Follow the money approach: Introducing a powerful strategy tool for your mobile money/banking initiatives (Part I)

by Krishna Thacker

Dec 15, 2013

5 min

What does an institution need to do to gain a bigger share of the client’s wallet, and dominate the market? This blog introduces the framework MicroSave uses to answer these questions.

Let us start with a quick reality check. Most financial service institutions aspire to gain a bigger share of the client’s wallet not only in terms of profit but also the value and number of transactions with them. This is true irrespective of whether you are a single, double or triple bottom line institution. Those in the digital financial services space are of course no different. That brings us to some core and high-level strategic questions for those involved in developing a strategy for their financial services institutions: 1) What do you (as an institution) need to do to gain a bigger share of client’s wallet? 2) How do you dominate the market on a sustainable basis? All institutions try to answer these fundamental questions in one or other form (albeit a bit more specific and contextual) as they think about their strategy.

This two-part blog introduces the framework/approach which MicroSave has used with some institutions to help them answer these questions through a quick exercise. Let us call it, ‘Follow the Money Approach’ (FMA). It has proved to be very effective irrespective of what stage of life cycle these institutions are at; whether they are developing their go to market strategy, whether they are just revisiting their strategy or they are trying to expand. Following are some of its key benefits:

- It helps you understand and clearly see your target customer’s financial world from a transactional as well as from a financial ecosystem perspective.

- It lays out a pictorial map of the potential user’s financial ecosystem in terms of money coming in, staying and money going out.

- Once that is done, it also helps institutions, based on an understanding of their market and their unique situation, strategize and prioritize on what type of transactions to digitize.

- And, ultimately it provides an informed and clear strategic foresight on what to focus on in the short, medium and long run.

In simple terms, this helps you put your mouth where there is money.

There are four key steps towards a successful implementation of the FMA approach:

The following is a detailed ‘how to’ explanation for each step. We will cover the first two steps in the first part of the blog and the remaining two steps in the second part.

Step one: Identify your users and user categories

The objective is to understand different use cases of your offering more than doing a rigid categorization of a fluid client base into narrow segments. And, the ultimate objective is to find high potential intervention points for you to covert a cash footprint into digital footprint or to convert an existing inefficient digital footprint (such as interbank cheque transfers or expensive money transfer system) into a more efficient (for yourself, your agents as well as for the end users) digital footprint.

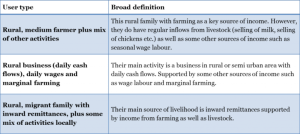

First activity within this step is to brainstorm and identify your key user types or client segments. Following is a sample categorization of use cases:

There are a few useful guiding points to help you come up with a dynamic categorization:

- Identify top livelihood activities: The categorization should be based on a solid understanding of the market in terms of the top livelihood activities for your market segment.

- Household as a unit of analysis: It is best to consider household/family as a user type and not an individual. It is because, in most cases, a household is the central processing unit for the majority of monetary transactions as well as decisions. And, of course, money is fungible between different sources/types of inflows. It makes the equation or analysis a bit more dynamic, vibrant and broad-based and, most importantly, realistic.

- Multiple livelihood sources: And, in almost all cases, households have multiple sources of income and inflows. Therefore your categories should not be focussed on a single livelihood source. Considering that, it is best to define your categories by putting the primary source of income first followed by a secondary source of income and/or other key attributes of this category.

- Number of categories: Optimally, one should have a minimum of 2-3 user segments to a maximum of five user segments.

Step two: Follow the money and map its footprint

The main objective here is to draw a unique Financial Footprint Map for each user segment.

Once the user types are identified, the next activity is to hit the ground, identify a few random households for each category (ideally 5-7 households per category) and engage in detailed qualitative conversations with the user segments.

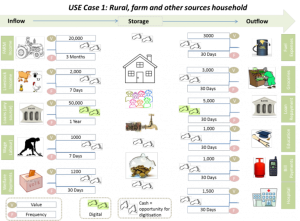

Under this step, all you have to do is follow the money, map its footprints and organize these footprints in a logical structure. In any active financial ecosystem, you will inadvertently observe that money (whether cash or digital) has the following logical (as well as practical) trial as it leaves it footprints:

- Money comes in (Inflows): Money has to come in from somewhere. All inflows such as income from the farm, loan from bank or remittance from a family member fall under this category. As discussed there are often multiple sources and it is actually best if an institution starts with capturing/digitising at least one or two key inflows and bringing them into their fold. Include questions around how much and how often.

- Money stays (Storage): Money has to stay somewhere. A household often uses several mechanisms, formal as well as semi-formal/informal, to store their money. The basic savings/deposit account falls under this category. Most banks in India have only focussed on this product for their financial inclusion initiatives. In the following sections, we will see why is it important to move (and quickly so) beyond this minimalistic approach. Include questions around where and how long does it stay (in the bank or household).

- Money goes out (Outflows): Money has to go somewhere. All payments, purchases, fees, and expenses fall into this category. Include questions around how much and how often.

The Financial Footprint Map, as an outcome of this exercise, should ultimately look like this:

A couple of useful points to remember during this step:

- Though each household would be different even within the same categories, that should not be a concern, as the broad idea/objective is to understand the most popular types of (high value and/or high frequency) irrespective of use cases. The use cases allow you to see things from a bit more holistic and realistic standpoint instead of just focussing on different types of transactions.

- Try and include as many transactions as possible. It is not advisable to filter at this stage as we will do so in the next step.

Once you have a financial footprint map ready, it is time to move to step three…

by

by  Dec 15, 2013

Dec 15, 2013 5 min

5 min

Leave comments