Offline Payment Acceptance: A Puzzle and an Opportunity

by Anil Gupta and Manoj Sharma

Jun 17, 2016

6 min

Reserve Bank of India estimates that 96% of all the retail transactions in India are conducted using cash, leaving only about 4% payments on cash-less/digital channels.

As Indians, we love cash, which is fungible and provides instant gratification – allowing us to buy anything across the country. Cash speaks one language, does not discriminate, and provides a seamless experience!

RBI estimates that 96% of all the retail transactions in the country are conducted using cash, leaving only about 4% payments on cash-less/digital channels. The situation in rural areas is even more pathetic, with less than half a per cent of payments being cash-less, and cash is the undisputed king. Cash is costly for the government to keep in circulation: the cost of printing, storing, safekeeping and transporting, all adds up. In the year July 2014 to June 2015, RBI incurred Rs. 3,760 crore (USD 578 million) on security printing alone. All the banking entities and RBI spend close to Rs. 21,000 crore (USD 3.2 billion) per annum to keep paper money in circulation according to a recent study on cost of cash.

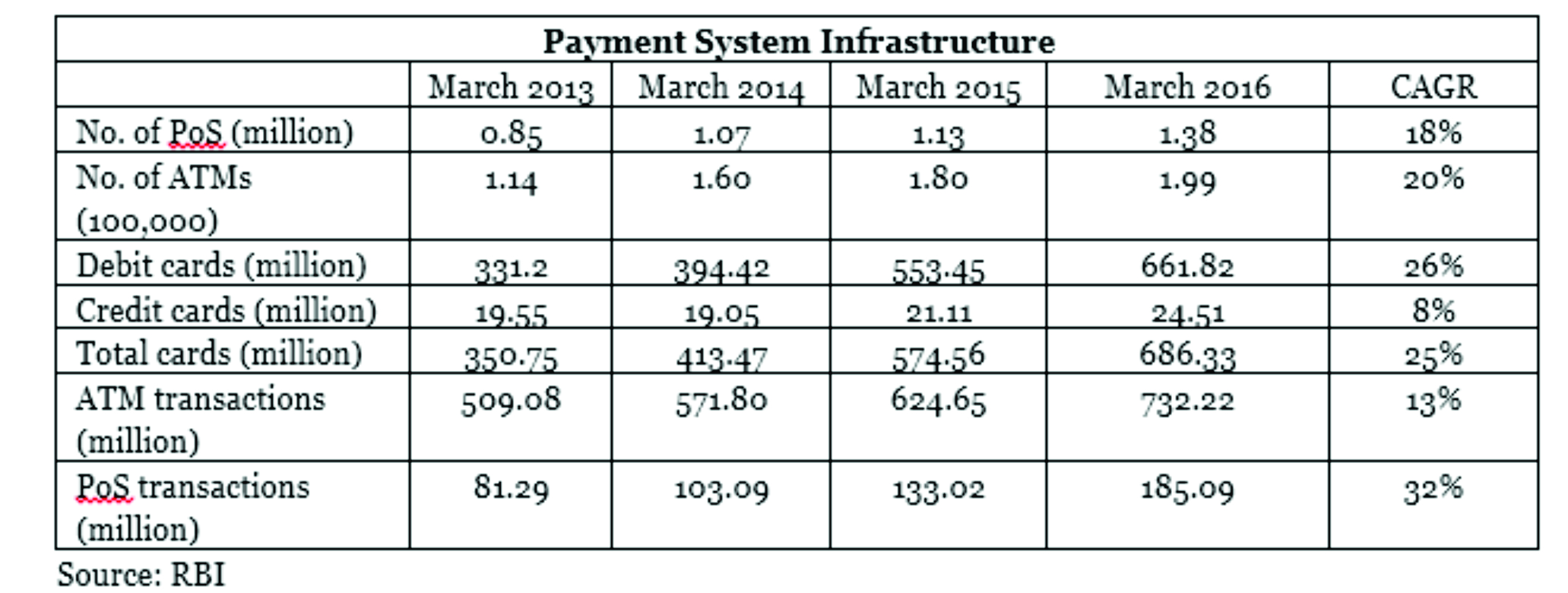

Cash is costly even for individuals, and despite the growth of ATMs (please see table below), the study estimates that the residents of Delhi spend 6 million hours and Rs. 9.1 crore (US $1.4 million) to obtain cash. Hyderabad spends 1.7 million hours and Rs 3.2 crore (US $0.5 million) to do the same – about twice as high as Delhi when calculated on a per capita basis.

