Expanding access to finance for small businesses in India: A critique of the Mor Committee’s approach part 2. Why are the banks not financing small businesses?

by Anup Singh, Abhay Pareek and Raunak Kapoor

by Anup Singh, Abhay Pareek and Raunak Kapoor May 26, 2014

May 26, 2014 5 min

5 min

The second part of the blog looks at the role of the banks, development finance institutions and NBFCs to examine why they haven’t come forward to meet this gap.

The previous blog in this series highlighted the context of the Mor Committee’s recommendations and the significant gap between the supply of and demand for credit for small businesses. This blog looks at the role of the banks, development finance institutions and nonbank financial institutions (NBFCs) to examine why they have been so backward in coming forward to meet this gap.

Why have banks not made successful inroads into small businesses financing?

So why is there a yawning gap in finance for MSMEs when India has good banking presence across the country? Is the finance gap a result of banks’ limited experience of, and interface with, MSMEs? Or is it on account of MSMEs rather ‘informal’ financial profile? Or do MSMEs simply not present an adequately interesting business case for banks.

The Mor Committee report has aptly pointed out the reasons for the large institutional finance gap to small business, which can be summarised as a case of “too much for too little”.

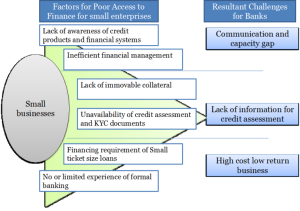

The reasons for such dismal access to finance by small businesses are ingrained in the very business and financial nature of the enterprises. On the demand side, small businesses have limited managerial capabilities and financial management skills, lack appropriate documents and require small ticket size loans. On the supply side, banks lack credit information about the client segment, perceive small businesses to be risky, and see financing to small enterprises as a low revenue activity with high costs of customer acquisition and servicing.

The reasons for such dismal access to finance by small businesses are ingrained in the very business and financial nature of the enterprises. On the demand side, small businesses have limited managerial capabilities and financial management skills, lack appropriate documents and require small ticket size loans. On the supply side, banks lack credit information about the client segment, perceive small businesses to be risky, and see financing to small enterprises as a low revenue activity with high costs of customer acquisition and servicing.

The latter two are the key reasons for banks shying away from financing small businesses. For a bank to assess the credit viability of a loan it is imperative to have access to credit information and the repayment pattern of the client. However, in the case of micro and small enterprises, such information available is limited. Also, banks still do not have customized and suitably crafted credit appraisal mechanisms to appraise the debt needs of micro and small enterprises.

In terms of the cost of customer acquisition and servicing, with relatively smaller ticket sizes, it is not profitable for banks to source the customer through direct sales channels. Considering the costs, banks are willing to serve walk-in customers (which are limited in numbers) rather than acquiring customers through a sales representative/agent. Establishing and managing a direct customer-sourcing channel is an added cost as compared to the thin revenues and perceived risks in micro and small enterprise finance.

The Role of Development Finance Institutions and Non-Bank Financial Institutions in Expanding Access to Finance for Small Businesses

Another important point on which the Committee has expressed its opinion is related to the role of development finance institutions (DFIs) such as SIDBI and NABARD. The Committee aptly redefines the role of DFIs as market-making entities focused only on risk-based credit enhancement schemes. The Committee recognizes the fact that the DFIs with their limited capacities in terms of funds and branch coverage (SIDBI has a network of 85 branches with MSME portfolio of circa US$ 9 billion) need to leverage their infrastructure to have a greater multiplier effect on the sector. A number of adequately funded credit risk enhancement schemes on similar lines to the Credit Guarantee Trust Scheme for Micro and Small Enterprises (CGTMSE) are the need of the hour. CGTMSE with a corpus of US$ 0.66 billion has accounted for cumulative disbursements of US$ 6.7 billion through 135 member financial institutions. However, there is significant scope to further expand the guarantee scheme, since the current coverage of CGTMSE accounts for 7-10 percent of the small business lending portfolio of banks based on 2011 data from the RBI.

The Committee also acknowledges the need to maintain the principle of neutrality in the selection of participating institutions in credit risk enhancement schemes that should be in line with nature of activity instead of a type of institutional setup. MicroSave has long advocated the inclusion of NBFCs and MFIs under such schemes. One has to bear in mind that 77 percent of the total finance gap in the India MSME space is in the micro-enterprise segment. While small and medium enterprises have access to cluster financing programmes, microenterprises, which are often dispersed, lack such access. Thus, NBFCs/MFIs can effectively serve this rather dispersed segment of microenterprises. As of 2012, the share of NBFCs/MFIs share in the institutional supply of debt finance is at a meager 8 percent of the total flow. MicroSave’s clients (NBFCs/MFIs) in this space have shown their intent and revealed process efficiencies to deliver appropriate credit products to small businesses.

The success story of Utkarsh, an NBFC-MFI in North India is a testimony of the opportunities that abound in the micro-enterprise lending space. Utkarsh started its micro-enterprise lending initiative in 2012 with objectives of:

- Addressing the credit needs of micro-enterprises which were not being served adequately either by MFIs or by commercial banks;

- Diversifying its existing portfolio beyond group lending operations; and

- Providing a bridge credit product to Utkarsh’s graduating JLG clients.

Utkarsh, with technical assistance from MicroSave, did a comprehensive market research study of the target segment and conceptualized a credit product with ticket sizes ranging from US$ 1,000 – 5,000. While the product suited the needs of the target segment, one thing that Utkarsh had to be mindful of was the flexibility it could offer to the segment on the collateral front. In order to make its product more flexible, Utkarsh introduced hypothecation option in addition to the more traditional option of property mortgage. The results of the initiative have been encouraging, with cumulative disbursements in excess of US$ 1 million within a span of 9 months. Also, Utkarsh was able to raise additional investments riding on the success of its micro-enterprise lending programme.

Another NBFC-MFI, Kshetriya Gramin Financial Services (KGFS), has an ecosystem approach that is built on more holistic principles of financial services. The three fundamental principles that define the KGFS approach are:

- Focussed geographic commitment – each KGFS institution and branch is responsible for a specific area;

- Client wealth management approach – customized set of financial services based on careful assessment of the financial needs of the household; and

- Access to a broad range of products – credit, savings, insurance, and payments.

The enterprise loan is just one of the products in a bouquet of around 15 financial products that KGFS offer through its branch-based model. However, what KGFS has been able to showcase is its success in offering products as complex as mutual funds customized to the needs of the target segment.

The KGFS model reaffirms the belief in taking a much broader view of financial services. The model also seems to be in agreement with the Mor Committee’s recommendations on high-quality, affordable and suitable credit along with basic payments and savings, and risk and investment products.

The example of both KGFS and Utkarsh highlight the innovation DNA in NBFC-MFIs, and how it is backed by the agility to execute the ideas. Given the right policy environment and incentives, such institutions can thrive and catalyze the MSME lending space. However, lending to small businesses is a very different business as compared to group-based lending and presents challenges that need to be appreciated by MFIs/NBFCs in India.

Leave comments