₹oopya for all; progressive credit that leaves no one behind

by Aanchal Aggarwal and Ankit Kumar

by Aanchal Aggarwal and Ankit Kumar Jun 28, 2023

Jun 28, 2023 6 min

6 min

Roopya is a startup under the Financial Inclusion (FI) Lab accelerator program’s sixth cohort. The Lab is supported by some of the largest philanthropic organizations across the world – Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

“Yet again, my loan application got rejected. These banks keep asking for an income certificate,” rued Mohan to his wife after another day at his garment shop. Mohan runs his small outlet in the Gorakhpur region of India’s Uttar Pradesh state. He has been looking for a business loan for about five months now. Mohan want to improve the stock at his shop to increase earnings to support his daughter’s education. He is short of capital and is tired of applying unsuccessfully for a loan at commercial banks.

Does he need to turn to the local moneylender again to fund his business? Will the system leave Mohan and countless others like him out of the formal lending ecosystem yet again? These are hard questions that a handful of FinTechs have tried to answer.

The FinTech market in India in 2022 was valued at USD 584 billion, of which the lending tech market was worth USD 270 billion. Digital lending is also expected to grow 4.75X by 2030, with a market size of USD 1.3 trillion. The top three lending SAAS platforms in India raised $58 million in total, while the FinTech SAAS platforms raised around $360 million. The availability of skilled talent, rapid adoption of digital solutions, and the enormous market potential of over 900 million smartphone users in India by 2025 have led to the growth of fintech companies. New-age FinTechs like Roopya can accelerate digital lending by using ubiquitous digital public infrastructure (DPI), India Stack.

Roopya’s foundation goes back to the founders’ early days

Raman and Sudipta found their entrepreneurial spirit in their early childhood days. Raman started earning in the eighth standard by renting out video games. Raman reminisces how those video games changed his future forever. On the other hand, Sudipta wrote software and did market research assignments to support his college fees. Raman and Sudipta are tech and data enthusiasts and realized early on that data could change the landscape of the lending industry.

Raman and Sudipta found their entrepreneurial spirit in their early childhood days. Raman started earning in the eighth standard by renting out video games. Raman reminisces how those video games changed his future forever. On the other hand, Sudipta wrote software and did market research assignments to support his college fees. Raman and Sudipta are tech and data enthusiasts and realized early on that data could change the landscape of the lending industry.

In 2014, they acquired a startup called Roopya.com that worked as an institutional DSA and generated loan leads for their lending partners. Over time, in 2018, they realized that to serve more customers, Direct Selling Agents (DSAs) need a platform that can connect them and their customers to multiple lenders. Hence, with a vision to make instant loans a reality for the masses, they founded another company called Roopya. Money that works to connect all stakeholders in a lending ecosystem on a single platform.

Roopya as a catalyst in #LendingToTheNextbillion

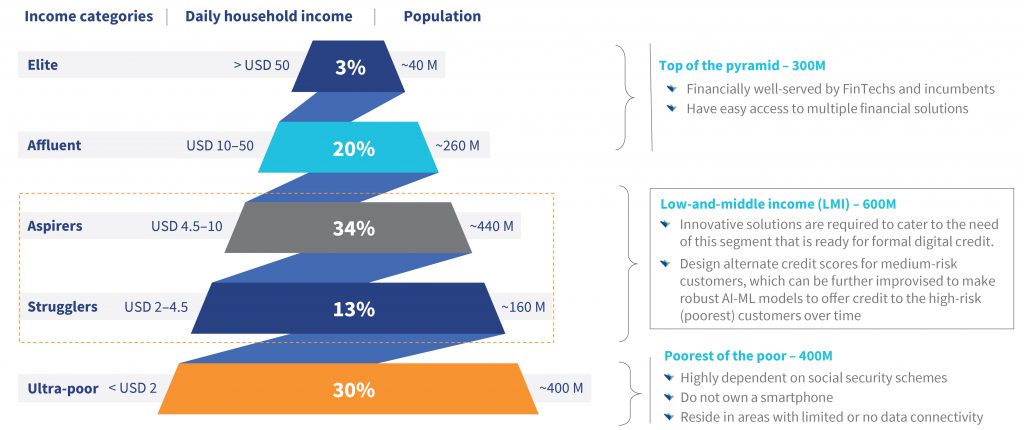

India has a diverse credit market, with a population of 1.4 billion people. We can categorize India’s population into five segments based on differentiated income levels (See diagram 1). As per an Experian report, while the elite and affluents have formal digital lending sources available, the aspirer and strugglers find it difficult to identify the right credit products, despite their readiness for formal digital credit. Our tailor, Mohan, who is from this segment, can approach the Roopya platform through their webpage on his own or through DSA to find a lender for his credit needs.

Roopya, with a specified user license, has made instant loans a reality

Roopya, with seven NBFC partners and 30+ DSA partners, has served as a catalyst to fulfill credit needs of more than 300,000 people like Mohan who often struggle to get a loan as they do not know lenders who offer a variety of credit products. The same is true for small lenders (Regional Rural Banks, Small Finance Banks, and Non-Banking Financial Companies) that intend to serve customers like Mohan but have limited avenues to reach and source these customers. Roopya made gross revenue of USD 194,000 in the financial year 2022-23.