There are a variety of barriers to ‘cash-less’ and one of the most important one is the acceptance of electronic money by merchants. In a country where we have more than 20 million merchant establishments and close to 690 million cards, only 6-7% of the merchants (1.38 million) have infrastructure to accept electronic payments. Providing (mainly debit) cards, largely addresses the demand-side issues – so the mass distribution of RuPay debit cards with Jan Dhan accounts could play a very important role. With a healthy CAGR of ~20% for both PoS and ATM infrastructure, usage is spurred by transactions at PoS (though from a lower base than ATM transactions).

On the supply side, the current process has been fairly tedious and controlled by some of the entities.

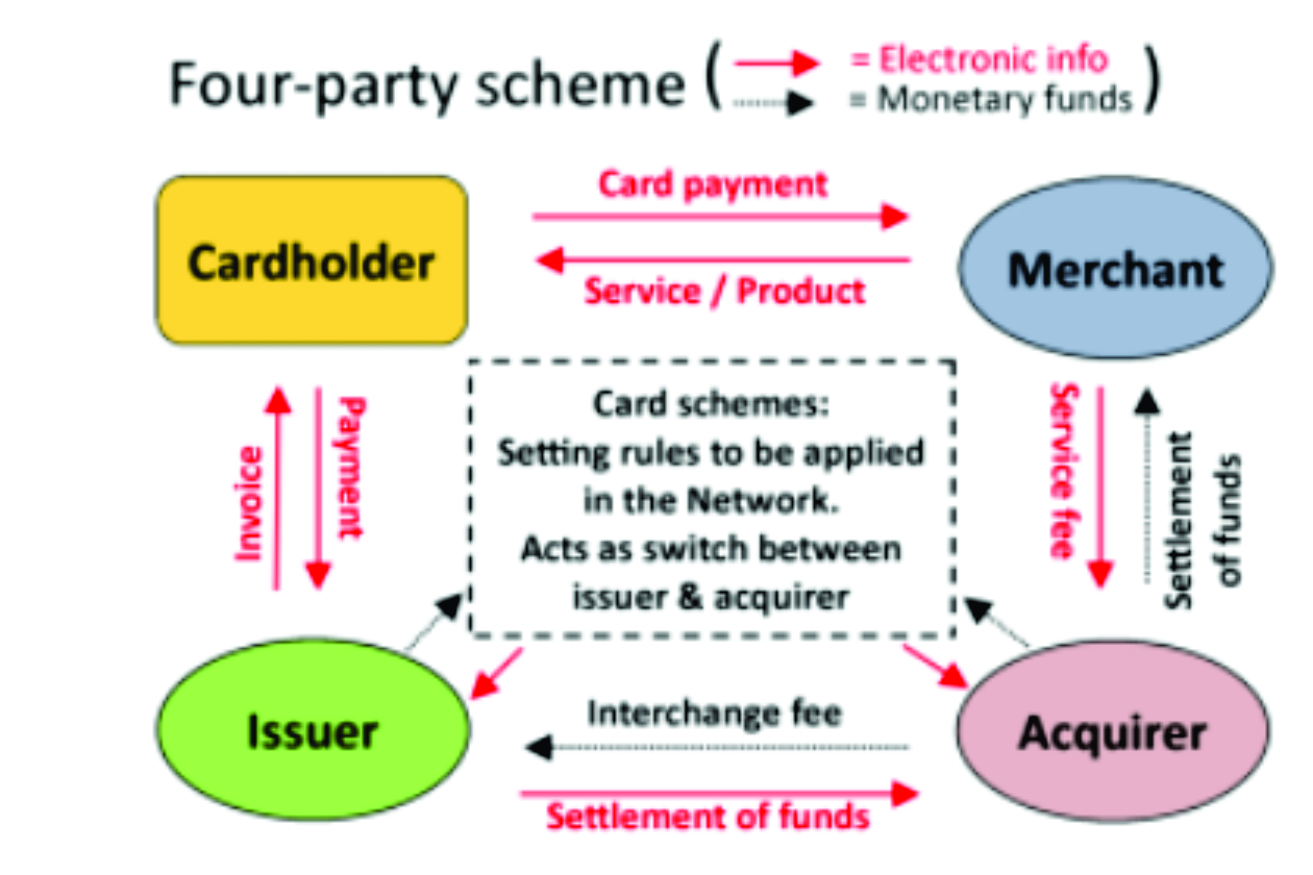

As depicted in the diagram, transactions require a customer or card-holder and a merchant, with card acceptance infrastructure, who provides goods and services in return. However, at the back end, the card used by the customer has to be issued by an ‘issuer’ (typically a bank) and the merchant is to be acquired by some entity which could be an aggregator, payment service provider, or bank. The card-holder is charged for goods purchased and the merchant is paid for goods sold through their respective acquirers. At the back end, a card association (like Master, Visa and RuPay) licenses card-issuers and provides settlement services. This provides convenience to the customer as he/she is not required to carry cash, while the PoS terminal ensures adequate safeguards.

