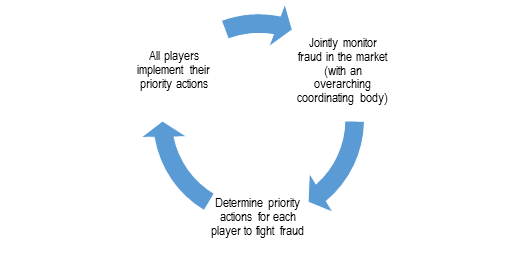

To set priorities for combatting fraud, the industry first needs to develop a baseline understanding of the various facets of this phenomenon, existing fraud mitigation mechanisms, and the gaps. This would inform a first round of initiatives. Fraud trends in the market would then need to be jointly monitored to identify further actions required from each stakeholder (Figure 1). Ideally, this cyclical collaborative effort would be overseen (in a non-punitive manner) by a coordinating body.

Figure 1. Cyclical Collaborative Effort

- DFS providers and trade associations. These entities are ideally positioned to help combat fraud as they can collaboratively develop guidance on fraud mitigation, prevention, and recourse. Such guidance would correspond to minimal regulatory requirements and champion best practices on internal controls, complaints/redress systems, contingency plans, and agent network management. Additionally, it could propose partnership modalities, say between insurers and MNOs, and blended products design. These associations are also well-positioned to maintain relationships with Criminal Investigations Directorate (CID) of the Uganda Police Force in order to identify, promptly sanction and track fraudsters.

In Uganda, associations in mind are Ugandan Bankers’ Association and Uganda Insurer’s Association. Though MNOs in Uganda do not have an apex body, leading MNOs can be expected to collaborate to fight fraud just as they did to crack down on OTC.

- Regulatory Bodies should be at the table to vamp up and harmonise rules and standards necessary to address fraud. They must also undertake supervisory activities to ensure that providers comply with regulations and adhere to consumer protection measures. Regulators of the DFS space in Uganda include Bank of Uganda, Uganda Communications Commission, and Insurance Regulatory Authority of Uganda.

- To counter fraud and mitigate AML/CFT risks, the National Identification and Registration Authority is an important player as it can facilitate customer identification and KYC compliance.

- Donor agencies and technical partners, like FSD Uganda, UNCDFMM4P, CGAP, and GSMA who promote the development of the financial sector as well as efforts to financially include the mass market, can offer technical and financial support to collaborative initiatives that address the issue of fraud, since it is one of the major threats to the emergence and sustainability of DFS ecosystems.

Next Steps

With these diverse players identified, we now consider how to get collaboration going, given the current landscape and barriers in Uganda. Below we provide a few recommendations on what it would entail for the industry to take the bold steps necessary.

- Timely, reliable market data on evolving fraud patterns. Providers’ levels of sophistication in tracking and analysing fraud vary, as do the capabilities and controls within their systems. This hinders any concerted effort to monitor and analyse fraud trends in the market. Although the Bank of Uganda requires providers to submit monthly reports on fraud and suspicious transactions, the information received is often incomplete and any clarifications that are solicited lead to delays, making it difficult to provide timely information on fraud trends.

It seems that the lack of effective market monitoring mechanisms is the biggest challenge facing most DFS regulators. Due to the absence of a rigorous and timely data collection mechanism, general understanding on fraud is derived from qualitative studies and one-off quantitative surveys like the Helix’s Agent Network Accelerator research. Generating timely market data on evolving fraud patterns through a combination of reporting and mystery shopping is a necessary first step for addressing fraud in a targeted and systematic fashion.

- Capable and motivated coordinator body. This body is needed to coordinate monitoring of fraud trends to enable decision making regarding priority actions for each stakeholder group and follow up on their implementation. There are several options for who might be suited to play the coordinator’s role, depending on varying competences:

- The Regulator. Central Bank of Kenya convenes stakeholder forums to discuss market trends and issues, like measures to address fraud and agent noncompliance. Formal industry dialogue and coordination processes also exist in Tanzania. This may not be feasible in Uganda, given the absence of a dedicated national payment systems legislation, disabling the Bank of Uganda’s supervisory authority over MNO e-money issuers.

- Adapt existing initiatives. The Fraud and Forgeries Subcommittee within the Ugandan Bankers’ Association already convenes consultative meetings on fraud within the banking industry, with participation of Bank of Uganda. With the rollout of agency banking, this may be the starting point for coordinating anti-fraud efforts in DFS.

Another option would be to build on GSMA’s efforts in holding consultative workshops . In 2012, GSMA convened a series of consultative meetings between MNO providers and the regulator on the issue of fraud. However, these have run into challenges on account of limited capacity of the regulator as well as delays in decision making. Reviving this forum with the support from technical partners could be a low-hanging opportunity

- A specialized body. This body would need to have strong backing and oversight from the regulator as well as credibility within the industry. Examples of such bodies include the USAID funded mobile money coordinating group in Malawi and Bangladesh.

Working Together

Making industry collaboration against fraud in Uganda requires concerted effort on the part of all stakeholders to appoint a coordinator, understand the nuances of the problem and implement collectively envisioned solutions. Nevertheless, the discussion during the 2015 ANA Uganda launch and our private consultations with key stakeholders show a growing and encouraging recognition of the urgent need to collaborate. We hope that this blog can help orient efforts to get the collaboration going. In our next blog “Fighting DFS Fraud from Five Fronts”, we focus on key steps Ugandan DFS providers can take to tackle the issue of fraud.

The Helix Institute of Digital Finance would like to thank FSD Uganda for funding and supporting the 2015 ANA research in Uganda.

Written by

by

by  Nov 7, 2016

Nov 7, 2016 5 min

5 min

Leave comments