Introducing a catalogue of product functionalities and innovations in mobile money

by Ignacio Mas

Mar 20, 2014

3 min

How diverse are the offerings of mobile money platforms? How much product experimentation is going on? Is there a healthy supply of creative new product ideas? Find out here.

Much of the dialogue around mobile money is shifting from how to build a basic mobile money proposition (regulatory enablement, industry partnerships, cash merchant networks, technology choices) to how to transition to an e-payment ecosystem, whereby funds are born and used digitally. New product development in mobile money is central to this much-awaited transition.

The key battleground in the future will be to increase usage levels, and that means providing more customers reasons to do more things using their mobile. Despite the growing clutter in mobile money menus, customers remain very limited in what they do: according to the latest MMU State of the Industry report, 92.5% of mobile money transactions globally are either airtime purchases or basic person-to-person transfers. I suspect that dispensing with the mobile wallet and allowing for over-the-counter transactions (which may make good business sense in the short run but limits the opportunities for customer growth) has been the biggest innovation in the last few years.

But beyond the headline products: how diverse are the offerings of mobile money platforms across the world? How much product experimentation is going on? Is there a healthy supply of creative new product ideas?

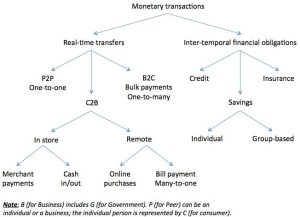

In a new paper written in collaboration with my former Gates Foundation colleague Mireya Almazán who is now with the MMU, we have sought to shed light on these questions by creating a first-of-its-kind catalogue of mobile money functionalities and services. We include offerings that have been rolled out or are being piloted, as well as service concepts that have been proposed. We structure the paper based on the product typology depicted in the figure below. For each product class, we describe the range of implementation modalities in detail. We hope this report will be viewed as a comprehensive product definition reference guide by practitioners.

We found that while the range of product categories is still rather narrow, the specific ways in which services are defined and packaged does vary to a surprising extent across operators and markets, especially for payment services (peer-to-peer transfers, bill payment, merchant payments, transfers to/from linked bank accounts) and for linking mobile money accounts to regular bank accounts.

The paper did not get into the factors which may be hindering more far-reaching innovation, but let me posit some hypotheses here. First, many mobile money providers have inflexible platforms which are run by small teams on tiny budgets; for them, innovation is seen as more of a distraction than a solution to their business problems. Second, practically all mobile money providers run closed systems without adequate application programming interfaces; they are unwilling or unable to enlist partners to experiment for them. Third, unnecessary regulatory barriers to entry prevent smaller, nimbler, more innovation-minded players from mounting credible competing propositions. (I’m thinking here about the unjustified regulatory insistence that cash in/out presents agency problems, hence requiring a strong contractual binding of cash merchants to individual banks or mobile money providers, which precludes the spontaneous development of cash in/out networks serving all providers. Or the unjustified regulatory insistence that non-bank players shouldn’t promote savings services or pay out interest, even if they are 100% backed-up into fully regulated bank accounts.)

I believe that embracing innovation will be the only way to achieve scale by most players. And for any transactional business, scale is job #1.

by

by  Mar 20, 2014

Mar 20, 2014 3 min

3 min

Leave comments