Great business for banks – So why are they slow to build agency banking?

by Graham Wright, Nitin Garg, Puneet Chopra, Amit Garg and Premasis Mukherjee

Aug 26, 2013

3 min

In this blog, MicroSave elaborates the reasons why despite clear business opportunity banks are reticent and unwilling to commit to agency banking.

MicroSave has been advocating that banks need to get into agent-based banking as a high potential business for several years now … as well as warning why most banks are so slow to do so.

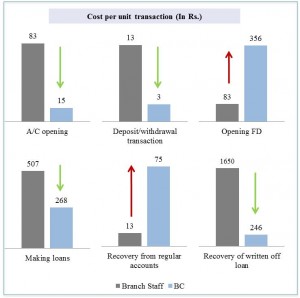

Earlier in the year we highlighted the remarkable progress that Equity Bank has made as it rolls out its agency banking, and how more transactions are now performed at agent’s than in the bank’s branches. This blog presents data from work done by MicroSave in 2012 to look at how agent banking worked for a bank in India. This bank runs its own agent network, supervised from, and working closely with, the branches as a “distributed banking” system. MicroSave has already calculated the type of savings that a bank might make at the aggregated level, concluding that the annual average cost of saving a customer through the branches (around Rs.400-500 or circa $8) could be slashed to Rs. 65-125 (circa $2). Similarly Kabir Kumar and CGAP concluded that in Latin America, “Transaction costs at agents range roughly from $0.27 to $0.58 per transaction and are 50% the transaction costs at branches and ATMs”

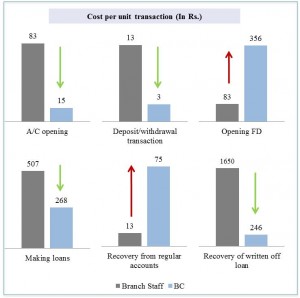

Furthermore, we calculated that the activities that could be undertaken by the BC agents were currently taking 51% of bank branch staff time as shown in the diagram below.

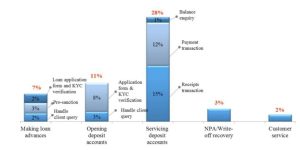

This means that if BC agents are deployed efficiently, a large part of the staff time could be freed up to focus on conducting high value-low volume transactions, as well as marketing to and servicing high net worth individuals. This, of course assumes that there is scope in the market for growth in services to high value customers. In the relatively remote area of rural India where we conducted the analysis, these customers were indeed present and a combination of the efforts of both branch staff and their BC agents yielded spectacular increases in business at both the branches and through the BC agents.

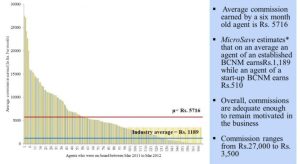

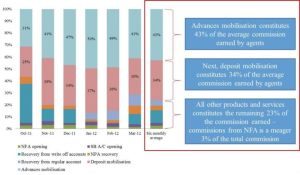

As a result the BC agents were earning an average of Rs.5,716 (circa $100 ) a month – five times the national average for BC agents in India. And the 20% most successful agents were earning more than Rs.10,000 (circa $175) a month.

As highlighted above, three quarters of this revenue comes from two key activities: marketing loans, doing the initial paper work and referring loanees to the branch for final review and authorisation; and marketing/ servicing deposits (in particular fixed deposits).

Yet despite the clear business opportunity to serve the low income market segment, most banks remain reticent and unwilling to commit to agency banking.

- Is it because banks are still unable to see the business potential or believe that the returns are higher elsewhere?

- Or is it that banks are fundamentally uncomfortable with a distributed banking model and running an agent network?

- Or is it that bank’s key management bandwidth is fully occupied with the battle to serve the higher value market and the burgeoning middle classes?

- Or is it that the lowest quality staff is assigned to financial inclusion and agency banking as it is typically viewed as a corporate responsibility or mandated requirement.

Who knows – but the first banks to wake up and sieze the opportunity have the potential to dominate the urban and rural mass markets … as Equity Bank is demonstrating.

by

by  Aug 26, 2013

Aug 26, 2013 3 min

3 min

Leave comments