Challenges to agency business – Evidence from Tanzania and Uganda (Part- I)

by Graham Wright

Jun 20, 2014

3 min

In this blog, we look at the fundamental issues of agent profitability, and the related issues of customer education (or marketing!) and the product range available to drive transactions.

As part of The Helix’s Agent Network Accelerator (ANA) survey programme, we interviewed 2,052 agents in Tanzania and 2,028 agents in Uganda. We looked at a wide variety of issues including:

- Agent and agency demographics

- Liquidity management

- Provider support for agents

- Agents’ business model viability

- Core operational issues

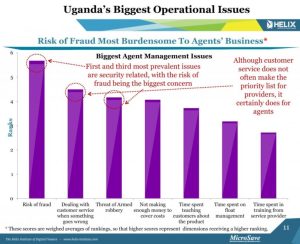

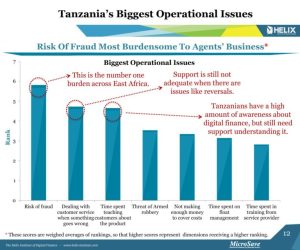

Under the latter section, we asked about the biggest operational challenges that agents were facing. The responses were instructive.

Fraud and armed robbery

Top of the list in both Uganda and Tanzania was fraud – closely followed by armed robbery. We have discussed these problems in the blog “Why Rob Agents? Because That’s Where the Money Is” about a year ago, and clearly they persist.

One of the key ways to address the challenge of fraud is through on-going support and training for agents, so that they are aware of and can respond to the latest scams being perpetrated in the market. And yet, the ANA surveys repeatedly show that agents receive very limited training.

In Tanzania, 55% of agents have never undergone refresher training, and in Uganda, 57% of agents have never undergone refresher training. In Uganda, only 33% of agents were visited by the provider, whereas 46% of agents report not being visited at all. Of those who were visited 35% report, they were with no fixed frequency. In contrast, 76% of Tanzanian agents report being visited. Of those visited about three quarters were visited directly by the provider with a frequency of at least once a month. Clearly, the agents are not getting the support they need. And given the prevalence of agents reporting “Time spent in training from a service provider”, much (if not all) of this training and support needs to be on-site as part of providers’ agent monitoring systems.

Customer service

Second on agents’ lists of challenges – both in Tanzania and Uganda – was dealing with customer services when something goes wrong. While customer service does not always appear to be a key area of focus for providers, it is a very real challenge for agents … and, if not adequately addressed, has the potential to undermine trust in digital financial services. Many, if not most, customer service issues arise from customer transaction errors and the resultant requests for reversal. This leads to the challenges of repudiation policy so well outlined by Joseck Mudiri in “Fraud in Mobile Financial Services”.

Providers can essentially choose between three policies on repudiation:

- No Repudiation: The provider opts not to interfere with the transactions, callers are advised to either resolve the matter with the recipient directly or seek legal redress.

- Call Centre Repudiates Instantly: The provider’s call center may repudiate transactions on the strength of the sender’s request only without consulting the recipient.

- Funds are Suspended Prior to Repudiation: Under this scenario, the customer calls the provider’s call center and requests for repudiation. The call center immediately suspends the funds to ensure that they cannot be withdrawn. The recipient is then called. If the recipient insists that the funds are genuinely theirs, the call center employees release the funds to the recipient. However, if the recipient accepts that the funds belong to the sender, the funds are reversed back to the sender.

Each of these policies has advantages and disadvantages – but all require a careful agent and customer education to manage expectations and behavior.

Effective fraud management, security and customer service require investment from the agents and/or mobile money providers. This, in turn, affects profitability and the ability of agents to educate/market to customers and offer a range of products. These aspects will be discussed in the next blog in the series.

Written by

by

by  Jun 20, 2014

Jun 20, 2014 3 min

3 min

Leave comments