Time for Action! Customer Service, Protection and Trust in Indian Digital Financial Services

by Soumya Harsh Pandey and Graham Wright

Feb 19, 2016

4 min

It is time that Indian mobile money providers focus on addressing customer service and protection issues to build trust in DFS and thus stimulate uptake and regular usage

|

MicroSave’s research (funded by the Omidyar Network) into customer protection, risk and financial capability in India shows that Gayatri’s experience is not uncommon across India.

India is a country committed to achieving full financial inclusion. The recent policy-push under the PMJDY programme and India’s commitment to Better Than Cash Alliance shows this intent. However, because of its sheer size and geographic and ethnic diversity, providing access to quality financial services, especially at the base of the pyramid, remains a challenge. MicroSave’s ANA India Survey report states that “India is a country with 1.2 billion people, 29 states, 100+ Agent Network Managers (ANMs), five major telecoms, 27 public sector banks, 23 private banks, and 100+ rural and cooperative banks participating in delivery of Digital Financial Services (DFS)”.

The Reserve Bank of India advised banks to open “no frills” account way back in 2005, and there have been a number of enabling (but sometimes conflicting) regulation and policy-pushes since then. However, the growth in active bank accounts has been slow and beset with a number of issues ― leading to account dormancy levels of 48%.

And the experience of DFS for both agents and the customers that they serve has been extremely mixed. There has been high churn amongst agents, who are often poorly trained, supported and remunerated; as a result, customers, who like the convenience of a local DFS outlet, are often unsure about its reliability. As with many deployments across the globe, it is basic hygiene factors, like system reliability and agent illiquidity that are primarily responsible for the lack of trust in DFS. These are seen to be both frequent and high-impact in nature … and ironically, at present, theft, robbery and fraud are viewed as both infrequent and low-impact. Our qualitative work suggests that these are low-impact because most customers have yet to experience them … this may well change over time as highlighted in Fraud in Mobile Financial Services.

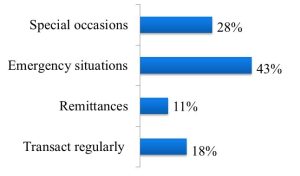

MicroSave field research highlights two contradictory facts that further indicate the fragile nature of DFS in India. While 85% of the DFS customers said that they would recommend DFS to others, they mainly treat it as a back-up option. While customers appreciated the accessibility and ease of use of DFS, they did not really trust it enough to use it regularly – see bar chart highlighting the use of DFS services.

The Indian context reflects a number of conditions highlighted in the MicroSave paper on fraud. The paper notes that weak processes, poor compliance monitoring, and poor customer awareness are key enablers of fraud. Our research shows that all of these are present in India. At present, there are not many reported risks or loss of funds; however, based on current conditions, these are likely to emerge as the system matures and grows

Furthermore, customers’ high trust in, and dependence on, agents for knowledge and conducting assisted transactions, coupled with their limited understanding of, and opportunities for, recourse may lead to a number of agent perpetrated frauds like:

- Unauthorised access to customer’s transaction PIN

- Imposition of unauthorised customer charges

- Split withdrawals (thus increasing commissions earned)

- Agents encouraging customers to leave money with them and then absconding (see box)

|

It is time that providers focus on addressing these customer service and protection issues – see Solving Customer Service Issues in Digital Finance – Can Do, Must Do. Doing so is essential to build trust in DFS and thus stimulate uptake and regular usage … and to prevent widespread fraud and loss for customers.

Written by

Soumya Harsh Pandey

Senior Manager

by

by  Feb 19, 2016

Feb 19, 2016 4 min

4 min

Leave comments