The merchant is able to service typically high-value customers, though at a cost known in payment parlance as MDR or Merchant Discount Rate. The overall cost is borne by the merchant and the proceeds are shared by the acquirer and the card-issuer as per terms of contract between them. If there are enough customers carrying cards, merchants have shown a willingness to be acquired and pay MDR to the acquirer. In the past, when carded transactions were in their infancy, many merchants insisted on 2% more (almost equal to MDR) when customers paid with cards. This practice has largely been curbed – at least in urban areas. However, some merchants like petrol filling stations, gold merchants, etc. still clearly display and charge extra for using cards. This leads us to believe that the other merchants either pay from their margins or have already factored the MDR into their costing. In the absence of credit risk, RBI capped MDR at 1% in June 2012 for debit cards. India is primarily a debit card market with close to 658 million debit cards outstanding (as of February 2016) compared to only 24.13 million credit cards. Over the last three years, both debit and credit card transactions have been growing rapidly; however, growth in the debit card segment has been higher.

Merchant-acquiring is an integral part of card-payment transaction processing. Acquirers enable merchants to accept card payments by acting as a link between merchants, issuers, and payment networks to provide authorisation, clearing and settlement, dispute management, and information services to merchants. The merchant-acquiring industry is dominated by a few large players across the globe, with the top 10 acquirers in the world handling nearly 50% of the global card transaction volume. In India, many banks have forayed into the merchant-acquisition process – with limited success, as it takes a fair amount of time and documentation to acquire merchants. The cost includes terminal infrastructure, which is in the range of US$ 150-200 and is generally paid for by the acquirer. The acquirer needs to be convinced that this expenditure is justified and more and more customers will indeed use the PoS terminal.

Currently, the cost of acquisition for the acquirer is high as a result of the device, paperwork, and the time involved; the cost to merchants is also high, given the operational costs of the card-acceptance machines and the MDR. To top it all, many customers typically carry cash and seem to be more comfortable in dealing with cash. For some people, it also helps that cash does not leave behind a trail in the way electronic money does, and hence allows the unscrupulous to evade taxation. With a growing number of debit cards issued, the focus of the government and of regulators is to grow the digital financial services ecosystem.

This requires a complete change in mindset in the way transactions are perceived and orchestrated. The 24×7 Immediate Payment Systems (IMPS) and Unified Payments Interface (UPI), managed by National Payments Corporation of India, which allow account-to-account (A2A) interoperability through a virtual or global (like Aadhaar) address, offer new opportunities. One option would be to effect P2P payments to any offline merchant (service provider), using UPI, an option that is now feasible since most households have a bank accounts and a mobile phone. This option allows a customer to easily pay (push) the amount to the merchant’s account using virtual address on UPI without requiring to share any sensitive details like account number, bank, etc. Alternatively, the merchant can collect (pull) the payment by sending a request using UPI, and the customer can then authorise this request for payment. This will not require any intermediation by any of the typical actors highlighted in the four-party diagram above. However, unlike a typical card transaction, it does not address dispute settlement between the transacting parties.

Furthermore, with IMPS and UPI in place, merchant Aadhaar and bank account details can be used to on-board all merchants en masse. It can be done leveraging the Lead Bank Scheme and service area approach for inclusive banking that makes the branches responsible for development of specific area, covering 15-25 geographically contiguous villages. Bank branches can easily identify merchants in their service area and on-board them. This would address the problem of lack of dispute settlement between the card-holder and merchant: banks would play the role of acquirers, whereas NPCI would act as card network service provider.

Another possibility to promote digital retail payment could be self-registration by merchants using Aadhaar as unique identifier through aggregators/intermediaries. These intermediaries can be new age financial technology companies (including Payment Banks), providing seamless processes at a very low cost, as compared to current MDR

These ideas may seem radical, but could be the future, given that incremental growth in PoS acceptance infrastructure is unlikely to lead to a cash-lite (let alone cash-less) India. To get to a level of large-scale acceptance infrastructure using IMPS and UPI, customer protection and dispute redressal mechanisms will require sharp focus and hard work.

That said for digital value transactions of US$ 10-50, these issues are really not that important. Most of these low-value transactions are conducted with both parties physically present; just as with a cash transaction. There is no intermediation between customer and merchant, and disputes, if any, are resolved on the spot.

If we look at the benefit to various stakeholders, these far outweigh the risk at this point of time. The merchant is not required to handle cash and pay MDR. Customers create a digital transaction history and can rely on their account for payments. The economy as a whole gets a boost from the lower cost of cash and possibly reduced costs of goods and services, as well as better tax compliance and a host of other benefits. Surely these benefits are worthy of radical, but low risk, change in procedures around merchant acquisition and offline payments?

Written by

Anil Gupta

Partner

by

by  Jun 17, 2016

Jun 17, 2016 6 min

6 min

Leave comments