Real and Perceived Risk in Indian Digital Financial Services

by Soumya Harsh Pandey and Graham Wright

Feb 26, 2016

3 min

The blog discusses the real and perceived risks in the Indian digital financial services and suggestions for providers and agent network managers for customer protection.

The risks associated with digital financial services (DFS) are varied and a growing area of attention and assessment. At the same time, digital payments and broader digital financial services introduce added complexity, with new participants constantly entering the market, new products regularly introduced, and value-chain dynamics in constant flux.

In MicroSave’s recent research for the Omidyar Network, we covered all types of risks that customers and agents face. It is important to note that fraud is just one facet of risk. There is a growing body of literature on risks in DFS, and these concepts are largely related to customer protection issues. From a customer protection perspective, both Alliance for Financial Inclusion and SMART Campaign have defined risks and vulnerabilities in DFS.

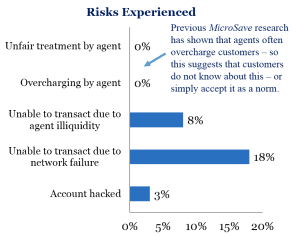

The risks and their ranking by customers (see graph) are not very different from the 16-country study conducted by CGAP. However, another risk that features prominently in India is ‘transaction data security’ or privacy of client account information. This mainly relates to agent-assisted transactions.

Most of the issues in India are operational in nature. Our qualitative research also shows that most significant risks perceived by the customers related to issues like network downtime, system and technology risks, agent unavailability, and agents lacking liquidity.

However, even these operational issues can have serious implications. Frequent service denial, incomplete and interrupted transactions, inaccessible funds, etc., leading to delay or loss of opportunity ― all negatively impact customers’ trust in DFS.

Agents face similar risks. Their key concern is also related to systems/technology and network downtime/outages while trying to serve their clients. We also explored four different types of risks individually in the research. These were:

- Account being hacked/compromised,

- Inability to transact due to network failure,

- Inability to transact due to agent liquidity issues, and

- Overcharging by the agent.

While (most) customers have not actually experienced these risks, the perception of risk has an effect on the usage and uptake of DFS.

Under the ‘Fraud Framework’, described in MicroSave’s ‘Fraud in Mobile Financial Services’ paper, India would still be classified under the “customer acquisition” stage.

This phase in India is led by government schemes like PMJDY and G2P payments. As a result, most risks rank low in terms of their occurrence. However, as the markets evolve and move to the “value addition” stage, different types of risks will evolve.

- Agents conducting round-tripping (cashing in and cashing out the same amount) transactions to earn higher commission;

- Splitting single big ticket transactions into multiple small transactions – again to maximise commission; and

- Agents overcharging customers to maximise earnings.

In response, financial service providers and agent network managers will need to:

- Contextualise risk management frameworks to the Indian context and according to the state of the evolution of the market

- Integrate this risk management framework into their operations and train agents accordingly

- Develop indicators for monitoring risks

- Regularly monitor risks and

- Develop risk-mitigation strategies

As part of this, providers and agent network managers will need to:

- Address the “hygiene factors” of system and agent reliability – see Solving Customer Service Issues in Digital Finance – Can Do, Must Do;

- Implement a comprehensive and formalised system of monitoring (something that has been largely absent to date – see Training, Monitoring & Support – Necessary, or An Opportunity To Cut Costs?

- Monitor agent performance, develop a system for warnings, censure and penal action, including termination; and

- Establish and enforce minimum disclosure and transparency requirements for product features, pricing, and terms of use.

Written by

Soumya Harsh Pandey

Senior Manager

by

by  Feb 26, 2016

Feb 26, 2016 3 min

3 min

Leave comments