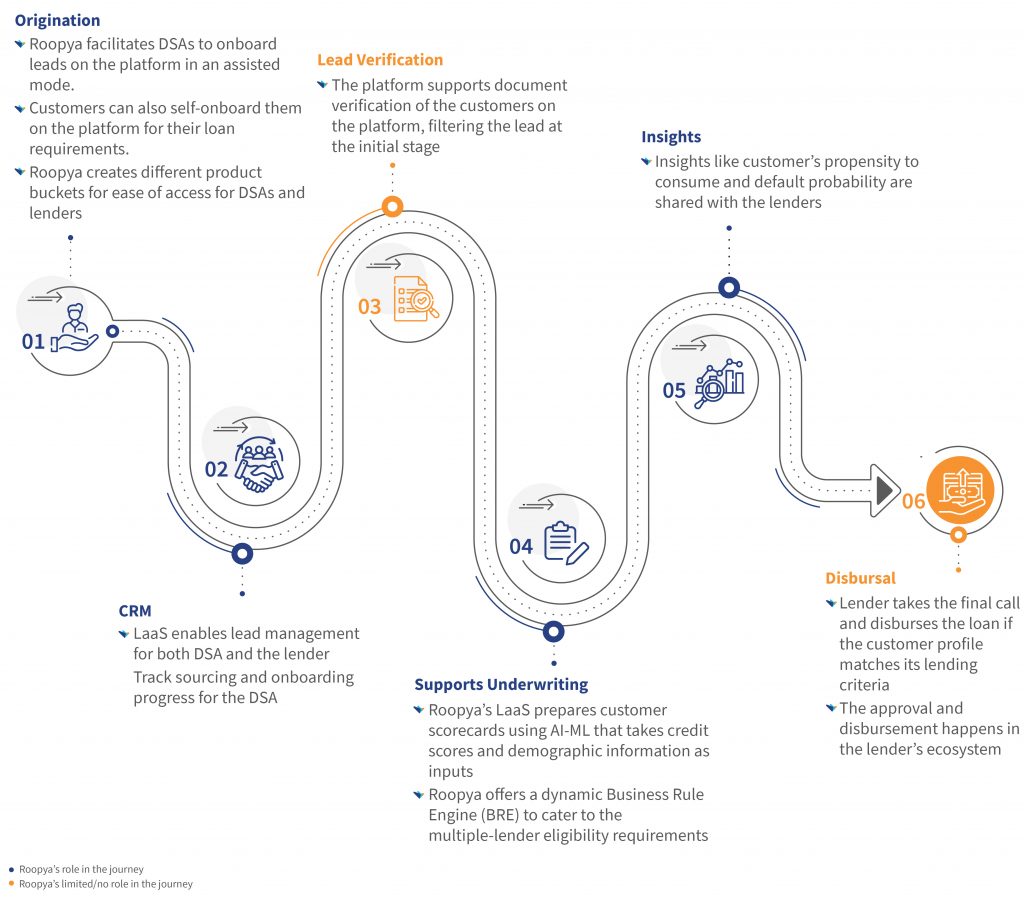

Roopya’s specified user license enables it to obtain the credit information of the borrowers from the credit bureaus registered on its platform. Roopya designed an AI/ML-based credit assessment tool that creates algorithms based on inputs such as credit scores and demographic variables to filter creditworthy individuals and share it with lenders. Lenders can then reach out to these borrowers and provide them with the desired loan. Roopya caters to the diverse credit requirements of customers by mapping them to portfolios offered by various lending platforms. The following diagram illustrates the role of Roopya’s LaaS platform in the digital credit journey of the customer.

What does Roopya offer to various stakeholders?

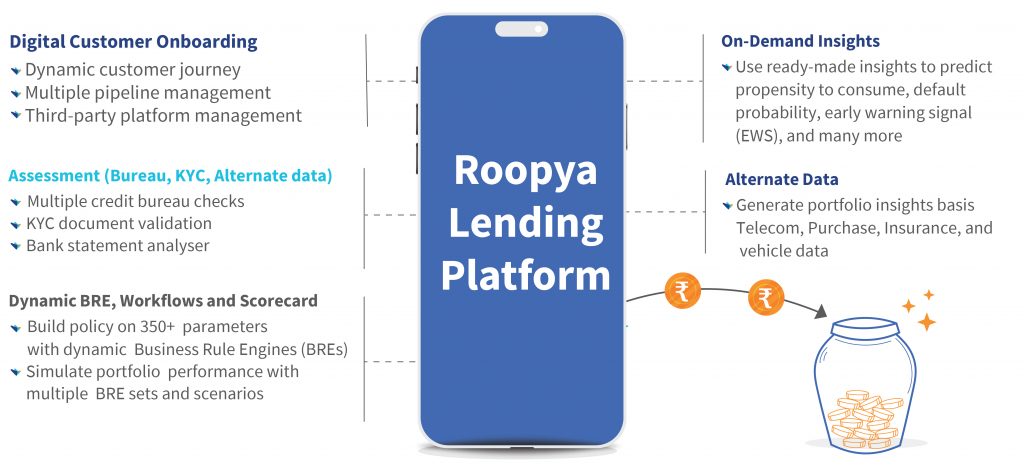

Roopya’s LaaS platform provides several benefits as follows to the DSAs and the lenders. The following figure illustrates how Roopya adds value for various stakeholders:

Primarily to lenders:

- Loan origination and underwriting: The platform enables loan origination and underwriting support on a single platform combined with a workflow module, decision engine, and scorecard to manage millions of customers. Its advanced AI/ML can help lenders design early warning signals to assist loan disbursement decisions.

