Financial services that poor people want

by Graham Wright

Jul 20, 2013

3 min

Speaking on financial institutions’ offering for the poor people, MicroSave director, Graham Wright emphasizes the need for a market-led approach towards product development to positively impact the lives of the poor.

Financial institutions trying to serve the mass market rarely seem to have the time to the conduct market research necessary to identify prospective clients’ real needs and aspirations. Many rely on “bath-tub product development” – product ideas developed on the basis of the senior management team’s experience and “gut instinct”, and often rolled out without any pilot-testing … let alone consultation with the target market.

Others prefer the “me too” strategy and thus simply wait, watch and copy products offered by their competitors. India’s “No Frills Accounts” rolled out by a wide variety of banks are a case in point – with dormancy estimated to be 80-90% despite the government’s attempts to push conditional cash transfers through them. MicroSave’s research into this phenomenon revealed that there were a series of features to which poor people aspired and needs that they could clearly articulate … and that poor customers were, in the main, willing to pay for these services.

MicroSave research over the years across Africa and Asia has highlighted that people need (not just want) financial services that are convenient, accessible, affordable and appropriate … and of course reliable in that they are consistently available, on demand. A single transaction account like the No Frills Account is unlikely to meet these criteria … particularly when delivered through traditional banking branch infrastructure.

- Convenience requires proximity and longer opening hours – most obviously through a distributed agent network.

- Accessibility often necessitates ATM cards or mobile money solutions to obviate the need to negotiate overcrowded branches, complex forms and intolerant bank staff, and is likely to require us to rethink how we communicate products.

- Affordable needs to encompass direct costs (transport to the branch and food when the trip take a full day), indirect costs (lost wages and other opportunity costs); and hidden costs (brides and commissions for filling up and processing forms) – and not just the “on the board” fees/interest rates that are formally charged by bank.

- Appropriate must reflect how poor people live and how they think about and manage their money.

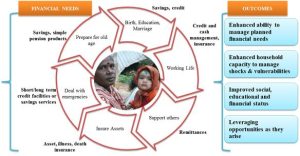

Poor people’s need for appropriate products mean that they need a range of products (just as you and I do) to reflect their life cycle. They also need disciplined systems that break down their accumulation of lump sums into small manageable amounts (saving up, through or down).

The products used to accumulate lump sums should ideally be differentiated and ear-marked for specific needs, in the same way that poor people often ear mark specific income streams for specific uses to help with their mental accounting. For example: savings for a bicycle, to buy some land and for old age are very different in terms of the time horizons and instalment amounts.

Similarly, loans for a medical emergency and for investing in a fixed asset are very different in terms of loan size and structure, as well as the pace at which they need to be appraised and disbursed. This has very important implications for financial institutions seeking to offer a range of products to the lower income market segment: a single transaction account will not help manage a series of complex savings goals; and a standard working capital loan repayable in weekly instalments over a year is only appropriate for a limited set of business people.

As a bare minimum, therefore poor people need a suite of products that includes:

- A transaction or very basic savings account (linked to a reliable and efficient payments/remittance system that is not too costly);

- Recurring deposit accounts for different goals (with an attached overdraft to which they have automatic and immediate access – up to 90% of the value of the amount deposited);

- A general short-term (up to one year) loan (that can be used for working capital as well as consumption smoothing, education etc.);

- A longer term loan (secured against assets acquired with the loan).

Clearly ,this suite of basic products need to be tailored for, and communicated to, specific markets and market segments – but a market-led approach to product development is essential if we are to have real positive impact on the lives of poor people. Just try imagining how you would manage your finances if you only had access to a typical microcredit product – a loan repayable weekly for 50 weeks!

Written by

by

by  Jul 20, 2013

Jul 20, 2013 3 min

3 min

Leave comments