Expanding access to finance for small businesses in India: A critique of the Mor Committee’s approach part 3. Assessing access to finance for small businesses?

by Anup Singh, Abhay Pareek and Raunak Kapoor

by Anup Singh, Abhay Pareek and Raunak Kapoor Jun 8, 2014

Jun 8, 2014 3 min

3 min

Critically reviewing the Mor Committee report, this concluding blog looks at the ways of measuring access to finance for small businesses.

The first blog in this series highlighted the context of the Mor Committee’s recommendations and the significant gap between the supply of and demand for credit for small businesses. The second blog in the series examined the role of the banks, development finance institutions and non-bank financial institutions (NBFCs) to examine why they have been so backward in coming forward to meet this gap. This concluding blog looks at the ways of measuring access to finance for small businesses.

Credit to GDP Ratio – Is it a good measure to assess access to finance for small businesses?

The Mor Committee report recommends that by January 2016 every significant (more than 1 percent contribution to GDP) sector and sub-sector of the economy should have a credit to GDP ratio of at least 10 percent. The Committee recommends the use of credit to GDP ratio to assess the extent of credit reach to various sectors in the economy. The report highlights that India at its abysmal 70 percent credit to GDP ratio is way below the averages of high-income countries (200 percent) and the middle-income countries (100 percent). The Committee argues that targeting 10 percent credit to GDP ratio for all significant sectors by 2016 would catalyze inclusive growth and subsequently reduce poverty.

At the small businesses level, the report presents the finding that the credit to GDP is 35 percent at an aggregate level. Similarly, at industry and services level, the ratio stands at 56 percent and 25 percent respectively.

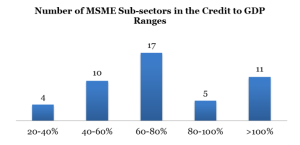

In our analysis of subsectors within the MSME segment at the two-digit level of NIC-2004 classification, MicroSave found that of 47 sub-sectors only five, namely Food Products and Beverages; Textiles; Chemicals and Chemical Products; Basic Metals; and Fabricated Metal Products contribute greater than 1 percent to the GDP. In terms of access to finance, these five subsectors had comfortable access ranging from 49 to 101 percent. Thus, we observe that while credit to GDP may be a good ratio to determine access to credit at the aggregate and sectoral level, at the sub-sector level it does not hold relevance.

Also, the targets assigned for January 2016, at 10 percent credit to GDP is not relevant for the MSME sector per se as all the sub-sectors within MSME segment have greater than 10 percent credit to GDP ratio. The credit flow is skewed in favor of medium enterprises with micro enterprises languishing for want to institutional credit.

A World Bank study highlights that access to credit is inversely related to firm size. Size is a significant predictor of the probability of being credit constrained and hence micro and small enterprises are highly credit constrained. In such as scenario, credit to GDP ratio would not sufficiently reflect the access to credit to small businesses. Lack of a clearly articulated and representative ratio may mean that the banks and financial institutions would expand access to credit to the MSME sector as a whole by focusing largely on medium-sized enterprises.

Thus, it would be worthwhile to use the formal credit to capital ratio to measure the access to credit by small enterprises. The underlying assumption upon which this indicator is suggested is the fact that it clearly defines the leverage of the enterprises. Also, in our opinion, instead of looking at MSME sector as a whole, it is important, for the purposes of measurement of access to credit to look at the micro, small and medium enterprises individually.

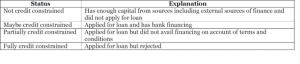

Another measure in line with the suggestions of World Bank’s report on the assessment of credit constraints for enterprises is the credit-constrained status of the micro, small and medium enterprises. World Bank suggest that the enterprises can be classified as below:

The status of all enterprises across the size ranges can be assessed periodically to estimate the access to finance. This will provide a better understanding of the access to credit amongst micro and small enterprises, and thus focus policymakers’ attention on these key drivers of Indian economic growth.

Leave comments