- Monitoring tool: The platform provides agent monitoring tools to lenders and institutional DSAs.

Primarily for DSAs:

- Automation: Roopya provides the digital infrastructure for agents to manage customer It automates the process through digital onboarding and processing customers’ documents. Consequently, the agents save time and effort as they no longer need to visit the customer’s location multiple times, earlier required for onboarding formalities.

- Many-to-many network benefit: The platform also supports the agents by connecting them to multiple lenders.

- Cost saving: Roopya can help DSAs cut down the opportunity costs associated with physical lending processes by more than 30%, thanks to its robust loan origination and AI metrics.

Challenges for Roopya

Roopya in its five years of operations, has grown to disburse loans with a cumulative value of USD 3.65 million. Roopya innovated to stay relevant in the challenging environment of economic shock and policy and regulatory changes that the digital lending industry has faced. The latter impacts their operations as they require more resources to build regulatory-compliant technology. In addition, it isn’t easy to convince traditional DSAs who operate within a closed credit ecosystem to use their platform. Hence, Roopya has to offer several customizations to cater to their varying needs to establish itself as a platform of choice.

Support provided by the Financial Inclusion (FI) Lab

The FI Lab’s technical support to Roopya capitalized on its strengths to position the startup as a preferred LaaS partners for lenders and institutional DSAs. The Lab helped Roopya to understand the needs of credit providers and enablers, such as lenders and DSAs, in the customer credit journey. The research with lenders and DSAs helped identify the pain points of these institutions and identify the stages in the journey where Roopya could support them. The insights helped Roopya identify the LaaS platform’s value proposition for different kinds of lenders and DSAs and thus design their partnership pitches accordingly.

MSC also supported Roopya in understanding various SaaS platforms used by banks in the loan process such as loan origination software (LOS), and loan process software (LPS). This helped Roopya identify the opportunities for value addition services that may be offered with the Roopya LaaS platform.

Way forward

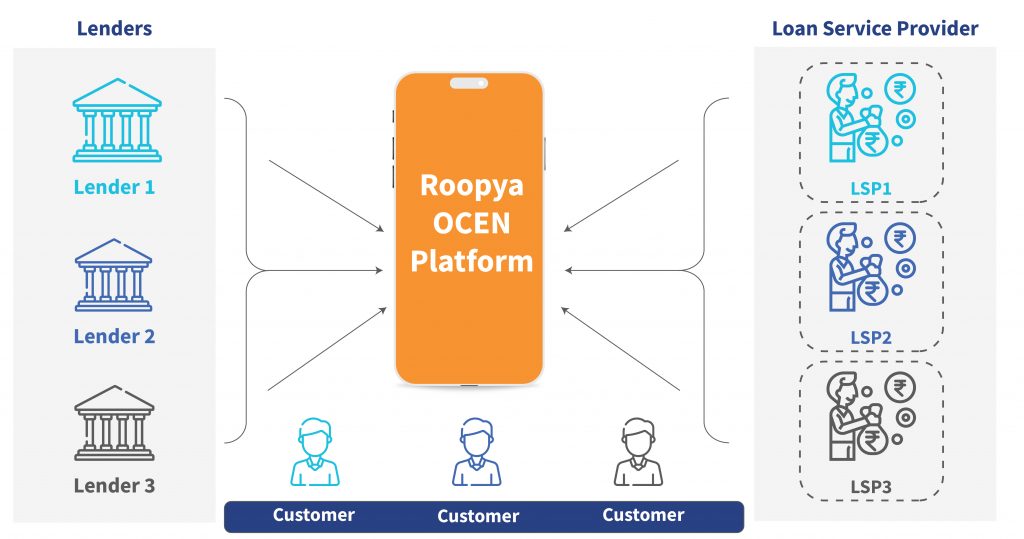

In conclusion, Roopya has significant tailwinds to become an important partner in the credit space for India’s LMI segment. Roopya can take advantage of the new Digital Public Infrastructure initiatives, such as Open Network for Digital Commerce (ONDC) and Open Credit Enablement Network (OCEN), that aim to create open and interoperable platforms for financial services. ONDC enables secure and consent-based data sharing among various entities, while the OCEN protocols allow lenders to connect with loan originators and service providers. Roopya can use these protocols to offer seamless and customized lending solutions to small enterprises and underserved individuals, the backbone of India’s economy. By doing so, Roopya can enhance its value proposition and contribute to the larger social and economic impact of financial inclusion.

Written by

Leave comments